41 gross pay vs net pay worksheet

Gross And Net Pay - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are Calculating the numbers in your paycheck, Teen years and adulthood whats on a pay stub, Its your paycheck lesson 2 w is for wages w 4 and w 2, My paycheck, Work 34 gross pay with overtime, Bring home the gold, Everyday math skills workbooks series, Reading a pay stub extension ... First, enter the net paycheck you require. Then enter your current payroll information and deductions. We will then calculate the gross pay amount required to achieve your net paycheck.

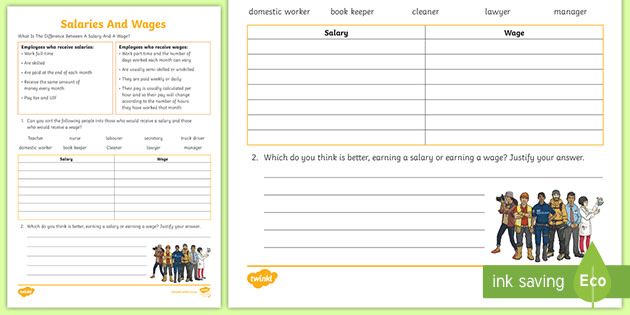

Gross pay is the amount of money that a worker receives before taxes are taken out. Net pay is the amount of money that a worker actually gets after taxes are taken out. The difference between...

Gross pay vs net pay worksheet

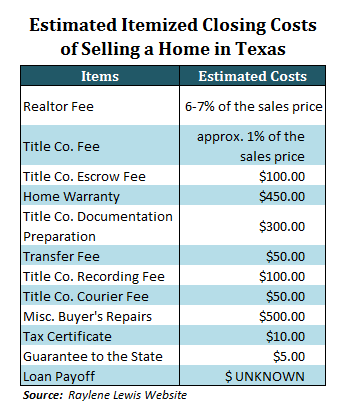

Gross Pay, Net Pay. & Required Deductions | 4-6. Exercise 1, Filling out Form W-4 | 7. Worksheet 1, Form W-4 | 8. Exercise 2, Questions | 9.32 pages from his gross pay. Federal & State Deductions: $221.65 + $123.74 + $28.94 + $35 + $20.50 = $429.83 Gross Pay - Federal & State Deductions = Net Pay $1,995.75 - $429.83 = $1,565.92 11. Andy is considering paying 1% of his monthly gross income for extra health coverage. How much would this additional coverage cost per month? a. $19.96 b. $15.66 This worksheet asks students to- -Find net income given an hourly wage and hours worked -Figure out how long a person needs to save to afford an item given a weekly income -Determine gross income given net income and amount paid in taxes -Fill out a simple budget form to determine the amount of mone. Subjects:

Gross pay vs net pay worksheet. He worked 25 hours in the previous 1-week pay period. ... paychecks to pay Steve's income tax, how much will Steve take home in this week's paycheck? Fill Gross And Net Pay Worksheets, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ✓ Instantly. Try Now! 900 seconds. Report an issue. Q. Net income is: answer choices. the total amount of money you earn. the amount of money you receive after deductions are subtracted from your gross income. the amount of money that is taken away in the form of taxes. the hourly rate of pay. the total amount of money you earn. Gross income refers to an individual's entire income from all sources -- wages, self-employment, bonuses, dividends, etc. Net income is the number that matters for tax purposes, and refers to your ...

Gross And Net Pay - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are Net pay work calculate the net pay for each, Computing gross pay, My paycheck, Work 14 calculate gross monthly income, Calculating payroll deductions, Hourly and overtime pay version 2 and answer keys, Calculating gross and weekly wages work, Worked. understand the difference between gross and net pay. • identify taxes and deductions taken ... Calculating Monthly Gross & Net Pay worksheet (1 per student).10 pages STUDENT 4: Calculating Wages and Income. Length = 3 weeks. In this unit you will learn different ways to earn money including hourly, salary, tips, and commission. You will also learn how to accurately compare different income values using equivalent hourly wage calculations. Calculate wages from straight time, overtime, double-time. - Gross vs. Net Pay - Periods of high activity with periods of low ... Income Calculation Worksheet Required. Program Requirements for CAPP (p. 12) 5CCR § 18081(1) (Appendix B) ... paycheck is included in gross pay or not • Determine if there is a cash benefit to the employee

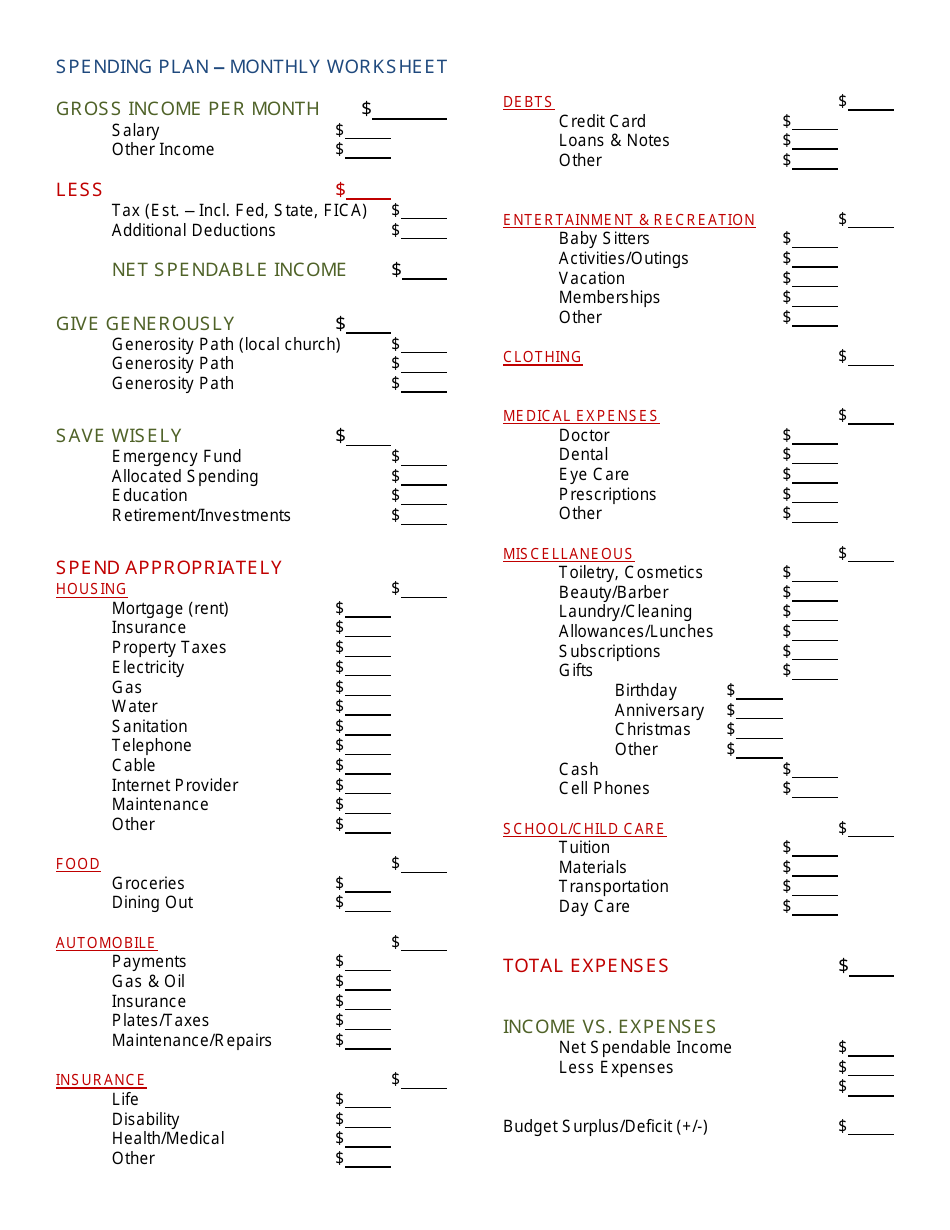

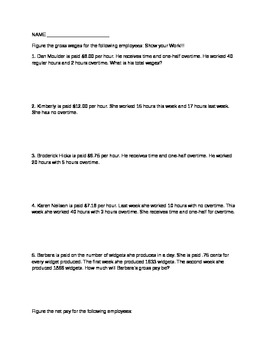

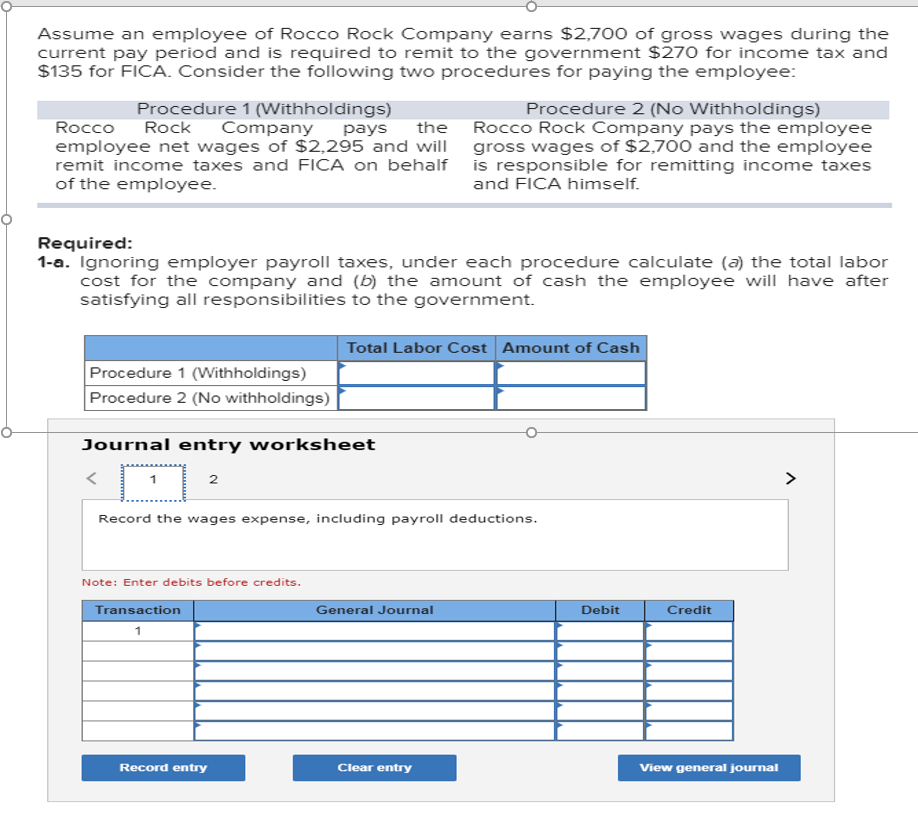

Gross pay, also called gross wages, is the amount an employee would receive before payroll taxes and other deductions. By contrast, net pay is the amount left over after deductions have been taken from an employee's gross pay. Net pay is sometimes called take-home pay. Understand what types of taxes are deducted from a paycheck; Calculate the difference between gross income and net income; What students will do. Review information on how to read a pay stub and answer questions about earnings and deductions. Calculate tax withholdings, deductions, and the difference between gross income and net income. The result of this calculation is your gross pay. What is Net Pay? Net pay is the amount of money you take home after deductions are made. A deduction is money that is taken out of your paycheck for taxes and employee benefits. Deductions can reduce your paycheck by 20-30%. In the state of Tennessee these deductions will include: Federal income tax The class treasurer and payroll clerks will learn to fill out payroll paperwork and pay students for both part-time and full-time jobs. Students will differentiate between gross pay and net pay . Students will use purchase orders to buy items from the class store.

Oct 5, 2021 - This is a workbook I created to teach my special education students about net and gross pay. On the first worksheet, students are given the deductions in dollar amounts. On the second worksheet, the students are given the wage and the deductions in percentages and asked to calculate the dollar amoun...

Calculating Gross and Net Pay. In this lesson, part of the "Plan, Save, Succeed!" unit, students will learn about voluntary and involuntary deductions on a sample paycheck, and then calculate the dollar amount of deductions using percentages. Grades. 6-8.

Module 1-Payroll Taxes and Federal Income Tax Withholding. For Teachers 10th - 11th. Learners complete lessons and worksheet to identify the different types and uses of payroll taxes. They examine how federal income taxes are used, determine the difference between gross and net pay, and determine how employers withhold...

Understanding paycheck deductions What you earn (based on your wages or salary) is called your gross income. Employers withhold (or deduct) some of their employees' pay in order to cover . payroll taxes and income tax. Money may also be deducted, or subtracted, from a paycheck to pay for retirement or health benefits. The amount of money you

Reportable Payroll. In most states, Reportable payroll is simply the straight time wage for the number of hours worked. There are no f ringe benefits, (i.e. health insurance, 401 (k) benefits, etc.) and no overtime rates included in the Reportable Payroll. For example, if your employee works 50 hours on a jobsite and is paid $20 per hour ...

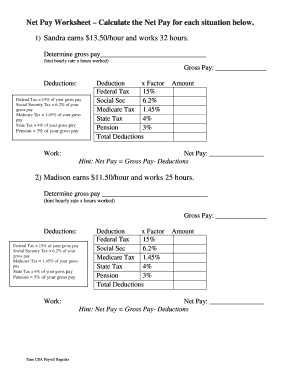

If last week she worked 46 hours, calculate her net pay. Regular Pay: Over- time Pay: Gross Pay: Deductions: Deduction x Factor Amount.2 pages

1) Sandra earns $13.50/hour and works 32 hours. Determine gross pay_______________________________. (hint hourly rate x hours worked). Gross Pay: Deductions:.3 pages

8. $2.00. PDF. This is a workbook I created to teach my special education students about net and gross pay. On the first worksheet, students are given the deductions in dollar amounts. On the second worksheet, the students are given the wage and the deductions in percentages and asked to calculate the dollar amoun.

Taylor's Teaching in Texas. 6. $1.25. PDF. This is a fun way for students to calculate gross and net income, and practice writing a check. Students select a gross income card, federal income tax card, medicare card and social security card and use the information to calculate total deductions and net income.

income ytd gross check no. rate ytd deductions deductions pay period hours year to date pay date current total ytd net pay total deductions net pay current total gross wages 2,800.00 479.02 2320.98 200.00 44.67 155.33 200.00 learn more at consumerfinance.gov 2 of 2

GROSS/NET PAY PROBLEMS CONTINUED 7. Martha Green worked 40 regular-time hours at $10.00 per hour and 4 overtime hours at $15.00 per hour. Find Martha's gross pay for the week.

Gross estate is the total value of a person's estate before deductions of any costs like for example taxes, living and funeral expenses or any other administration costs. Net is the term opposite to the gross and refers to the amount after we have done any deductions. So, net income is the income we receive after paying taxes.

Net Take‐Home Pay 1099 Contractor vs. W‐2 Employee Contractors directed to a payroll service are often concerned that they will lose all their deductions, pay more taxes and ... Gross Receipts/Wages $75,000 $75,000 $100,000 $150,000 $200,000 $250,000 Less Expenses1 ...

Net and Gross Pay (Workbook- 4 Worksheets) by. Sophie's Stuff. 8. $2.00. PDF. This is a workbook I created to teach my special education students about net and gross pay. On the first worksheet, students are given the deductions in dollar amounts. On the second worksheet, the students are given the wage and the deductions in percentages and ...

you take home. 2. What is the difference between Hourly Wages and Salary? • Hourly you get paid for the hours you work, including ...4 pages

5. $2.00. PDF. Created by a CPA, this resource is aligned to TEKS 5.10B and explains the difference between gross income and net income. This resource also includes two projects - one project has the student calculate a net paycheck, or "take home" pay, from basic information; and the other project has the studen.

Gross pay is the amount people earn per pay period before any deductions or taxes are paid. Net pay is the amount people receive after taxes and other deductions are taken out of gross pay. 6. Explain that one tax many people pay is federal income tax. Income tax is a tax on the amount of income people earn. People pay a percentage of their ...

What is net pay vs. gross pay Gross pay, wage, or income can basically be defined as the total income a person makes. For a monthly gross wage, that's the hourly wage multiplied by the number of hours the person worked that month, or it is the person's set monthly salary.

This worksheet asks students to- -Find net income given an hourly wage and hours worked -Figure out how long a person needs to save to afford an item given a weekly income -Determine gross income given net income and amount paid in taxes -Fill out a simple budget form to determine the amount of mone. Subjects:

from his gross pay. Federal & State Deductions: $221.65 + $123.74 + $28.94 + $35 + $20.50 = $429.83 Gross Pay - Federal & State Deductions = Net Pay $1,995.75 - $429.83 = $1,565.92 11. Andy is considering paying 1% of his monthly gross income for extra health coverage. How much would this additional coverage cost per month? a. $19.96 b. $15.66

Gross Pay, Net Pay. & Required Deductions | 4-6. Exercise 1, Filling out Form W-4 | 7. Worksheet 1, Form W-4 | 8. Exercise 2, Questions | 9.32 pages

0 Response to "41 gross pay vs net pay worksheet"

Post a Comment