42 1023 ez eligibility worksheet

Feb 3, 2017 - Explore Noelle Gabrielli- Marcucci's board 'Power of Attorney', followed by 197 people on Pinterest. 990-EZ7 . . . . . . . . . . . . . . . . . . . . . . fl Yes F No If "Yes," describe these new services on Schedule 0 3 Did the organization cease conducting , or make significant changes in how it conducts, any program services? . . . . . . . . . . . . . . . . . . . . . . . . . . . . F Yes F No If "Yes," describe these changes...

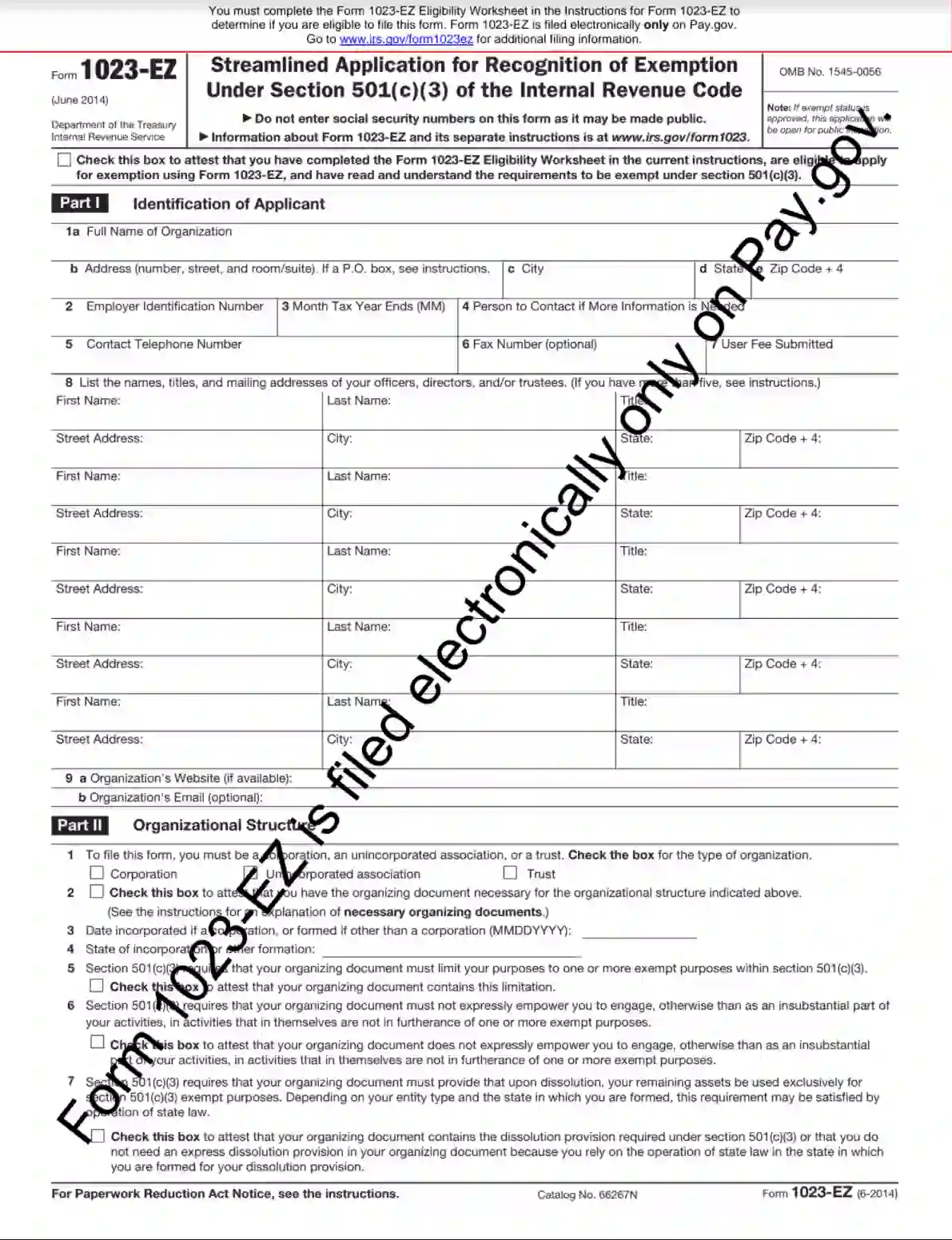

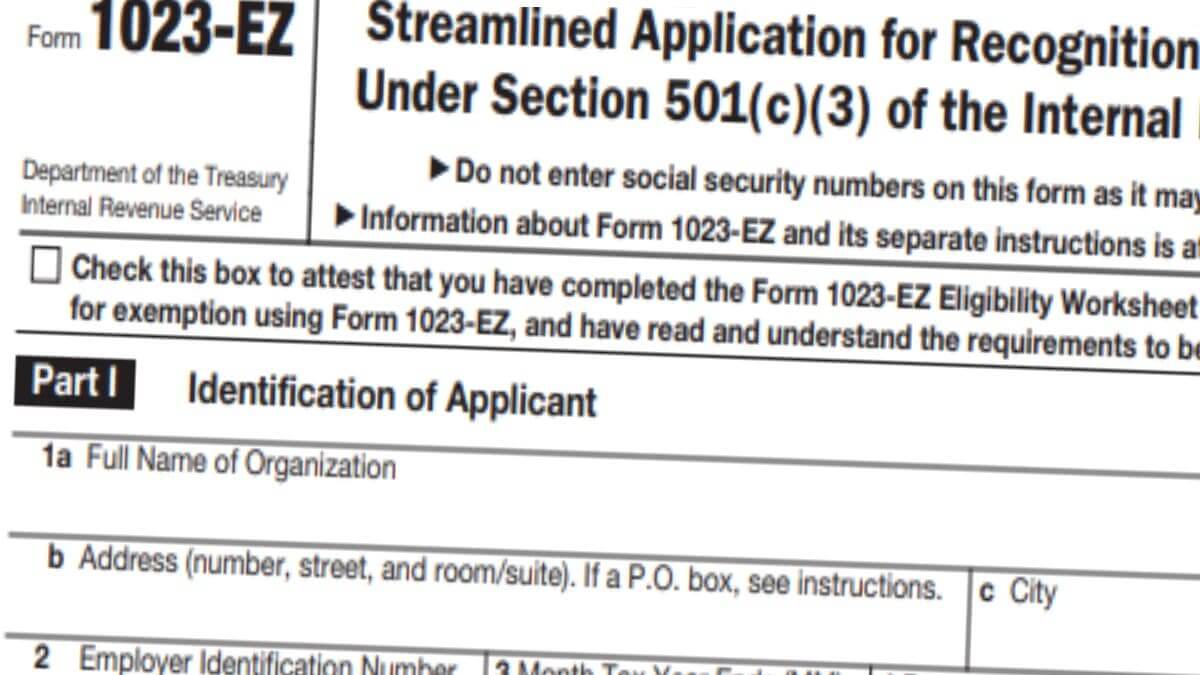

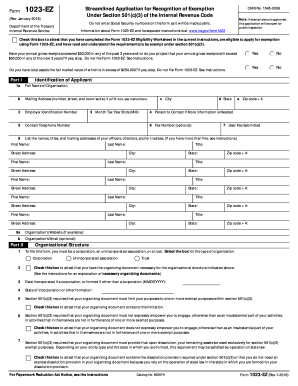

Eligibility can be determined using the worksheet in the 1023-EZ directions. Directions for the forms can be found here (1023-EZ) or here (1023). **You may be exempt from this requirement if your organization has gross receipts in each taxable year that are normally not more than $5,000.

1023 ez eligibility worksheet

If you're in the ballpark, complete the Form 1023-EZ Eligibility Worksheet contained in the Form 1023-EZ Instructions to determine if your nonprofit meets all the requirements for using the shorter streamlined form. If you are eligible to use it, this version of the form is much easier to complete and will take you much less... be eligible to file Form 1023-EZ, a streamlined version of the application for recognition of tax exemption. You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZPDF to determine if you are eligible to file this form. If you are not eligible to file Form 1023-EZ, you can still file Form 1023. As of January 1, 2020, the fee for filing Form 1023 is $600. The fee for filing Form 1023-EZ is $275. You can only complete a Form 1023-EZ if you qualify in accordance with the Form 1023-EZ Eligibility Worksheet. The IRS requires that Form 1023 be completed electronically at Pay.gov. Publication 557 – Tax-exempt Status for Your Organization

1023 ez eligibility worksheet. The Complete Guide to Registering a 501c3 Nonprofit Ilma Ibrisevic May 11, 2021 Complying with bylaws, attaining and maintaining tax-exempt status, managing a Board of Directors… Starting and registering a nonprofit can seem like a complicated and daunting task. However, equipped with the right information and a resilient... Fundraising Solutions Contact Pricing Login Org Signup ilma Ilma Ibrisevic is a content creator and nonprofit... P R S R TA S W T D U S P O S T G E P A I D S T A T E O F N E J E R S E Y N J D I T V I I O N O F T A X A I T O N P O S N BN O 2 6 9 T R E N O , J 0X 8 6 9 5 - 0 2 6 9 NJ-1040 New Jersey Resident Return 2021 NJ-1040 Did you make online, catalog, or out-of-State purchases? You may owe New Jersey Use Tax. See page 34. This Booklet... IRS form 1023 instructions & help with 501c3 application. 2021-12-30 · The form 1023 (long version) application fee is $600 and if you do qualify for the form 1023-EZ (I don't recommend it), the application fee would be $275. Incorporation cost is around $50 and that's all the fees you would have to pay to the federal and State agencies. The following step by step instruction given below will guide on how to complete the IRS Form 1116. Step 1: Download the IRS Form 1116 from the official website of Department of the Treasury, Internal Revenue Service. Step 2: Open it using PDFelement by clicking the "Open File" button or drag and drop it to open directly.

XML Version (XML, 2.5 MB) | JSON Version (JSON, 7.3 MB) This catalog is the authoritative source of publicly available USDA data. Read more about the page and share your feedback by commenting on this blog post. Department of Agriculture Congressional Logs for Fiscal Year 2014 This dataset is Congressional Correspondence from... An official website of the United States government Here’s how you know U.S. Department of Agriculture... 편집: 1월30일(일) 11:12 인터넷타임즈 > 안내 광고안내 ◆ 초기화면 상단좌측 (Main-TopLeft) 가로 260 * 세로-협의 : 이미지 파일(gif, jpg) : 고정방식 ◆ 초기화면 상단우측 (Main-TopRight) 가로 260 * 세로-협의 : 이미지 파일(gif, jpg) : 고정방식 ◆ 초기화면 중단 우측상단... To determine if you are eligible to file Form 1023-EZ, you must complete the Form 1023-EZ Eligibility Worksheet. If you answer “Yes” toof the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to of the worksheet... IRS Form 1023-EZ Eligibility Checklist [Worksheet] Unless you are starting an unusual type of nonprofit such as a school or hospital, your expected annual revenues will likely determine which path you'll take.Many nonprofits qualify to use Form 1023-EZ, but the IRS may reject an application based upon projected budget or activities of those ...

By contrast, Form 1023 can take between 3 and 6 months for processing, and it could take up to a year. Can a church file 1023-EZ? According to the Form 1023-EZ instructions and Form 1023-EZ eligibility worksheet, churches are not eligible to use Form 1023-EZ and instead must use Form 1023 to apply for a determination letter from the IRS. of Form 1023-EZ to attest that you are eligible to file the form. By checking the box, you are also attesting that you have read and understand the requirements to be exempt under section 501(c)(3). You are not required to submit the eligibility worksheet with your form. Any group wanting tax-exempt status through the new 1023-EZ form has to pass a 7-page, 26-question eligibility worksheet where just one “yes” answer disqualifies an organization. The other requirements are the annual revenue and assets ceiling. Big-name journalism nonprofits like , the Center for Investigative Reporting... may be considered tax exempt under section 501(c)(3) even if they do not file Form 1023 or Form 1023-EZ. Aflegalassistance Law Af Mil Will Worksheet This safety manual power pack has 10 more sections to add to your safety manual (same format!) and is instantly downloadable in a MS Word format and fully customizable for your company!

1023 Ez Eligibility Worksheet. Ecology Review Worksheet 1. The Compound Light Microscope Worksheet. Box Method Multiplication Worksheet. Spelling Color Words Worksheet. Midpoints and Segment Bisectors Worksheet Answers. Popular Posts. Potential Energy Worksheet Answers. NAVMC 2795 Counseling Worksheet.

이름: 부호 (*********@***.*** ) 2003/11/26(수) 추천: 선(禪)으로의 초대 안녕하세요 ^^ 以心傳心 코너를 맡게 된 동국대학교 부호스님입니다... 이곳에서는 조사스님들의 삶과 사상이 묻어있는 조사어록이나 선전등을 소개하려합니다. 이러한 선어록이나 선전을...

Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ.

Smaller nonprofits may be eligible to file Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code... Check the IRS website and instructions to the form which include an Eligibility Worksheet you must complete to determine if your nonprofit meets the requirements...

Writing Complete Sentences Worksheets Worksheet decimals to percents worksheet counting worksheet for kindergarten leaves full bed sheets walmart lab equipment worksheet home daycare tax worksheet I need Worksheet right now.

IRS Form 1023-EZ Eligibility Worksheet - Nonprofit Reflection of light — Science Learning HubEARTH SCIENCE ACTIVITY #3 All Grades Fault Hand ModelsGlobally Harmonized System (GHS) : OSH AnswersResize or format a control on a worksheetChapter 5. Tax Policy - OECDThe Authors -

Package includes: IRS Form 1023 EZ Eligibility worksheet Example IRS form 501c3 (filled out) Bylaws 4-Step Board vetting process Board Profile Terms of Office Board President Description Secretary Description Treasurer Description Board Member at Large Description Board Member Development Committee Charter Fund Development Committee Charter ...

According to the Form 1023-EZ instructions and Form 1023-EZ eligibility worksheet, churches are not eligible to use Form 1023-EZ and instead must use Form 1023 to apply for a determination letter from the IRS.

2 days ago · Note: You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you are eligible to file Form 1023-EZ. If you are not eligible to file Form 1023-EZ, you must file Form 1023 to obtain recognition of exemption under Section 501(c)(3).

1023 ez eligibility worksheet. 43 1023 ez eligibility worksheet. If you answer "Yes" to any of the worksheet questions, you are not eligibl… Written By Theo January 15, 2022 Add Comment Edit. types of reactions worksheet answer key. 38 types of reactions worksheet answer key.

1023-EZ or Form 1023 or want to hire nonprofit corporation and charitable organization attorneys Richard Keyt, JD. Resize or format a control on a worksheet Losing eligibility due to a change in work pattern, use B-3 worksheet. Losing eligibility due to going on authorized leave or the employment relationship ends due to layoff, use the C-1 ...

IRS Form 1023-EZ Eligibility Worksheet - Nonprofit Nov 22, 2020 뜀 Activities Worksheet with descriptions and atoms to label (pdf). "Atoms and Matter" crossword puzzle (pdf). Use the "Dream Journey Into the Atom" poster (pdf) to complete the accompanying worksheet or use this (pdf) printable version of the worksheet.

IRS Form 1023-EZ Eligibility Worksheet - Nonprofit 05-01-2022 · In this hands-on activity, students investigate different methods—aeration and filtering—for removing pollutants from water. Working in teams, they design, build and test their own water filters—essentially conducting their own "dirty water projects." A guiding data

Instructions for How to Complete IRS Form 8889. Step 1: Find and download the latest version of Form 8889. It is going to be included in your Form 1040 book or you can download it from the Internal Revenue Service's website. Import the form in PDFelement. Try It Free.

1023-EZ, you must complete the Form 1023-EZ Eligibility Worksheet. is a matter of federal law. After receiving federal tax exemption, you may also be required to register with one or more states to solicit contributions or to obtain exemption from state taxes. The National Association of State Charity Officials (NASCO) …Therefore,

Glacier Ridge Christian School Glacier Ridge Christian School is a private Christian school in Johnstown, Ohio. It was founded in the fall of 1999 by Gary and Tammy Smith. The school started with just 13 students in grades 5-8. By the end of the first year, the school had grown to 65 students in those same grades. As the school... GPT-3 Samples @anonymous· May 29, 2020 0 0 0

Print Conditional Field Notice. pdfFiller is the best quality online PDF editor and form builder -it's fast, secure and easy to use. Edit, sign, fax and print documents from any PC, tablet or mobile device. Get started in seconds, and start saving yourself time and money!

Annual information returns include Form 990, Form 990-EZ and Form 990-PF. Form 990-N (e-Postcard) is an annual notice. Failure to file for three consecutive years can result in loss of tax exempt status. Posted on January 8, 2022 by ipconcerns Tagged IRS Social Security ...

You can determine if you qualify for this easier, streamlined option by filling out the eligibility worksheet. File IRS Form 1023 or 1023-EZ within 27 months to receive tax exemption dating from the date of your incorporation. Your exemption will only be valid from the application's postmark date if you wait any longer. You can...

Attorney General’s Guide for Charities Best practices for nonprofits that operate or fundraise in California California Department of Justice Charitable Trusts Section Protecting Charitable Assets and Donations for the People of California Message from the Attorney General What makes California great? The generous people who...

1023 Ez Eligibility Worksheet. Ecology Review Worksheet 1. The Compound Light Microscope Worksheet. Box Method Multiplication Worksheet. Spelling Color Words Worksheet. Popular Posts. Potential Energy Worksheet Answers. NAVMC 2795 Counseling Worksheet. Transcription and Translation Worksheet Key.

As of January 1, 2020, the fee for filing Form 1023 is $600. The fee for filing Form 1023-EZ is $275. You can only complete a Form 1023-EZ if you qualify in accordance with the Form 1023-EZ Eligibility Worksheet. The IRS requires that Form 1023 be completed electronically at Pay.gov. Publication 557 – Tax-exempt Status for Your Organization

be eligible to file Form 1023-EZ, a streamlined version of the application for recognition of tax exemption. You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZPDF to determine if you are eligible to file this form. If you are not eligible to file Form 1023-EZ, you can still file Form 1023.

If you're in the ballpark, complete the Form 1023-EZ Eligibility Worksheet contained in the Form 1023-EZ Instructions to determine if your nonprofit meets all the requirements for using the shorter streamlined form. If you are eligible to use it, this version of the form is much easier to complete and will take you much less...

0 Response to "42 1023 ez eligibility worksheet"

Post a Comment