42 Qualified Education Expenses Worksheet

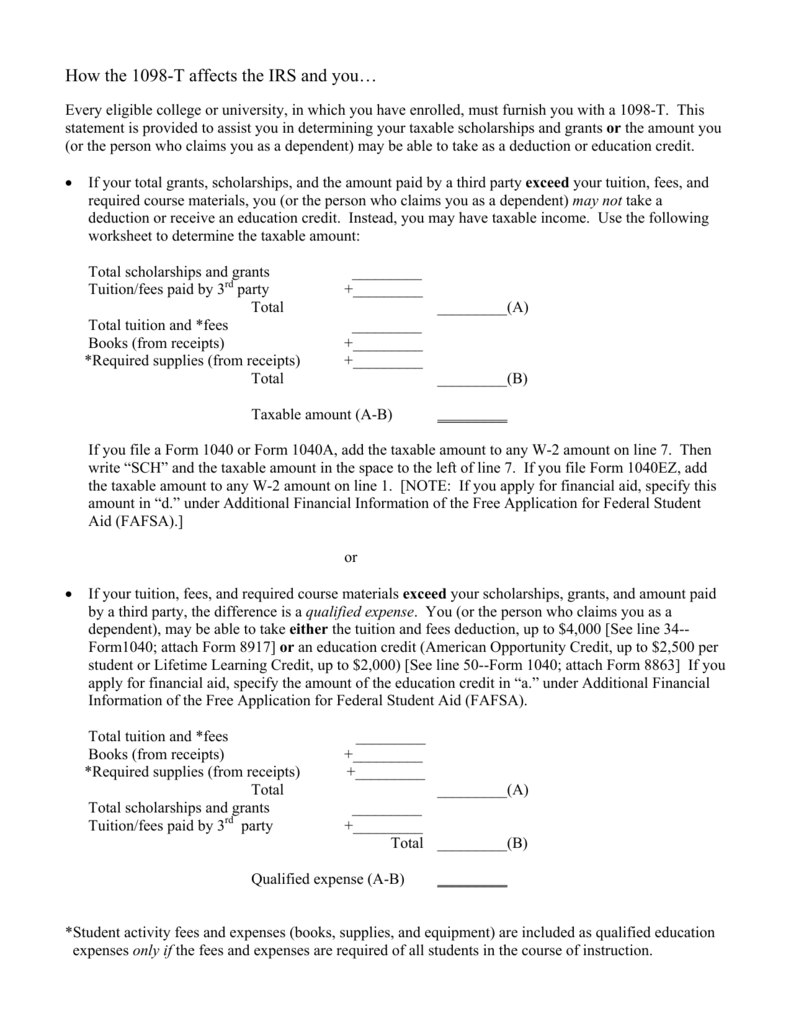

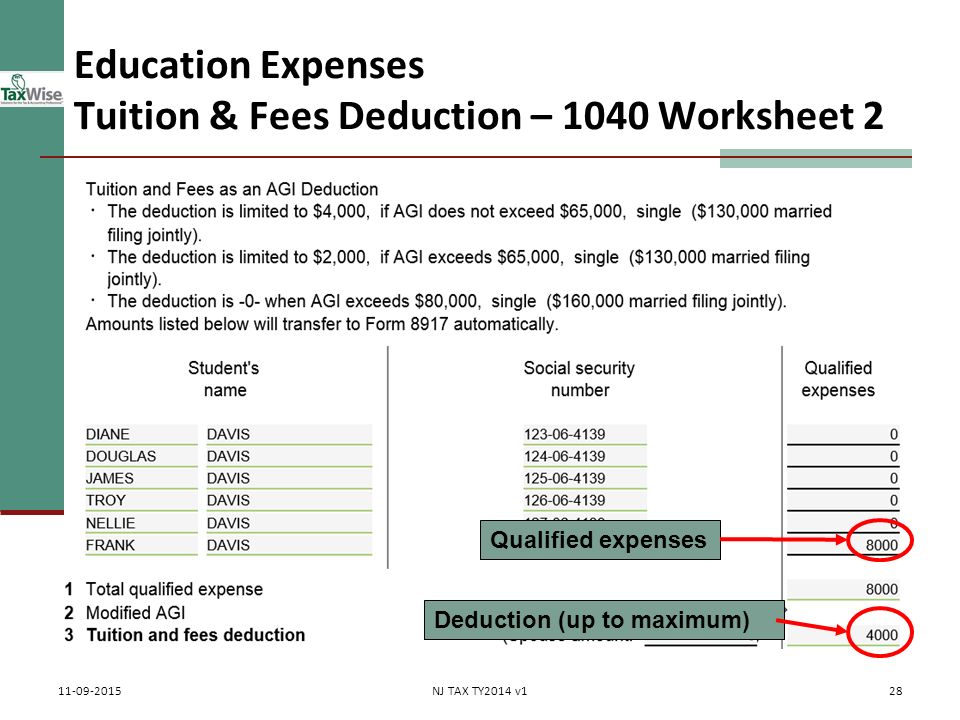

PDF Determining Qualified Education Expenses - IRS tax forms the worksheet above. The $3,000 Pell Grant will be entered on line 2a. The line 3 amount is $3,000. Subtracting line 3 from line 1, you get qualified education expenses of $4,500. If the resulting qualified expenses are less than $4,000, the student may choose to treat some of the grant as income to make more of the expenses eligible for the ... Education Expense Credit - Credits - Illinois You may figure a credit for qualified education expenses, in excess of $250, you paid during the tax year if . you were the parent or legal guardian of a full-time student who was under the age of 21 at the close of the school year, you and your student were Illinois residents when you paid the expenses, and

Worksheet Formats - Cost Report Data Worksheet formats are based on information supplied by the Centers for Medicare and Medicaid Services (CMS).Forms and instructions can be downloaded from the CMS website and are presented here as a convenient reference.

Qualified education expenses worksheet

How do I calculate the amount of qualified education expenses? This total would become the qualified expenses plus any eligible books and supplies. For example, Box 5 is $1000 and Box 1 is $3000, then the qualified expense amount would be $2000 plus any books or supplies. If the amount in Box 5 is greater than the amount in Box 1, then you are not eligible to take an education credit. Error in "Adjusted Qualified Higher Education Expenses ... $17,718 in educational expenses (including room & board) -$4950 paid by tax free scholarship*** -$7609 used to claim the LLC =$5159 Can be used against the 1099-Q (usually on the student's return) Box 1 of the 1099-Q is $17718 Box 2 is $3727 5159/17718 =29% of the earnings are tax free; 71% are taxable 71% x 3727= $2642 Adjusted Qualified Education Expenses Worksheet Qualified Education Expenses For purposes of total tuition and fees deduction, qualified education expenses are tuition in certain related expenses required for enrollment or attendance at an...

Qualified education expenses worksheet. Topic No. 313 Qualified Tuition Programs (QTPs) | Internal ... Qualified higher education expenses generally include expenses required for the enrollment or attendance of the designated beneficiary at any college, university, vocational school, or other postsecondary educational institution eligible to participate in a student aid program administered by the Department of Education. Publication 970 (2021), Tax Benefits for Education | Internal ... If you pay qualified education expenses in both 2021 and 2022 for an academic period that begins in the first 3 months of 2022 and you receive tax-free educational assistance, or a refund, as described above, you may choose to reduce your qualified education expenses for 2022 instead of reducing your expenses for 2021.. 529 Plan Qualified Expenses: Using the 529 to Pay Off-Campus ... Jul 27, 2016 · 529 Plan Qualified Expenses: Using the 529 to Pay Off-Campus Rent. A 529 Plan is an ideal way to save for higher education costs. But can you use funds from your 529 plan to pay your off-campus rent? We tapped into an advisor from the accounting firm of Baker Tilly for some guidance on 529 plan qualified expenses. PDF A OPPORTUNITY TAX CREDIT WORKSHEET - Tyler Hosting qualified education expenses and $4,400 for his room and board for the fall 2013 semester. He and the college meet all the requirements for the American opportunity credit. He figures his American opportunity credit based on qualified education expenses of $4,000, which results in a credit of $2,500.

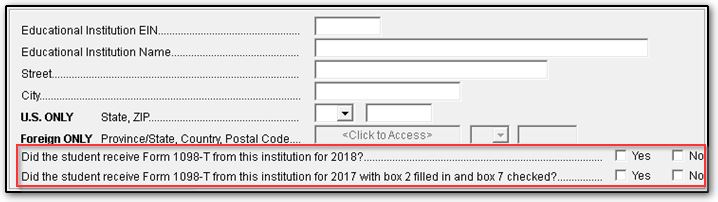

Fill - Free fillable 2020 Education Expense Worksheet (H ... 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) Form 1.: Yes. Add $350 to your earned (H&Rblock) MetaBank Opt-Out Notice for Information Sharing (H&Rblock) 2019 IRA DEDUCTION WORKSHEET - SCHEDULE 1, LINE. Form 3.: STATEMENT OF INCOME FROM DISCHARGE OF. Form 1: Year you turn age 70 -. PDF IL-1040-RCPT, Receipt for Qualified K-12 Education Expenses Add the amounts in the "Total Amount of Qualified Expenses Paid by Parent or Guardian" column for each student. Use this total to complete the K-12 Education Expense Credit Worksheet on Schedule ICR. Total $ (This required information may be (K-12 only) provided by the recipient) PDF Education Expenses - IRS tax forms scholarship. (But for exceptions, see Payment for services in Publication 970, Tax Benefits for Education.) Use Worksheet 1-1 below to figure the amount of a scholarship or fellowship you can exclude from gross income. Education Expenses The following are qualified education expenses for the purposes of tax-free scholarships and fellowships: Reporting 529 Plan Withdrawals on Your Federal Tax Return When 529 plan funds are used to pay for qualified education expenses there is usually nothing to report on your federal income tax return. Form 1099-Q and Form 1098-T will list the amount of the 529 plan distribution and how much was used to pay for college tuition and fees, but it is up to the 529 plan account owner to calculate the taxable portion.

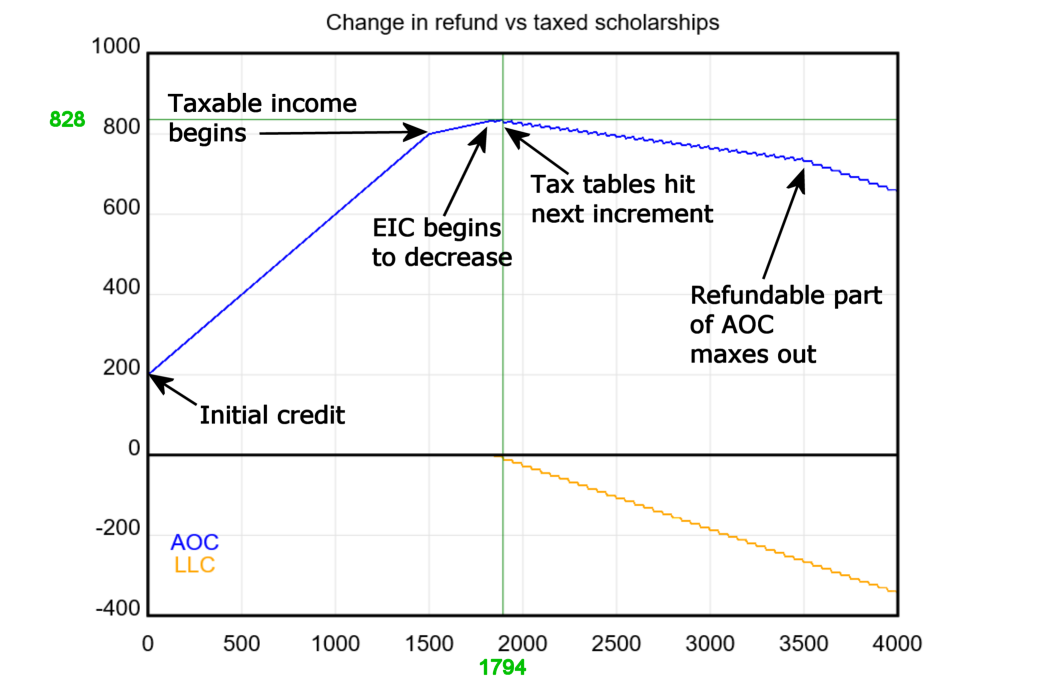

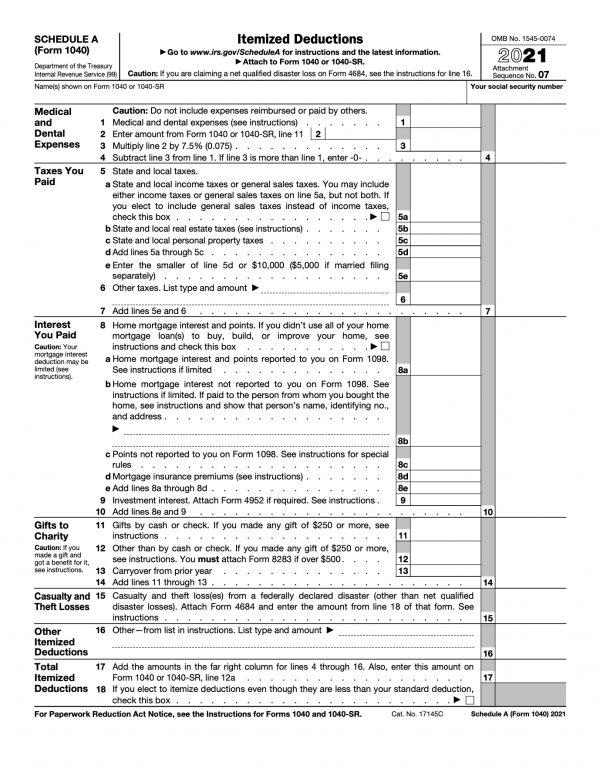

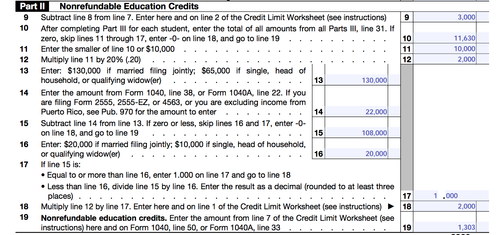

What Counts As Qualified Education Expenses? | Credit ... The credit is worth 100% of the first $2,000 of qualified education expenses and 25% of the next $2,000 of qualifying expenses, for a maximum credit of $2,500 per eligible student. If the credit brings the amount of tax you owe to $0, 40% of the remaining amount of the credit (up to $1,000) may be refundable. PDF 2021 IL-1040 Schedule ICR Instructions - Illinois an education expense credit. However, you both may not claim a credit for the same expenses, and the total amount of credit claimed between both parents or guardians may not exceed $750. Qualified education expenses Education expenses that qualify for this credit include tuition (including summer school classes meeting elementary or Is this TurboTax bug when it figures out "adjusted... - Intuit Is this a bug in TurboTax when it is figuring out "adjusted qualified education expenses" for 529? My son is a full-time college student. He has the following expenses for 2019: (1) tuition $19,560, (2) books and supplies $1,001, (3) room and board $9,504, and (4) computer/software $2,397. PDF 2020 Education Expense Worksheet Education Expenses 1. Payments received for qualified tuition and related expenses (total from column B above) 1. 2. Amounts actually paid during 2020 for qualified tuition and related expenses (total from column D above) . . . . . . . 2. 3. Qualified books, supplies, and equipment purchased from education institutions (eligible for Lifetime ...

Solved: 529 qualified distributions I paid for room and board from a 529 plan distribution, which should be a qualified expense, yet Turbotax deems it to be an excess distribution taxable in my hands (I am the recipient, my daughter is the beneficiary). Turbotax seems to only allow the tuition expense specified in the 1098-T as a legitimate expense. I tried to fix this manually in the Student Information Worksheet Part VI ...

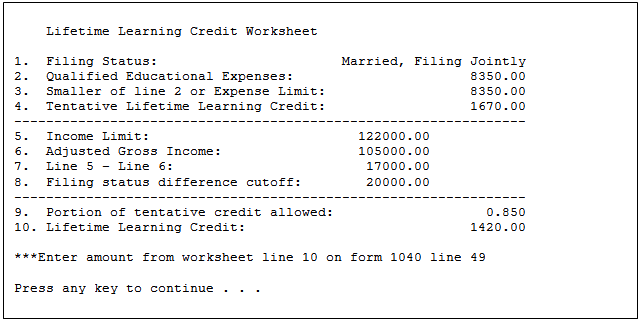

Education Calculator - cotaxaide.org Tax credits are based on qualified education expenses payed for the taxpayer, spouse, or a dependent who is claimed as an exemption on the tax return. The credit is allowed for qualified education expenses paid in the current tax year for an academic period beginning in that year or in the first 3 months of the following year.

Education Credits - Tax Season ... - Tax Season Resources Maximum amount of expenses for calculating credit Line 1 $4,000 Enter $4,000 for AOC or $10,000 for LLC Qualified Tuition, Fees, Books, and Supplies for AOC/LLC Line 2 $0 Taken from table above Expenses that qualify for scholarships/grants but not AOC/LLC Line 3 $0

PDF 21 Internal Revenue Service Department of the Treasury qualified education expenses of the student are treated as having been paid by that person. Therefore, only that person can claim an education credit for the student. If a student isn't claimed as a dependent on another person's tax return, only the student can claim the credit.

How do I report Qualified Education Expenses involving a ... For qualified expenses paid with his 1099-Q distribution, he enters $5000. He is indicating that the full distribution went towards qualifying education expenses. Dave chooses to use the remaining expenses that he paid out-of-pocket ($3000) as a Tuition and Fees Deduction.

PDF 2021 M1M, Income Additions and Subtractions The maximum amount of education expenses you can subtract is $1,625 for each child in grades K through 6, and $2,500 for each child in grades 7 through 12. If you qualify for the K-12 Education Credit (Schedule M1REF, line 3) and you cannot use all of your education expenses on Schedule M1ED, complete the Worksheet for Line 13.

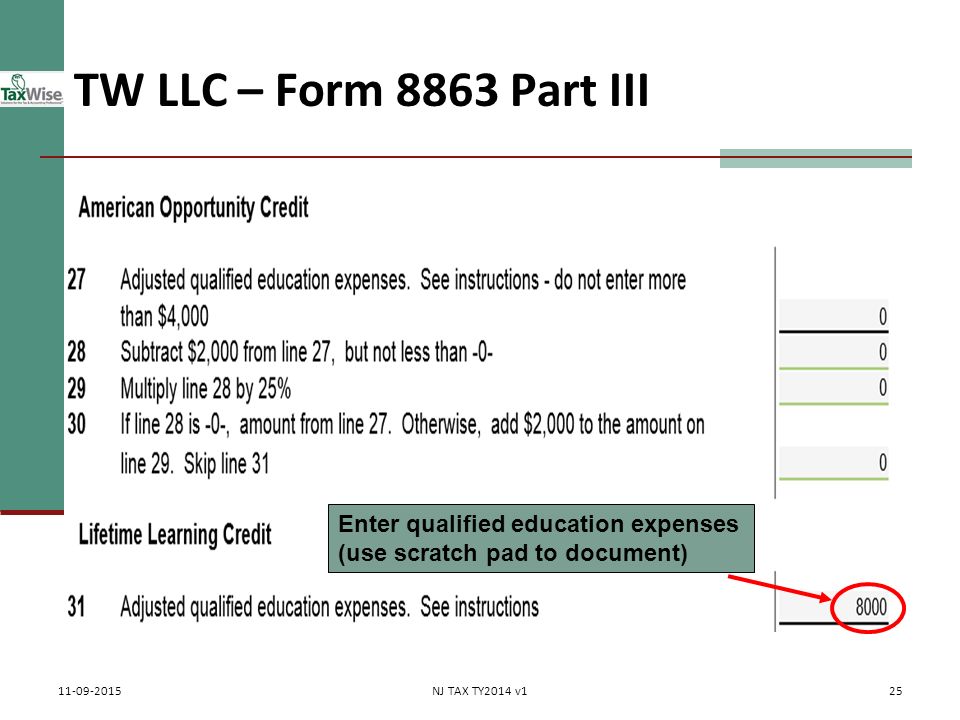

39 qualified education expenses worksheet - Worksheet Live Finally, out of pocket money is applied to qualified education expenses Fill out lines 27 through 30 for the American Opportunity Credit or line 31 for the Lifetime Learning Credit. Use the Adjusted Qualified Education Expenses Worksheet to calculate the amount for line 27, reducing education expenses by any tax-free scholarships and grants.

Guide to IRS Form 1099-Q: Payments from Qualified ... For example, suppose your qualified education expenses are $10,000, you receive a $2,000 Pell grant and boxes 1 and 2 of your 1099-Q report a gross distribution of $8,000 and earnings of $1,000. Your adjusted expenses are $8,000—which means you don't have to report any education program distributions on your tax return.

What is considered a qualified education expense and what ... Generally, qualified education expenses are amounts paid for tuition, fees and other related expenses for an eligible student at any accredited college, vocational school, or other post-secondary educational institution eligible to participate in the student aid programs administered by the Department of Education.

Qualified Ed Expenses | Internal Revenue Service Nov 03, 2021 · Qualified education expenses must be paid by: You or your spouse if you file a joint return, A student you claim as a dependent on your return, or; A third party including relatives or friends. Funds Used. You can claim an education credit for qualified education expenses paid by cash, check, credit or debit card or paid with money from a loan.

Why are the Adjusted Qualified Higher Education Expenses ... The qualified expenses for 1099-Q funds are tuition, books, lab fees, AND room & board. That's it. If there are any excess 1099-Q funds they are taxable. The amount is included in the total on line 7.. Finally, out of pocket money is applied to qualified education expenses

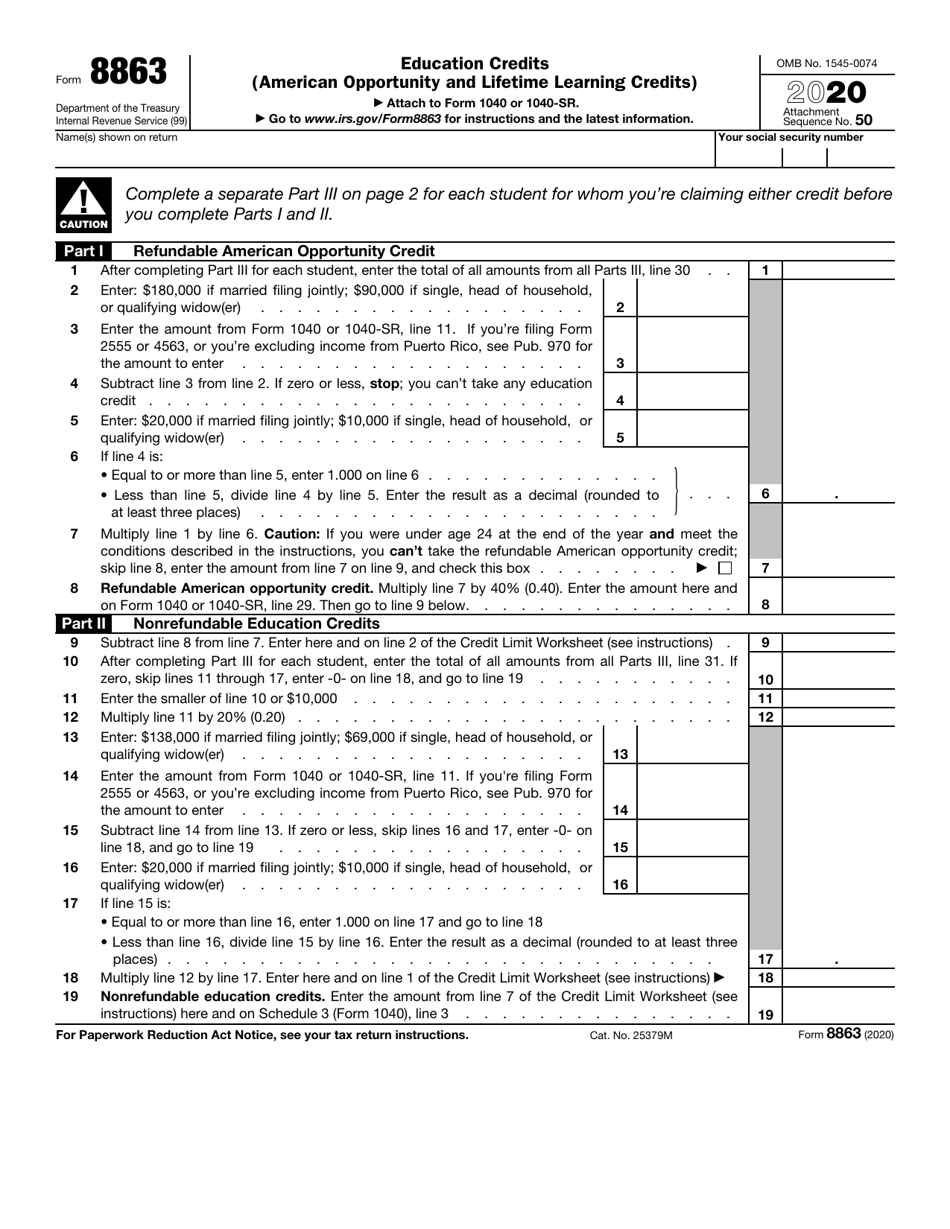

Instructions for Form 8863 (2021) | Internal Revenue Service Generally, qualified education expenses are amounts paid in 2020 for tuition and fees required for the student's enrollment or attendance at an eligible educational institution. It doesn't matter whether the expenses were paid in cash, by check, by credit or debit card, or with borrowed funds.

PENSION EXCLUSION COMPUTATION WORKSHEET (13A) Use the You Spouse were not used for qualified higher education expenses, and any refunds of contributions made under the Maryland College Investment Plan, to the extent the contributions were subtracted from federal adjusted gross income and were not used for qualified higher education expenses. See Administrative Release 32. l.

Adjusted Qualified Education Expenses Worksheet Qualified Education Expenses For purposes of total tuition and fees deduction, qualified education expenses are tuition in certain related expenses required for enrollment or attendance at an...

Error in "Adjusted Qualified Higher Education Expenses ... $17,718 in educational expenses (including room & board) -$4950 paid by tax free scholarship*** -$7609 used to claim the LLC =$5159 Can be used against the 1099-Q (usually on the student's return) Box 1 of the 1099-Q is $17718 Box 2 is $3727 5159/17718 =29% of the earnings are tax free; 71% are taxable 71% x 3727= $2642

How do I calculate the amount of qualified education expenses? This total would become the qualified expenses plus any eligible books and supplies. For example, Box 5 is $1000 and Box 1 is $3000, then the qualified expense amount would be $2000 plus any books or supplies. If the amount in Box 5 is greater than the amount in Box 1, then you are not eligible to take an education credit.

0 Response to "42 Qualified Education Expenses Worksheet"

Post a Comment