40 real estate agent tax deductions worksheet

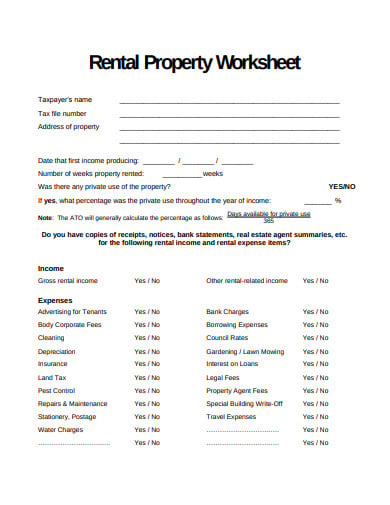

Real estate employees - income and work-related deductions. If you earn your income as a real estate employee, this information will help you to work out what: income and allowances to report. you can and can't claim as a work-related deduction. records you need to keep.

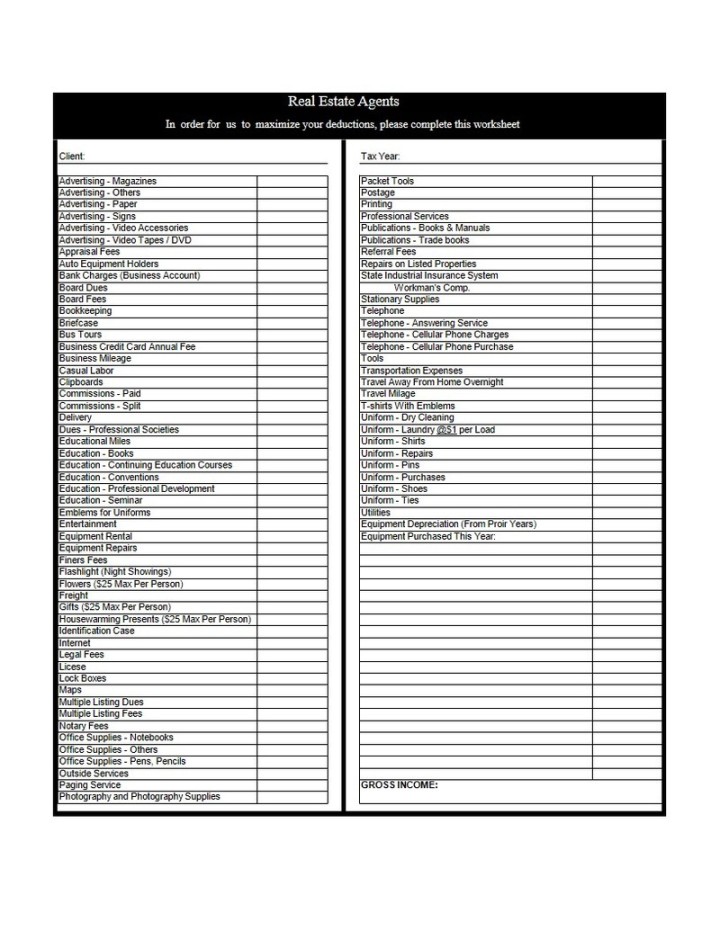

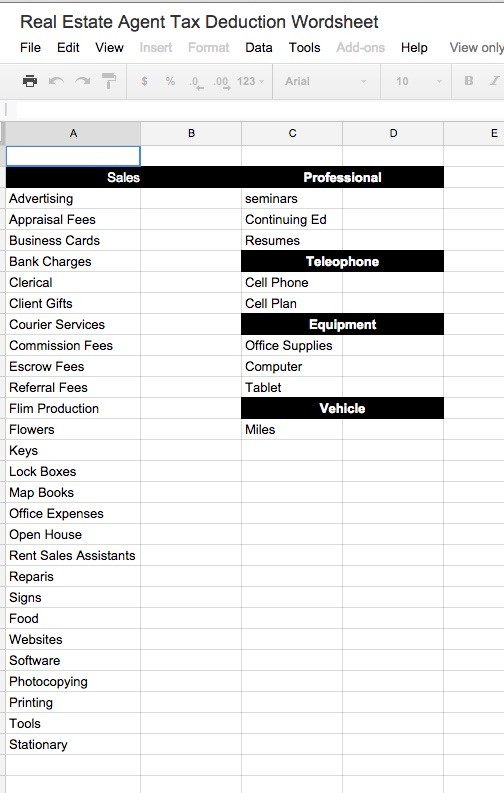

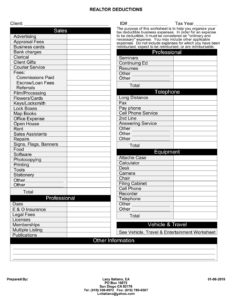

Appraisal Fees, Continuing Ed. 5. Business Cards, Resumes. 6. Bank Charges, Teleophone. 7. Clerical, Cell Phone. 8. Client Gifts, Cell Plan.

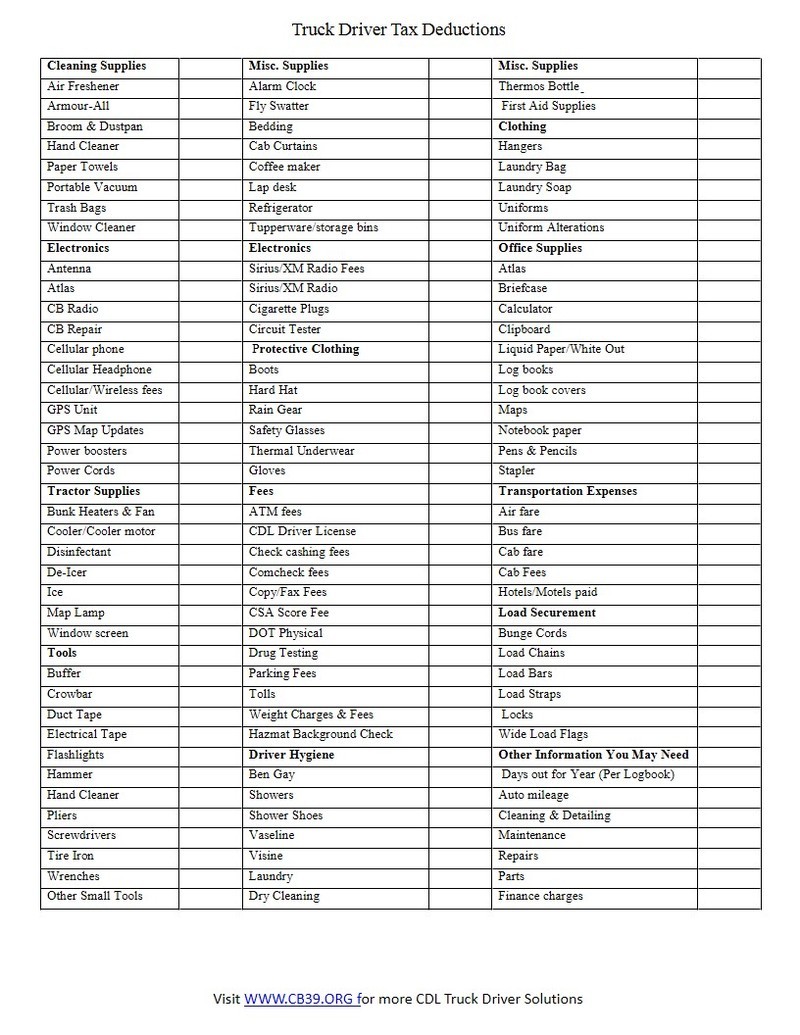

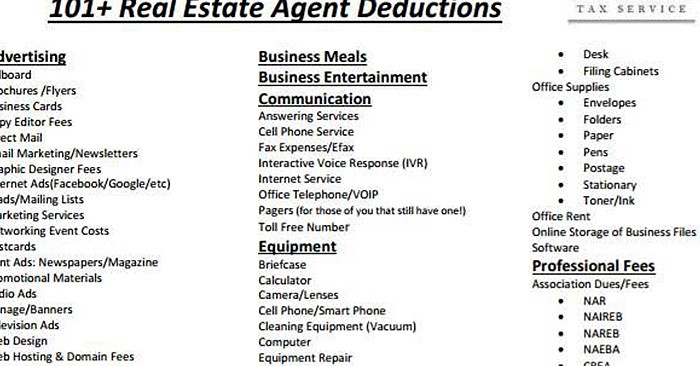

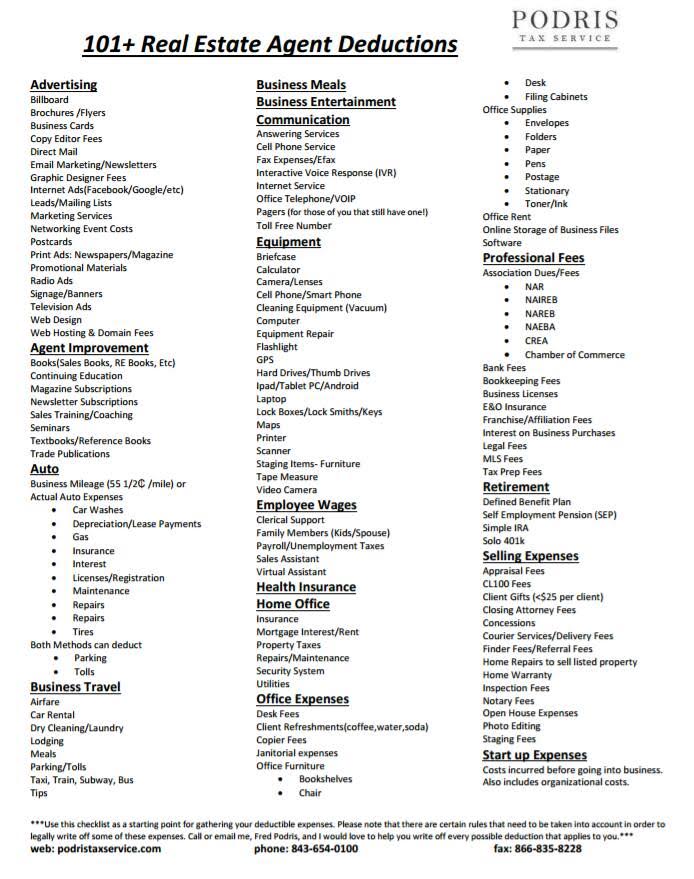

This is an ultimate guide to tax deductions for real estate agents that'll help you lower your tax bill and keep more of your hard-earned money! Your state license renewal, MLS dues, and professional memberships, are deductible. Online and newspaper ads, photography, staging, and signage are all tax deductible.

Real estate agent tax deductions worksheet

Get the Cyataxes Realtors Tax Deductions Worksheet you need. Open it using the cloud-based editor and begin adjusting. Fill in the empty areas; concerned parties names, places of residence and phone numbers etc. Customize the template with smart fillable fields. Include the particular date and place your electronic signature.

Real Estate Agent Business Tax Deductions. Home Office Expenses. If you use all or part of your home for business purposes, you may be able to deduct several related expenses, including insurance, internet costs, utilities, repairs, and even mortgage interest and depreciation.

16 Real Estate Agent Tax Deductions (4 days ago) Please review the sample worksheet below. Now let's discuss the 16 tax deductions for real estate agents. 1.) Commissions Paid. Commission paid by your business to other agents includes referrals and third-party lead generations systems. 2.) Standard Auto Deduction.

Real estate agent tax deductions worksheet.

Here Are 7 Popular Tax Deductions For Real Estate Agents For 2020 . The average real estate agent's business expenses during the year come in around $6,500, while top performers' expenses can exceed $10,000. If you're not tracking and deducting all of your eligible business expenses, you're shrinking your net income and paying too much ...

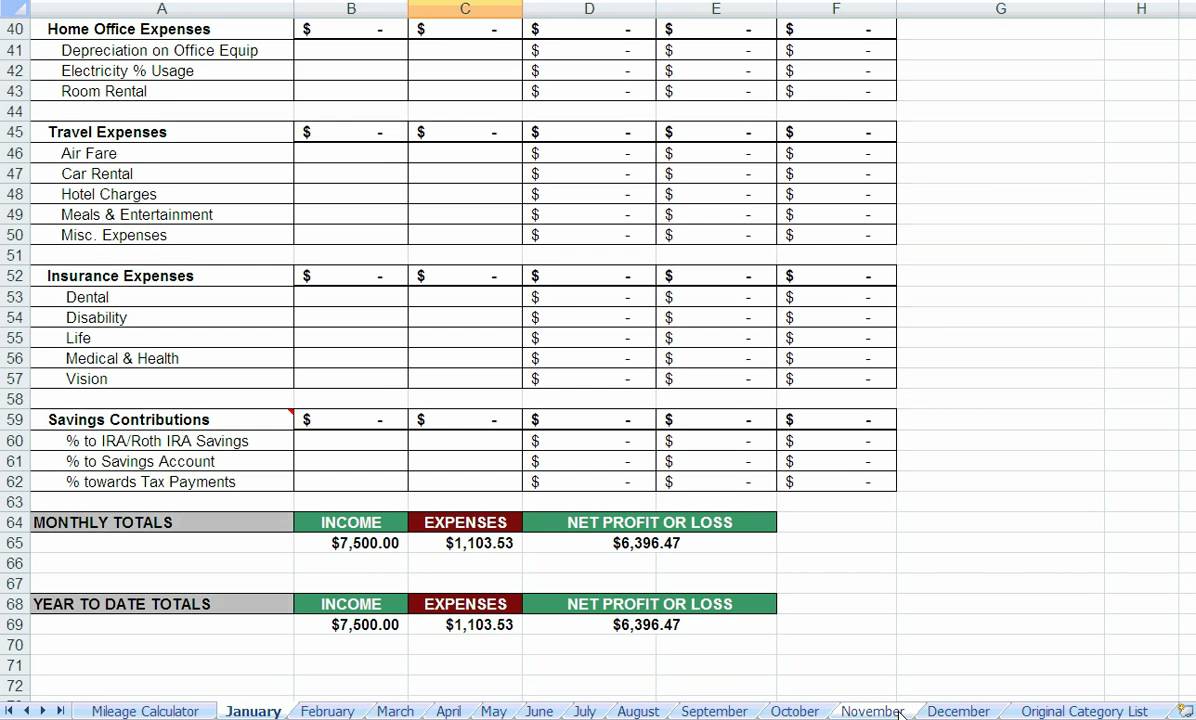

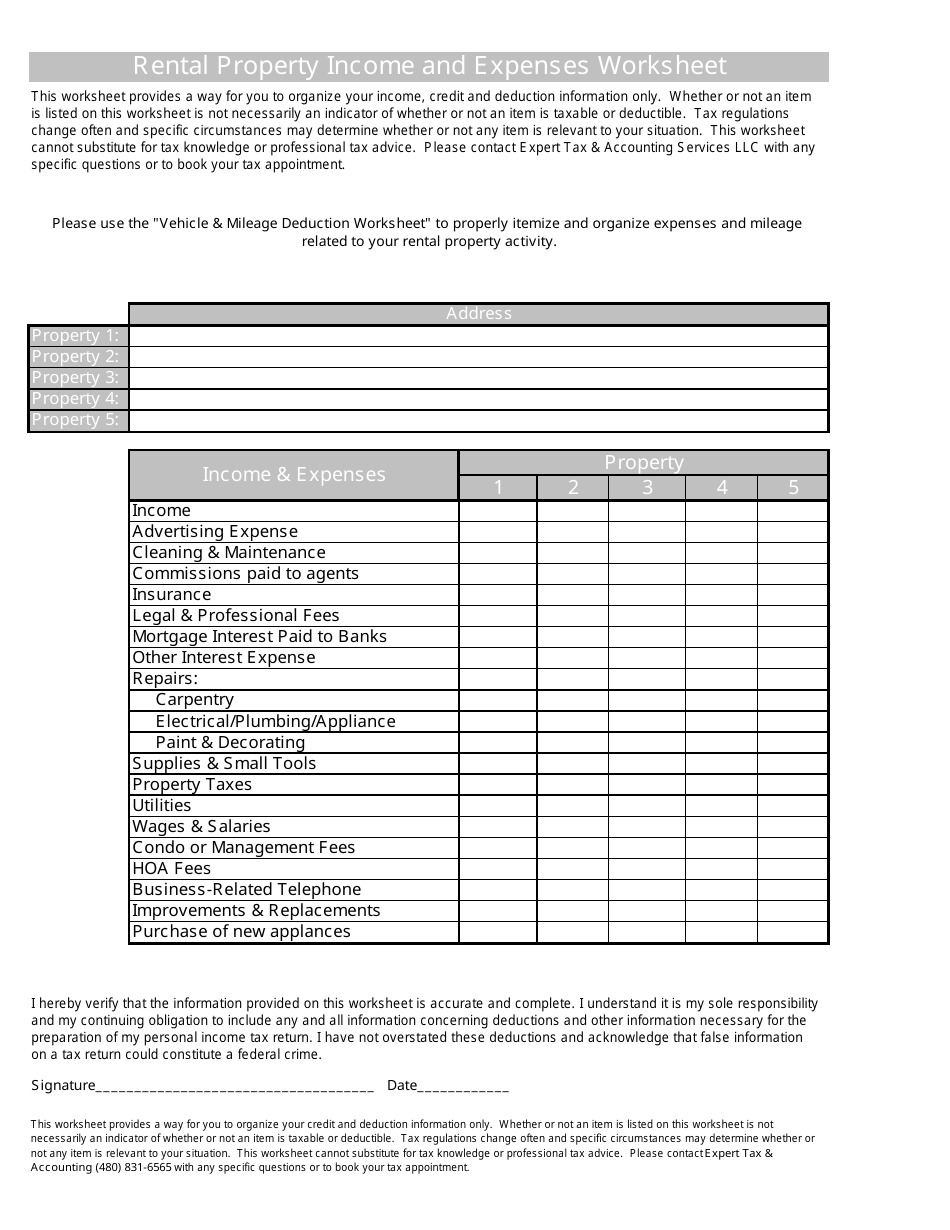

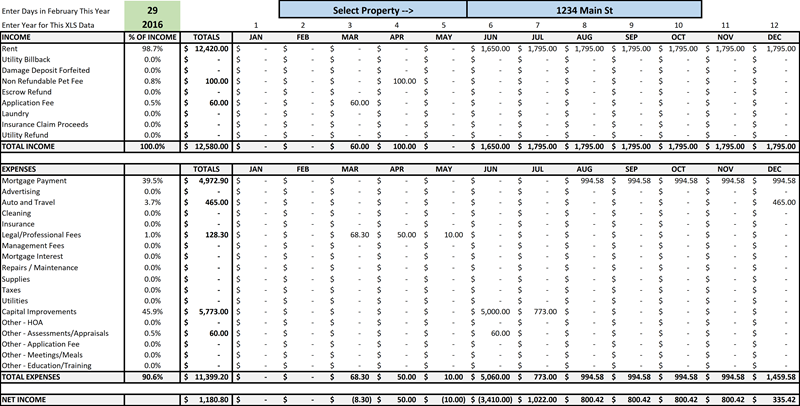

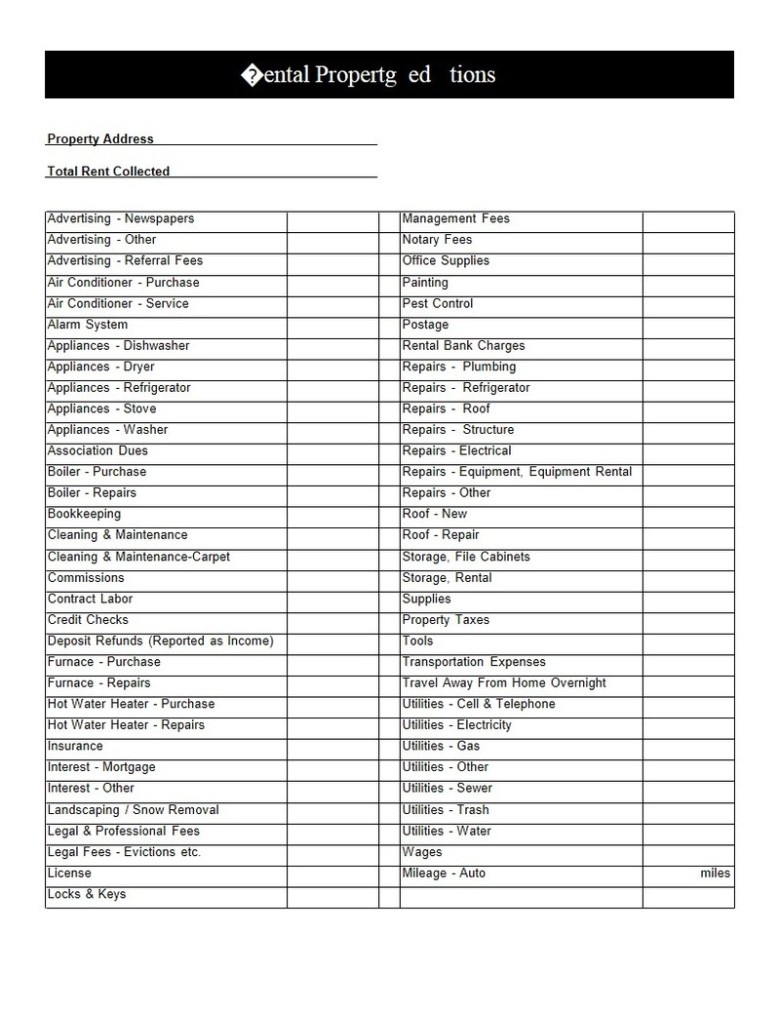

Below are forms and worksheets to help you keep track of your expenses: Real Estate Professional Expense Worksheet (.xls) Re...

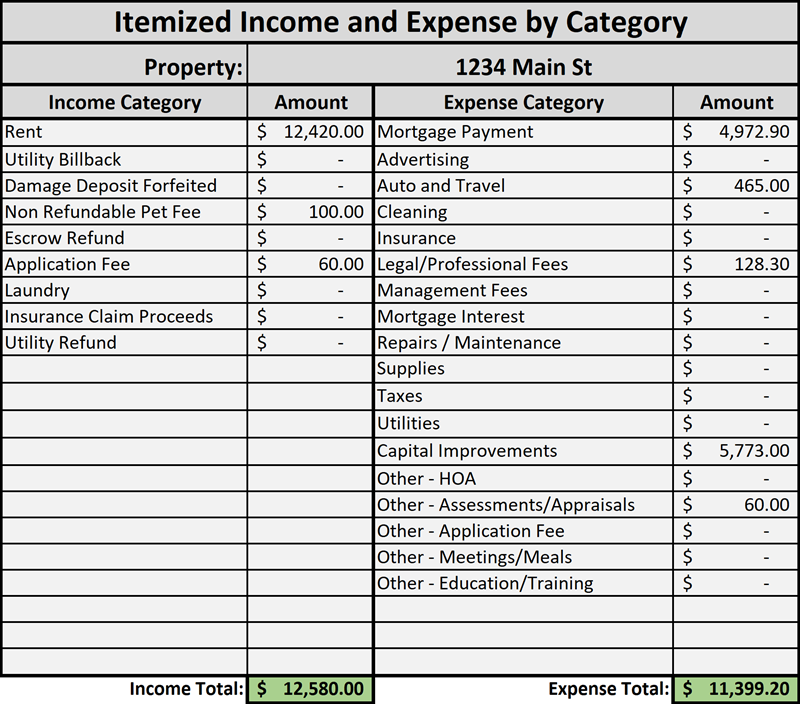

Real estate agents who also own rental property may be able to deduct any revenue losses they incurred during the tax year. These can include things like: loss on the sale of rental properties expenses related to maintaining your property (such as bills for cleaning, landscaping, and repairs)

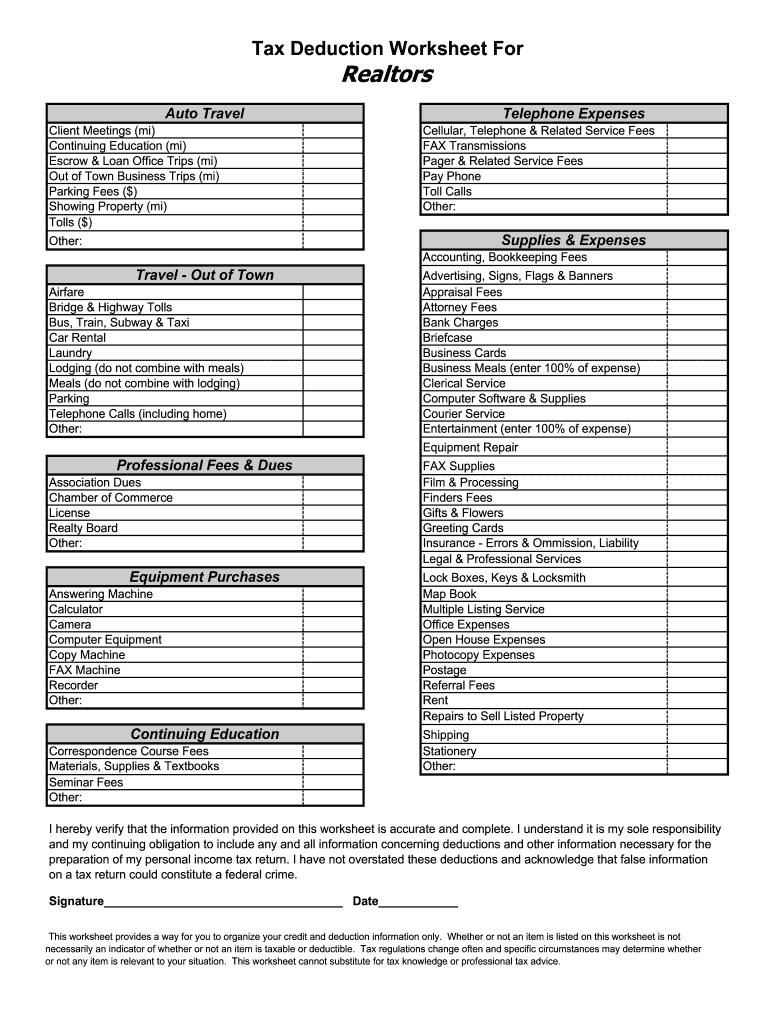

Realtors Tax Deductions Worksheet AUTO TRAVEL Your auto expense is based on the number of qualified business miles you drive. Expenses for travel between business locations or daily transportation expenses between your residence and temporary work locations are deductible; include them as business miles. Expenses for your trips between home and

Real Estate Agent Tax Deductions Worksheet - 35+ images - tax deduction tracker spreadsheet within spreadsheet, anchor tax service, anchor tax service, anchor tax service, 30 realtor tax deduction worksheet

Tax Deductions & Write-Offs: With a quick Google search or talking to some experienced Real Estate Agents, you can probably get a sense of the type of expenses that are commonly deductible. In addition to all of the standard expenses (Advertising & Promotions, Meals, Monthly Brokerage Fees, TREB/RECO/OREA/CREA dues, etc.),

However, this deduction is limited for people whose business is providing personal services, which includes real estate agents and brokers. You're entitled to the full 20% pass-through deduction only if your taxable income from all sources after deductions is less than $315,000 if married filing jointly, or $157,500 if single.

Marketing Tax Deductions For Real Estate Agents. Most real estate agent marketing expenses will fall under the category of a tax deduction. Whether it's sales and open house signs and flyers or business cards, these types of marketing materials are all tax deductions for real estate agents. Other items include website development and ...

(8 days ago) Realtors Tax Deductions Worksheet AUTO TRAVEL Your auto expense is based on the number of qualified business miles you drive. Expenses for travel expenses - gas, oil, repairs, insurance etc.-and of any reimbursement you received for your expenses. Generally, to be deductible, items must be ordinary and necessary to your real estate

The real estate expense worksheets can be used per real estate property or a year end ... Cheat Sheet Of 100+ Legal Tax Deductions For Real Estate Agents.

Real Estate Agent Tax Deductions Worksheet 2021 Fill … Worksheet Signnow.com Show details . 9 hours ago Real Estate Agent Tax Deductions Worksheet 2020. Fill Out, Securely Sign, Print or Email Your Realtor Tax Deduction Worksheet Form Instantly with SignNow. the Most Secure Digital Platform to Get Legally Binding, Electronically Signed Documents in Just a Few Seconds.

Real Estate Professionals. Title: real Estate Expense Worksheet.xlsx Author: Peter Jason Riley Created Date: 12/28/2011 9:08:41 PM ...

Fill Real Estate Agent Tax Deductions Worksheet 2020, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller Instantly. Try Now!

Mar 11, 2015 ... These realtor tax deductions and tips should help you get more organized for the coming tax year ... Want our Realtor tax deduction worksheet?

Licensed real estate agents are statutory nonemployees and are treated as self-employed for all Federal tax purposes, including income and employment taxes, if: Substantially all payments for their services as real estate agents are directly related to sales or other output, rather than to the number of hours worked.

Real estate agent tax deductions worksheet excel Photo courtesy. 1 PDF editor e-sign platform data collection form builder solution in a single app. Fill Real Estate Agent Tax Deductions Worksheet 2020 Edit online. Concerned parties names places of residence and phone. Just Now Real estate agents can deduct qualifying education expenses on their Schedule C or E. Most real estate agents and ...

Real Estate Agent Tax Deductions Worksheet 2021 Fill Out . 9 hours ago Real Estate Agent Tax Deductions Worksheet 2020. Fill Out, Securely Sign, Print or Email Your Realtor Tax Deduction Worksheet Form Instantly with SignNow. the Most Secure Digital Platform to Get Legally Binding, Electronically Signed Documents in Just a Few Seconds. Available for PC, iOS and Android. Start a Free Trial Now ...

For busy real estate agents who manage their own finances, it can be hard to find time (and energy) to get expenses in order. Luckily, the Internal Revenue Service recently announced an extension to file for the 2020 tax year, stating: "This postponement applies to individual taxpayers, including individuals who pay self-employment taxes." These groups now have until May 17, 2021, to file.

Cyataxes Realtors Tax Deductions Worksheet - Fill and Sign Real Estate Details: You can deduct any costs associated with selling the home including legal fees, escrow fees, advertising costs, and real estate agent commissions, says Joshua Zimmelman, president of Westwood Tax and Consulting in Rockville Center, NY. › Verified Just Now

Real Estate Agent Tax Deductions Worksheet 2020 Fill Out . 9 hours ago Real Estate Agent Tax Deductions Worksheet 2021. Fill out, securely sign, print or email your realtor tax deduction worksheet form instantly with SignNow. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now ...

16 Real Estate Tax Deductions for 2021 2021 Checklist … Deduct Hurdlr.com Show details . Just Now Real estate agents can deduct qualifying education expenses on their Schedule C or E. Employees may be eligible to deduct unreimbursed training and education expenses on their Schedule A, subject to the 2% limit. For Example. Angel is a self-employed real estate agent who has been in the ...

real estate agent or broker worthwhile. You feel great when a deal closes and you feel successful when you receive a hard earned commission. You can add to those positive feel-ings with the knowledge that you are taking advantage of every plan, program, deduction, and law that exist to make your tax bill low. Keep your money in your pocket.

Most real estate agents and brokers receive income in the form of commissions from sales transactions. You're generally not considered an employee under federal tax guidelines, but rather a self-employed sole proprietor, even if you're an agent or broker working for a real estate brokerage firm. This self-employed status allows you to deduct many of the expenses you incur in your real estate ...

REALTOR/REAL ESTATE AGENT - TAX DEDUCTION CHEAT SHEET Advertising Billboards Brochures/Flyers Business Cards Copy Editor Fees Direct Mail Email Marketing & Newsletters Graphic Designer Fees Internet Ads (Google, Facebook, etc) Leads/Mailing Lists ...

Write your Real Estate Agent Tax Deductions Worksheet Form online is easy and straightforward by using CocoSign . You can simply get the form here and then fill in the details in the fillable fields. Follow the tips given below to complete the document. Fill out the blanks eSign the form using our tool Send the completed form

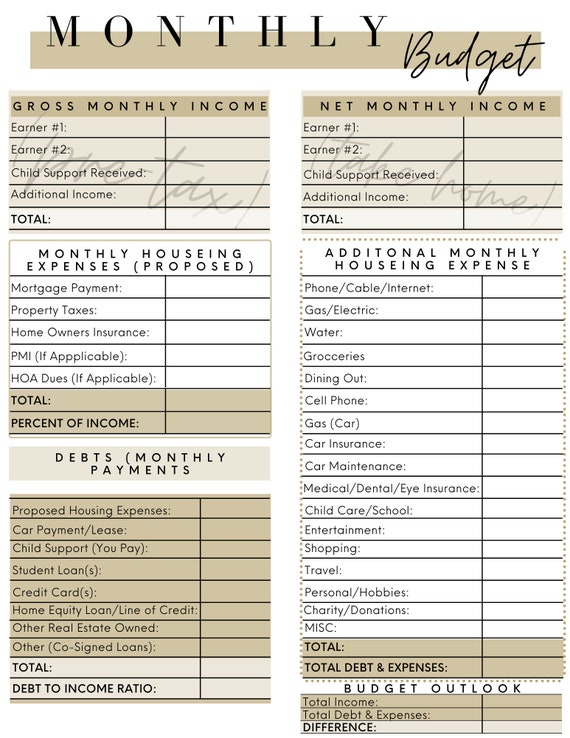

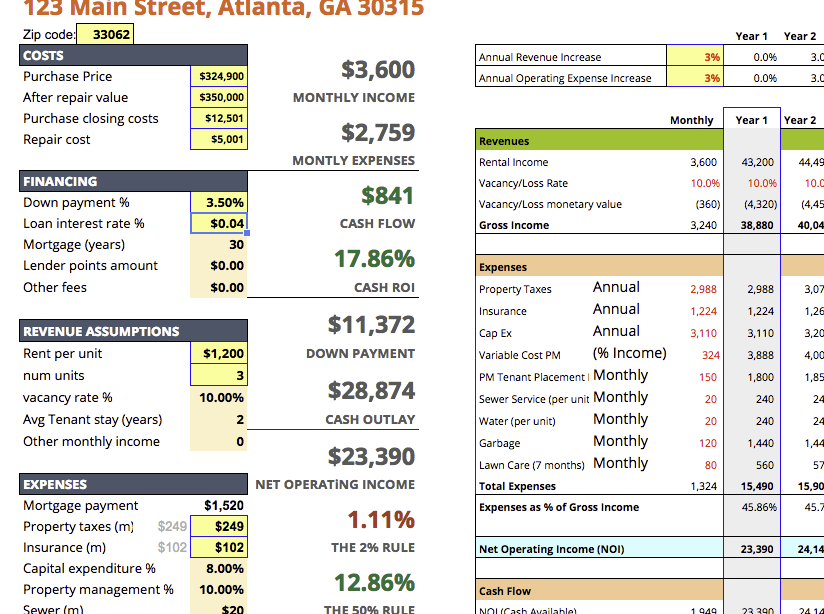

However, investing in real estate requires extensive analysis to ensure you aren't stuck with a massive financial headache. Whether you're investing in residential or commercial real estate, flipping homes, or buying a home for you and your family, here are 15 real estate spreadsheets to help you make prudent buying decisions and organize ...

Get and Sign Real Estate Agent Tax Deductions Worksheet Form Book as follows 1 give the date and business purpose of each trip 2 note the place to which you traveled 3 record the number of business miles and 4 record your car s odometer reading at both the beginning and end of the tax year.

Get and Sign Realtor Tax Deduction Worksheet Form Operation of your real estate business. Do not include expenses which are reimbursable, for which you have been reimbursed, or expect to be reimbursed. If you have any questions or need specific advice on a particular Real Estate issue, please contact Jeff Bolton, CPA at 561-367-1040.

Real estate agents can deduct qualifying education expenses on their Schedule C or E. Employees may be eligible to deduct unreimbursed training and education expenses on their Schedule A, subject to the 2% limit. For Example. Angel is a self-employed real estate agent who has been in the business for over 20 years.

16 real estate tax deductions for 2021 | 2021 checklist hurdlr. Real estate agent tax deductions worksheet. Forget about scanning and printing out forms. Progress reports can also request additional advice, discuss topics that have risen from the ministry and indicate paths ahead when. Download our 12 month expense worksheet excel worksheet.

Details: Real Estate Agent Tax Deductions Worksheet Form. Book as follows 1 give the date and business purpose of each trip 2 note the place to which you traveled 3 record the number of business miles and 4 record your car s odometer reading at both the beginning and end of the tax year. Keep receipts for all car operating expenses- gas oil repairs realtor expense spreadsheet for taxes ...

![1099 Excel Template [Free Download]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5f63b7164b3b9866f01727c2_IRS-form-schedule-C.png)

0 Response to "40 real estate agent tax deductions worksheet"

Post a Comment