42 self employment expenses worksheet

Get a free self-employed expenses spreadsheet or use Bonsai to track your expenses for free. Simplify your accounting and billing and get on with your work. Cooler Screens was founded on the core idea that consumers deserve a far better experience than what is available today in brick-and-mortar retail. We rience ("CX") and it guides all that we do. We have begun the CX journey by bringing what consumers love about shopping on-line to the frozen and refrigerated food aisle.

Cooler Screens is re-imagining the business of brick-and-mortar ...

I'm a bit frustrated, as I had (for the first time) my Fed & State both rejected with the following errors: >Schedule1\_Self-Employed\_Health\_Insurance\_Hold\_Rule - Your federal return was rejected due to an issue with Self-Employed Health Insurance Deduction on Schedule 1: Additional Income and Adjustments to Income When I log into Turbotax, it states that it was rejected due to an issue on the Self Employed Health Insurance Deduction on Schedule 1. I will note that I didn't put a...

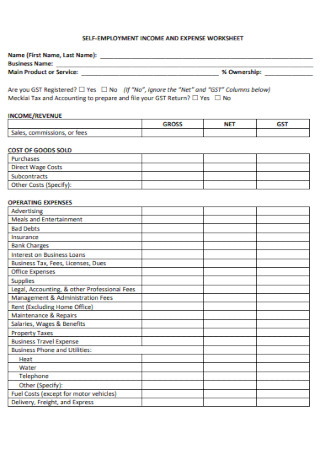

Self employment expenses worksheet

March 22, 2017 - Similarly, any expenses incurred but not yet paid will also be reported. For specific information on what expenses can be claimed, please see my Self-employed income and expense worksheets. In general, there are four main categories of expenses: Expenses that are 100% related to the business ... For full official rules, prize disclosures, and to enter, visit . The show had an impressive run of 147 episodes, spanning seven action-packed seasons. Games, auto-scoring quizzes, flash cards, worksheets, and tons of resources to teach kids the multiplication facts. Free multiplication, addition, subtraction, and division games. Planning my travels from the end of January and I wonder what can I claim as my expenses? Part of accommodation, co-working spaces etc? If I buy a new laptop, can I claim it? What do you guys claim? Thanks!

Self employment expenses worksheet. We are an independent company established in 1981. Our philosophy is to provide high quality professional financial planning, tax and accounting services to individuals and business at a high personal service level. We seek to help our clients become more informed and in control of their own ... Project 4: Finance for Managers Start Here As a senior analyst at Maryland Creative Solutions (MCS), you have continued to prove your value after helping Choice Hotels make strategic decisions by analyzing their financial reports. Frank Marinara and Elisa Izuki, continually happy with your work, have decided to transfer you to the finance team. Printable Schedule C Form - 9 images - periodic maintenance schedule yanmar download printable, 1040 form 2019 get irs 1040 printable form instructions, Need Help? Try me! Your answer is just one search away! Voluntary Simplicity Toward a Way of Life that is Outwardly Simple, Inwardly Rich / Rev ed

Location: New Richmond

The Accountant is responsible for grant and contract related accounting tasks including; invoicing for costs incurred, recognition of revenue, financial reporting; budget to actual monitoring, budget creation and revision, salary allocation, and other support as needed. Communi

Care Health Centers is a Federally Qualified Health Center providing ... Download the Victim Advocate Job Profile Worksheet located in this module's Learning Resources. Answer the questions on the worksheet. Then, in approximately 500 words, describe types of services and supports that are available to victim witnesses. Victimology. Victim Advocate Job Profile. Worksheet Leave job of $40K+commission annual...to live off of $50K withdrawn from $200K total sum, for one year rent, utilities, groceries, gas, etc. Edit: quit* not quite Edit: 35 about to be 36 yrs old in a couple months I'm looking into a couple of interesting jobs that would require me to work as a contractor. I started calculating day rates but then found there are significant tax & social insurance liabilities. Looking for an official website for a breakdown but couldn't find one. Can anyone else help? This old thread has some overviews to show what I mean, with specific % and comparisons between legal forms, but now of course outdated: https://www.reddit.com/r/lithuania/comments/6ii3f0/anyone_here_s...

"Welcome to Virtually Online Tax Service" We are Convenient, Low-Cost, Friendly and Fast · De'More Tax Service & AsSaP Financial is Christian based on which I have been providing service for Individual, Sole Proprietor, LLCs, Partnerships, Corporations, Foreign National nationwide for over ... Hey everyone, I am self employed and make 90%+ of my revenue through software development and design. I am also a landscape photographer and have sold enough of my photography to account for \~1-2% of my income. In the past year I also invested \~$5000 in new camera gear. Am I able to claim the cost of this gear (capital cost) despite it only reflecting or generating a disproportionate amount of revenue, relative to my earnings in a different sector? I am not incorporated. Thank you, happy... So I'm a self employed musician in the UK. And the past year all my work was paused because of Covid. I was automatically put on to Universal credit, and every 3 months receive the self employment grant, when I receive the grant it wipes out my Universal Credit payment for that month. Unless my expenses are more than the grant. I have been organising to get 200 Vinyls printed , as I am starting to work again, the vinyls will cost £1500 . I am hoping to put the vinyls down as an expense so I re... As a self employment expense I paid $791 for a service ($91 HST). I was reviewing my tax before submitting, and I thought I'd double check to make sure that I'm doing this correctly. I double check here https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/gst-hst-rebates/employees-partners.html#lgbl_rbt_prtnrs and I see that one of the conditions is that "Your employer is a GST/HST registrant". So as a self-employed person I wouldn't be able to deduct this...

Jake is a self-employed carpenter. Last year his net self-employment income was $25,200. How much would Jake's self-employment tax be on line 4 of Schedule 2 (Form 1040)? Select one: a. $3,856 This answer is incorrect. $3,856 is figured as: $25,200 x 15.3% = $3,856. b. $1,928. c. $1,781. d. $3,561. Question 64

Title pretty much says it. 1. Google/facebook/linkedin Ads. Says they have to be targeted at Canada, not from a foreign broadcaster (Google.ca ?!) Obviously I can't target the USA I guess. Something about 80% of the ad content has to be relevant... I cant seem to find if Google (obviously American) qualified, I assume it does as a deduction on statement of business activities. 2. Wages deduction. It Says you can of course deduct wages/gross salaries, but I can't find anything on paying period ...

I'm trying to fill out my self assessment tax return online - I want to claim for some expenses relating to my employment (professional memberships). I cannot see how to do this - I can find lots of information on-line saying that I can claim expenses, but I can't see *how* to do it - i.e I can't see anywhere that I can enter this information on the online tax return (I can see how I would enter it if it was self employment, but that isn't the case here).

So I’ve been self employed on Universal Credit, I’m a freelancer rather than a traditional business, but I’ve been heavily investing in my work (audio industry), buying a lot of equipment etc. I have, perfectly within the rules, been claiming this as expenses when reporting my income, so often when I earn money I still get UC as the money I’ve earned I’ve just reinvested in the ‘business’. Something weird has now happened with my Universal Credit where I am now being asked to re-verify my self ...

November 10, 2021 - Here are 4 important tips on how to track your self-employed expenses throughout the year and ensure you stay on top of your tax payments. Visit TaxAct Blog!

Afaik mortgage lenders look at your gross income, not net, but someone told me banks look more into your net income when you’re self employed. Is that true? I’m planning to get a mortgage next year and I’m working on my taxes now. I can deduct many expenses in my business but I could not include them this year to increase my net income. Also I plan to sell part of my stocks for my down payment. Should I sell them this year to bump my income more, or would it be fine to do it shortly before I ...

December 9, 2021 - Here are 15 big self-employment tax deductions and tax benefits that could slash tax bills for freelancers, contractors & other people who work for themselves.

Hello everybody I'm an immigrant from an EU country, with Settled Status. My partner is a British citizen, and disabled. They receive Universal Credit and PIP. I am self employed to allow all the time needed to care for my partner. I am a sole trader and is VAT registered. I work from home and have a dedicated office. My business was started after moving to the UK and has been operating for two years. When I moved to the UK I had only a few sets of clothing, a mobile phone and a laptop. Orig...

Hey PFC, Asking on behalf of someone - What % of your taxes from self employment income can you deduct as business expenses? Let's say you earn 50k a year, incur 11k in taxes every year. Can you expense all 11k worth? or is it a certain %. Thanks for the assistance!

Tags. Resource Manual for Nursing Research Generating and Assessing Evidence for Nursing Practice. Posted by bibi on 26.01.2022 in 592 | No Comments

We are an Authorized E-File Provider. E-File helps taxpayers file their income taxes faster, easier and more accurately than with traditional paper forms · To find out your Federal tax refund status you’ll need your SSN or ITIN, your filing status, and your exact tax refund amount

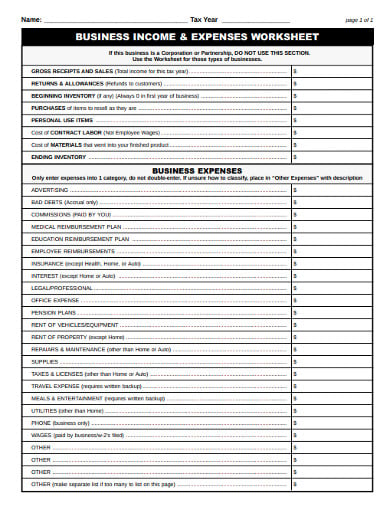

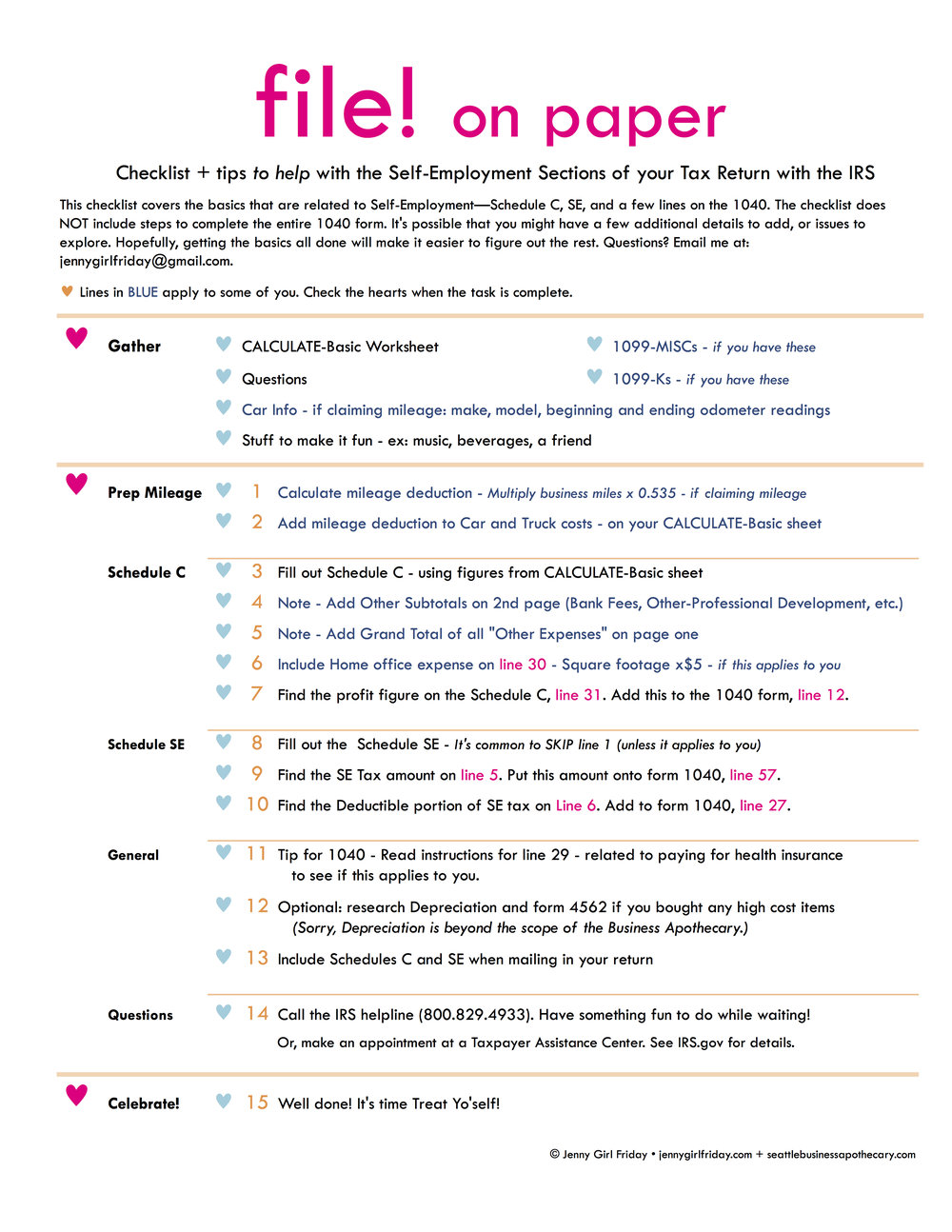

February 17, 2016 - Finally, self-employed individuals deduct business expenses on Schedule C of Form 1040. These expenses include advertising, utilities and other business costs. Your income less all expenses equals net profit, and the Schedule C profit, is added to other sources of income on Form 1040, the personal ...

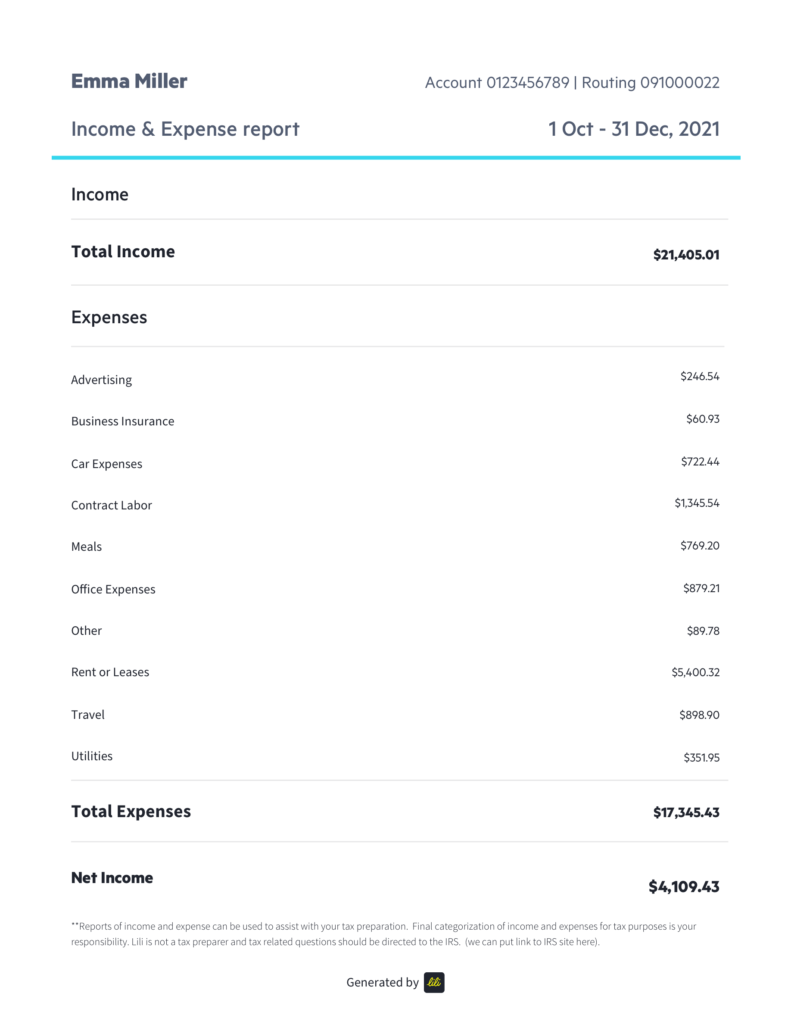

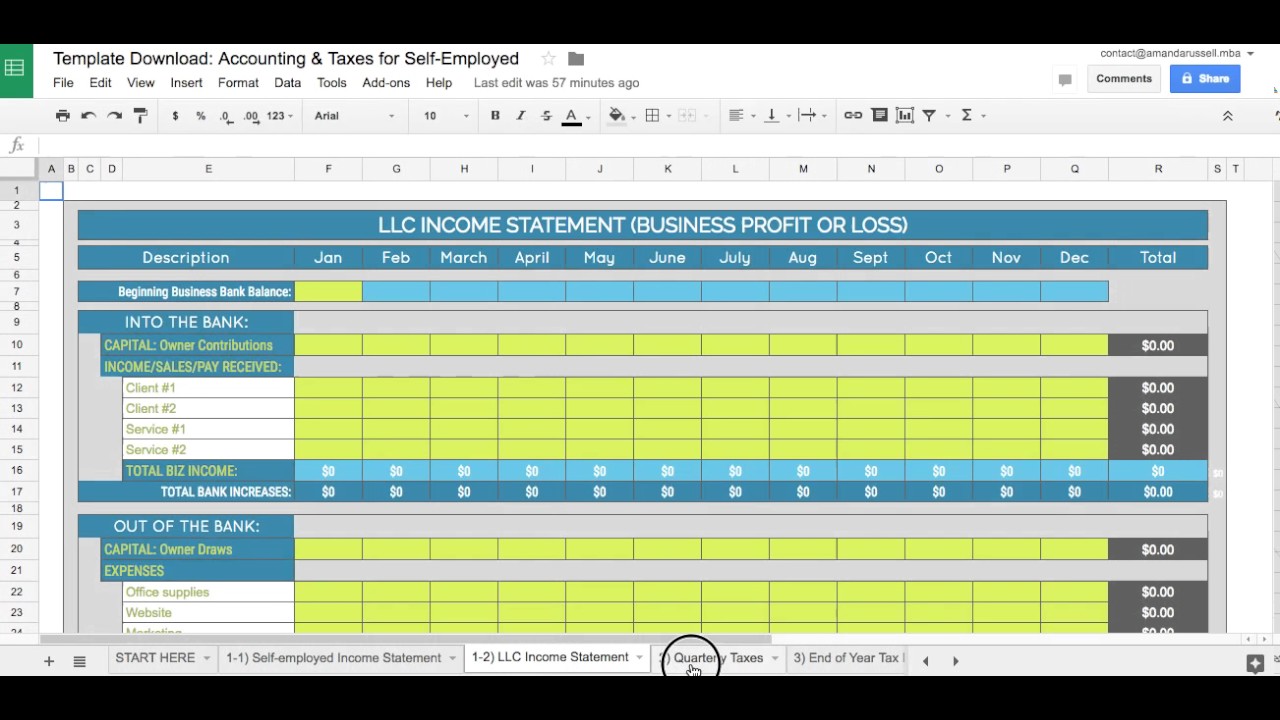

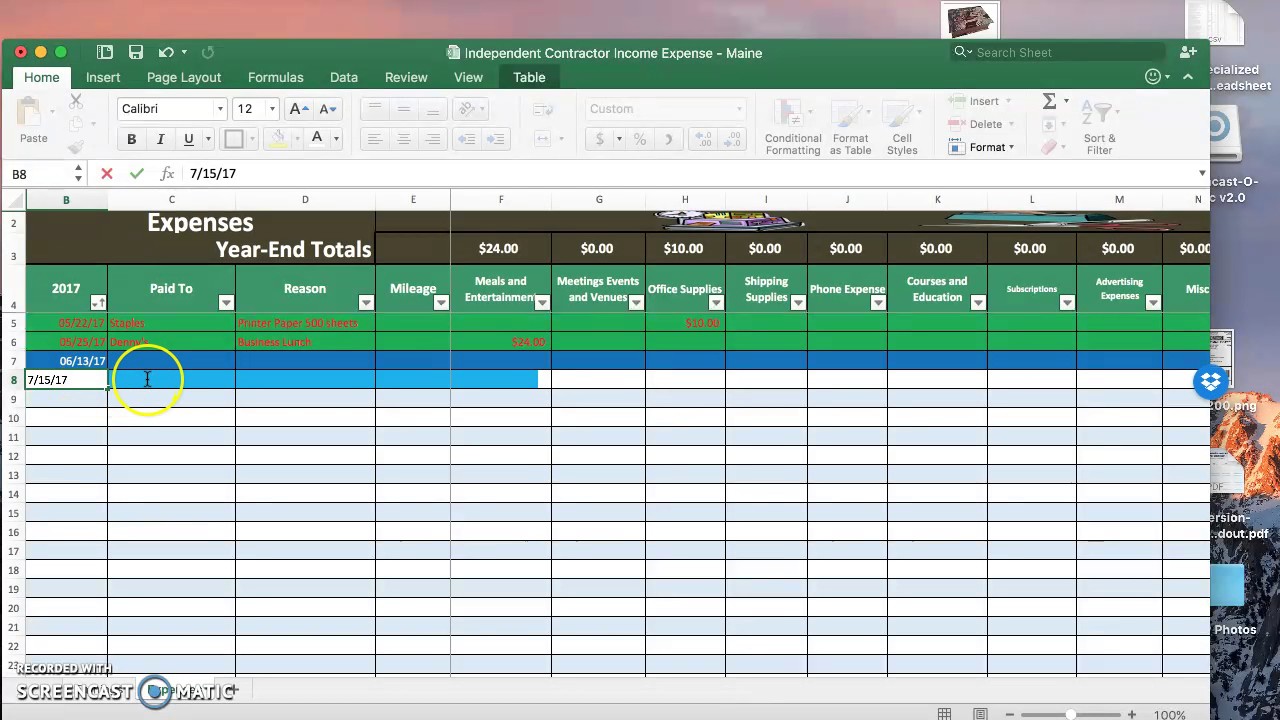

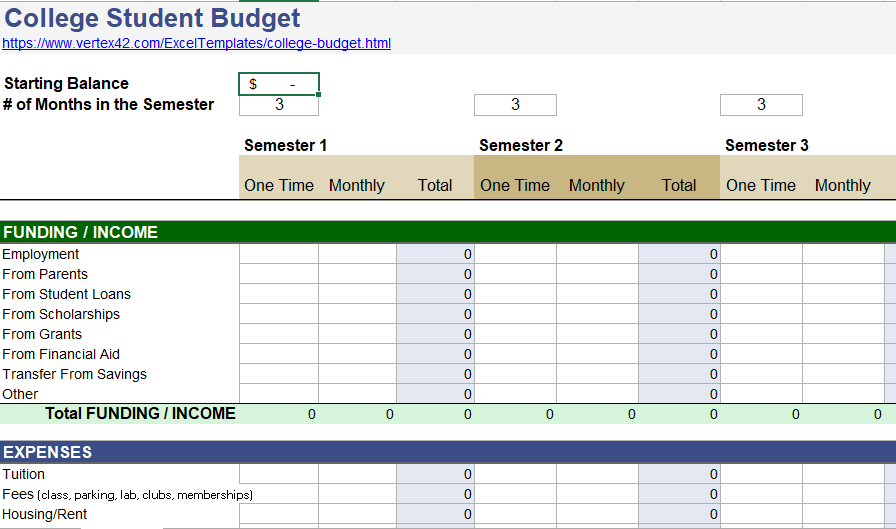

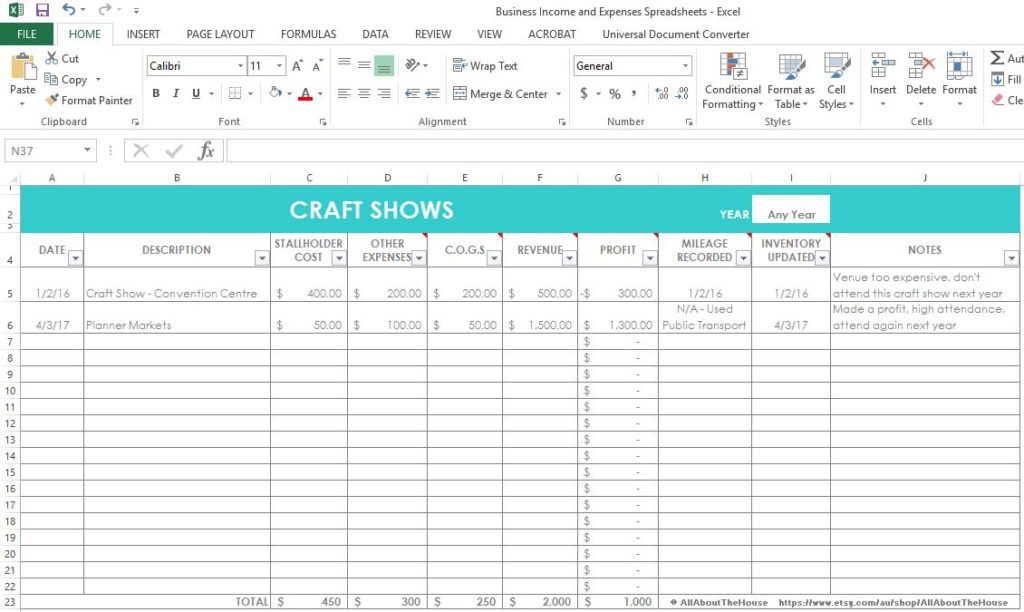

December 10, 2010 - Recently, I had a client ask me for a spreadsheet to help her track her business expenses. I put together an Excel

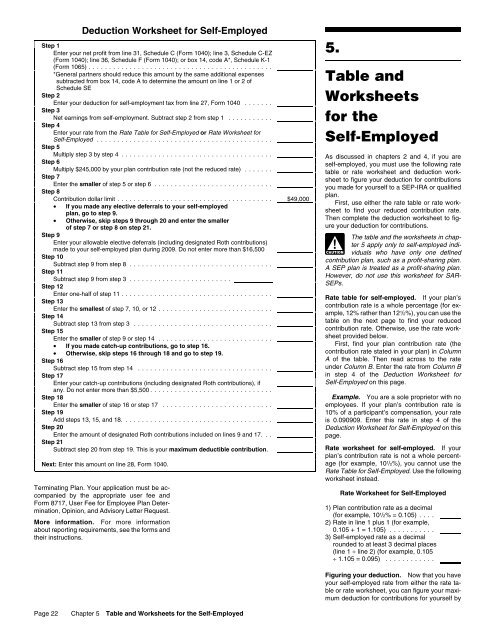

October 27, 2021 - Calculate the deduction using the Self-Employed Health Insurance Deduction Worksheet in IRS Publication 535. ... A meal is a tax-deductible business expense when you are traveling for business, at a business conference, or entertaining a client. The meal cannot be extravagant under the ...

October 28, 2015 - Track your income and expenses so you can grow your business. You need to be aware of where you stand each and every month. ... I think many people go into side hustling and self-employment blindly not realizing just how big of a chunk they’re going to owe Uncle Sam once tax time rolls around.

I was self-employed in 2020: I worked part-time for some months + full-time for some other months, and I have all the time information. I do software development. I want to expense part of my rent/electricity/internet. I'm on the lease along with two other people. I don't have any dedicated space; I use the same desk for work and for non-work stuff. My desk area takes about half my room. How do I figure out how much of my rent/electricity/internet to expense with relation to the space itself? S...

Fill Out, Securely Sign, Print or Email Your Self Employment Income Expense Tracking Worksheet Form Instantly with SignNow. the Most Secure Digital Platform to Get Legally Binding, Electronically Signed Documents in Just a Few Seconds. Available for PC, iOS and Android.

July 29, 2013 - Links to pages containing the following Medicaid documents; Administrative Directives (ADM), General Information System Messages (GIS), and Informational Letters (INF).

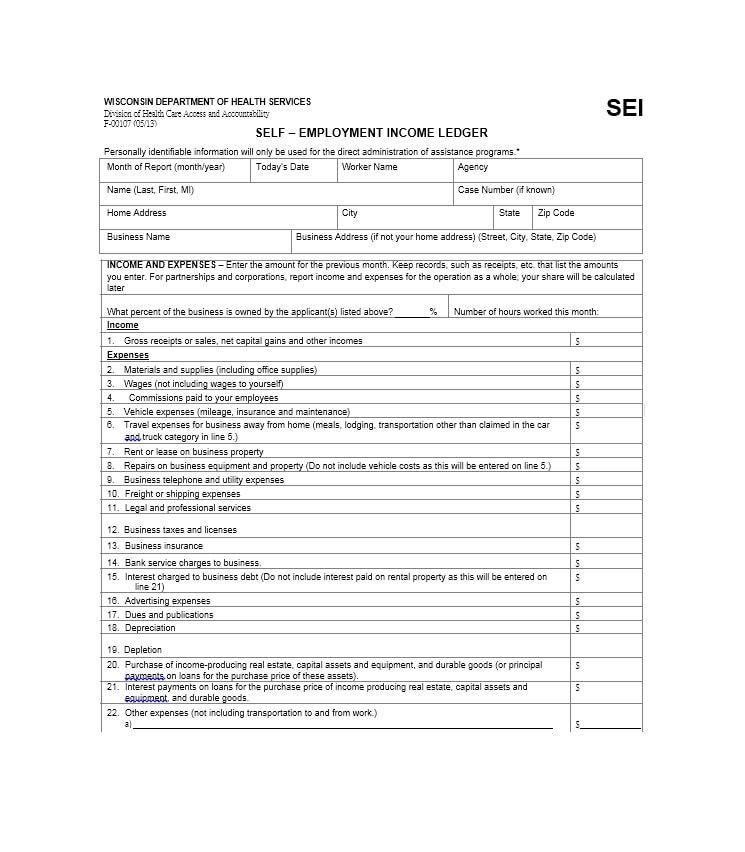

The first link below opens a .pdf document that outlines the various income and expense categories that are reported on a Schedule C and discusses what record keeping is required. This document makes several references to the following companion Excel spreadsheets that can be downloaded and used ...

These additional worksheets cover specialized situations in more detail. We encourage you to print out any that are relevant to you to ensure that no deductions or expenses get overlooked.

I'm using Fidelity for my Roth and have FZROX, FZILX, and FSKAX. I didn't really know what I was doing so I tried a few over the last 2 years to see what happens. My first question is, can I sell any of these, leave the money in the Roth and use it to buy the other? Like sell off the FSKAX and put it all into the FZROX. I believe that should be okay since I'm not taking the money out, just moving it around, but I'm new to this. Second, I was looking at Freedom Fund 2045, the target date fun...

As I said in the title really. I work as a decorator and have been for many years now. I’ve always done my own taxes and invoices ect ect using quickbooks and have never had any problems until now. I recently got hired to prepare and decorate some bespoke bookcases a local carpenter made and when I issued him the invoice he paid straight away less 20%. And issued me a CIS payment deduction receipt. My issue is I’ve always been paid directly by my clients until now and therefore am not CIS re...

Disaster Cash Assistance is a temporary program activated by the Governor’s declaration of a statewide emergency and subsequent proclamation. Households in a county designated as a disaster area by Governor Inslee may be eligible for DCAP, if they meet all eligibility criteria and even if ...

Hi there, I have a couple of quick questions about my tax return that I'm hoping someone can help with. The first is regarding the Form T777S (the simple "flat rate" method). Pre-pandemic, I worked about half of my hours in office, and half from home. I've never claimed WFH expenses, because the detailed method just seemed too fiddly for a near-insignificant payoff. Starting in March 2020, I had to start working all my hours from home. However, my job then ended in September. So my questions ar...

Get the latest info about Arizona's Response. Have specific questions? Call: 1-844-542-8201 · The Arizona Department of Health Services is on the front lines as we respond to the COVID-19 pandemic. Our team is committed to providing up-to-date information and resources to keep Arizonans safe, ...

Sigh, so I'm filing taxes late. I'm working on it. I'm self-employed (a consultant) and only earned foreign income (with no tax forms e.g. W-2). I have self-employment expenses to declare against that income as well as receipts for foreign withholding tax. I declare my foreign income on Line 10400, fine. However, do I also enter that income in my self-employment income? This seems to double count my total income. If I don't enter that income on my self-employment income (0 for line 13499), ...

Hi, A bit of a question about HMRC self-assessment here that might be obvious to some - if it's not the appropriate place let me know and I'll delete. In the last couple of years for covid reasons I've had to work from home. Because of this I've bought some equipment to help me do my work (extra monitor, desk, office chair etc as long with more minor things like stationary). I bought it myself without 'expensing' it through work. I've also had to heat and power my house more than usual. I a...

December 3, 2019 - Deducting business expenses can help you save money as a self-employed professional or freelancer. We have a complete list of self-employed tax deductions you can take.

Disaster Cash Assistance is a temporary program activated by the Governor’s declaration of a statewide emergency and subsequent proclamation. Households in a county designated as a disaster area by Governor Inslee may be eligible for DCAP, if they meet all eligibility criteria and even if ...

Fill Self Employment Income Expense Tracking Worksheet Excel, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ✔ Instantly. Try Now!

Planning my travels from the end of January and I wonder what can I claim as my expenses? Part of accommodation, co-working spaces etc? If I buy a new laptop, can I claim it? What do you guys claim? Thanks!

For full official rules, prize disclosures, and to enter, visit . The show had an impressive run of 147 episodes, spanning seven action-packed seasons. Games, auto-scoring quizzes, flash cards, worksheets, and tons of resources to teach kids the multiplication facts. Free multiplication, addition, subtraction, and division games.

March 22, 2017 - Similarly, any expenses incurred but not yet paid will also be reported. For specific information on what expenses can be claimed, please see my Self-employed income and expense worksheets. In general, there are four main categories of expenses: Expenses that are 100% related to the business ...

![Business Accounting: Income and Expenses [Self Employed Accounting Spreadsheet Template]](https://i.ytimg.com/vi/As6h2lcssCI/mqdefault.jpg)

.png)

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-feature.jpg?strip=all&lossy=1&ssl=1)

![Business Accounting: Income and Expenses [Self Employed Accounting Spreadsheet Template]](https://i.ytimg.com/vi/As6h2lcssCI/maxresdefault.jpg)

![1099 Excel Template [Free Download]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5f63b6bbc9752d68cdd11bac_excel-template-1099.png)

0 Response to "42 self employment expenses worksheet"

Post a Comment