39 1031 like kind exchange worksheet

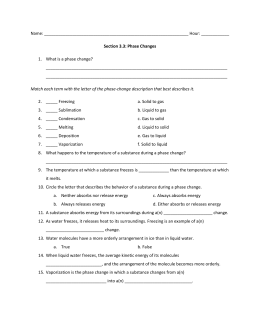

A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded. Form 8824 figures the amount of gain deferred as a result of a like-kind exchange. Part III computes the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of a like kind is involved in the exchange. Also, the basis of the like-kind property received is figured on Form 8824.

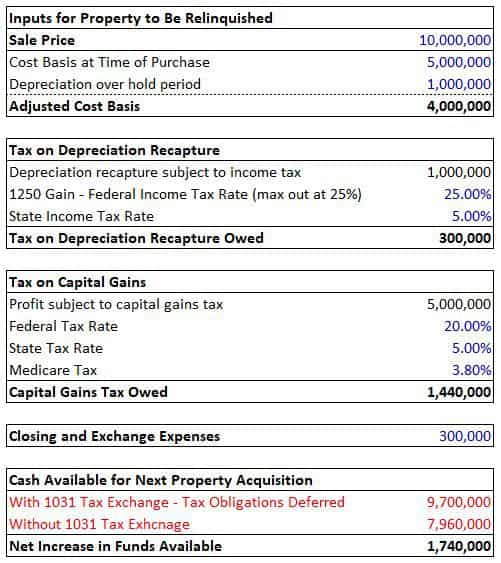

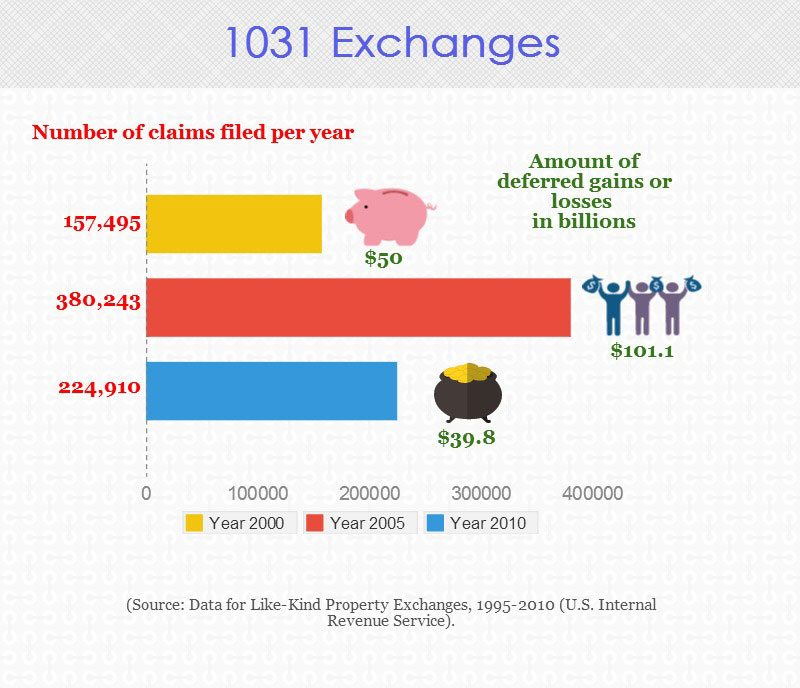

A 1031 like-kind exchange is a tax strategy to delay paying capital gains taxes when selling investment properties. These taxes can be up to 20% of the sale price. The name 1031 comes from Section 1031 of the U.S. Internal Revenue Code. This is a section of the tax code that lets taxpayers sell a qualified property.

1031 like kind exchange worksheet

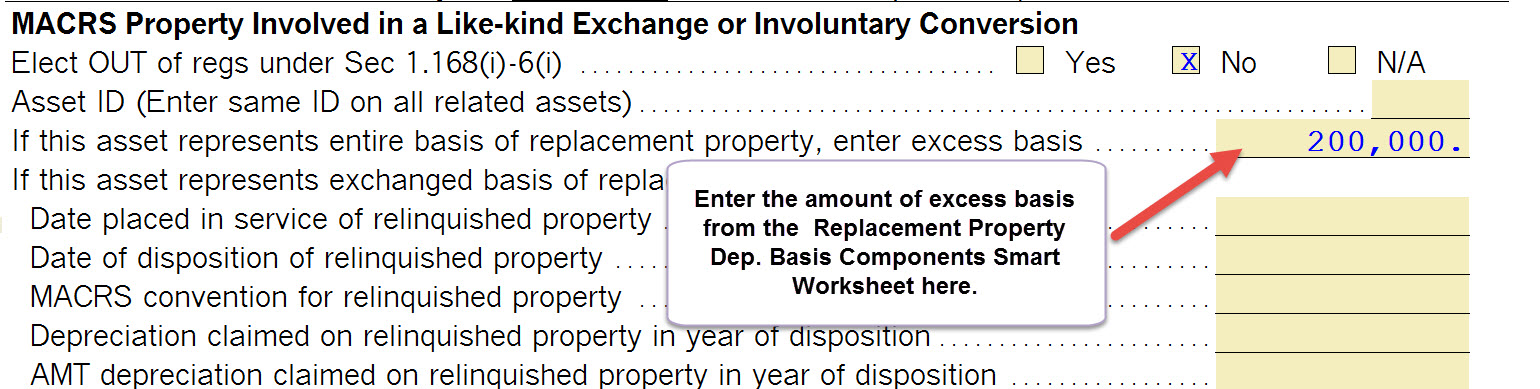

The qualified depreciable property is the property received as a part of the transaction that qualified for like-kind exchange treatment under the Internal Revenue Code, Section 1031, as amended through December 16, 2016, but not as amended through December 31, 2018. 1031 Corporation Exchange Professionals - Qualified ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 A. Depreciation taken in prior years from WorkSheet #1 (Line D)$ _____ B. Taxable gain from ...

1031 like kind exchange worksheet. IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example. Worksheet April 17, 2018. We tried to find some amazing references about IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example for you. Here it is. It was coming from reputable online resource and that we like it. We hope you can find what you need here. Jan 10, 2022 · A 1031 exchange, named after section 1031 of the U.S. Internal Revenue Code, is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to buy a ... as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind. If you receive cash, relief from debt, or Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free) www.1031cpas.com

Incomplete or Partial Exchange Spanning Two Tax Years 4 . Depreciation of Replacement Property 5 . Personal Property Exchanges after December 31, 2017 6 . Reporting State Capital Gain 6 . Completion of IRS Form 8824 "Like-Kind Exchanges" 6 FORM 8824 IRS Form 8824, the Like Kind Exchange form, is where you report your Section 1031 Exchange - Delayed, Reverse, or Construction. The Form 8824 is due at the end of the tax year in which you began the transaction, as per the Form 8824 Instructions. Purchase Inherited/gift Like-kind (1031) exchange: Was this your main home? Yes No: Was the home jointly owned with a spouse? Yes No: Were you divorced after obtaining the home? Yes No: Were you divorced after 7/18/1984? Yes No: Is that spouse deceased? Yes No: Check if community property state: Died after ? Yes No: Have you remarried? Like-Kind Exchanges Generally, if you exchange business or investment real property solely for business or investment real property of a like kind, section 1031 provides that no gain or loss is recognized. If, as part of the exchange, you also receive other (not like-kind) property or money, gain is recognized to the extent of

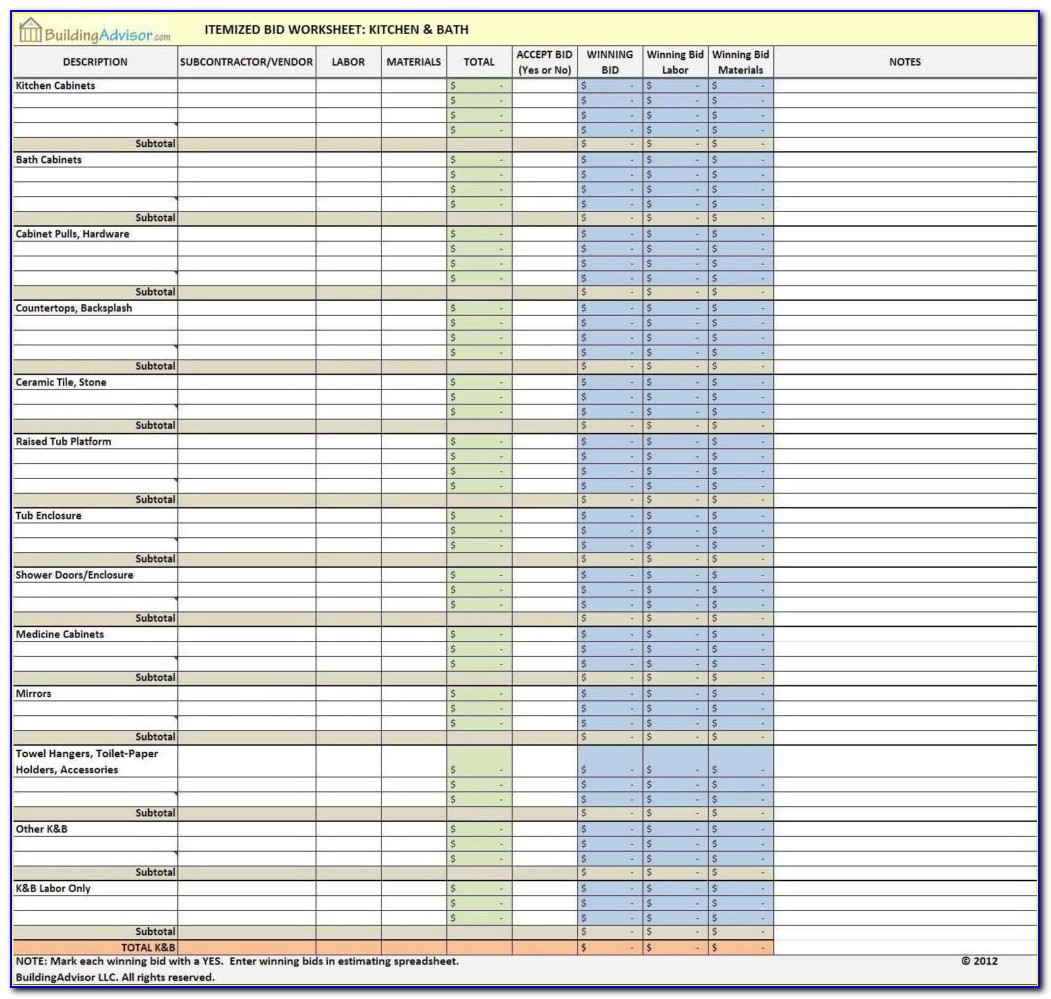

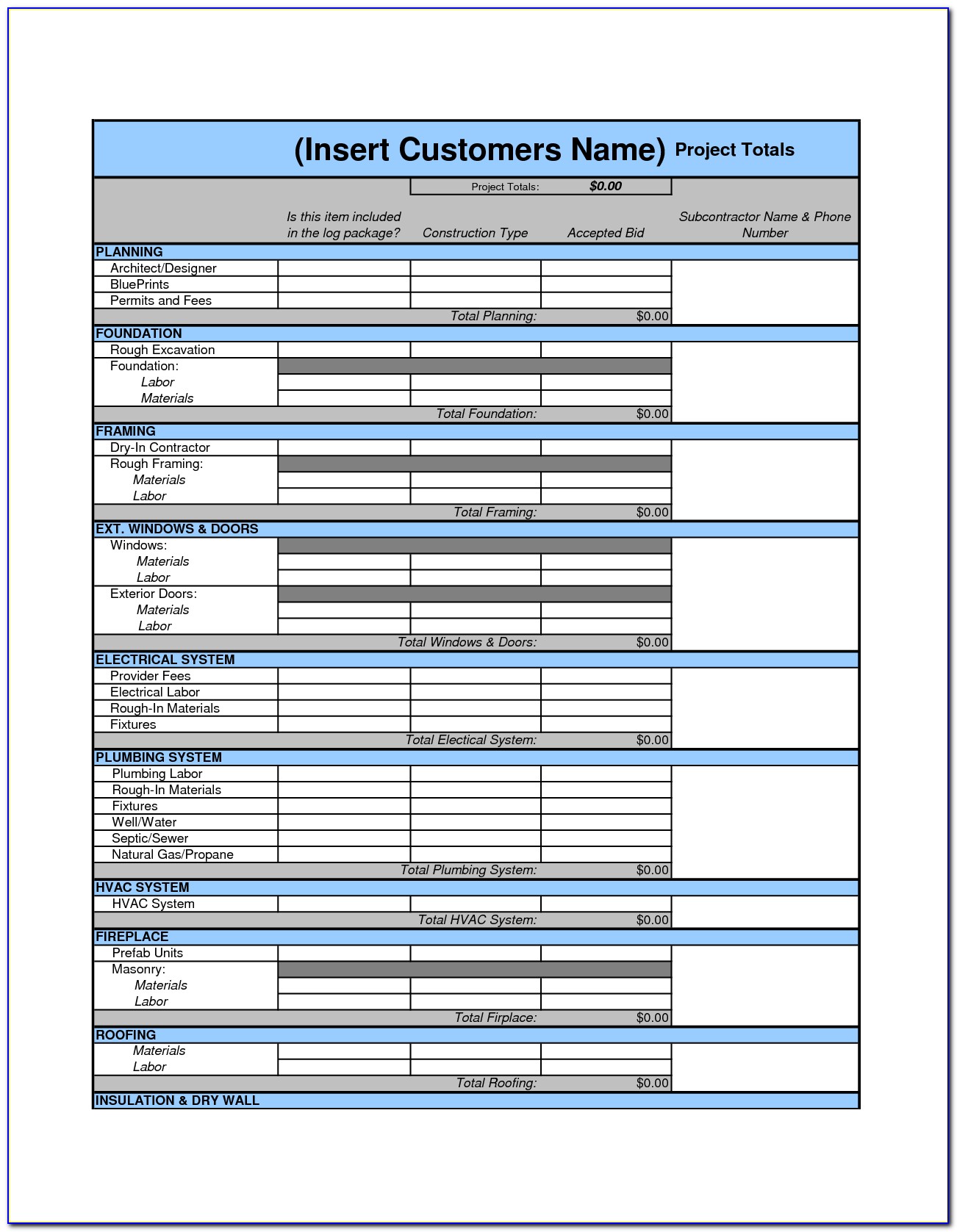

Worksheet April 17, 2018. We tried to get some amazing references about 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template for you. Here it is. It was coming from reputable online resource and that we enjoy it. We hope you can find what you need here. We constantly attempt to reveal a picture with high resolution or with perfect ... Like kind exchange worksheet excel and irs 1031 exchange worksheet can be beneficial inspiration for those who seek an image according specific categories you can find it in this site. By changing any value in the following form fields. 1031 Like Kind Exchange Calculator - Excel Worksheet Smart 1031 Exchange Investments We don't think 1031 exchange investing should be so difficult That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. 01-01-2015 · Like-Kind Exchanges – California requires taxpayers who exchange property located in California for like-kind property located outside of California, and meet all of the requirements of the IRC Section 1031, to file an annual information return with …

A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded.

Check the second-to-last box from the bottom for like-kind and section 1031 exchanges and click Continue. On the next screen, answer Yes and proceed through the interview questions. We'll fill out Form 8824 for you. If you accidentally generated a Form 8824 that you don't need, you can delete it by repeating steps 1 and 2 above.

HUD-1. Line #. A. Exchange expenses from sale of Old Property. Commissions. $_____.6 pages Like kind exchange worksheet 1031 exchange calculator excel. 1031 like kind exchange worksheet and form 8824 worksheet template can be valuable inspiration for those who seek a picture according specific topic you will find it in this website.

1031worksheet - Learn more about 1031 Worksheet 1031 Exchange Rules In all cases of a 1031 exchange, the owner must close on the identified replacement property (s) within 180 days from the sale date of the original property. The "three-property" 1031 exchange rule: the owner may identify up to three properties, regardless of their value.

Nov 27, 2021 · Deferrals of capital gains tax are allowed for investment properties under the 1031 exchange if the proceeds from the sale are used to purchase a like-kind investment.

Aug 31, 2021 · Swap properties using a 1031 exchange. A 1031 exchange allows you to defer paying capital gains taxes when you sell one investment property and use the proceeds to buy another. The other property must be of “like-kind,” which generally means any piece of real estate can be exchanged for another piece of real estate, as long as they’re ...

3D illustration of blocks in a blockchain. 「 LOGO / BRAND / 3D design 〠WhatsApp: +917559305753 Email: shubhamdhage000@gmail.com

Click here for your 1031 Exchange Tool Kit including at 1031 checklist, qualified intermediary locator, close date form, 1031 identification form and more. Click here to schedule your free 1031 exchange and investment consultation.

The Exchange is reported on IRS Form 8824, Like-Kind Exchanges. The Form 8824 is divided into four parts: Part I. Information on the Like-Kind Exchange Part II. Related Party Exchange Information Part III. Realized Gain or (Loss), Recognized Gain, and Basis of Like-Kind Property Received Part IV.

1031 -Like Kind Exchange. The interview guidance is confusing and incomplete. For an exchanged property, the form 8824 interview and form does not link back to the schedule E and correct ( partial year) depreciation, and does not calculate or link basis for the exchange as reported on the form 8824. If you have entered assets in previous years ...

1031 Relinquished Property Worksheet. Read more. 1031 Replacement Property Worksheet. Read more. 1031 "Like-Kind" Exchange Best Practices. Raising the Bar for Secure, Transparent, and Compliant Exchanges. Read more. How to do a 1031 Exchange. The 1031 Forward Exchange Process.

Take A Sneak Peak At The Movies Coming Out This Week (8/12) Why Your New Year’s Resolution Should Be To Go To The Movies More; Minneapolis-St. Paul Movie Theaters: A Complete Guide

Like-Kind Exchanges. The Form 8824 is divided into four parts: Part I. Information on the Like-Kind Exchange Part II. Related Party Exchange Information Part III. Realized Gain or (Loss), Recognized Gain, and Basis of Like-Kind Property Received Part IV. Not used for 1031 Exchange - Used only for Section 1043 Conflict of Interest Sales.

Like-kind exchanges don't have to be exact replacements—a warehouse for a warehouse, for example—but they do have to be of the same "nature, character or class," the IRS says. Swapping a warehouse that includes land for vacant property or a factory with land would be a like-kind exchange, since all involve real property.

3D illustration of tezos blockchain. a blockchain designed to evolve. 「 LOGO / BRAND / 3D design 〠WhatsApp: +917559305753 Email: shubhamdhage000@gmail.com

A 1031 exchange (also commonly referred to as a "like-kind exchange") is a tax strategy for real estate investors that allows for the deferment of any taxes the investor might owe on the sale of an investment property. When you sell an investment property, there are two potential types of taxes you might have to pay.

09-12-2021 · Event1644Reader.ps1 is a PowerShell script that extracts 1644 events from saved Directory Service event logs and imports them into predefined views in an Excel spreadsheet for analysis. Event1644Reader.ps1 can be used on event logs generated by Windows Server 2012 R2 domain controllers or Windows Server 2008 R2 and Windows Server 2012 domain …

Everything You Need to Know About 1031 Exchanges. 1031 tax-deferred swaps allow real estate investors to defer paying capital gains taxes when they sell a property that is used "for productive use in a trade or business," or for investment.This is due to IRC Section 1031, and when structured correctly, it lets you sell a property and reinvest the proceeds in a new property - while deferring ...

You acquired your home in a like-kind exchange (also known as a section 1031 exchange), or. Your basis in your home is determined by reference to a previous owner's basis, and that previous owner acquired the property in a like-kind exchange (for example, the owner acquired the home and then gave it to you); and

received in exchange for the property sold.....$ _____ 4. Allocation of the remaining cost basis to §1031 Replacement Prop erty: 4.1 Enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost ... §1031 BASIS ALLOCATION WORKSHEET Replacement Property Depreciation Analysis (Supplement to §1031 Recapitulation Worksheet Form 354)

When a like-kind exchange is entered on like-kind exchanges worksheet and the "Automatic Sale" feature is used, up to five assets can be sold and new continuation assets are created for all five. An additional asset is created if there was Total Cash Paid entered on Income/Deductions > Like-Kind Exchanges > section 3 - line 4 entered in the ...

01-01-2015 · Like-Kind Exchanges – The TCJA amended IRC Section 1031 limiting the nonrecognition of gain or loss on like-kind exchanges to real property held for productive use or investment. California conforms to this change under the TCJA for exchanges initiated after January 10, 2019.

Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 A. Depreciation taken in prior years from WorkSheet #1 (Line D)$ _____ B. Taxable gain from ...

Just watching people live their life and catching up with friends, old and new–it’s a wonderful thing.

1031 Corporation Exchange Professionals - Qualified ...

The qualified depreciable property is the property received as a part of the transaction that qualified for like-kind exchange treatment under the Internal Revenue Code, Section 1031, as amended through December 16, 2016, but not as amended through December 31, 2018.

3D illustration of tezos coin, A blockchain designed to evolve. 「 LOGO / BRAND / 3D design 〠WhatsApp: +917559305753 Email: shubhamdhage000@gmail.com

0 Response to "39 1031 like kind exchange worksheet"

Post a Comment