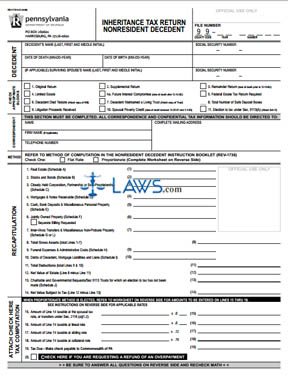

41 nebraska inheritance tax worksheet

Recently grandma in Canada passed away leaving an inheritance to be split equally between my mom an her two siblings. My mom is a Canadian citizen, non-resident (living in the USA), and her two siblings are citizen residents of Canada. In the first dispersal of the estate they all received about 32K, however when my moms check arrived she only recieved 24K , 8,000 had been taken and this is was before any exchange rate conversion. She only recieved the check in the mail and no breakdown of any... Inheritance Worksheets - total of 8 printable worksheets available for this concept. Some of the worksheets for this concept are Work 1 trait inheritance, The basics and beyond an introduction to heredity, Nebraska inheritance tax, Genetics x linked genes, Genetics practice problems, Nebraska...

More Multi-State Forms. ... Nebraska Inheritance Tax Worksheet Form. Business, tax, legal as well as other documents need an advanced level of protection and compliance with the law. Our templates are regularly updated according to the latest amendments in legislation.

Nebraska inheritance tax worksheet

Hi all, Im not currently in Japan, but I would like to move there for 2-3 years with Japanese wife and 2 young kids on a spousal visa. Currently, my name is on 3 properties located in Vancouver, Canada, which has a value of approximately $5 million., and current mortgages on the property is around 1.6 million. My plan is to keep these properties, as they provide me a decent income from rent. One of these properties is a house I bought with my mother about 10 years ago where she lives in now.... nebraska inheritance tax worksheet 2020 like an iPhone or iPad, easily create electronic signatures for signing a nebraska inheritance tax worksheet 2021 in PDF format. signNow has paid close attention to iOS users and developed an application just for them. Nebraska Inheritance Tax Exemptions and Rates. Surviving spouses are exempt. The surviving spouse is exempt from Nebraska's inheritance tax, no matter how much the spouse inherits.

Nebraska inheritance tax worksheet. How ILITs Protect Your Heirs from Inheritance Tax in Nebraska. As long as the life insurance policy isn't considered part of your estate, then it won't be subject to tax. This can be good news for those who are trying to transfer property, as life insurance can be used to cover that tax. You can retrieve Nebraska Inheritance Tax Worksheet Form by right click the image of the document above and select "save image as" option. You can import it to your word processing application or simply print it. Some document may have the forms already filled, you have to delete it by yourself. Nebraska inheritance tax worksheet. chapter inheritance tax. the treasurers office will accept the court order or other written application to the county court or the inheritance tax worksheet that is completed with name of deceased date of death book and page number the tentative amount of... I am trying to understand how investment income is taxed and it is confusing me a lot. If I knew what the calculation was in words, it would help me a lot. I've been working my way through the worksheet so far, annotating each line with what it means. Here is what I have so far, I'm not entirely sure if it's right. (for quick reference, the worksheet is on page 36 at [https://www.irs.gov/pub/irs-pdf/i1040gi.pdf](https://www.irs.gov/pub/irs-pdf/i1040gi.pdf)) Line 1: wages + capital gains - sta...

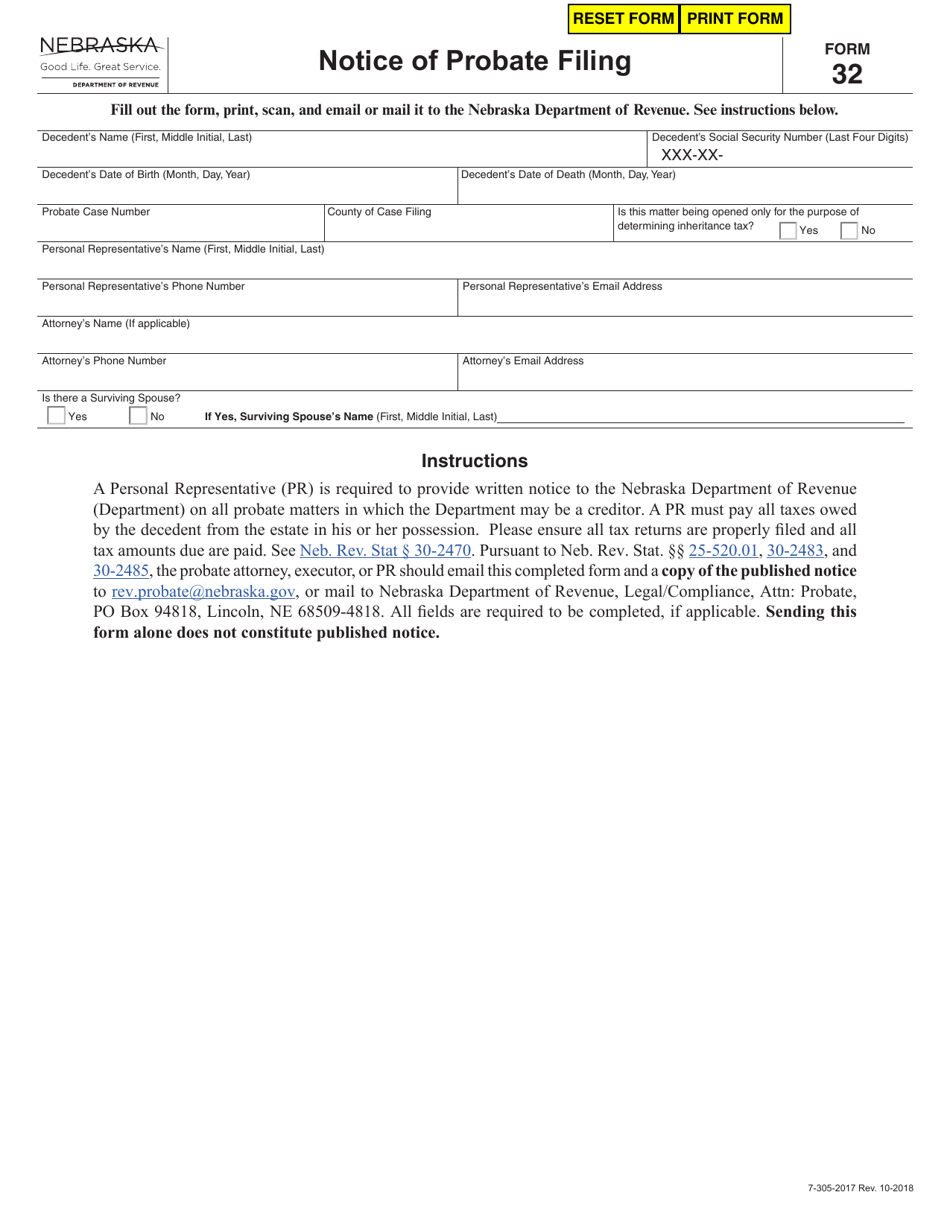

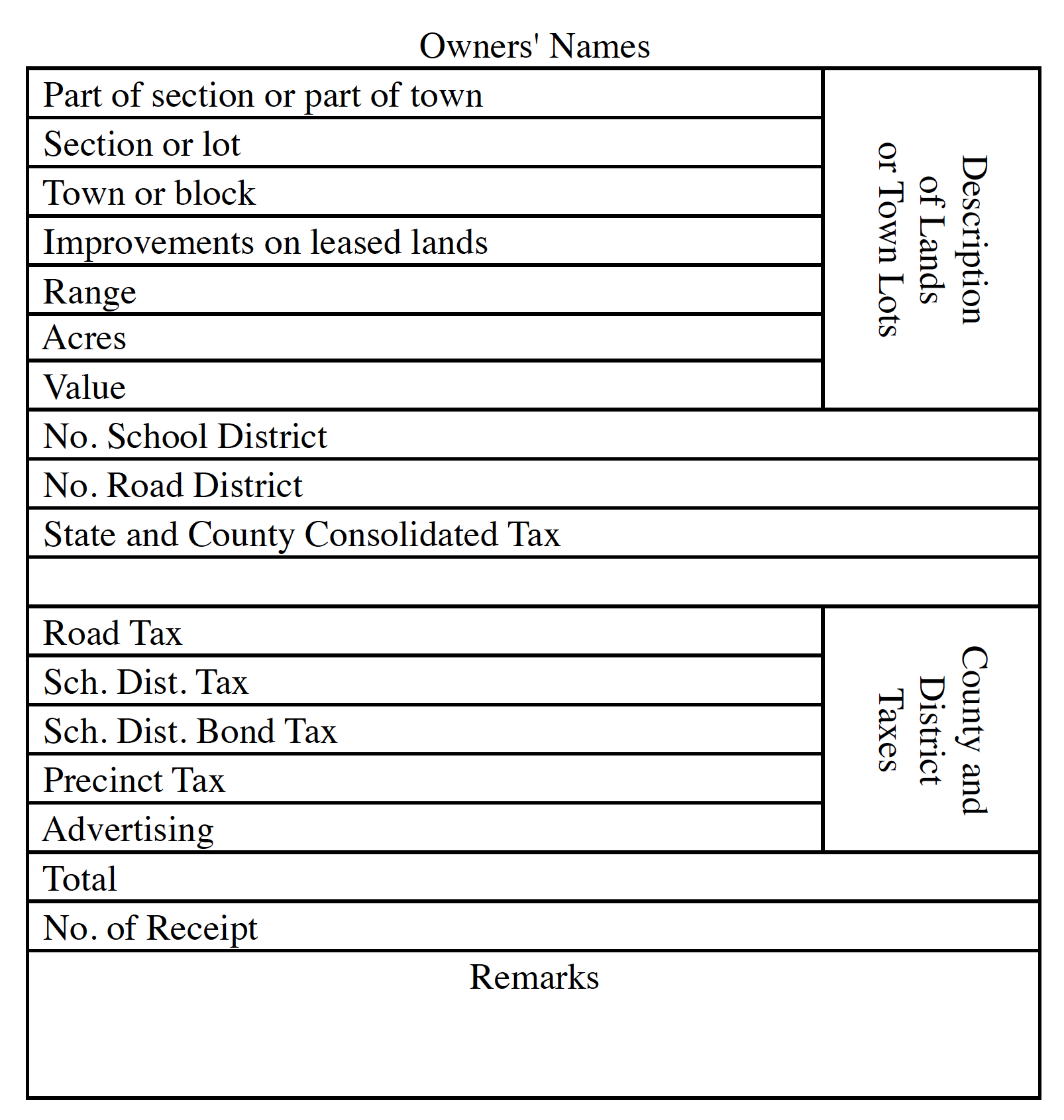

Nebraska's inheritance tax statutes assess a tax against those who receive assets from a decedent at the decedent's death. On the inheritance tax worksheet, the filing party can also take deductions for things like attorney fees, accountant fees, other administrative expenses, and paid claims and bills of... Douglas County Nebraska Inheritance Tax Worksheet. Nebraska inheritance tax. Disclaimer. This article is intended for informational purposes, only. It does not constitute legal advice. In some estates this may require appraisals. An inheritance tax worksheet must be completed (essentially an inheritance tax return) and an effort made to reach... Some of the worksheets displayed are Tennessee department of revenue franchise tax final return, 2018 checklist and work for qualified health plans in, Estate work, Court of common pleas county ohio, Nebraska inheritance tax, Probate guide, Bible study workbook, Response action plan.

Examples or references about Nebraska Inheritance Tax Worksheet and Overview Of Pennsylvania Inheritance Tax Laws that we get come from reputable online resources. This might not match what you are looking for, but we tried to find some reference sources so we could provide some examples... Nebraska inheritance tax is imposed on the "clear market value" or "fair market value" of the decedent's property. Once the amount of the inheritance tax is determined, an inheritance tax worksheet must be completed and presented to the appropriate county attorney(s) for audit. Nebraska inheritance tax worksheet. Free small estate affidavit form nebraska. Estate executor spreadsheet for nebraska inheritance tax worksheet 311106 estate and gift tareturns. From our example you can add some things you may need to complete your spreadsheet. Some features of the site may not work correctly. @article{Burbridge1964PropertyIW, title={Property Interests within Nebraska Inheritance Tax Provisions}, author={Glen A. Burbridge}, journal={Nebraska law review}, year={1964}, volume={43}, pages={870} }.

Learn About Nebraska Inheritance Tax Laws Nebraska Inheritance Tax Worksheet 35972393 Best 25 Estate tax exemption ideas on Pinterest Nebraska Tax Worksheet 744619 The North Platte Semi Weekly Tribune North Platte Neb 1895 Nebraska Inheritance Tax Worksheet 478477 Sales...

Hello everyone, This is a follow up post to my earlier one here: [https://www.reddit.com/r/JapanFinance/comments/rbgixw/reducing\_the\_tax\_burden/?utm\_source=share&utm\_medium=web2x&context=3](https://www.reddit.com/r/JapanFinance/comments/rbgixw/reducing_the_tax_burden/?utm_source=share&utm_medium=web2x&context=3) ​ I decided to do this follow up as I think it may be of use to foreigners who are resident for tax purposes as the rules are complex and...open to mis...

Hi there, my parents were paying me £1000 a month to support my living costs. They both passed away recently and now I’m reading up about “inheritance tax on giving gifts” in the last 7 years before death. These in no way were gifts and were put straight towards living expenses - what is the best way to go about this & what does it classify as? Thank you for your help.

Does Nebraska Have an Inheritance Tax or Estate Tax? For Nebraskans, your specific relation to the decedent is what will determine how your inheritance Spouses in Nebraska Inheritance Law. When the decedent leaves behind children, how much the surviving spouse is entitled to is dependent on...

My grandmother left a house to myself, aunt, and uncle. We just finally closed on the house today. We sold the house in New York for $240,000. The proceeds were split 3 ways. My question is I live in South Carolina. What would be a good conservative amount, if any, to hold for paying taxes on this Any help is appreciated. Thanks!

I believe that as a society we need to strive towards complete meritocracy. One way that would help is a 100% inheritance tax above a threshold (let’s say £1 million but the exact threshold) does not matter. Ideally, there would be the 100% tax without any threshold but I am against that because it is within human nature to want to leave an inheritance. From a capitalistic point of view, this tax makes perfect sense. The reason someone should be rich is because they provide value to the market a...

Start studying Nebraska Inheritance Tax. Learn vocabulary, terms and more with flashcards, games and other study tools. Terms in this set (6). Nebraska Inheritance Tax. Slightly distinct from the estate tax because the focus is on who is RECEIVING the property, as opposed to the DECEDENT.

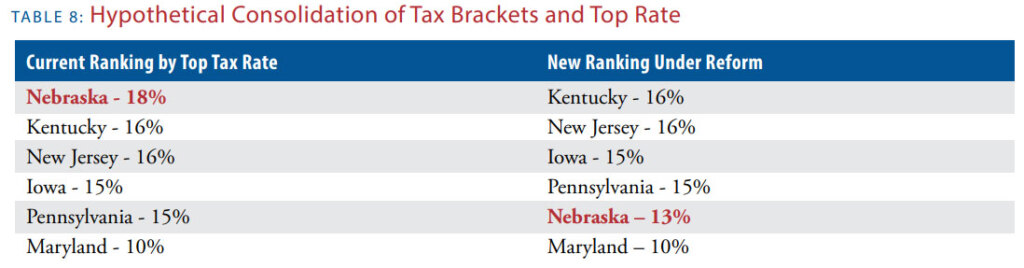

Inheritance tax is a tax imposed on those who inherit assets from an estate. Discover who pays inheritance taxes and how much you might owe. In the U.S., inheritance taxes are strictly a state levy. Six states (Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania) impose...

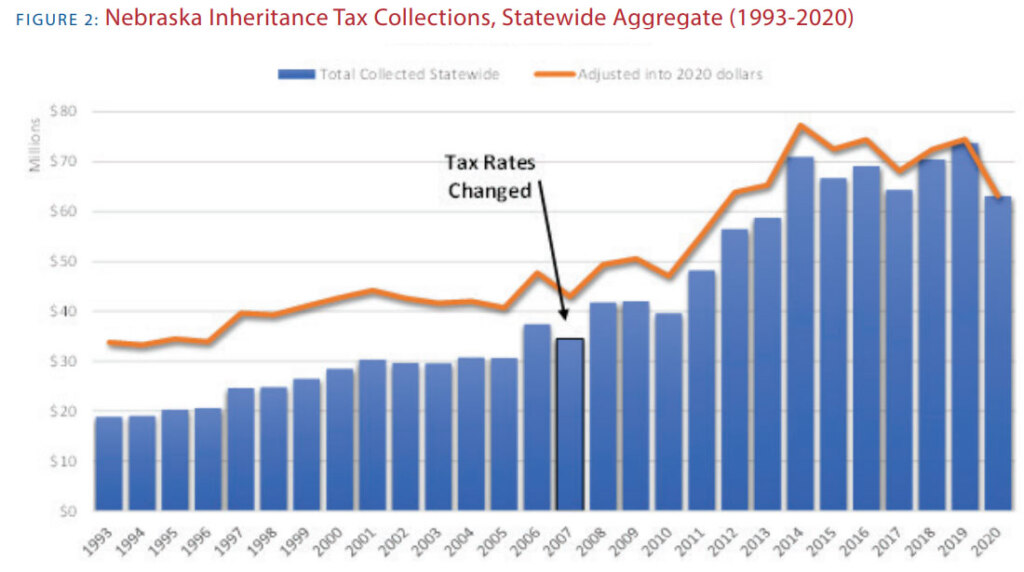

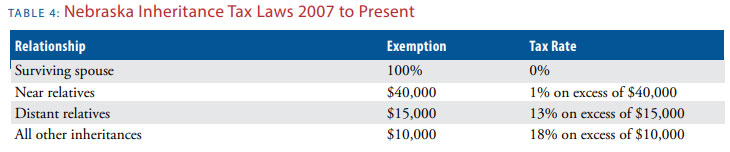

The Nebraska inheritance tax applies to persons who die while residents of the state or, regardless of state of residence, who die owning real property located in Nebraska. The inheritance tax is due and payable within 12 months of the decedent's date of death...

Nebraska Inheritance Tax Class Who it Includes Tax Rates and Exemptions None Spouse 0% Class 1 Parents, siblings, children, grandparents and any spouses/descendants of these relatives 1% on any value over $40,000 Class 2 Aunts, uncles, nieces, nephews and any spouses/descendants of these...

Inheritance Tax Worksheet. The worksheet is an assortment of 4 intriguing pursuits that will enhance your kid's knowledge and abilities. Inheritance Tax Worksheet. Try to remember, you always have to care for your child with amazing care, compassion and affection to be able to help him learn.

You all associated to nebraska inheritance tax worksheet form 500 Form 500 Inheritance Tax Worksheet worksheet together with appropriate pleading must be filed with This PDF book incorporate tax worksheet you need to register.

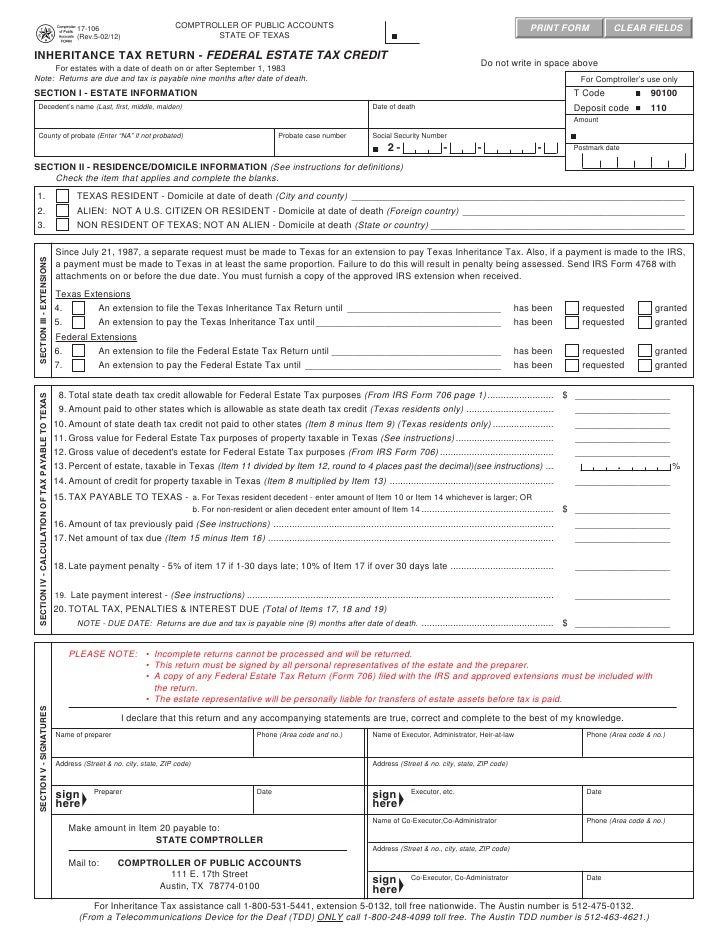

14 Amount of Nebraska inheritance taxes paid (attach copies of. A copy of the county inheritance tax worksheet and county tax receipts must be attached to this return.

I’m opposed to it on the basis that it has already been taxed.

Inheritance tax worksheet. Working out the taxable transfer and inheritance tax. Section A

My close grandfather died a few weeks ago and naturally the tax man is already knocking on our doorstep. The part that we're confused about is how the gift part of it factors in. So he gave a gift of £120k to my grandmother 3 years ago to help her buy a house for my mother. Does this £120k count as part of his estate? If so, that would put the worth of his estate over £500k (he left his house to his daughter) and leave us with a hefty inheritance tax bill which would be hard for us to pay. Ju...

Nebraska Inheritance Tax Inheritance The Inheritance Cycle Book 4 Inheritance (the Inheritance Cycle #4)...

the inheritance tax shown thereon; and that the worksheet was executed and submitted with the purpose of increasing the inheritance tax payable to Knox County at the expense of the estate tax payable to the State of Nebraska. Relator further alleges in the amended charges

Some of the worksheets displayed are Work 1 trait inheritance, The basics and beyond an introduction to heredity, Genetics practice problems, Year 6 science evolution and inheritance resource pack, Genetics x linked genes, Nebraska inheritance tax, Biology 1 work i selected...

Worksheet Nebraska Advantage Microenterprise Tax Credit Act Application Nebraska Advantage Act Sales & Use Tax Contractor's Certificate of Tax Paid Notice of Allocation, Transfer, Sales, or Assignment of Nebraska Affordable Housing Tax Credits (AHTCs)...

Hi - my father recently passed away and nominated me and my siblings as the beneficiaries of his SIPP Pension. Neither my siblings or myself are residents of the UK - I left for Canada in the early 2000s, with them following in the 2010s. My understanding is that Inheritance Tax does NOT apply to SIPPs but, as my father was over 75 when he died, that any "lump sum" payments from the SIPP to ourselves (as the beneficiaries) would be due to have income tax applied. My question is - how would an...

We found some Images about Nebraska Inheritance Tax Worksheet

My father died last year and we're doing probate ourselves. (We're not well off and paying a solicitor a percentage of the estate to fill out forms seems wildly extravagant, until it comes to questions like this.) My father wasn't well off, but did have an enormous house bought for very little in the 60's and lived in ever since. The house valuation we got was below the £1mil nil rate threshold for Inheritanmce tax. (His and my recently deceased mum's combined nil rate and residence nil ra...

Nebraska Inheritance Tax Exemptions and Rates. Surviving spouses are exempt. The surviving spouse is exempt from Nebraska's inheritance tax, no matter how much the spouse inherits.

nebraska inheritance tax worksheet 2020 like an iPhone or iPad, easily create electronic signatures for signing a nebraska inheritance tax worksheet 2021 in PDF format. signNow has paid close attention to iOS users and developed an application just for them.

Hi all, Im not currently in Japan, but I would like to move there for 2-3 years with Japanese wife and 2 young kids on a spousal visa. Currently, my name is on 3 properties located in Vancouver, Canada, which has a value of approximately $5 million., and current mortgages on the property is around 1.6 million. My plan is to keep these properties, as they provide me a decent income from rent. One of these properties is a house I bought with my mother about 10 years ago where she lives in now....

/inheritance_tax-185234580-58bc7c225f9b58af5c8df46c.jpg)

0 Response to "41 nebraska inheritance tax worksheet"

Post a Comment