41 1031 like kind exchange worksheet

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses HUD-1 Line # A. Exchange expenses from sale of Old Property Commissions $_____ 700 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 Overwatch 2 reaches 25 million players, tripling Overwatch 1 ... Oct 14, 2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc

Solved: Like-Kind Exchange - Intuit The property I relinquished in the like-kind exchange is being reported in form 4797, "Sale of Business Property". There are two entries for the same property that was relinquished: I see that the two entries amount to the improvements and the current list of depreciating assets. The second entry is the land amount, when I purchased the property.

1031 like kind exchange worksheet

The Ultimate Partial 1031 Boot Calculator (Avoid Boot!) You can reinvest $400,000 in a replacement property through a partial 1031 exchange and cash out the remaining $100,000 as boot, which will be taxed. Similarly, boot can help you reduce your debt. If you have $200,000 in mortgage debt on your $750,000 property, you can use a partial 1031 exchange to flip it for a fully paid off $750,000 property. 1031 Exchange Calculator | Calculate Your Capital Gains 1031 Exchange Calculator | Calculate Your Capital Gains Capital Gains Calculator Realty Exchange Corporation has created this simple Capital Gain Analysis Form and Calculator to estimate the tax impact if a property is sold and not exchanged, and to calculate the reinvestment requirements for a tax-free exchange. IRS 1031 Exchange Worksheet And Vehicle Like Kind ... - Pruneyardinn We constantly effort to show a picture with high resolution or with perfect images. IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example can be beneficial inspiration for people who seek an image according specific categories, you will find it in this site. Finally all pictures we've been displayed in this site will inspire you all.

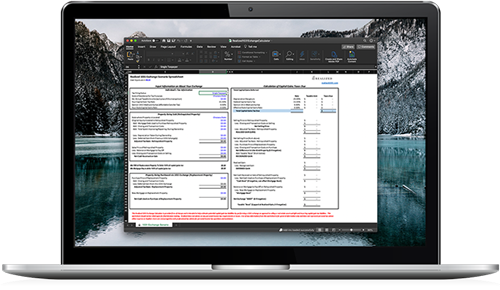

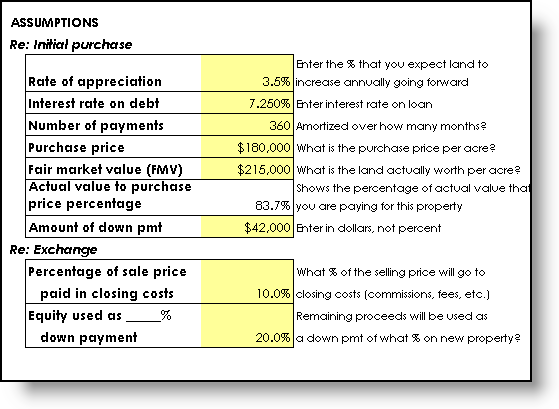

1031 like kind exchange worksheet. 1031 Like Kind Exchange Calculator - Excel Worksheet 1031 Like Kind Exchange Calculator - Excel Worksheet Smart 1031 Exchange Investments We don't think 1031 exchange investing should be so difficult That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. IRC Section 1031 Like-Kind Exchange Calculator: IRS Home Swapping Rules While not all investment opportunities will benefit from a 1031 exchange, any like-kind exchange should at least explore the 1031 exchange option for maximum investing savings. 1031 Resoures. Resources to consider when obtaining a section 1031 tax-deferred exchange: IRS.gov: Like-Kind Exchanges; 1031.org: FAQs; Realtor.org: 1031 NAR Field Guide PDF 2019 Exchange Reporting Guide - 1031 Corp Incomplete or Partial Exchange Spanning Two Tax Years 4 . Depreciation of Replacement Property 5 . Personal Property Exchanges after December 31, 2017 6 . Reporting State Capital Gain 6 . Completion of IRS Form 8824 "Like-Kind Exchanges" 6 IRC 1031 Like-Kind Exchange Calculator Exchange vs. Sale A 1031 arrangement allows you to defer all of your capital gains taxes. And this amounts to getting a long-term and interest-free loan from the Internal Revenue Service. The real advantage is not just in tax savings - investors who take advantage of 1031 provisions can acquire much more investment real estate than those who don't.

May 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site. Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ... Form 8824: Do it correctly | Michael Lantrip Wrote The Book Form 8824 is the 1031 Exchange tax form. We explain the Instruction for completing it, using real numbers from a real deal, and your HUD-1. ... The name of the form is Form 8824, it's called Like-Kind Exchanges, and you attach it to your Form 1040 if you are an individual. ... FORM 8824 WORKSHEET. 1031 Exchange Examples | 2022 Like Kind Exchange Example What is a 1031 Exchange? eBook Download The Ron and Maggie Story Let's take an example couple, Ron and Maggie 1, who purchased a small apartment building in California 10 years ago for $1,500,000. They invested $500,000 of their own money and financed the rest with a $1,000,000 mortgage. Purchase Price Step 1 Determine Adjusted Basis

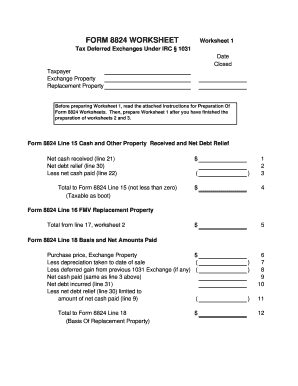

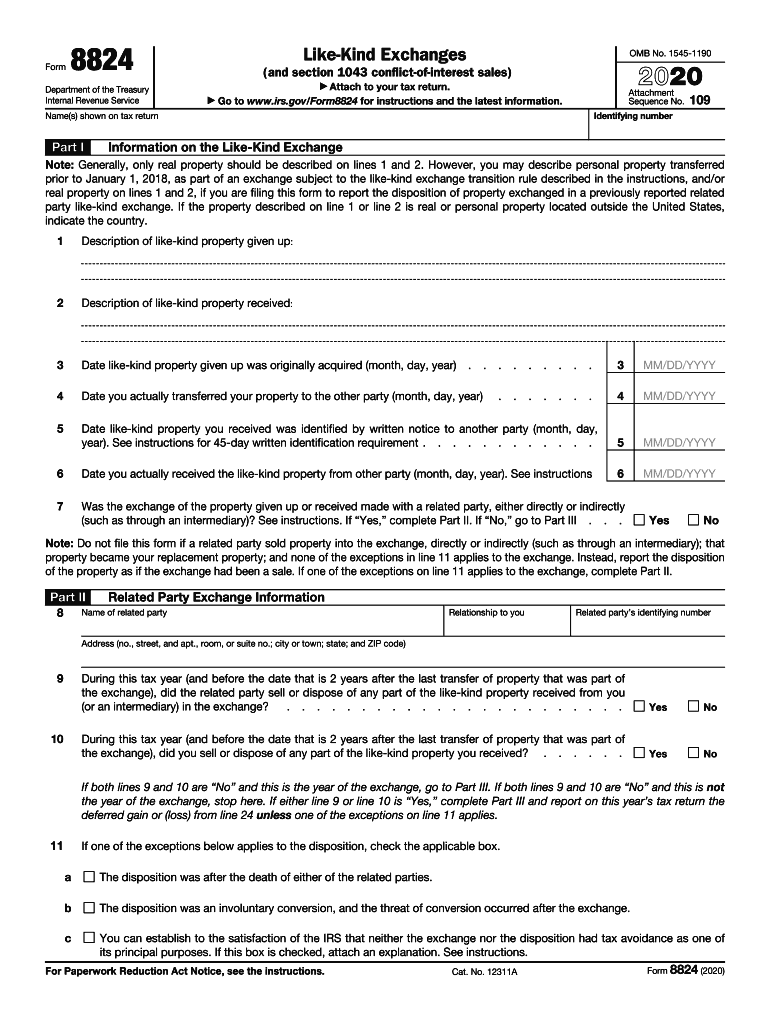

Solved: 1031 exchange - Intuit Accountants Community A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset. Open the Asset Entry Worksheet for the asset being traded ... PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind. If you receive cash, relief from debt, or Partial 1031 Exchange | 1031 Exchange for Lesser Value Property Buying Down in Value Example: Lila is selling her rental townhouse for $1,000,000 and plans to utilize a 1031 Exchange to defer her taxes. However, she can only locate new property with a sales price of $800,000 that she desires to purchase. The $200,000 not reinvested into like kind property will be taxable. PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free)

1031 Exchange Examples: Like-Kind Examples to Study & Learn From You would like to do a 1031 exchange into a $3,975,000 Walgreens in McDonough, Georgia. You exchange your $4,000,000 property for the $3,975,000 7-Eleven and an adjoining lot worth $275,000 for a total value of $4,250,000. This means that there is no boot in the exchange. You qualify for a full tax deferral for the $500,000 capital gain.

PDF Home - Realty Exchange Corporation | 1031 Qualified Intermediary Home - Realty Exchange Corporation | 1031 Qualified Intermediary

1031 Tool Kit - TM 1031 Exchange Purchase 1031 Exchange Books Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. Informed Decisions Make the Best Investments Thousands of Properties Rated Each Month. Only the Worthiest Investments Make it Into Your Vault.

Net Gains (Losses) from the Sale, Exchange, or Disposition of ... Pennsylvania tax law contains no such provision, the difference between the basis of the old property and the current market value of the property received in exchange is the taxable gain and must be reported. Definitions of like-kind properties can be found in IRC Section 1031. Involuntary Conversions

1031 Like Kind Exchange Worksheet And Form 8824 ... - Pruneyardinn 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template Worksheet April 17, 2018 We tried to get some great references about 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template for you. Here it is. It was coming from reputable online resource and that we like it. We hope you can find what you need here.

Completing a like-kind exchange in the 1040 return - Intuit A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded.

Instructions for Form 8824 (2022) | Internal Revenue Service Form 8824 figures the amount of gain deferred as a result of a like-kind exchange. Use Part III to figure the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of a like kind is involved in the exchange. Also, use Part III to figure the basis of the like-kind property received.

Accounting for 1031 Like-Kind Exchange - BKPR A Section 1031 or like-kind exchange is an income tax concept. It applies when you swap two real estate properties with the same nature or character. Even if the quality or grade of these properties differs, they may still qualify for like-kind exchange treatment. Personal Property Not Qualified for Like-Kind Exchange

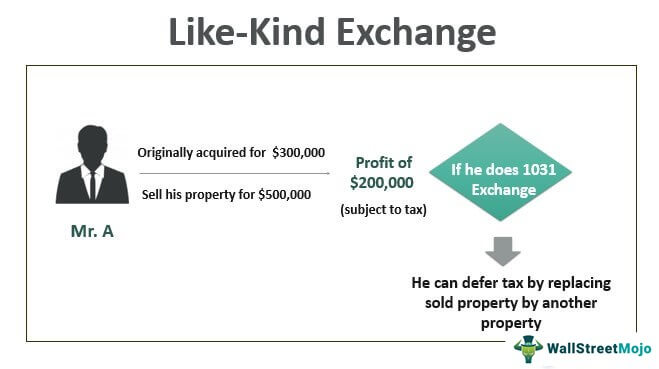

IRC 1031 Like-Kind Exchange Calculator Under Section 1031, taxpayers can postpone paying this tax if they reinvest the profit in similar property. Doing so is known as a like-kind exchange, which allows taxpayers to grow their investment on a tax-deferred basis. Considering that long-term capital gains taxes are either 15 or 20 percent, and short-term capital gains rates range from ...

1031 Exchange: Like-Kind Rules & Basics to Know - NerdWallet What is a 1031 exchange? A 1031 exchange, named after section 1031 of the U.S. Internal Revenue Code, is a way to postpone capital gains tax on the sale of a business or investment property by ...

Like Kind Exchange Calculator - cchwebsites.com Like Kind Exchange Calculator If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. Like Kind Exchange * indicates required.

1031worksheet - Learn more about 1031 Worksheet In a 1031 Exchange, Section 1031 of the Internal Revenue Code (IRC) allows taxpayers to defer capital gain taxes by exchanging qualified, real or personal property (known as the "relinquished property") for qualified "like-kind exchange" property (replacement property). The net result is that the exchanger can use 100% of the proceeds (equity) from their sale to buy another property ...

Publication 544 (2021), Sales and Other Dispositions of Assets An exchange of city property for farm property, or improved property for unimproved property, is a like-kind exchange. The exchange of real estate you own for a real estate lease that runs 30 years or longer is a like-kind exchange. However, not all exchanges of interests in real property qualify. The exchange of a life estate expected to last ...

️1031 Exchange Worksheet Excel Free Download| Qstion.co 1031 exchange worksheet excel (QSTION.CO) - The 1031 exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. Evaluate boot given and received. If in doubt a tax advisor shoud be Like kind exchange tax worksheet and irs form 8824 simple worksheet.

Guide to Like-Kind Exchanges & Taxable Boot Examples | 1031X $430,000 - 1031 proceeds as down payment $20,000 - Closing Costs $145,000 - New Mortgage Loan Here, For the Birds LLC faces $280,000 in capital gains (after closing costs). It will not incur any cash boot because the LLC transferred 100% of net equity from the relinquished property to the replacement property as down payment.

What Expenses Are Deductible in a 1031 Exchange? - Affiliated 1031 To answer any of your questions or to open a Section 1031 transaction, please contact Stephen A. Wayner, Esq. CES at our toll-free telephone number: 866-903-1031 or at swayner@liberty1031.com. Previous Use the 3 Property Rule to Create More Options in a 1031 Exchange Next Final Regulations Defining Real Property Effective December 2, 2020

IRS 1031 Exchange Worksheet And Vehicle Like Kind ... - Pruneyardinn We constantly effort to show a picture with high resolution or with perfect images. IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example can be beneficial inspiration for people who seek an image according specific categories, you will find it in this site. Finally all pictures we've been displayed in this site will inspire you all.

1031 Exchange Calculator | Calculate Your Capital Gains 1031 Exchange Calculator | Calculate Your Capital Gains Capital Gains Calculator Realty Exchange Corporation has created this simple Capital Gain Analysis Form and Calculator to estimate the tax impact if a property is sold and not exchanged, and to calculate the reinvestment requirements for a tax-free exchange.

The Ultimate Partial 1031 Boot Calculator (Avoid Boot!) You can reinvest $400,000 in a replacement property through a partial 1031 exchange and cash out the remaining $100,000 as boot, which will be taxed. Similarly, boot can help you reduce your debt. If you have $200,000 in mortgage debt on your $750,000 property, you can use a partial 1031 exchange to flip it for a fully paid off $750,000 property.

0 Response to "41 1031 like kind exchange worksheet"

Post a Comment