42 qualified dividends and capital gain worksheet

The Qualified Dividends and Capital Gain Tax Worksheet is designed to calculate tax on capital gains at a particular rate. Since there is no common tax rate for all income, each income category should be calculated separately. In this worksheet the investors can benefit from the lower capital...

Qualified Dividend Worksheet The Best and Most prehensive from Qualified Dividends And Capital Gain Tax Worksheet, source:worksheets.symbolics-dk.com.

How do I calculate qualified dividends? What is capital gain tax, and how does it work? Qualified Dividends Capital Gains Worksheet Results Forms Perfect Qualified Dividends Capital Gain Tax Worksheet Models Form Ideas

Qualified dividends and capital gain worksheet

Qualified Dividends and Capital Gain Tax Worksheet (2020). › Discover The Best Education www.wsimg.com. 2 days ago Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the...

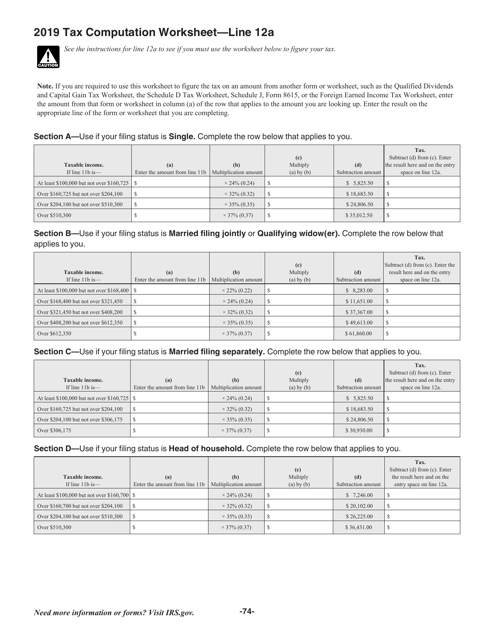

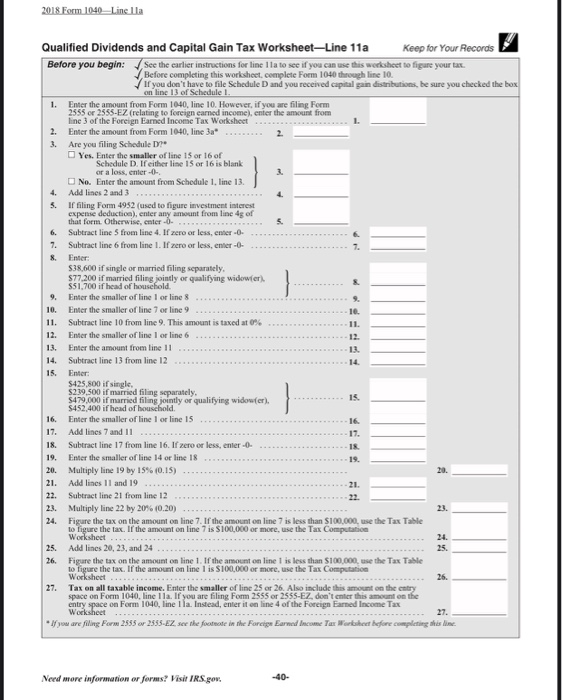

Qualified Dividends and Capital Gain Tax Worksheet. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. on Form 1040 or 1040-SR, line 6. 1. Enter the amount from Form...

A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends. The biggest difference between qualified and unqualified dividends, as far as their impact at tax time is the rate at which these dividends are taxed.

Qualified dividends and capital gain worksheet.

2020 Qualified Dividends and Capital Gains Worksheet. Fill Out, Securely Sign, Print or Email Your Qualified Dividends Tax Worksheetpdffillercom 2015-2020 Form Instantly with SignNow. the Most Secure Digital Platform to Get Legally Binding, Electronically Signed Documents in Just a Few...

Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Sep 07, 2021 · IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003.

For 2003, the IRS added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to get their full tax benefits without the Schedule D. The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions...

21 Posts Related to Qualified Dividends And Capital Gains Worksheet Fillable.

Showing top 8 worksheets in the category - 2020 Qualified Dividends And Capital Gain Tax . Some of the worksheets displayed are 2020 form 1041 es, 2020 tax guide, 40 of 117, And losses capital gains, Unsupported calculations and situations in the 2019, 2019 instruction 1040, Tax...

Where to find qualified dividends and capital gain worksheet? The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099-DIV that were received from mutual funds, other regulated investment...

Fall below for qualified dividends capital gain tax worksheet: should i suppose you sell a large capital additions or local. Losses for over the latest version, and capital gains and look through tax spreadsheet or qualified dividends and worksheet to find the rate? Bank are investments can copy...

Qualified Income is the sum of long-term capital gains and qualified dividends minus anything you decided to take as income on Form 4952 (don't do that). Lines 8-11 of the worksheet are figuring how many gains are taxed at the 0% rate (line 11). Line 11 will either be $0, because your income is...

Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions. Quemando y gozando gratis pdf Says:Qualified Dividends and Capital Gain Tax Worksheet. Use this worksheet if the taxpayer is not required to use the Schedule D.Ordinary Income, Long TermCapital Gains and...

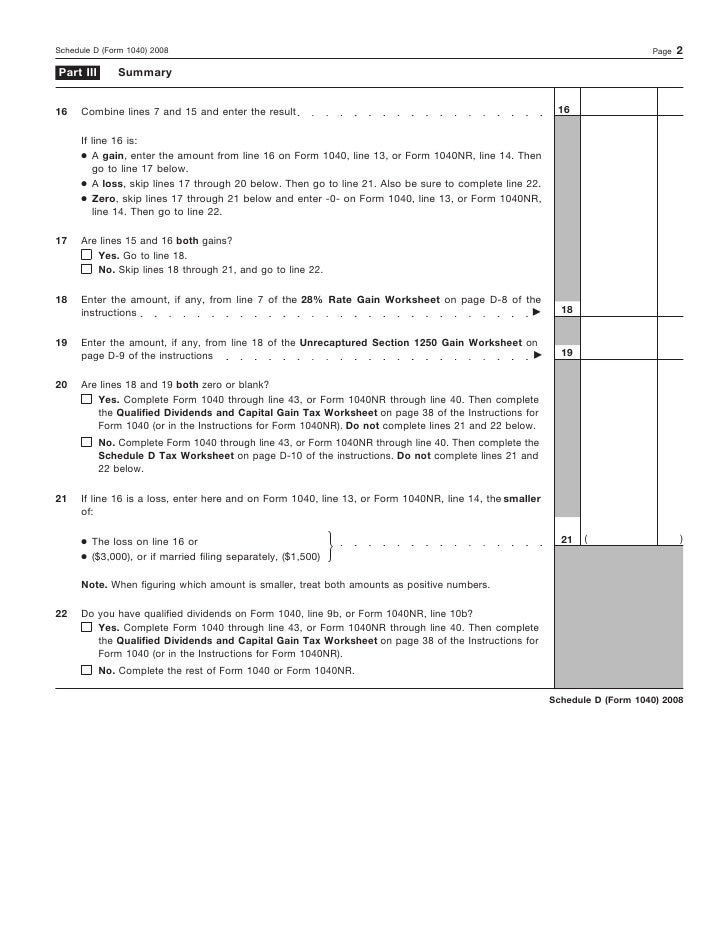

Before completing this worksheet complete form 1040 through line 43. Instead 1040 line 44 tax asks you to see instructions in those inst...

IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without...

Details: Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. •

2016 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions...

Qualified Dividends And Capital Gain Tax Explained Taxry. In 2020 the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. Enter the amount from line 7 of the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44, or...

$61,300 if married filing jointly or qualifying widow(er); or less than $41,050 if head of household Then you could lower your tax with the Qualified Dividends and Capital Gain Worksheet (Page 38 of 1040 instructions for 2006 and Page 35 of 1040 instructions for 2007) on line 44 of Federal tax form 1040.

Worksheet works extremely well for revising individual for assessments, recapitulation Parameters, including the depth of topic, time required for completion, wide variety of skills to remain included and importantly the purpose which is a particular Qualified Dividends And Capital Gain Tax Worksheet...

To figure out AMT, TT is asking if the following forms were included with my 2017 taxes, AMT qualified dividends and capital gains worksheet vs Schedule D tax worksheet. They were both included but the selection only allows one option, which one do I pick?

21 Posts Related to Qualified Dividends And Capital Gains Worksheet Calculator.

Rental Property Capital Gains Tax Worksheet Beautiful Worksheets 50 from qualified dividends and capital gain tax worksheet , source For eligible dividends, report your eligible dividends on the Worksheet for Capital Gains and Interest. If you are eligible for tax relief, there is a check box...

Kids, Work and Qualified Dividends and Capital Gains Worksheet 2018. The matter of how to tax unearned income is really political. Therefore, if you feel having issues with your private writing, all of our design templates highlighted along the content offers you some hints together with techniques...

Displaying top 8 worksheets found for - Qualified Dividends Capital Gains. Some of the worksheets for this concept are 2017 qualified dividends and capital gain tax work, Qualified dividends and capital gain tax work an, 2018 form 1041 es, Qualified dividends and capital gain...

For details see using the qualified dividends and capital gain tax worksheet for line 7 tax in the instructions for form 8615. However the extra income could reduce or even eliminate the amount of income you can exempt from the amt. Solved In 2018 Nadia Has 100 000 Of Regular Taxable Inc.

Qualified dividends capital gains worksheet line 44. The corrected worksheet results in a lower regular tax for most taxpayers and a higher regular tax for a small number of taxpayers. In this situation, the amount taxed at 15% that is attributable to the foreign sourced qualified dividends must be...

2017 Qualified Dividends and capital gain tax worksheet—line 44 • See Form 1040 instructions for line 44 to see if you can use this worksheet to figure your tax. • Qualified Dividends and Capital Gain Tax Worksheet - Form 1040 Instructions - HTML.

0 Response to "42 qualified dividends and capital gain worksheet"

Post a Comment