40 nc 4 allowance worksheet

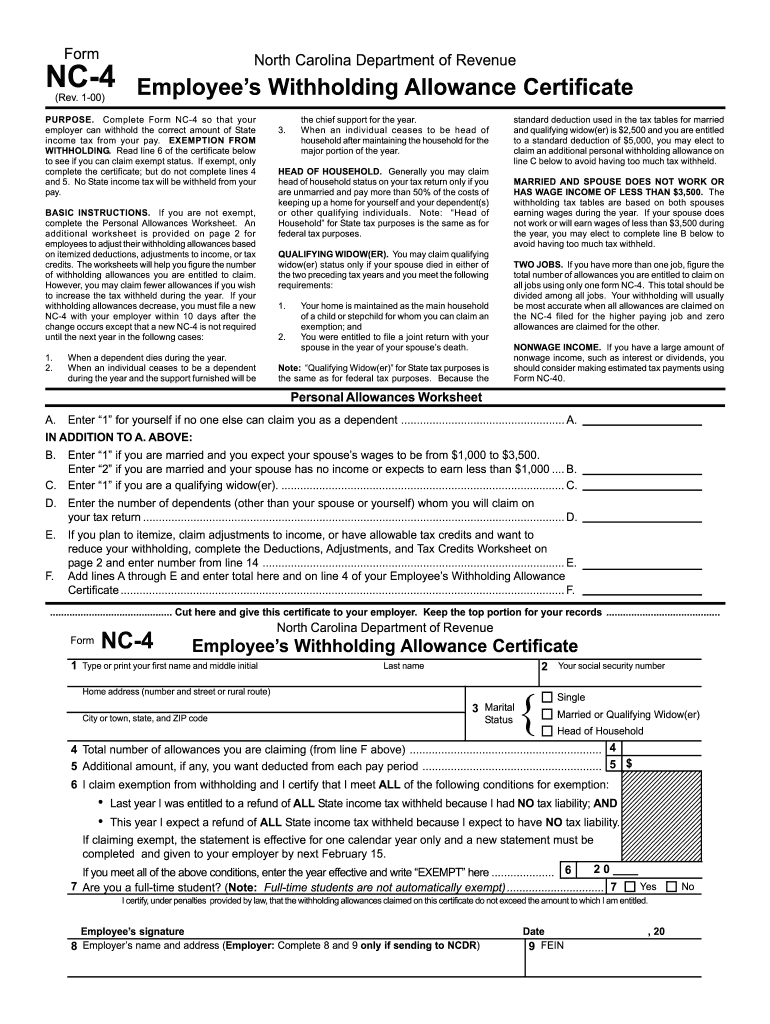

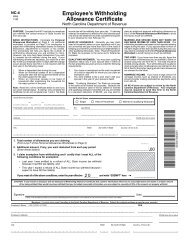

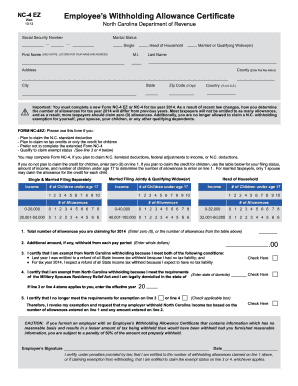

» Employee's Withholding Allowance Certificate NC-4 Employee's Withholding Allowance Certificate NC-4. Form NC-4 Employee's Withholding Allowance Certificate. Files. NC-4_Final.pdf. PDF • 488.48 KB - December 17, 2021 Taxes & Forms. Individual Income Tax; Sales and Use Tax; Withholding Tax ... NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

Items needed to fill out NC-4 EZ Form NC-4 EZ Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014

Nc 4 allowance worksheet

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet). It will send you to the NC-4 Allowance Worksheet to determine the number to enter here. Find the secton for your Marital Status and answer all the questions for that section and follow its directions. It may send you back with a number to enter on Line 1 or send you to complete Part II of the Allowance Worksheet. NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

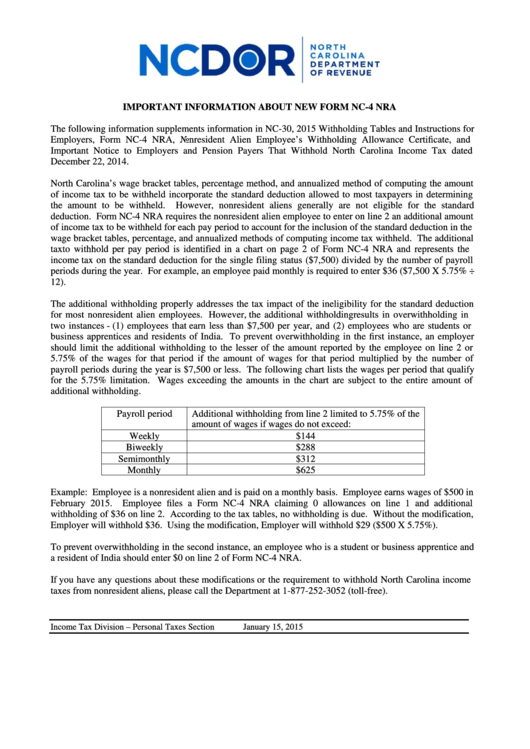

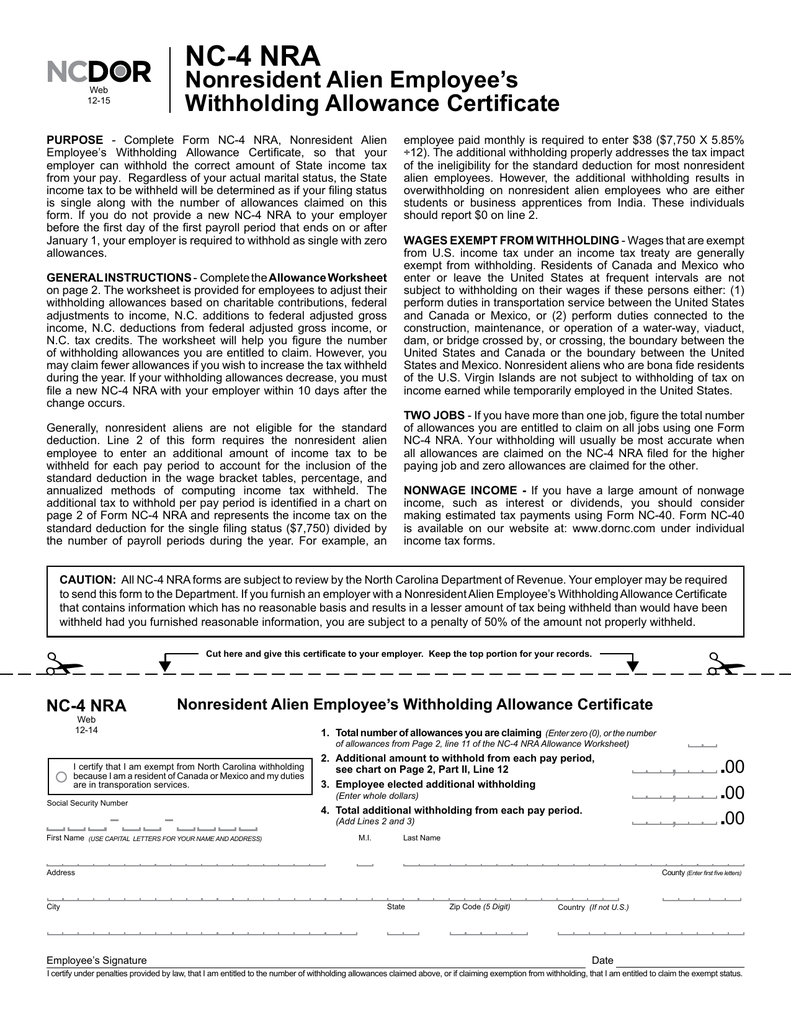

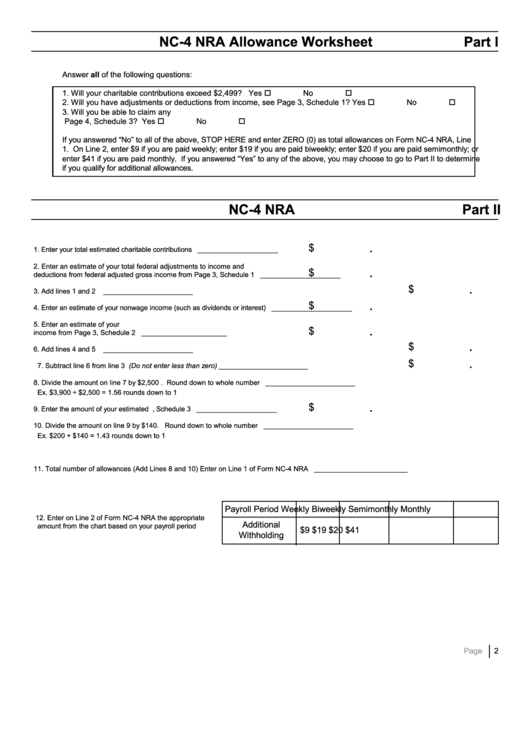

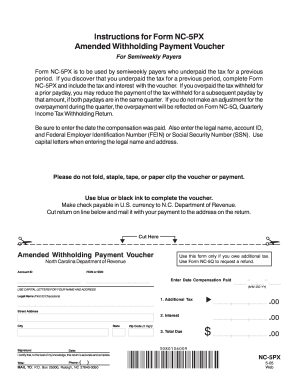

Nc 4 allowance worksheet. (From Line F of the Personal Allowances Worksheet on Page 2) Additional amount, if any, you want withheld from each pay period (Enter whole dollars) 2. • This year I expect a refund of all State income tax withheld because I expect to have no tax liability. ... NC-4 Web 10-12. Employee's Withholding Allowance Certificate NC-4: Employee's Withholding Allowance Certificate NC-4 NRA: Nonresident Alien Employee's Withholding Allowance Certificate NC-4P: Withholding Certificate for Pension or Annuity Payments NC-1099M: Compensation Paid to a Payee NC-AC: Business Address Correction NC-BN: Out-of-Business Notification NC-CICN Employee's Withholding Allowance Certificate North Carolina Department of Revenue. 1. Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 16 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars) GENERAL INSTRUCTIONS- Complete the NC-4 NRAAllowance Worksheet on page 2. The worksheet will help you determine the number of withholding allowances you are entitled to claim based on federal and State adjustments to gross income, including the N.C. Child Deduction Amount, N.C. itemized deduction for charitable contributions, and N.C. tax credits.

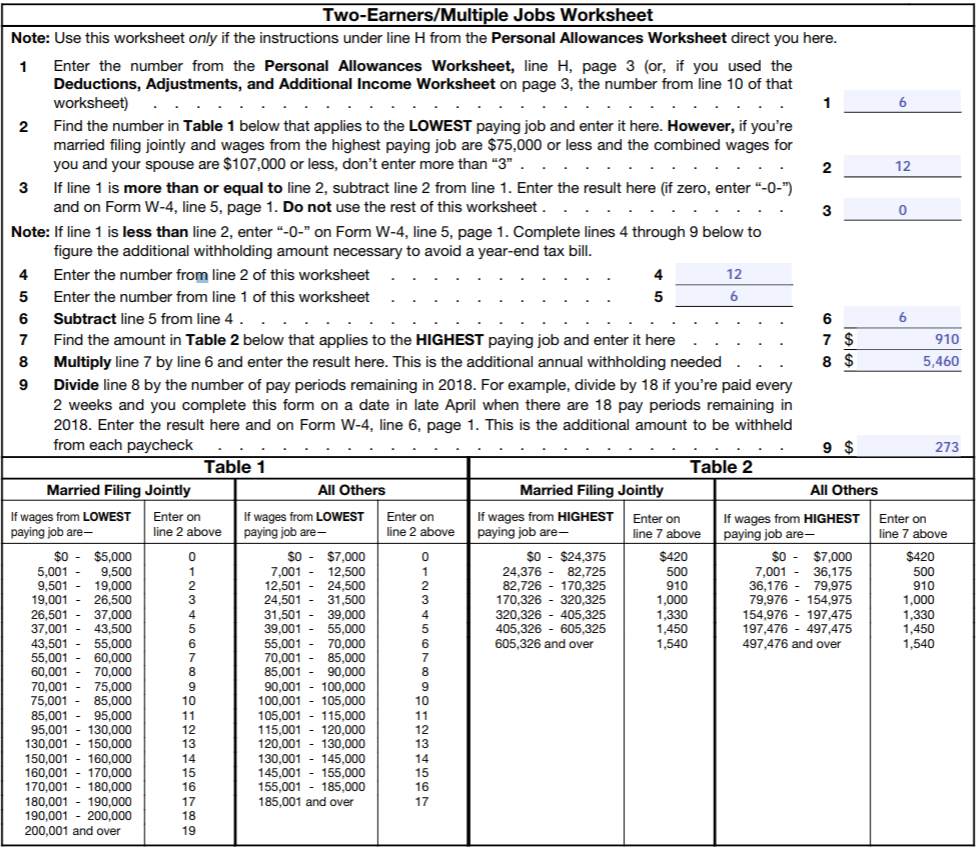

TWO OR MORE JOBS - If you have more than one job, figure the total number of allowances you are entitled to claim on all jobs using one Form NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4). FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance Worksheet. The worksheet will help you determine your withholding allowances based on federal and State adjustments to gross income including the N.C. Child Deduction Amount, N.C. itemized deductions, and N.C. tax credits. NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 led for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 5).

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4). Here is more information about the W-4 Worksheet, including how to fill out the W-4 allowance worksheet, line by line. Although it is late in the year, if you were disappointed in the size of your refund or you had an unexpected balance due when you filed your 2018 tax return, it is not too late to make changes for 2019. FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance Worksheet. The worksheets will help you figure the number of withholding allowances you are entitled to claim. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 See Allowance Worksheet. completing the NC-4 Allowance worksheet? A15. No. Pre-tax items are not included in taxable income and similarly should not be included when completing the NC-4 Allowance worksheet. Q16. When do we send a NC-4EZ or NC-4 to the Department? A16. If an employee claims more than 10 allowances, you should forward this document to

The worksheets will help you figure the number of withholding allowances you are entitled to claim. However, you may claim fewer allowances if you wish to increase the tax withheld during the year. If your withholding allowances decrease, you must file a new NC-4 with your employer within 10 days after the change occurs except that a new NC-4 ...

Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Line 1 of NC-4 You are no longer allowed to claim a N.C. withholding allowance for yourself, your spouse, your children, or any other dependents.

Instructions on completing new NC-4. This does take a more work to complete properly than the new NC-4 EZ. The NC-4 is designed for people that want to be ...

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

NC-4 Allowance Worksheet. Your withholding will usually be most accurate and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet). NONWAGE INCOME - If you have a large amount of nonwage income,

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Line 1 of NC-4 You are no longer allowed to claim a N.C. withholding allowance for yourself, your spouse, your children, or any other dependents.

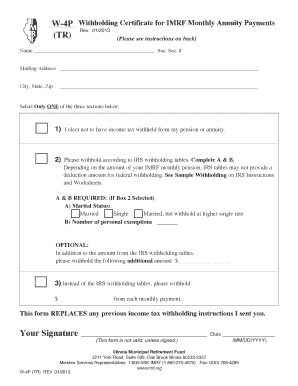

Allowance Worksheet. You can designate an additional amount to be withheld on line 3 of Form NC-4P. Submit the completed form to your payer. If you do not submit Form NC-4P to your payer, the payer must withhold on periodic payments as if you are single with no withholding allowances. stays in effect until you change or revoke it.

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

Withholding Allowance Certificate NC-4 NRA 1.Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 11 of the NC-4 NRA Allowance Worksheet) Additional amount to withhold from each pay period, see chart on Page 2, Part II, Line 12 2. Employee elected additional withholding (Enter whole dollars ...

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

It will send you to the NC-4 Allowance Worksheet to determine the number to enter here. Find the secton for your Marital Status and answer all the questions for that section and follow its directions. It may send you back with a number to enter on Line 1 or send you to complete Part II of the Allowance Worksheet.

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

0 Response to "40 nc 4 allowance worksheet"

Post a Comment