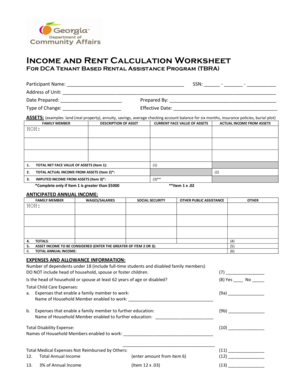

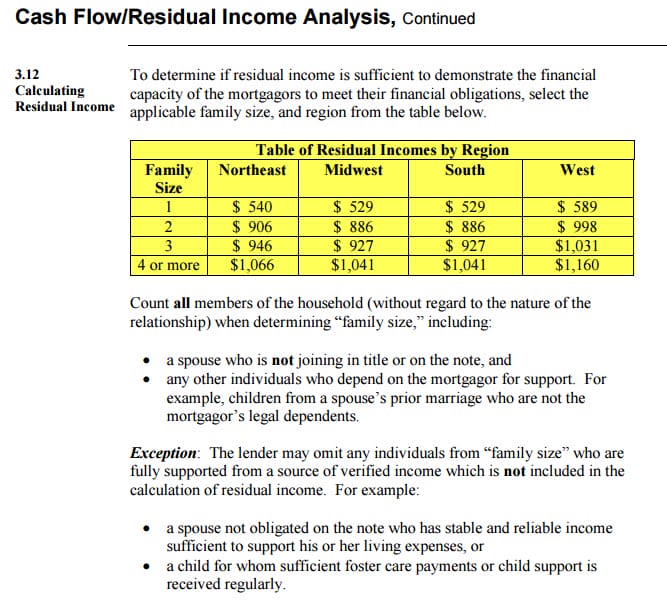

40 rental income calculation worksheet

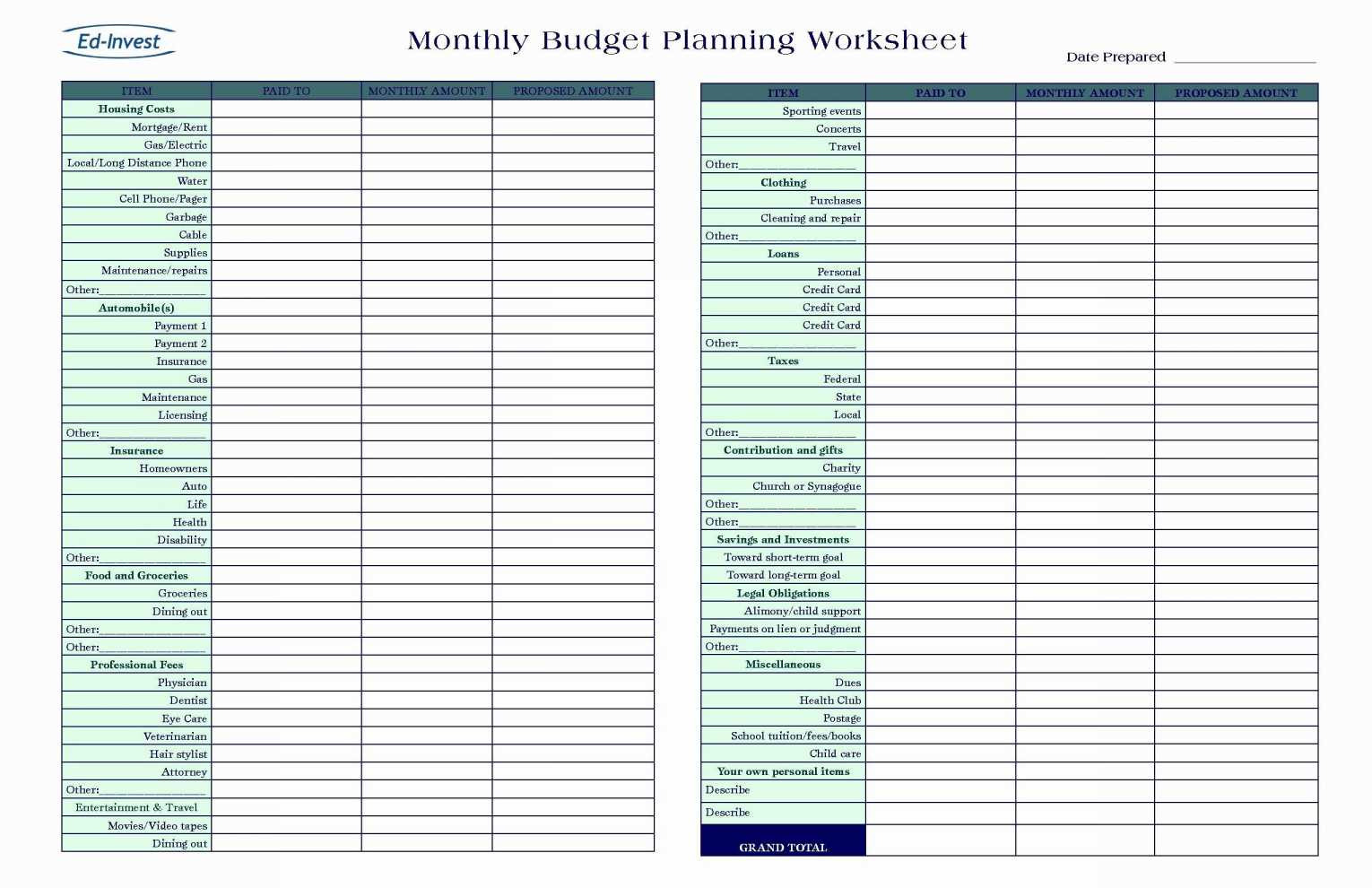

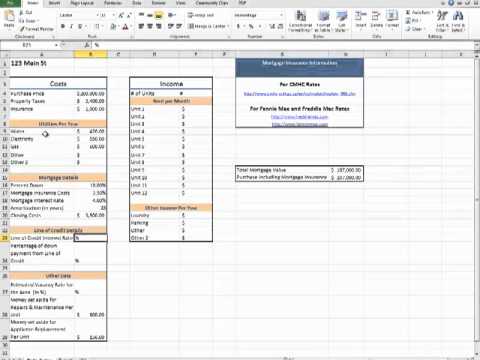

June 11, 2021 - Here you'll find a simple spreadsheet to help you better analyze your potential investment properties and make better decisions. June 15, 2021 - This worksheet, designed for property owners with one to five properties, has a section for each category of income and spending associated with managing a rental property. Appropriate sections are broken down by month and by property. Each section automatically calculates the totals to provide ...

February 26, 2018 -

Rental income calculation worksheet

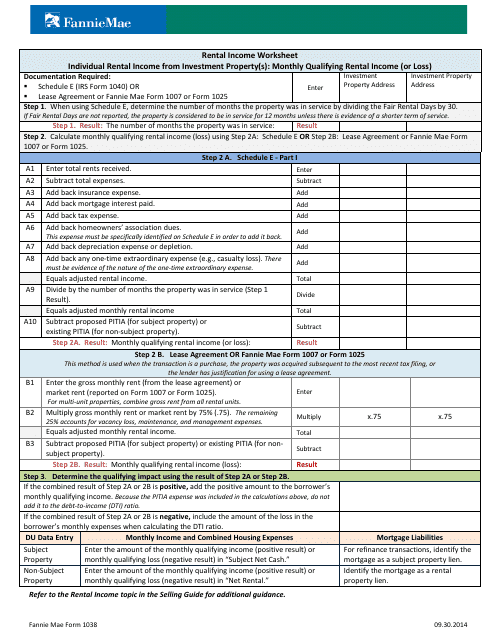

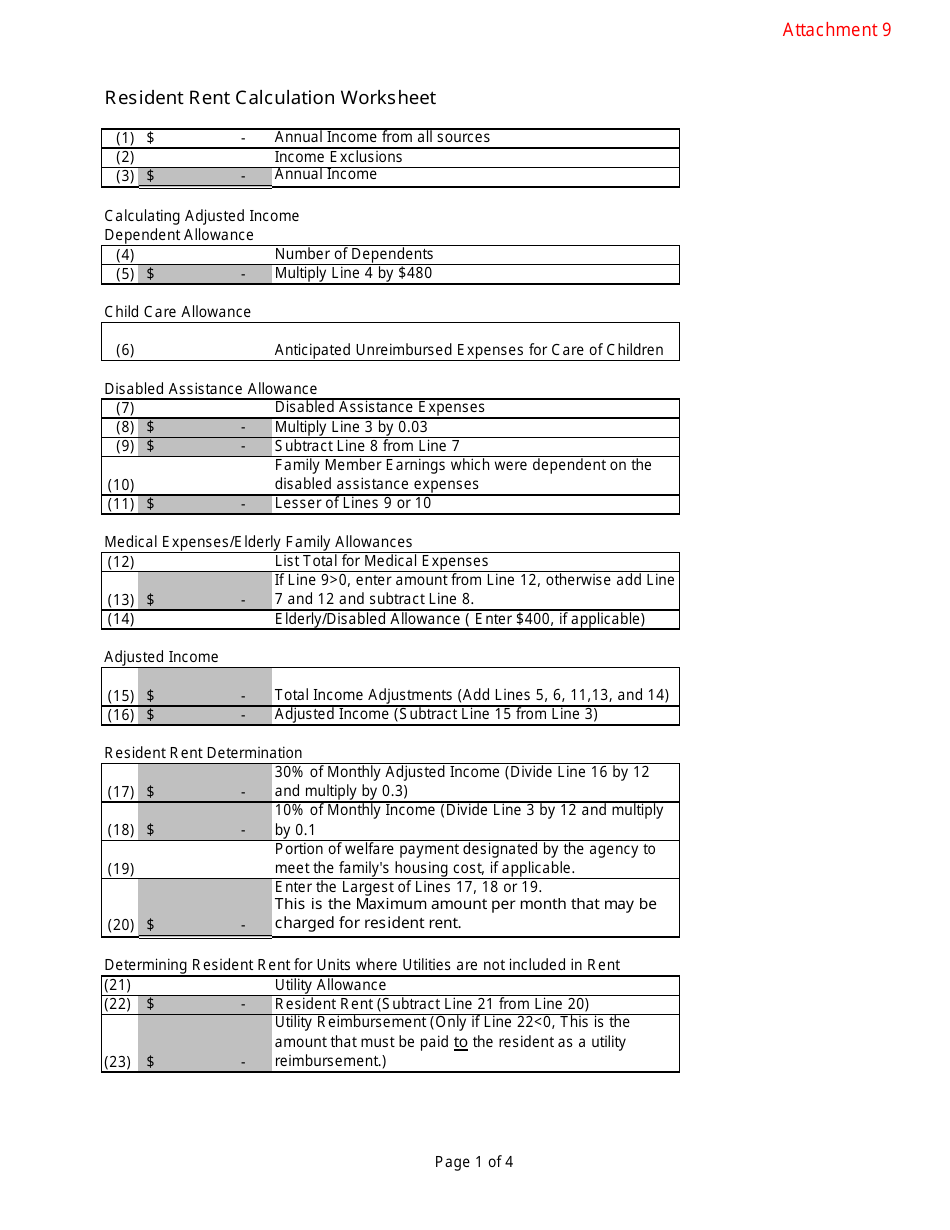

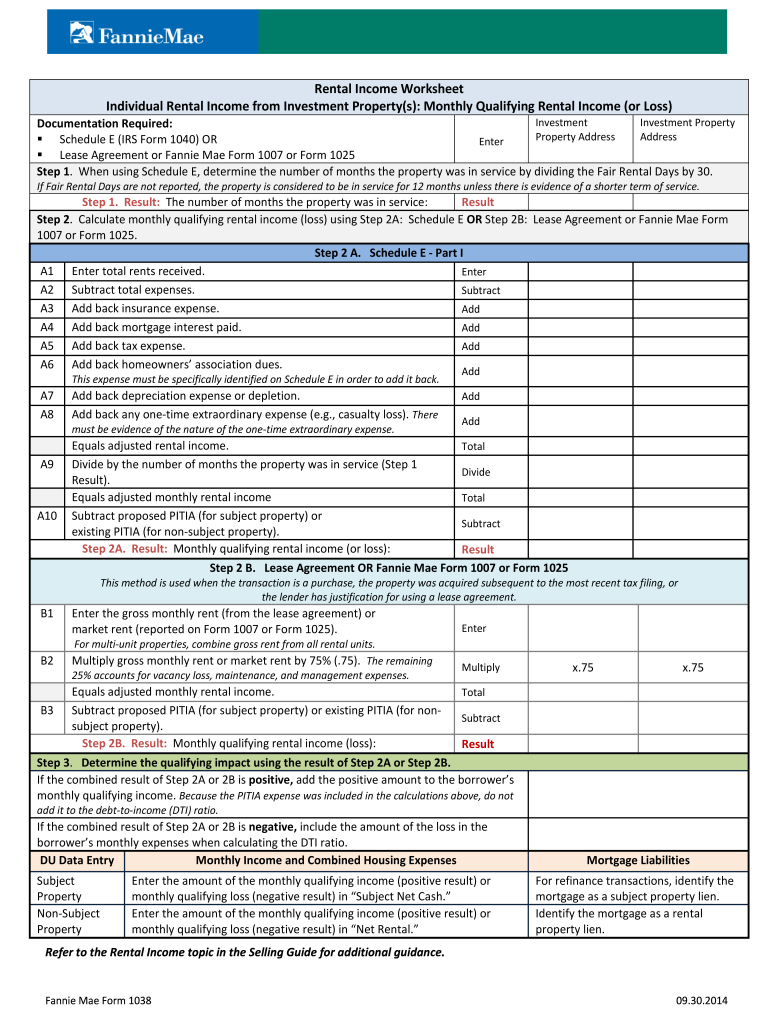

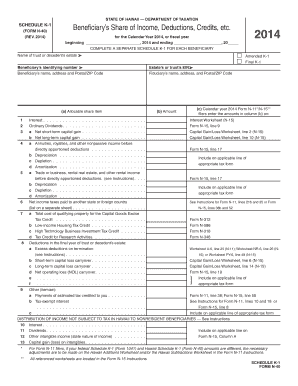

As the title suggests, I’m trying to work out an accurate net return on a property I have owned for 22years. I’ve just sold it, and while the amount that has hit the bank account looks nice, I want to be able to calculate the actual return. Has anyone come across a nice little calculator? December 4, 2019 - In order to include a positive ... for income received from a partnership or an S corporation. See B3-3.4-01, Analyzing Partnership Returns for a Partnership or LLC and B3-3.4-02, Analyzing Returns for an S Corporation. ... Fannie Mae publishes four worksheets that lenders may use to calculate rental ... Two questions: 1. I'm paid Bi-Weekly, so twice a year I have an extra paycheck each month. For rental applications should I calculate my monthly income based on my annual divided by 12, or the lower bi-weekly amount? 2. My salary could cover (on a 3x the rent basis) a cheaper rental, but my wife is recently unemployed. We're moving and selling our current home and we were hoping we could move into a nicer rental while she finds full-time work. That said, can we combine her current unemploymen...

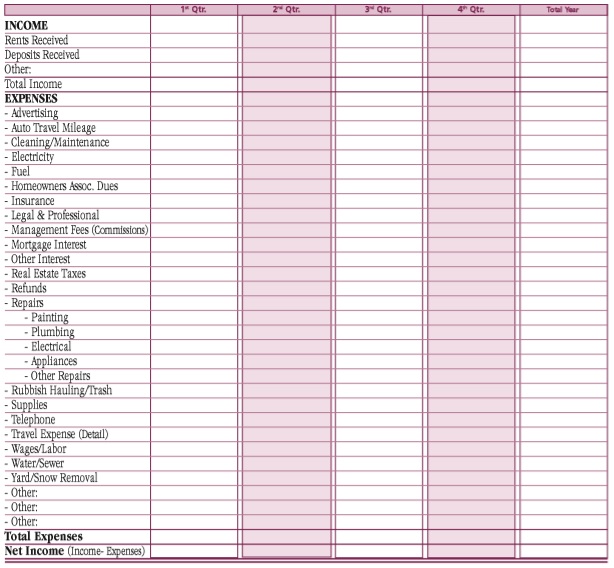

Rental income calculation worksheet. We’ll be honest, we’re going to “keep it simple” and not go too far into the weeds on how the Qualifying Income for rental income is calculated. That said, we can provide the concept and a good rule-of-thumb if you’re trying to use the Debt To Income Calculator to determine how much ... We own a rental property and receive rental income greater than our total PITI for that property. Does the PITI count against our DTI when applying for a new mortgage for a primary residence? February 23, 2016 - Fannie Mae Single-Family loan products help to build the American dream by making stable, predictable products such as the 30-year, fixed-rate mortgage possible December 15, 2021 - In order to include a positive ... for income received from a partnership or an S corporation. See B3-3.4-01, Analyzing Partnership Returns for a Partnership or LLC and B3-3.4-02, Analyzing Returns for an S Corporation. ... Fannie Mae publishes four worksheets that lenders may use to calculate rental ...

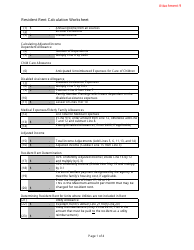

August 18, 2021 - This spreadsheet is for people who are thinking about purchasing rental property for the purpose of cash flow and leverage. It is a fairly basic worksheet for doing a rental property valuation, including calculation of net operating income, capitalization rate, cash flow, and cash on cash return. Welcome to this choice lending corp tutorial for the rental income worksheet you will complete this worksheet in order to calculate the rental income when you have borrowers with the rental properties that are listed on their schedule ii in their 1040 taxes this worksheet will help you determine ... Hello, I’m a homeowner in Ontario renting 2 bedrooms in my house to international students. Recently, one renter asked if I’d exaggerate the price of rent on our rental agreement by close to double. She said it was for immigration purposes as her work permit expires in January and she has to apply for another. This didn’t make a lot of sense to me. So I asked a former renter of mine, who’s pretty well versed on the immigration process, what benefit paying higher rent has to getting a work... What income would rental income be considered? If you get 4K each month from rental income and your job gives you around 20k then how much do you owe on rental income? How is it calculated. I meant 20k a year not a month To the people in the comment section, you already are assuming I am male even though I am a woman and you are assuming many things that are wrong due to your own insecurities and maybe you should look into yourself before you attack other people because you clearly have issues...

Hey! Basically the title. I've gotten into writing books, annnnnnnnnd they've done incredibly well. While "actively" working, marketing, selling, etc., I'm pulling in roughly $15k/month before expenses, more like 13-14k post expenses. Huzzah! I've been selling them on Amazon, selling the audibooks, etc. This income is more or less forever, although I anticipate as time goes by it'll trickle off, probably ending up close to 0. Still. I have absolutely no idea how to even begin calculating the... August 21, 2019 - Keep Your Career On The Right Track Our income analysis tools are designed to help you evaluate qualifying income quickly and easily. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you. March 1, 2021 - Arch MI provides an array of products and services, including first-lien mortgage guaranty insurance in a range of premium payment plans. I'm calculating my rental income over the past 12 months and I have had multiple tenants over this period. I have received rental payments on 11th May 2020, and 11th day of each subsequent month during that tenancy period. The current tenancy period starts on the 1st day of the month. When I'm calculating income over the prior 12 month period do I include the rental payment from 11th May 2020 and 1st May 2021? Assuming I submit the application before 11th May 2021. This has the potential to be ...

Lunafi is a comprehensive accounting tool for freelancers and independent contractors. Professionals can use it to calculate their taxable income, understand deductions, and save money on taxes. [https://www.lunafi.co/post/basics-of-1099-income-for-new-freelancers](https://www.lunafi.co/post/basics-of-1099-income-for-new-freelancers)

Hi Spreadsheet Reddit People, This is a brain-buster that might be difficult to figure out. Anyone up for the challenge? There is a problem that I am trying to solve which perplexes me on how to create the formulas for this spreadsheet. The question I am trying to solve is "How long will it take before the proceeds of my income producing assets from prior incoming producing earned assets earn enough to buy another income producing assets?" In this particular case I have exactly $50,000 worth ...

I couldn't find exactly what I was trying to ask while searching the existing Reddit, so I apologize if this has already been partially or fully addressed, but felt like the Landlord Reddit might be a good place ask this. Two questions: 1. I'm paid Bi-Weekly, so twice a year I have an extra paycheck each month. For rental applications should I calculate my monthly income based on my annual divided by 12, or the lower bi-weekly amount? 2. My salary could cover (on a 3x the rent basis) a cheaper...

General Products Forms · Bulletins · Archive Bulletins Current Bulletins · Communications Search Help

A pioneer in digital banking, Axos Bank offers a comprehensive range of innovative financial products and services with the highest level of security.

I'm of age where I must take money out from IRA and trying to figure out how much I can withdraw with tax efficiency this year because I need the cash and am running out of time to do it for 2020. My only income is rental, social security, and a little bit of interest. I have $1000 in rental income, $100 in interest income, and $7000 in social security. 1. I have only $1000 in rental income due to depreciation. I qualify for the rental qualified business income deduction of 20%. Here, I report ...

February 23, 2016 - Fannie Mae Single-Family loan products help to build the American dream by making stable, predictable products such as the 30-year, fixed-rate mortgage possible

3 weeks ago - Explore Arch MI's dedicated website for credit unions focused on supporting member homebuyers.

for example (location is BC) For an investment rental property that rents for $2500/month \- Expenses (Mortgage payment, property tax, home insurance, strata fees) = $2300/month If someone wants to get **another** mortgage, does that $2500 get counter 100% as income? Thus in this case, having this rental property actually increased my income by 200$/month ($2500 income - $2300 expense), hence increasing my borrowing power? TIA

I've been working on a worksheet for prospective rental properties. Sale price, expected rent, expenses, etc., to make it easy to compare properties and get a rough ROI. But I feel like it's too confusing so am hoping for an easier to use worksheet. I generally prefer SFHs, but will also look at multis sometimes. Sorry if this has been asked before, I tried a search and didn't get anything.

Hi everyone! I have a nurse that applied with me. I had a question about how to calculate their income. They were a w2 hourly hospital nurse for 2.5 years. 6 months ago, they took a job as a Home Health Nurse. They’re W2 but paystub says they are commissioned and gets paid per home visit. There’s three different visits payout. In total, they get 40 hours per week. Example: Visit 1 - $20/hr - 5 hrs Visit 2 - $80/hr - 10 hrs Visit 3 - $60/ hr - 25 hrs My other question, can I even use thi...

Free rental property calculator estimates IRR, capitalization rate, cash flow, and other financial indicators of a rental or investment property considering tax, insurance, fees, vacancy, and appreciation, among other factors. Also explore hundreds of other calculators addressing real estate, ...

Let's suppose I have stock tickers data by date in different worksheets. For simplicity, three sheets named Day1, Day2, Day3. The sheets have data such as: |Ticker|Price Open|Price Close|Change| |:-|:-|:-|:-| |TSLA|$1000|$1010|2%| For each ticker, I want to take take the data from each sheet and do some calculations. My idea is to: 1. Create a Dictionary 2. Add the tickers from sheet Day1 (for each ticker in sheet add it to dict) 3. Go to sheet Day2 4. For each ticker in Day2 add the dat...

It’s easy to run an online calculator if you have cash , stocks, bonds and ETFs. If I have properties I plan to use for rental income, how do I figure out my projected fire date? Are there any tools, spreadsheets or formulas I can use for this?

I'm relatively new to investing (have a very small portfolio in my TFSA) and I'm looking to invest 'properly" to set myself up for retirement (36 at the moment). My holdings include VFV and XEQT, as well as some Apple, Google, and Alps. Now I'm looking now into dividend investment. I've done hours of reading and watching videos, I've learned how to calculate DRIP, which Canadian stocks are good future Dividend investments, etc. However I'm really struggling with calculating the potential annual ...

Mortgage insurance by MGIC - whether borrower paid or lender paid - helps you serve your customers by making homeownership more affordable for them.

Hi, If I have a base salary, but I do get a bonus and my salary say for example becomes 1.2-1.3 when I work for irregular hours, which will be almost every month, how is my salary calculated? \*\*This is a shift bonus.\*\* This will be my new job, so they are going to consider just the contract. and not a werkgeversverklaring. Someone please help! My contract mentions these extra pays.

So I am trying to fill out w4's for my two incomes and my wife's new job. My income is $86k at job one My secondary income is $12k My wife will be making $30k at new job (her current job is approx $21k per year) We have two dependents who will be under 17 at the end of 2022. When I do the worksheet it is saying that I need to take an additional $395 out of first jobs check per pay period. When I use the calculator and enter in income from all four jobs (include her current job) it is sayin...

Hi, I have a rental property and full time job and my gross income from both goes slightly over £100k which makes me ineligible for free child care. I want to pay from my rental income to my workplace pension to bring the net income below £100k. However, I find the definitions slightly confusing. If my salary is £90k and my rental income is £15k, is it correct to pay £5k of rental income to pension?

Two questions: 1. I'm paid Bi-Weekly, so twice a year I have an extra paycheck each month. For rental applications should I calculate my monthly income based on my annual divided by 12, or the lower bi-weekly amount? 2. My salary could cover (on a 3x the rent basis) a cheaper rental, but my wife is recently unemployed. We're moving and selling our current home and we were hoping we could move into a nicer rental while she finds full-time work. That said, can we combine her current unemploymen...

December 4, 2019 - In order to include a positive ... for income received from a partnership or an S corporation. See B3-3.4-01, Analyzing Partnership Returns for a Partnership or LLC and B3-3.4-02, Analyzing Returns for an S Corporation. ... Fannie Mae publishes four worksheets that lenders may use to calculate rental ...

As the title suggests, I’m trying to work out an accurate net return on a property I have owned for 22years. I’ve just sold it, and while the amount that has hit the bank account looks nice, I want to be able to calculate the actual return. Has anyone come across a nice little calculator?

0 Response to "40 rental income calculation worksheet"

Post a Comment