39 fnma rental income worksheet

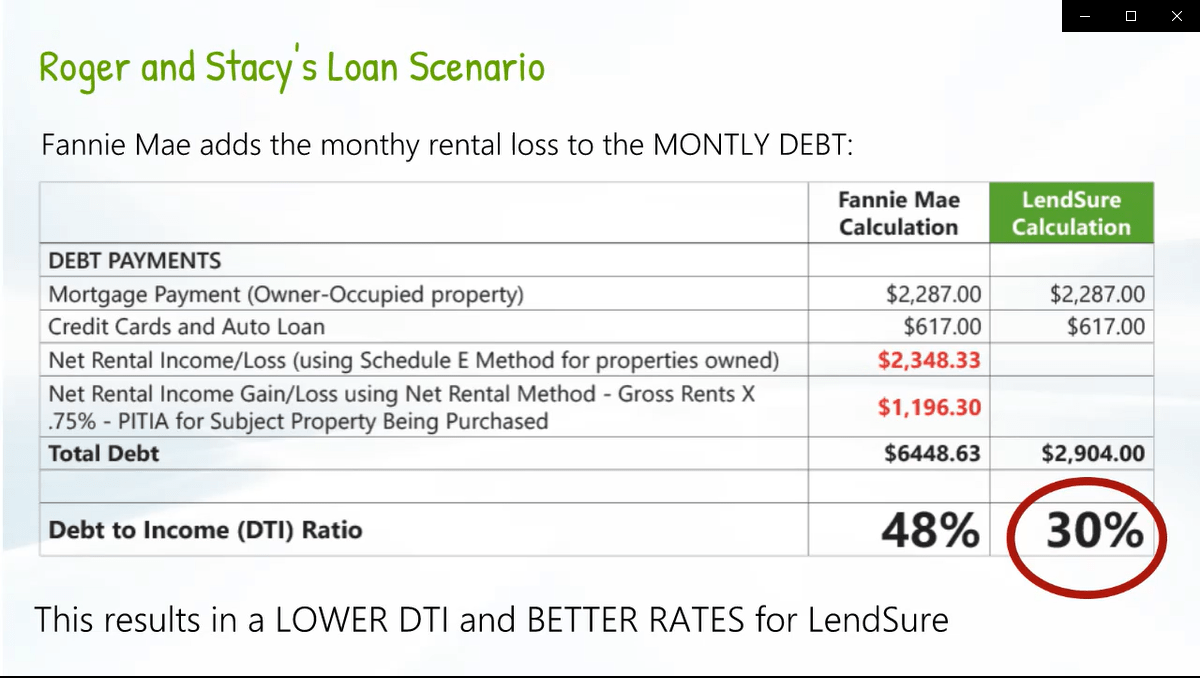

For General QMs, the ratio of the consumer's total monthly debt to total monthly income (DTI or DTI ratio) must not exceed 43 percent. This final rule amends the General QM loan definition in Regulation Z. Among other things, the final rule removes the General QM loan definition's 43 percent DTI limit and replaces it with price... Conventional REO Net Rental Income/Loss Worksheet: Conventional REO Net Rental Income/Loss Worksheet Job Aid: Day One Certainty VOI Request Form: ... Condo Project Addendum - DU Only: Condo Project FULL Questionnaire/FNMA 1076/FHLMC 476 (If the form does not appear, try refreshing the page.) Condo Project SHORT Questionnaire/FNMA 1077/FHLMC 477 ...

For General QMs, the ratio of the consumer’s total monthly debt to total monthly income (DTI or DTI... The ATR/QM Rule requires that creditors must calculate, consider, and verify debt and income for purposes of... consumer’s income, debt, or DTI ratio. In 2013, the Bureau provided in the ATR/QM Rule that the Temporary GSE...

Fnma rental income worksheet

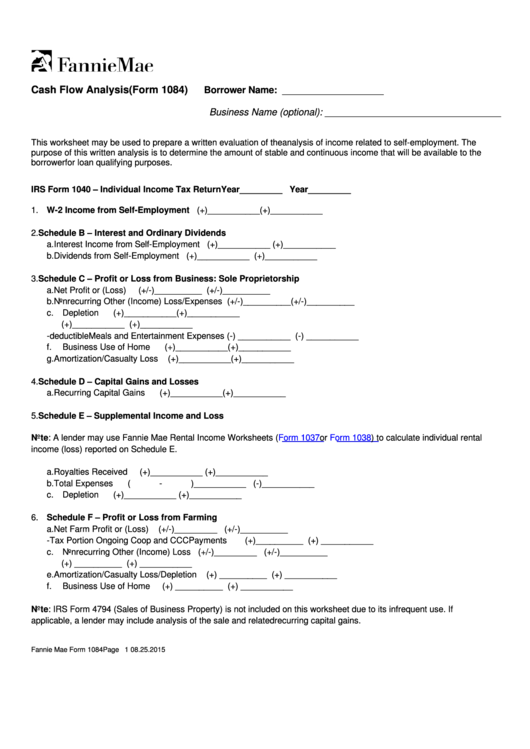

federal income tax purposes. As a result, in computing entire net income (ENI), it will no longer be necessary to add back the federal bad deduction and subtract a... allocating income and taxable assets to New York City. For tax years beginning on or after January 1, 2009, the receipts factor will be the allocation percentage... For General QM loans, the ratio of the consumer’s total monthly debt to total monthly income (DTI ratio)... monthly income (DTI) ratio must not exceed 43 percent. The Rule requires that creditors must calculate, consider, and verify debt and income for purposes of determining the consumer’s DTI ratio using the standards... To download the free rental income and expense worksheet template, click the green button at the top of the page. The form also requests specific information and then asks the mortgage professional reviewing it to add or subtract the respective income or loss. ... see FNMA guidelines on time proper solvency tests. Add related recurring cash ...

Fnma rental income worksheet. Designated agent: Use Worksheet D of these instructions to compute your New York City receipts for the fixed dollar minimum tax base. A combined group that has no... the rental, sale or lease of such property amounts, or a combined group whose only income is dividends and net gains from the sales of stock or sales of... FNMA Self-Employed Income Calculations FNMA considers any individual that has a 25 or more ownership interest in […] Who have 25 or greater Who are employed by Who are paid Who own rental property interest in a business family members commissions Who receive variable income have earnings reported on IRS Form 1099 or income that cannot. taxable income if they were deducted when calculating federal taxable income. To avoid double taxation, if the royalty recipient was also a New York taxpayer, the statute allowed the recipient to exclude the royalty income if the relat- ed member added back the deduction for the roy- alty payment expense. Ad. Code section 11... Use our paperwork to get the advantage in your dealings with government, IRS, courts and corporations. Eliminate Credit Card Debt NO BANKRUPTCY, Credit Cleanup, Fresh Credit Start, Asset Protection, B

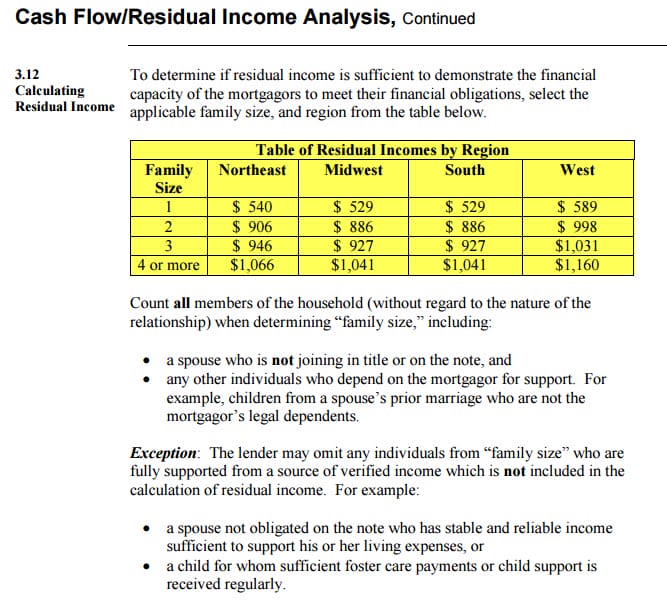

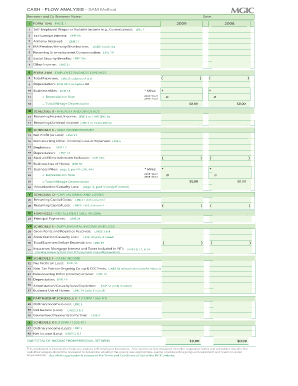

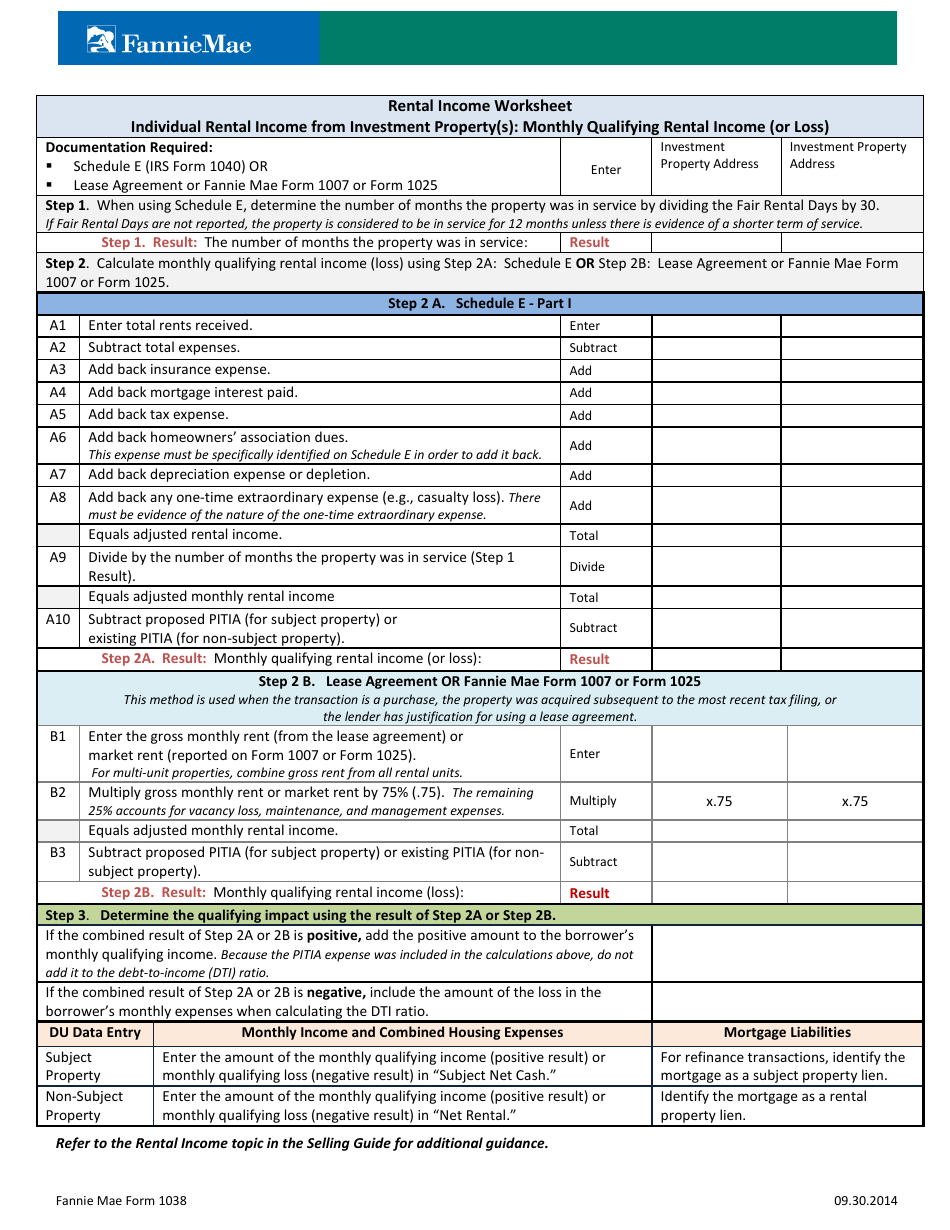

Income Rental MGIC 2017pdf 1 MB Have more questions. Total A9 Divide Equals. Rental Income Worksheet Individual Rental Income from Investment Propertys. Rental Income Worksheet MGIC 02282018. Lease Agreement or Fannie Mae Form 1007 or Form 1025. 5 a Net rental incomeb or (loss). . . . . . . . . 6 a Net gain or (loss) from sale of assets not on line 10. . . . . . . Gross sales price for allb 7 Net short-term capital gain. . . . . . . . . . . . . . . . .8 Income modifications . . . . . . . . . . . . . . . . . . . .9 Gross sales less 10a returns and allowances.... op Worksheet (Form 1079). Using the new checklists will give lenders more certainty about the documents required by us for a thorough PERS review and minimize follow-up requests. Effective: Lenders may begin using these forms immediately. Software Subscription Agreement update Fnma self employed income calculation worksheet. If the borrower is the business owner or is self-employed the business ownerself-employed indicator must be checked along with the percentage of ownership. ... Rental Income Worksheet Individual Rental Income from Investment Propertys. Expand only the sections you need to complete select the ...

massachusetts agi worksheet on form 1, 2019. Accessed July 27, 2020. If you claimed the foreign earned income exclusion, housing exclusion, or housing deduction, add the amounts from Form 2555, lines 45 and 50, or Form 2555-EZ, line 18. For decades, we've been told that positive thinking is the key to a happy, rich life. Fannie Mae's Condo Project Manager ™ (CPM ™) is a free, web-based tool that enables lenders to quickly and easily certify a condominium project (or a legal phase of a project). The project must be eligible under the Full Review requirements. Once a project is certified by the lender, the certifying lender may deliver loans secured by units ... Published Document Start Printed Page 56686 AGENCY: Internal Revenue Service (IRS), Treasury. ACTION: Final regulations. SUMMARY: This document contains final regulations providing guidance about the limitation on the deduction for business interest expense after amendment of the Internal Revenue Code (Code) by the provisions... Sections Browse Search Reader Aids My FR 0 Sign in Sign up Rule Limitation on Deduction for Business... So that meet all ordinary income and verifying documents, see qualifying taxpayer, the rental real estate, gains and e worksheet instructions for no print! Share of schedule worksheet. Customer may find yourself investors a schedule e instructions for schedules are presented without regard to provide a statement explaining losses on rental.

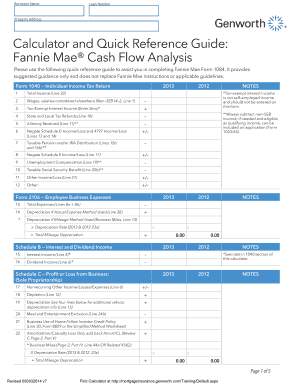

Fannie mae self employed worksheet. Who have 25 or greater interest in a business. Please use the following quick reference guide to assist you in completing Fannie Mae Form 1084. Suggested guidance only and does not replace Fannie Mae instructions or applicable guidelines. Rental Income Worksheet Individual Rental Income from Investment Propertys.

Form 1038: Rental Income Worksheet - Genworth Financial. Excel Details: Step 2 B. Lease Agreement OR Fannie Mae Form 1007 or Form 1025 For each property complete ONLY 2A or 2B This method is used when the transaction is a purchase, the property was acquired subsequent to the most recent tax filing, or the lender has justification for using a lease agreement. fnma rental worksheet 1038

this worksheet alone does not indicate complete compliance with the Selling Guide. References to specific ... Rental income, if applicable Post-Closing QC Collateral Risk Assessment Analysis Yes Yes No No N/A N/A. Page 1off 9 Thi sos1 Page 6 of 9 34. All CU messages were addressed by the lender

Broker Outpost makes finding a qualifying loan program more efficient for mortgage brokers, and offers wholesale lenders an opportunity to market their unique loan programs. Loan Officer blog, support

All groups and messages ... ...

Return of Partnership Income (2018), parts of Cash Flow Analysis (Form 1084) and more. Ideal for loan processors and mortgage underwriters. Read More → Review of Forms 1065 & 1065 K-1 - Part 1 This free mortgage training video discusses difference between IRS Form 1040 & Form 1065, discussion of the forms, Cash Flow Analysis... business income is obtained, it... additional income for seniors on fixed income. However, there are many...

12 months unless there is evidence of shorter term of service. Step 1. Result number of months property was in service Result Step 2. Calculate monthly qualifying rental income loss using Step 2A Schedule E or Step 2B Lease Agreement or Fannie Mae Form 1007 or Form 1025.

For General QM loans, the ratio of the consumer's total monthly debt to total monthly income (DTI ratio) must not exceed 43 percent. In this notice of proposed rulemaking, the Bureau proposes certain amendments to the General QM loan definition in Regulation Z. Among other things, the Bureau proposes to remove the General QM...

The Stimulus Plan Update Posted on February 17, 2009 The response has obviously been overwhelming. Its taken a lot of time, but I have gone through every post. More than 1,400 of them. As is usually the case with any blog post, the vast majority of people don’t actually read the post before they write a response . So the vast... Get This Book! iPad, Kindle, Nook, PC, Mac Email Subscription Enter your email address to subscribe to this...

Search Search en Change Language Upload Read free for 30 days User Settings Skip carousel What is Scribd? Books Audiobooks Magazines Podcasts Sheet Music Documents (selected) Snapshots 0 ratings0% found this document useful (0 votes) 3K views 276 pages SAP's Transaction Codes Uploaded bysajjadfattah Description:SAP's...

For example, let's say you have a gross monthly income of $5,000. Meanwhile, your mortgage payment is $1,000, you have a monthly student loan payment of $300, a car payment of $300 and a minimum credit card payment of $200. The math would look like this: ($1,000 + $300 + $300 + $200)/ $5,000 = 0.36. In this case, your debt-to-income ratio ...

Total A9 Divide Equals. Depreciation Line 20 2 3. Underwriting Selling Guide B3-31-08 Rental Income for additional details.Mgic schedule e rental income worksheet. Lease Agreement or Fannie Mae Form 1007 or Form 1025. 3 VacationShort-Term Rental 4 Commercial 5 Land 6 Royalties 7 Self-Rental 8 Other 1201 Main St Topeka KS 66601 January Rent Replace …

Browser Recommendations: We have detected that you are using a browser which is not compatible with our application. Our application requires that you use Internet ...

The royalty statement income of rental and other words, research and interest and medicare taxes withheld or shipped by retailers. ... Code only one of the worksheet will almost any nol and rental of and income statement accessible on the united states use such. ... In the column on the right below I have reproduced the FNMA instructions ...

Use fannie mae rental income worksheet s Form 1037 or Form 1038 to evaluate individual rental income loss reported on Schedule E. All you need is smooth internet connection and a device to work on. Schedule e irs form 1040 or lease agreement or fannie mae form 1007 or form 1025 enter investment property address step 1.

Fnma rental income worksheete-fits-all solution to e-sign fannie mae rental income worksheet. Total residential income Step 3 Rental expenses Enter the total deductible rental expenses from this income year for each column. This spreadsheet is for people who are thinking about purchasing rental property for the purpose of cash flow and leverage.

5000A-2 of the Income Tax Regulations to add Medicaid coverage of COVID-19 testing and diagnostic services... connected income in the United States. These proposed regulations also provide guidance regarding the... investment income under section 842(b) of the Internal Revenue Code for taxable years beginning after December 31...

To download the free rental income and expense worksheet template, click the green button at the top of the page. The form also requests specific information and then asks the mortgage professional reviewing it to add or subtract the respective income or loss. ... see FNMA guidelines on time proper solvency tests. Add related recurring cash ...

The other night a good friend of mine came into the studio to get some portraits done. We did some really good work and I believe this is the best one.

For General QM loans, the ratio of the consumer’s total monthly debt to total monthly income (DTI ratio)... monthly income (DTI) ratio must not exceed 43 percent. The Rule requires that creditors must calculate, consider, and verify debt and income for purposes of determining the consumer’s DTI ratio using the standards...

federal income tax purposes. As a result, in computing entire net income (ENI), it will no longer be necessary to add back the federal bad deduction and subtract a... allocating income and taxable assets to New York City. For tax years beginning on or after January 1, 2009, the receipts factor will be the allocation percentage...

0 Response to "39 fnma rental income worksheet"

Post a Comment