37 self employed deductions worksheet

self–employed borrower’s business only to support its determination of the stability or continuance of the borrower’s income. A typical profit and loss statement has a format similar to IRS Form 1040, Schedule C. Allowable addbacks include depreciation, depletion and other non–cash expenses as identified above.

TRUCKER’S EXPENSES (continued) EQUIPMENT PURCHASED Radio, pager, cellular phone, answering machine, other… Item Purchased Date Purchased Cost (including sales tax) Item Traded Additional Cash Paid Traded with Related Property Other Information 1099s: Amounts of $600.00 or more paid to individuals (not

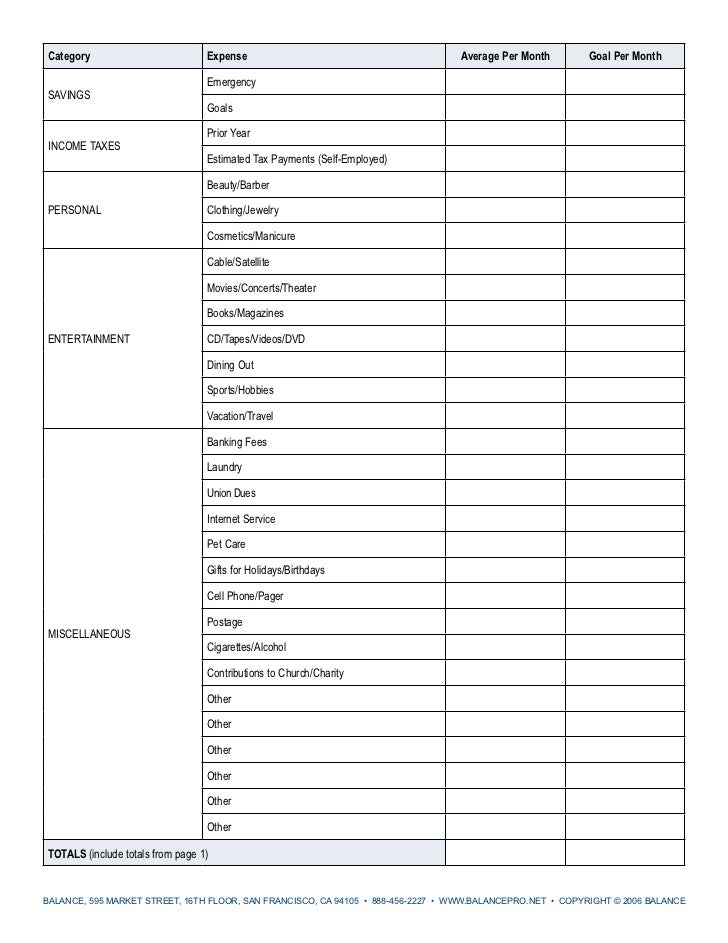

13. Advertising. 14. Certain memberships. 15. The qualified business income deduction. There are many valuable tax deductions for freelancers, contractors and other self-employed people who work ...

Self employed deductions worksheet

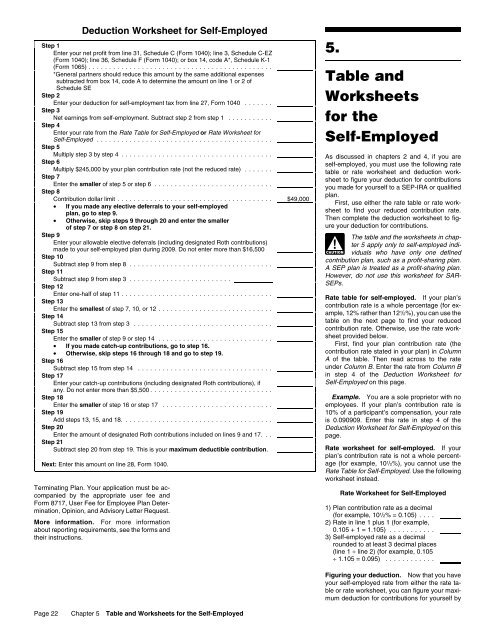

Deductions worksheet. The deductions worksheet is for anyone who plans to itemize deductions. Since the TCJA increased the standard deduction, way fewer people will itemize their deductions. Many high-earners will still itemize, however, so proceed accordingly.

A self-employed borrower’s share of Partnership or S Corporation earnings may be considered provided that: The borrower can document ownership share (for example, the Schedule K-1); and The K-1 reflects a documented, stable history of receiving cash distributions of income consistent with the level of business

HONORARIA: Direct expenses Relating to self-employment INTEREST: (do not include auto or truck) List life insurance loans separately Business only credit card LEGAL & PROFESSIONAL: Attorney fees for business, accounting fees, copyright fees, bonds… OFFICE EXPENSE: Postage, stationery, office supplies, pens, etc. RENT/LEASE: Machinery and ...

Self employed deductions worksheet.

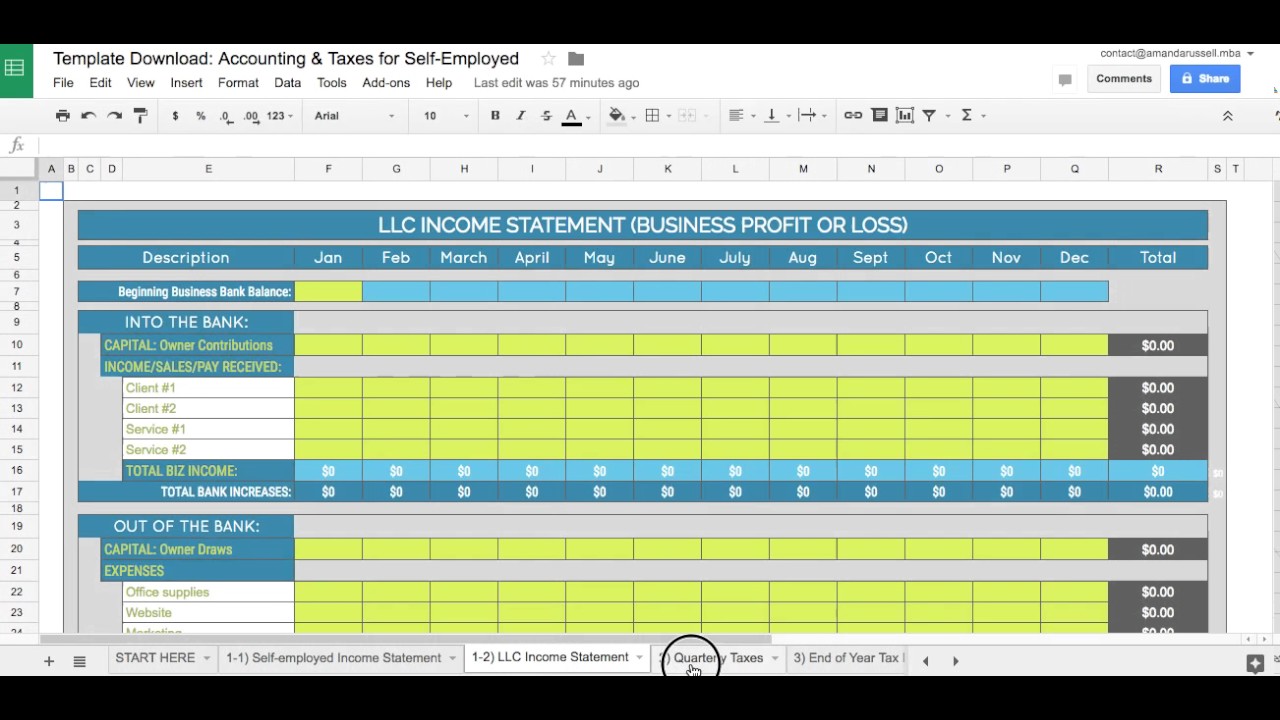

Get and Sign Business Income and Expense Worksheet Form . Inv. -Cost of Labor -Materials/Supplies -Other: -Other: = TOTAL COGS EXPENSES Advertising Bad Debts (If reported as income) Bank Charges Cabs, Bus, Rentals Car/Truck Expense (Detail) Commissions & Fees Paid Depreciation (Attach Schedule) Dues & Publications 2nd Qtr. 3rd Qtr. 4th Qtr. 1st Qtr. Total Year 2nd Qtr. 3rd Qtr. 4th Qtr. Total ...

Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you’re not sure where something goes don’t worry, every expense on here, except for meals, is deducted at the same rate.

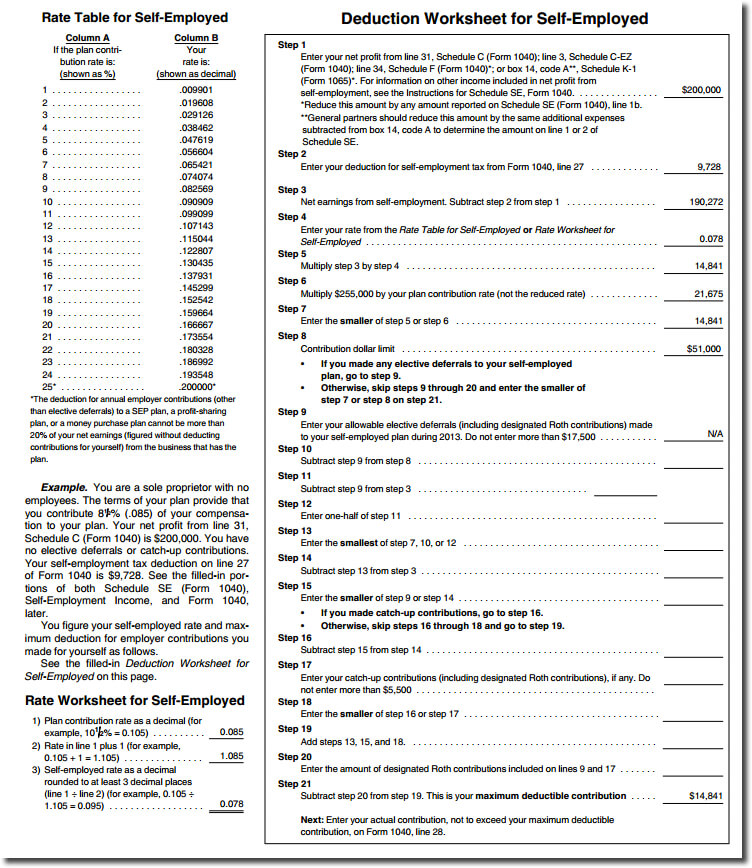

step 4 of the Deduction Worksheet for SelfEm ployed on this page. Example. You are a sole proprietor with no employees. If your plan's contribution rate is 10% of a participant's compensation, your rate is 0.090909. Enter this rate in step 4 of the De duction Worksheet for SelfEmployed on this page. Rate worksheet for self-employed. If your

(Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse

![1099 Excel Template [Free Download]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5f63b30151dff905f0198f6a_1099-template-excel.png)

0 Response to "37 self employed deductions worksheet"

Post a Comment