41 1040 qualified dividends worksheet

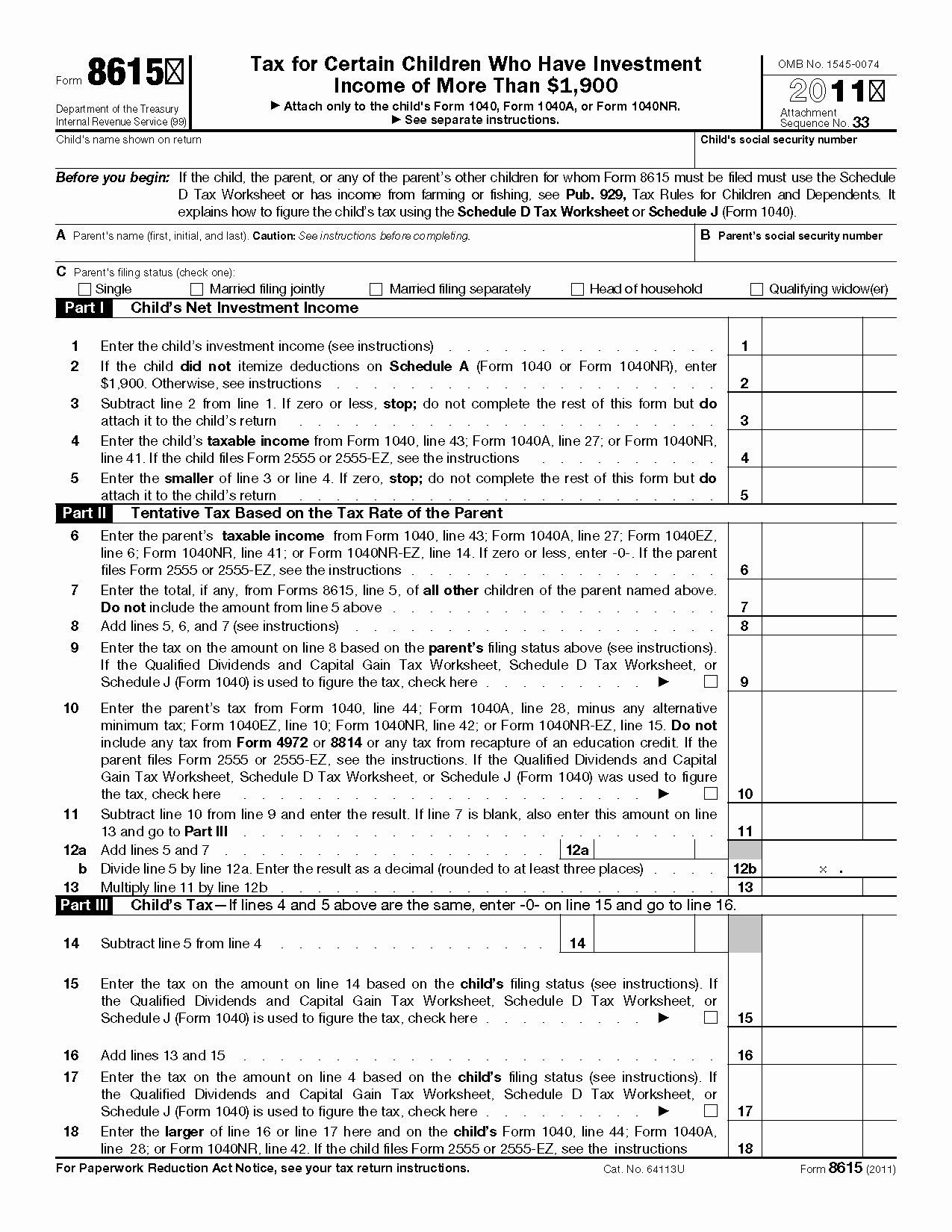

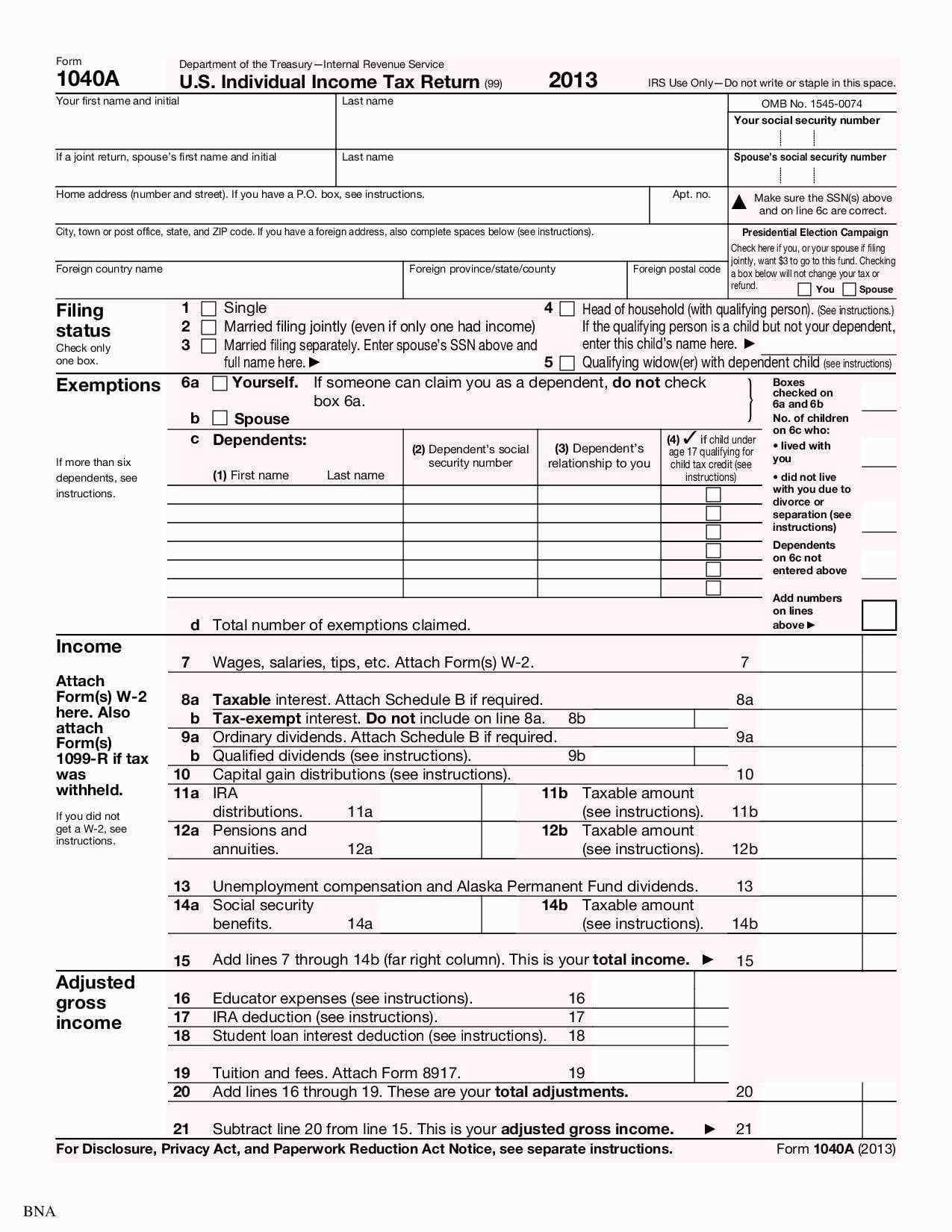

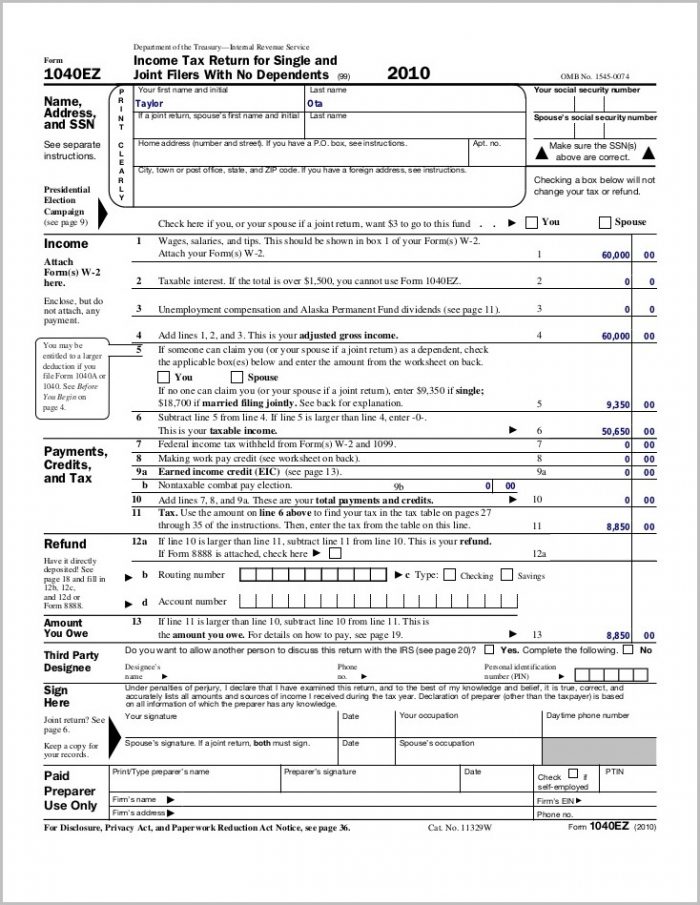

Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018. The Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 form is 1 page long and contains: IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States. The qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you.

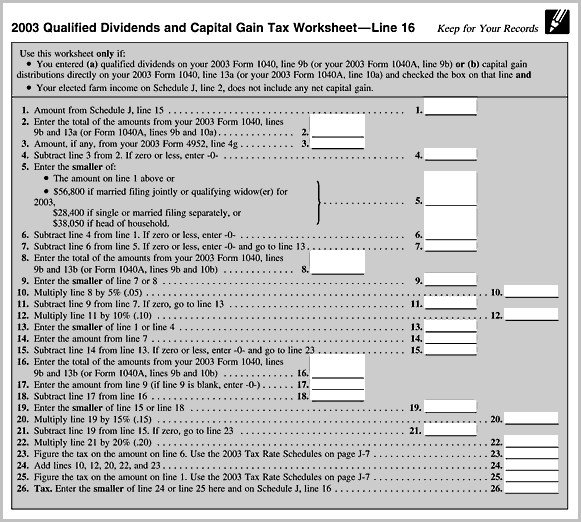

Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax, if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040, line 9b. You do not have to file Schedule D and you reported capital gain distributions on Form 1040, line 13.

1040 qualified dividends worksheet

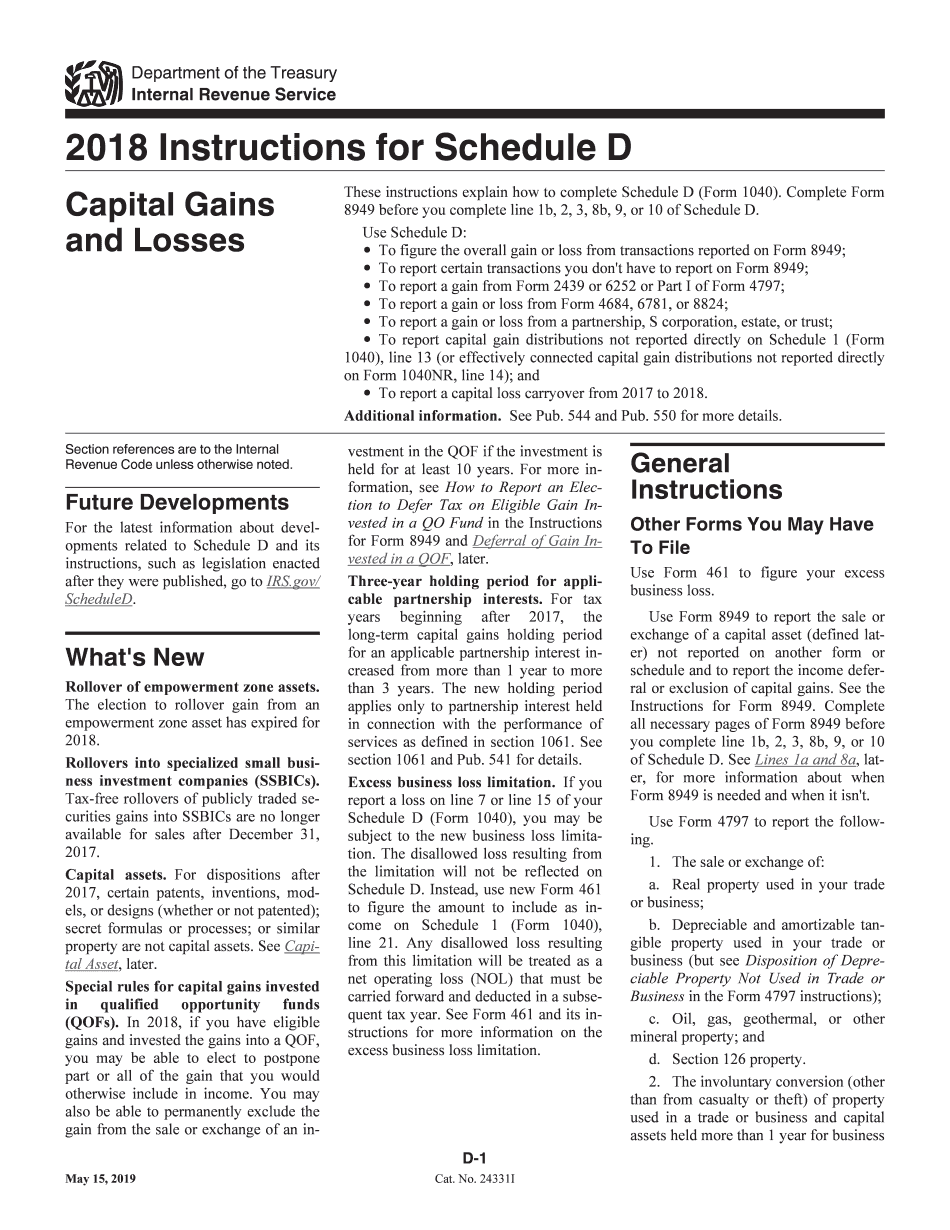

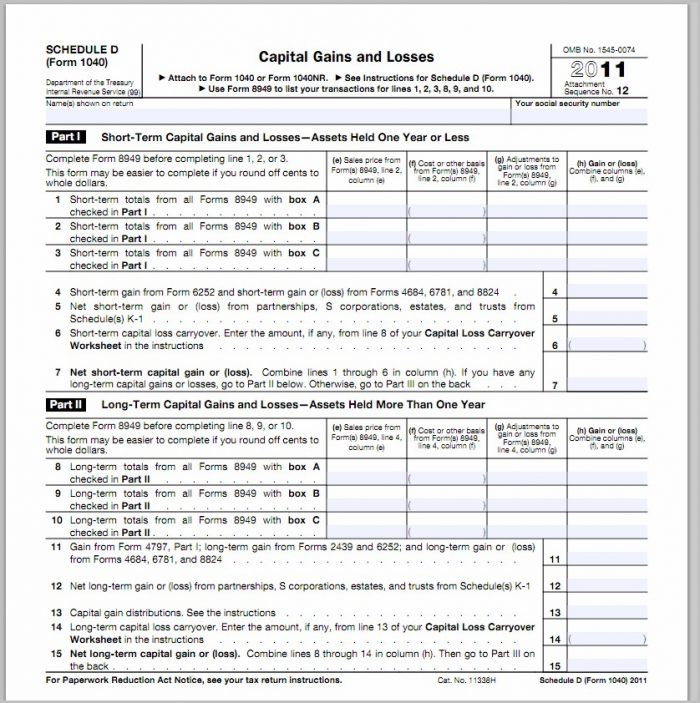

Tax Tables. You can find them in the Form 1040 Instructions. Qualified Dividend and Capital Gain Tax Worksheet. To see this select Forms View, then the DTaxWrk folder, then the Qualified Div & Cap Gain Wrk tab. Per the IRS Form 1040 Instructions, this worksheet must be used if: The taxpayer reported qualified dividends on Form 1040, Line 3a. Do you have qualified dividends on Form 1040 or 1040-SR, line 3a; or Form 1040-NR, line 10b? ... Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 12a (or in the instructions for Form 1040-NR, line 42). No. Complete the rest of Form 1040, 1040-SR, or 1040-NR. Schedule D (Form 1040 or 1040 ... Calculate the desired tax rates on qualifying dividends using the Qualified Dividends and Capital Gains Tax Worksheet included in the Form 1040 instructions. Where can I find Schedule D? For the most up-to-date information, visit www.irs.gov/ScheduleD. Lines 1b, 2b, 3b, 8b, 9, and 10 of Form 8949 can be used to list your transactions.

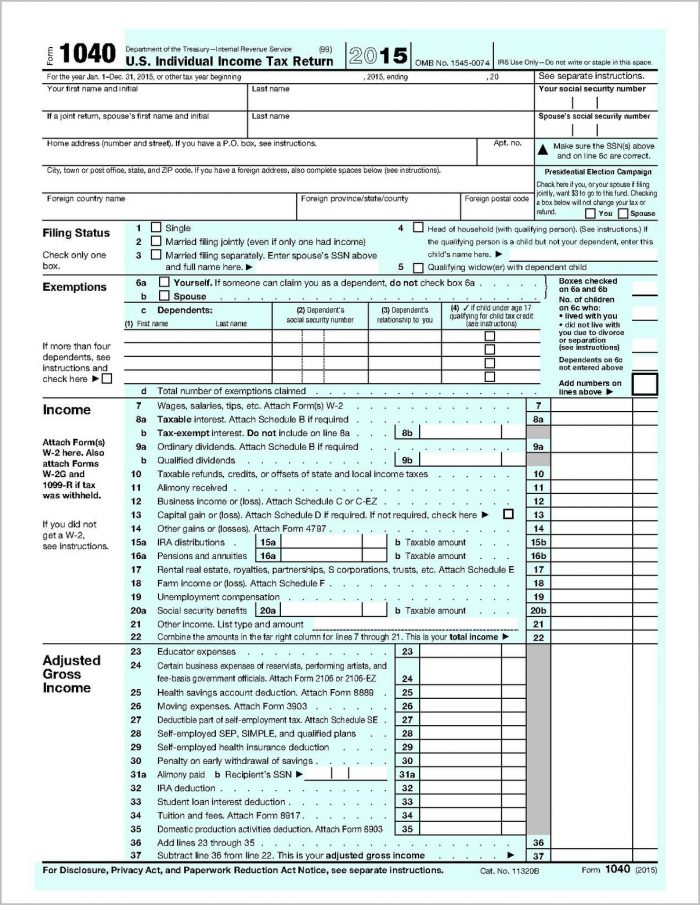

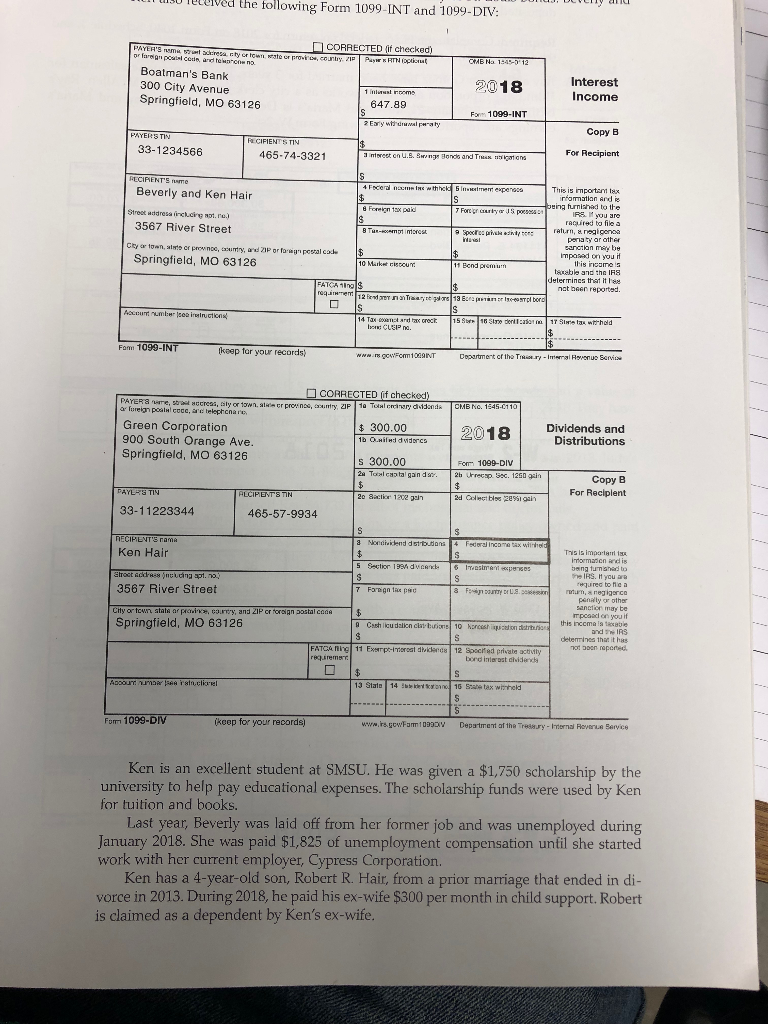

1040 qualified dividends worksheet. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount. Use the Schedule D worksheet to figure your tax. IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without having to fill out the Schedule D. (However, if you are filing Form 2555 (relating to foreign earned income), enter instead the amount from line 3 of the Foreign Earned Income Tax Worksheet in the instructions for Forms 1040 and 1040-SR, line 16) 1. _____ 2. Enter your qualified dividends from Form 1040, 1040-SR, or 1040-NR, line 3a: 2. _____ 3. Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

Qualified dividends are reported on Line 3a of your Form 1040. You can use the Qualified Dividends and Capital Gain Tax Worksheet found in the instructions for Form 1040 to figure out the tax on qualified dividends at the preferred tax rates. 7 Non-dividend distributions can reduce your cost basis in the stock by the amount of the distribution. qualified dividends and capital gain tax worksheet line 16 2020reate electronic signatures for signing a qualified dividends and capital gains worksheet 2020 in PDF format. signNow has paid close attention to iOS users and developed an application just for them. About Schedule B (Form 1040), Interest and Ordinary Dividends. Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond. How are qualified dividends reported on tax return? Qualified dividends are taxed at preferred tax rates if they are calculated using a worksheet included in instructions for Form 1040. What is the difference between qualified and nonqualified dividends? As of November 12, 2020, this blog has been revised for accuracy and comprehensiveness' sake.

Instead, 1040 Line 16 "Tax" asks you to "see instructions." In those instructions, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 16 tax. The 25 lines are so simplified, they end up being difficult to follow what exactly they do. Do you have qualified dividends on Form 1040, 1040-SR, or 1040-NR, line 3a? Yes. Complete the : Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. No. Complete the rest of Form 1040, 1040-SR, or 1040-NR. Schedule D (Form 1040) 2021: Instead, 1040 Line 44 "Tax" asks you to "see instructions." In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 44 tax. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do. IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States. Total capital gain or loss from Schedule D is entered on a different line of Form 1040.

Qualified Dividends. Enter your total qualified dividends on line 3a. Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. Qualified dividends are eligible for a lower tax rate than other ordinary income. Generally, these dividends are shown in box 1b of Form(s) 1099-DIV.

This is not just a problem with Turbotax, the flawed logic is in the IRS worksheet included in the 1040 instructions. I am attaching a hypothetical example of a completed worksheet. As noted in my question, the flaw occurs on line 18 where you subtract line 17 (effectively taxable income that is not qualified dividends or capital gains ) from the 15% bracket threshold (in the example, $479,000 ...

Line 9b of Form 1040 or 1040A is where you report your qualifying dividends. To calculate your total tax amount, use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a. To calculate your tax, use the Schedule D spreadsheet. Are qualified dividends tax deductible?

Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Keep for Your Records See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

Qualified dividends are taxed at preferred tax rates if they are calculated using a worksheet included in instructions for Form 1040. How do I know if my dividends are qualified? The 121-day period begins 60 days before to the ex-dividend date, therefore you must have held the shares for at least 60 days to qualify.

Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain ...

Qualified dividends and capital gains tax worksheet. IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States. The difference between the two means that the tax rate can be substantial.

Apr 16, 2021 — Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR, line 16.

• Before completing this worksheet, complete Form 1040 or 1040-SR through line 15. • If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 or 1040-SR, line 7. Enter the amount from Form 1040 or 1040-SR, line 15. However, if you are filing Form 2555 (relating to foreign ...

senior college graduation photography poses funny happy smiling cap and gown sorority chi omega symphony honors cords glasses outdoor natural light brown curly hair plus size

Calculate your qualified dividend amount using Form 1099-DIV. Ordinary dividends should be filed in Box 1a, qualifying dividends should be filed in Box 1b, and total capital gain distributions should be filed in Box 2a. Line 9b of Form 1040 or 1040A is where you report your qualifying dividends. To calculate your total tax amount, use the ...

Easily complete a printable IRS Instruction 1040 Line 44 Form 2015 online. Get ready for this year's Tax Season quickly and safely with pdfFiller!

Calculate the desired tax rates on qualifying dividends using the Qualified Dividends and Capital Gains Tax Worksheet included in the Form 1040 instructions. Where can I find Schedule D? For the most up-to-date information, visit www.irs.gov/ScheduleD. Lines 1b, 2b, 3b, 8b, 9, and 10 of Form 8949 can be used to list your transactions.

Do you have qualified dividends on Form 1040 or 1040-SR, line 3a; or Form 1040-NR, line 10b? ... Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 12a (or in the instructions for Form 1040-NR, line 42). No. Complete the rest of Form 1040, 1040-SR, or 1040-NR. Schedule D (Form 1040 or 1040 ...

Tax Tables. You can find them in the Form 1040 Instructions. Qualified Dividend and Capital Gain Tax Worksheet. To see this select Forms View, then the DTaxWrk folder, then the Qualified Div & Cap Gain Wrk tab. Per the IRS Form 1040 Instructions, this worksheet must be used if: The taxpayer reported qualified dividends on Form 1040, Line 3a.

0 Response to "41 1040 qualified dividends worksheet"

Post a Comment