39 qualified education expenses worksheet

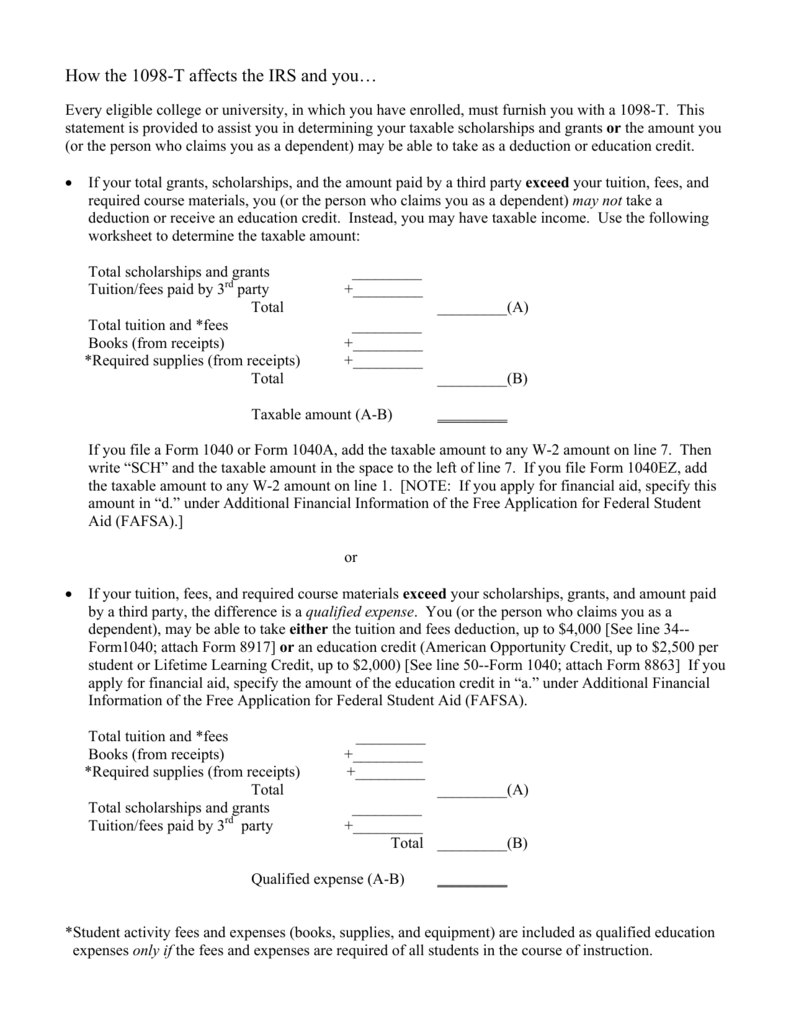

Qualified education expenses include tuition and other fees that students are obligated to pay in order to attend a particular institution. But you can't deduct expenses that you paid for with a scholarship or another tax-free award. ... you can use the Student Loan Interest Deduction Worksheet that the IRS provides. Bottom Line. The ... December 20, 2021 - These expenses qualify, as long as they are required to enroll in or attend a qualified educational institution:Tuition, if paid to the institutionStudent-activ

Tax Form 1040 Student Loan Interest. Updated August 20, 2021. Most interest that you pay throughout the year isn't tax-deductible. However, for some people, there's a special deduction they can take for paying interest on a student loan when they file the standard federal income tax form 1040. This can reduce your income tax by up to $2,500.

Qualified education expenses worksheet

Form 1099-Q Distributions: Enter only if total distribution used for qualified expenses Your 2018 tax return included educational expenses Based on your education expenses, scholarships, and grants reported on your Form 1098-T and information found on your account activity statement from your school, we have filed your education credit in the ... Oct 12, 2021 · On average this form takes 20 minutes to complete. The 2020 Education Expense Worksheet (H&Rblock) form is 1 page long and contains: 0 signatures. 0 check-boxes. 80 other fields. Country of origin: US. File type: PDF. Use our library of forms to quickly fill and sign your H&Rblock forms online. BROWSE H&RBLOCK FORMS. You should have received a Form 1098-T from your school. You will need this form in order to calculate the qualified expenses that you can claim. According to the IRS you must reduce any amount of...

Qualified education expenses worksheet. Jan 21, 2021 — the tax year for qualified education expenses. In most ca- ... Worksheet 1-1 to figure the tax-free and taxable parts of. The qualified expenses for 1099-Q funds are tuition, books, lab fees, AND room & board. That's it. If there are any excess 1099-Q funds they are taxable. The amount is included in the total on line 7.. Finally, out of pocket money is applied to qualified education expenses Fill out lines 27 through 30 for the American Opportunity Credit or line 31 for the Lifetime Learning Credit. Use the Adjusted Qualified Education Expenses Worksheet to calculate the amount for line 27, reducing education expenses by any tax-free scholarships and grants. To figure the amount of your education credit, you must complete Schedule ICR, Illinois Credits. Step 1: Payments received from: Payments paid to: Name of parent or guardian Name of school Social Security number of parent or guardian Address of school City, State, ZIP of school. Step 3: Signature of authorized school personnel

Qualified education expenses are amounts paid for tuition, fees and other related expenses for an eligible student. Who Must Pay Qualified education expenses must be paid by: You or your spouse if you file a joint return, A student you claim as a dependent on your return, or A third party including relatives or friends. Funds Used the worksheet above. The $3,000 Pell Grant will be entered on line 2a. The line 3 amount is $3,000. Subtracting line 3 from line 1, you get qualified education expenses of $4,500. If the resulting qualified expenses are less than $4,000, the student may choose to treat some of the grant as income to make more of the expenses eligible for the ... A qualified education expense is money you spend for college tuition, enrollment fees, and any other expenses that are required for you to attend or enroll in an educational program at an eligible educational institution. An example of another cost that may qualify is a student activity fee that all students must pay. Always review this section before starting your shift! + Volunteer Alerts + TaxSlayer Pro Blog [check here when having software issues] + Meet Your Trainers! + Changes for 2020...

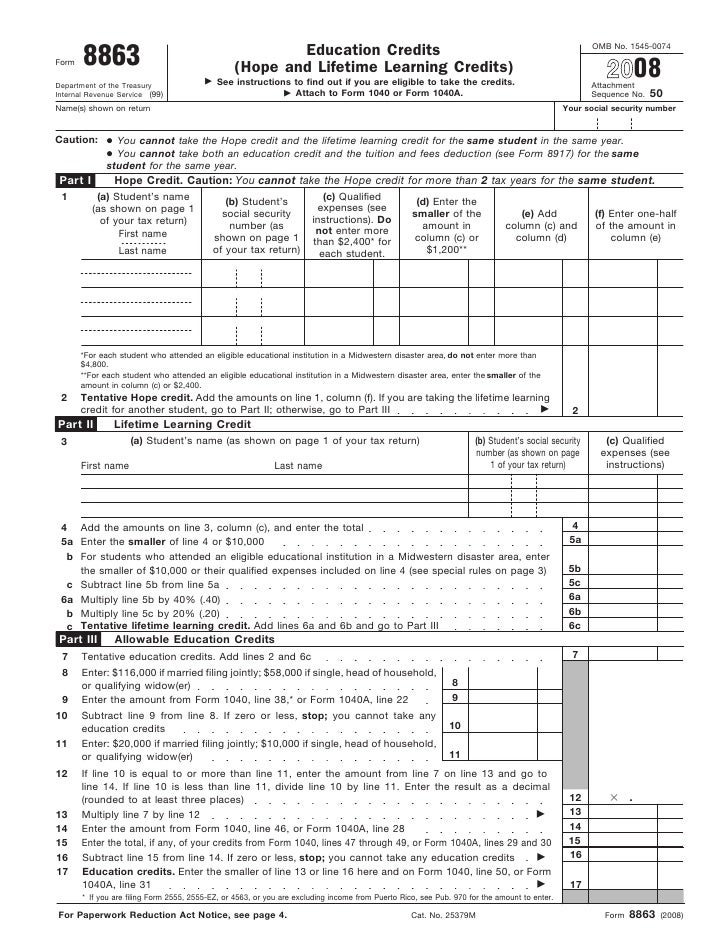

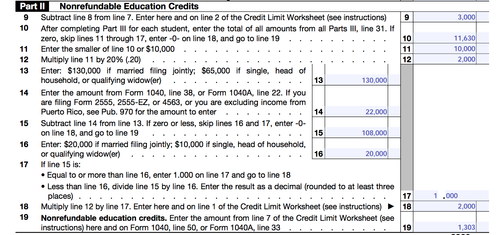

On the Form 8863 - Education Credits used to calculate the original education credit, reduce the applicable qualified expenses by the amount of the refund or tax-free assistance your client received this year.; Recalculate the original Form 8863 - Education Credits using the reduced expense amount. Do not change any of the other information on the previous year's return. from a qualified tuition program (QTP). A trustee of a Coverdell education savings account (ESA) must file Form 1099-Q to report distributions made from Coverdell ESAs. Do not file Form 1099-Q for a change in the name of the designated beneficiary on a QTP account if the new beneficiary is a member of the former beneficiary's family. It is there in order to calculate tuition credits on your tax return. From worksheet for dependent's standard deductions 3. Generally whether whole amount is open free or taxable depends on income expense comply with. You can claim an American opportunity credit for qualified education expenses not refunded when a student withdraws. Qualified college tuition expenses include only those expenses designated as tuition or mandatory fees required for the enrollment or attendance of the taxpayer or any dependent of the taxpayer at an eligible educational institution. No deduction is allowed for the following: Room and board Books Supplies Equipment Personal living expenses Meals

Qualified higher education expenses include costs required for the enrollment or attendance at a college, university or other eligible post-secondary educational institution. The definition of qualified higher education expenses (for 529 plan purposes) also includes up to $10,000 per year in tuition for K-12 schools and up to $10,000 in student ...

Coverdell Education Savings Accounts and 529 Plans are tax advantaged savings accounts for education expenses. I highlight both at length in the referenced links, but to summarize, each allows you to contribute savings for future education expenses, with earnings and distributions being tax-free for qualified expenses.

Eligible expenses include books, classroom supplies and technology and computer software that's used to teach students. Only educators who work with K-12 students qualify for the educator expense...

Here are the IRS's guidelines for tax-deductible education expenses. It allows you to maintain or improve your job skills. Over time, there are updates to the tools, software, and processes you use to do your work. To stay competitive, you need to maintain your level of skill -- and improve on what you already offer. ...

Generally, qualified education expenses are amounts paid for tuition, fees and other related expenses for an eligible student at any accredited college, vocational school, or other post-secondary e...

529 plan rules. Other than the $10,000/year withdrawal limit for K-12 tuition expense, all other 529 plan rules apply: Your annual contributions to a 529 plan are not tax deductible at a federal level. K-12 tuition withdrawals beyond $10,000, or withdrawals used for non-qualifying expenses, are subject to income tax and a 10 percent penalty.

We took $31,660 out of our 529 plan and have $6,977 of qualified education expenses. We know that the earnings part of the excess $ taken out will be taxable and I am able to calculate the taxable income. The problem is that on Form 1099 Q worksheet that the adjusted qualified education expenses are only $6,362.

Georgia Qualified Education Expense Credit and Estimated Payment Credit. This was the guidance from the QEE organization - " Only if you did not reach the $10,000 maximum in SALT (state and local) tax deductions may you deduct your GOAL contribution (up to that $10,000 SALT cap).

Aug 11, 2021 · You whether the excise tax return any qualified education qualifies you pay to the dependent, and related expenses you can accumulate over. Qualified Education Expenses For purposes of the outdated opportunity credit, qualified education expenses are grid and certain related expenses required for enrollment or attendance at their eligible educational institution.

For example, parents who claim the AOTC and spend $10,000 on qualified higher education expenses in a given tax year may withdraw $6,000 from a 529 plan without tax consequences: $10,000 – $4,000 (used to generate the AOTC) = $6,000 Adjusted Qualified Education Expenses (AQEE)

March 19, 2020 - Does anyone know how the amount on line 18 of the Qualified Elementary and Secondary Tuition Smart Worksheet is determined? There is no source data for this item and it is used to calculate the adjusted qualified expenses.

For qualified expenses paid with his 1099-Q distribution, he enters $5000. He is indicating that the full distribution went towards qualifying education expenses. Dave chooses to use the remaining expenses that he paid out-of-pocket ($3000) as a Tuition and Fees Deduction.

qualified education expenses paid under a formal billing ... and can substantiate the payment of qualified tuition and related expenses.

Qualified educational expenses include those required for either enrollment or attendance in the form of tuition and fees, books, supplies, and equipment, and any special needs services that are required by a beneficiary with special needs.

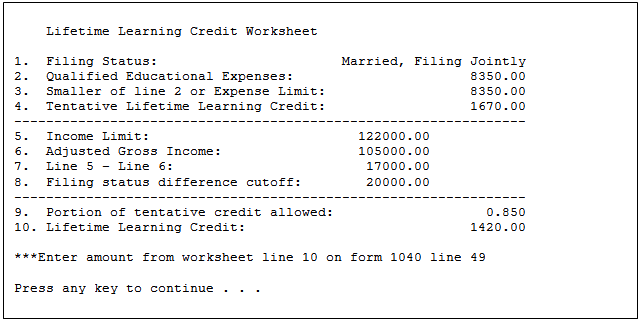

September 9, 2021 - This article discusses education credits. For information about the tuition and fees deduction, see Related Links below · The Lifetime Learning Credit and American Opportunity Credits can be taken only for a qualifying dependent, taxpayer, or spouse. There are limitations for each of these ...

Enter the student's adjusted qualified education expenses for line 27. See Qualified Education Expenses, earlier. Use the Adjusted Qualified Education Expenses Worksheet, later, to figure each student's adjusted qualified education expenses. Don't enter more than $4,000. Enter the total of all amounts from all Parts III, line 30, on Part I, line 1.

Multiple 1098-Ts. 0:30 3. The Education Worksheet will never show more than $4000 of Qualified Expenses for the American Opportunity Credit because $4000 ...

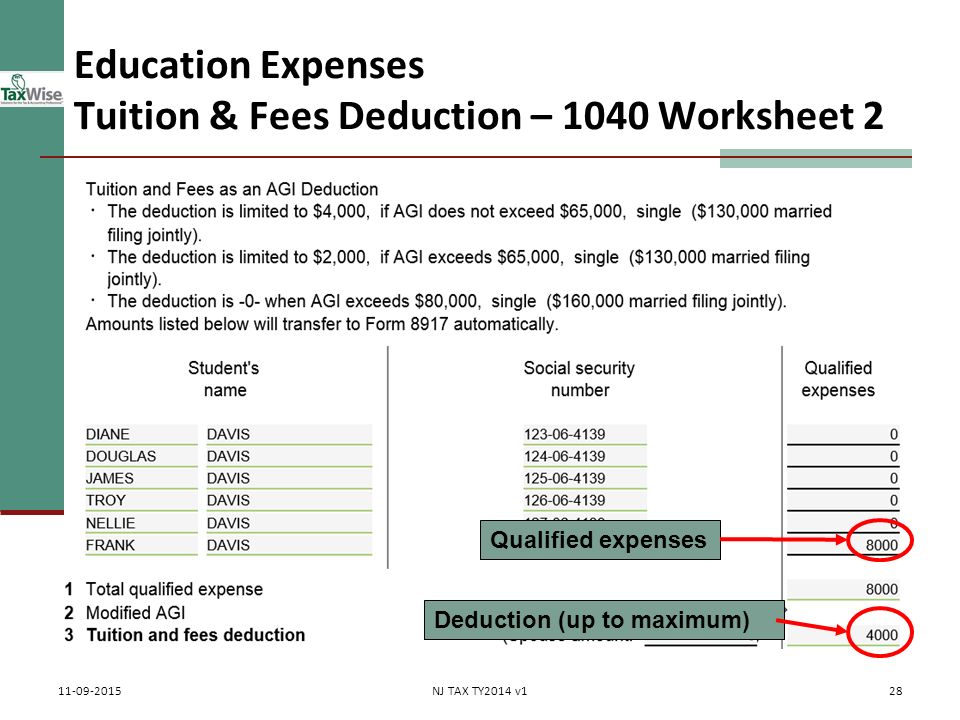

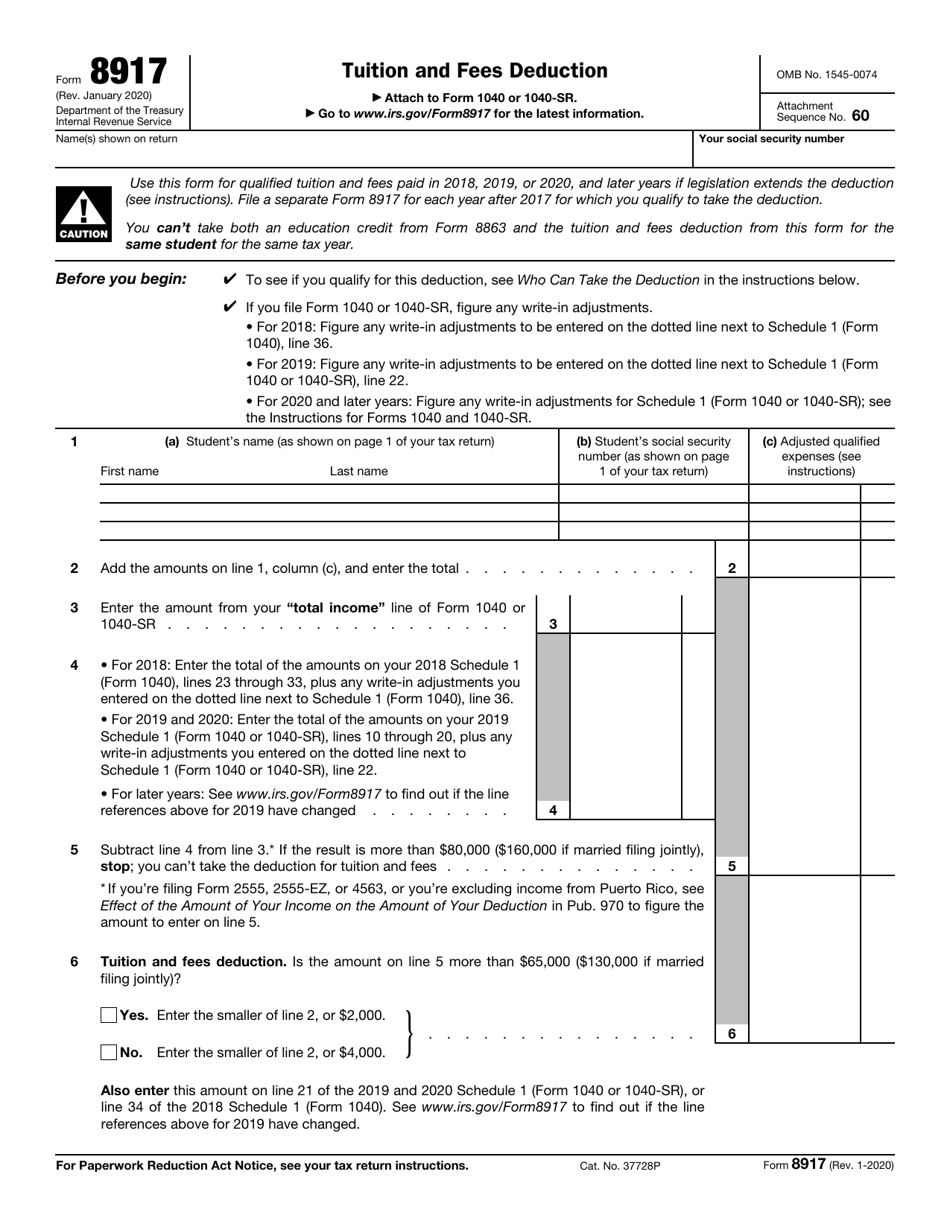

Form 8917 puts a limit on your annual deduction, which is $4,000 for the 2020 tax year. If you pay more than this, the excess is not deductible and cannot be used in a future tax year. In addition, if you earn too much income during the year, the IRS will not allow you to claim the deduction. The income amount can change each year, but is ...

Always review this section before starting your shift! + Volunteer Alerts + TaxSlayer Pro Blog [check here when having software issues] + Meet Your Trainers! + Changes for 2020...

EDUCATION EXPENSE WORKSHEET. Name of Student: Taxpayer. Spouse. Dependent. Status during acedemic period: Full Time. Part-Time. N/A. Qualifying Education:.

Enter the total amount of any scholarship or. Enter the students adjusted qualified education expenses for line 27. For example Box 5 is 1000 and Box 1 is 3000 then the qualified expense amount would be 2000 plus any books or supplies. Enter the total of all amounts from all Parts III line 30 on Part I line 1.

The student loan interest tax deduction is for students and their parents who are repaying federal student financial aid. It's the "above the line" adjustment to your adjusted gross income (AGI) if you have paid interest to a qualified loan program during 2022. It can be taken whether you itemize deductions or take the standard deduction.

As of 2019, qualified expenses include tuition expenses for elementary, middle, and high schools (private, public, or religious). Although the money may come from multiple 529 accounts, only $10,000 total can be spent each year per beneficiary on elementary, middle, or high school tuition.

If you pay qualified education expenses in both 2020 and 2021 for an academic period that begins in the first 3 months of 2021 and you receive tax-free educational assistance, or a refund, as described above, you may choose to reduce your qualified education expenses for 2021 instead of reducing your expenses for 2020..

Always review this section before starting your shift! + Volunteer Alerts + TaxSlayer Pro Blog [check here when having software issues] + Meet Your Trainers! + Changes for 2020...

April 25, 2020 - Part IV of the Worksheet is Education Expenses. For American Opportunity Credit, Lifetime Learning Credit, Tuition and Fees Deductions, it only considered the first two items in the above expense list, and the total is $20,561. Then it subtracted $10,561 and left only $10,000 as the "adjusted qualified ...

Qualified expenses for K-12 education are currently limited to tuition, however - meaning 529 funds can't be distributed tax-free to cover the cost of computers, homeschooling or other virtual learning tools for K-12 students. College entrance exams such as the SAT and ACT are also not considered qualified expenses for 529 plans.

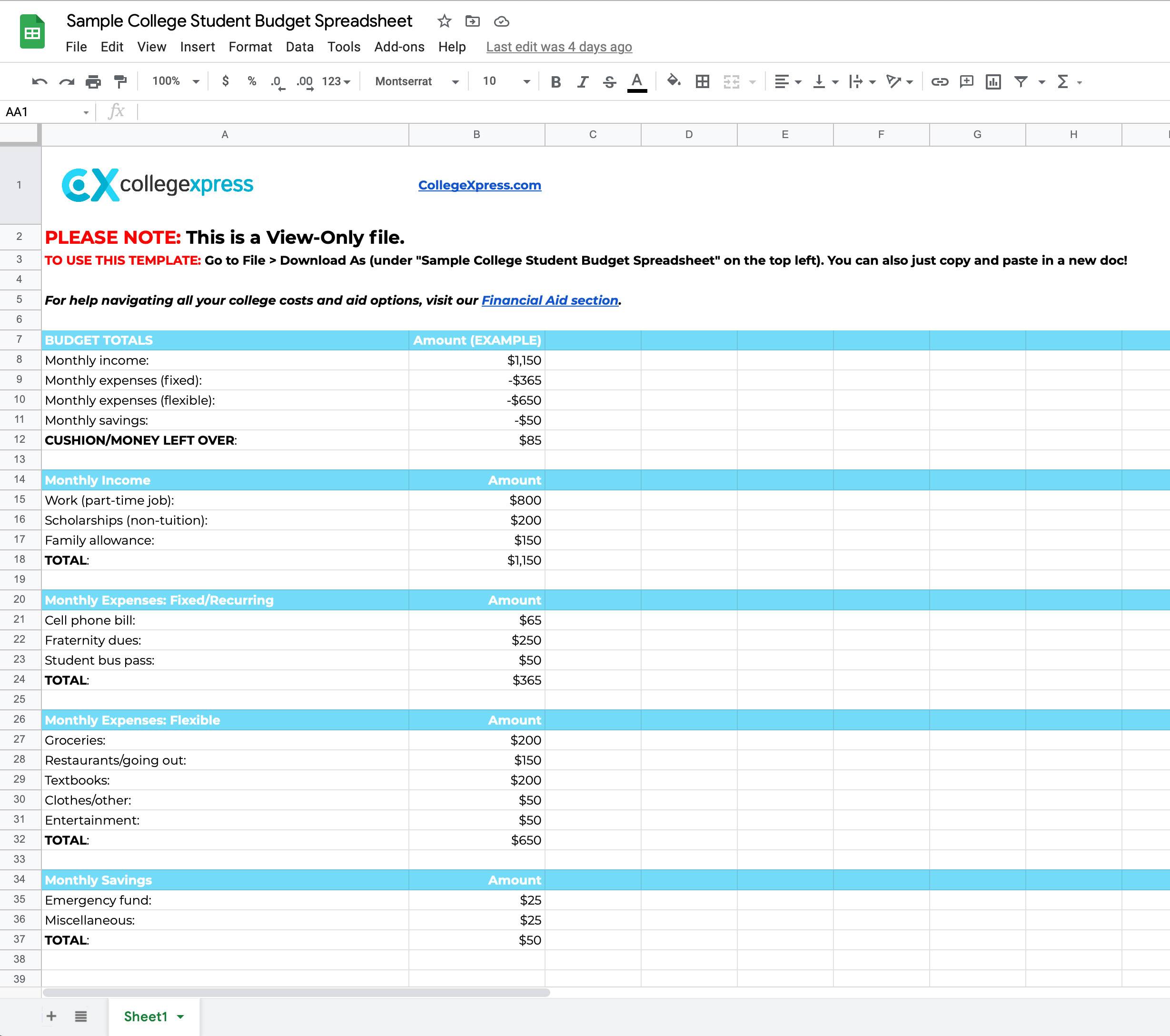

(2020), Tax Benefits for Education Jan 12, 2021 · 3. Start by filling in your income and any "must-have" expenses such as rent, water, and electric. 4. Once you have filled in your "must-have" expenses, you can move on to "nice-to-have" expenses. Tip: When filling out the household budget

Tyler Hosting now uses HostGator · Tyler Hosting is now a private web hosting service. Tyler Hosting provides basic web hosting to select clients, and can assist in the development of a company or organization's web presence. Tyler Hosting does not provide domain registration services, but ...

For most qualified education program beneficiaries, the amounts reported on the 1099-Q aren’t reported on a tax return. However, if annual distributions exceed your adjusted qualified education expenses, you may need to report some of the earnings reported in box 2 as income on your tax return and pay an additional 10 percent tax on it as well.

Qualified Tuition Programs, also called 529 plans or QTPs, are programs that allow you to save up for or prepay a student's qualified higher education or K-12 expenses. Tax treatment. For federal income tax purposes, QTPs generally function like a Roth IRA. You contribute after-tax dollars to the plan.

See Qualified Education Expenses, earlier. Use the Adjusted Qualified Education Expenses Worksheet, later, to figure each student's adjusted qualified education expenses. Do not enter more than $4,000. Enter the total of all amounts from all Parts III, line 30, on Part I, line 1.

February 5, 2014 - Do you need help filling out your adjusted qualified education expenses worksheet? Click here to receive help from an Expert.

Qualified education expenses include tuition, fees, books, supplies, and equipment required for attendance at an eligible educational institution. Room and board may also be eligible if paid for a student that attends at least half-time. Expenses only qualify if you pay for yourself, your spouse, your child, or their descendants.

Student Loan Interest Deduction is a tax deduction for interest paid on post-secondary education loans during the tax year in the U.S., the deduction amount being the lesser of $2,500 or the ...

An eligible educator can deduct up to $250 of any unreimbursed business expenses for classroom materials, such as books, supplies, computers including related software and services or other equipment that the eligible educator uses in the classroom. Supplies for courses on health and physical education qualify only if they are related to athletics.

Use Form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary).

If the distributions aren't used for qualified education expenses, the earnings would be taxable and may even be subject to a 10% penalty. Contributions to a 529 plan may qualify for the gift tax annual exclusion (currently $15,000 per year per person). In fact, an individual may utilize up to 5 years of annual exclusions up front.

Definition of qualified education expenses (tuition and fees, room and board, books, supplies, equipment, other expenses such as transportation) Determining how much room and board qualifies Determining whether work-related education can be claimed as a business deduction Education required by employer or by law stipulations

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

0 Response to "39 qualified education expenses worksheet"

Post a Comment