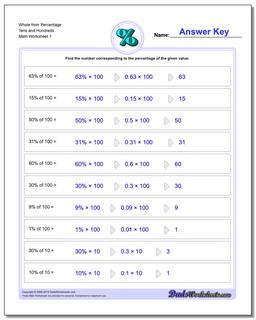

43 calculating sales tax worksheet

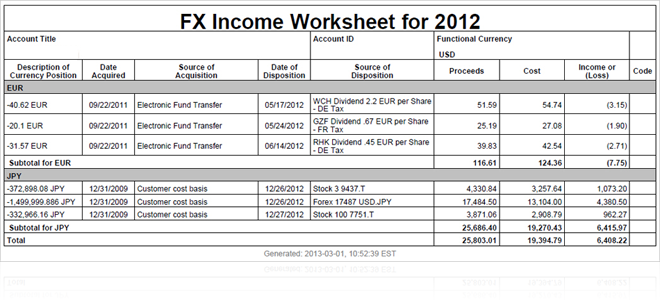

support.cch.com › kb › solutionQualified Dividends and Capital Gain Tax Worksheet. - CCH Schedule D Tax Worksheet If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040, line 44. Qualified Dividends and Capital Gain Tax Worksheet. Excel Project Discussion Paper Assignment Help - Homework ... a. Use the Sales worksheet data to create a Pivot Table into a new worksheet. Name the new worksheet SalesPivot. For Mac users especially, do not create the pivot table by selecting the worksheet (data). Instead, from the Sales worksheet, simply Insert -> Pivot Table and the data will be automatically selected. b.

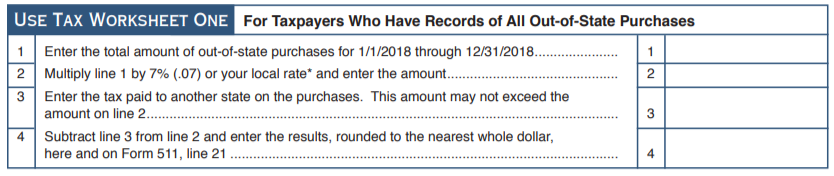

incometax.utah.gov › paying › use-taxUse Tax Use tax is a tax on goods and taxable services purchased for use, storage or other consumption in Utah during the taxable year and applies only if sales tax was not paid at the time of purchase. If you purchased an item from an out-of-state seller (including Internet, catalog, radio and TV purchases) and the seller did not collect sales tax on ...

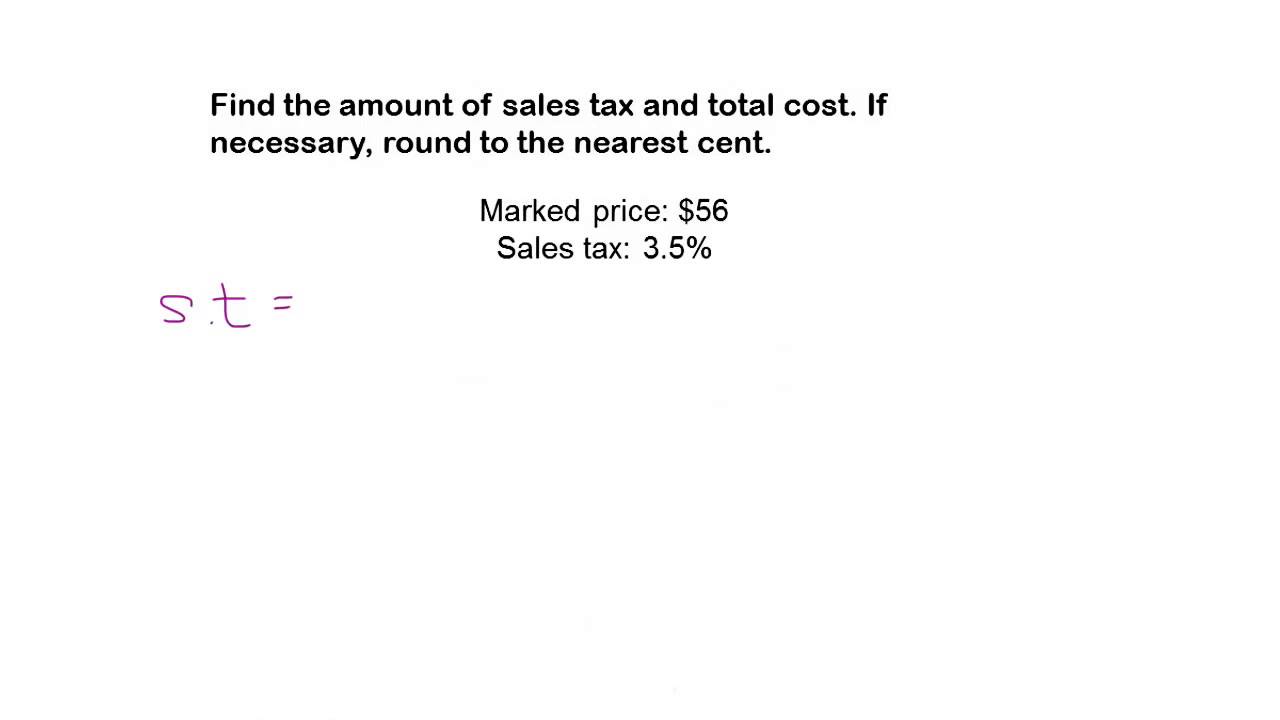

Calculating sales tax worksheet

Excel Project Discussion Paper Assignment Help a. Use the Sales worksheet data to create a Pivot Table into a new worksheet. Name the new worksheet SalesPivot. For Mac users especially, do not create the pivot table by selecting the worksheet (data). Instead, from the Sales worksheet, simply Insert -> Pivot Table and the data will be automatically selected. b. SOLUTION: CMU Management and Organization Leadership Paper ... Track sales receipts on daily or weekly basis Don't ignore bad news e.g., adequate billing and collection system Cash-basis accounting Accrual-basis accounting BUS/MSCIS 6190 Capstone Global Financial Considerations BUS/MSCIS 6190 Capstone Key Financial Forms Income Statement: shows whether your company is making a profit 26481 Purissima Rd, Los Altos Hills, CA 94022 | MLS # ... 26481 Purissima Rd , Los Altos Hills, CA 94022-3326 is a single-family home listed for-sale at $6,495,000. The 3,581 sq. ft. home is a 5 bed, 4.0 bath property. View more property details, sales history and Zestimate data on Zillow. MLS # ML81879304

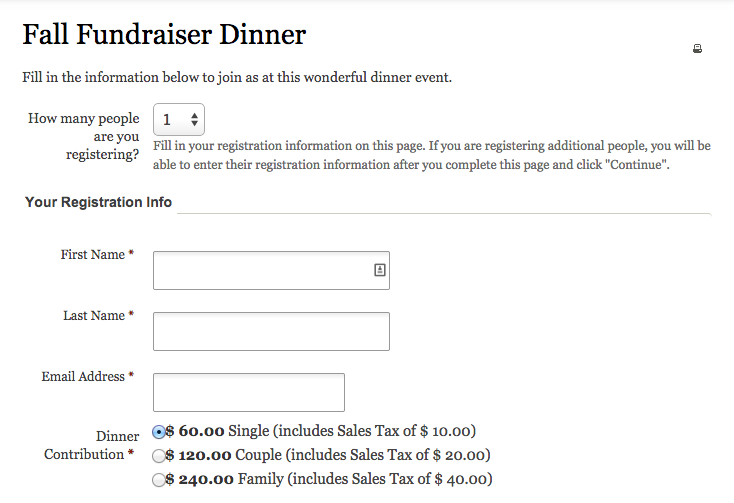

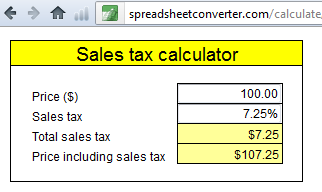

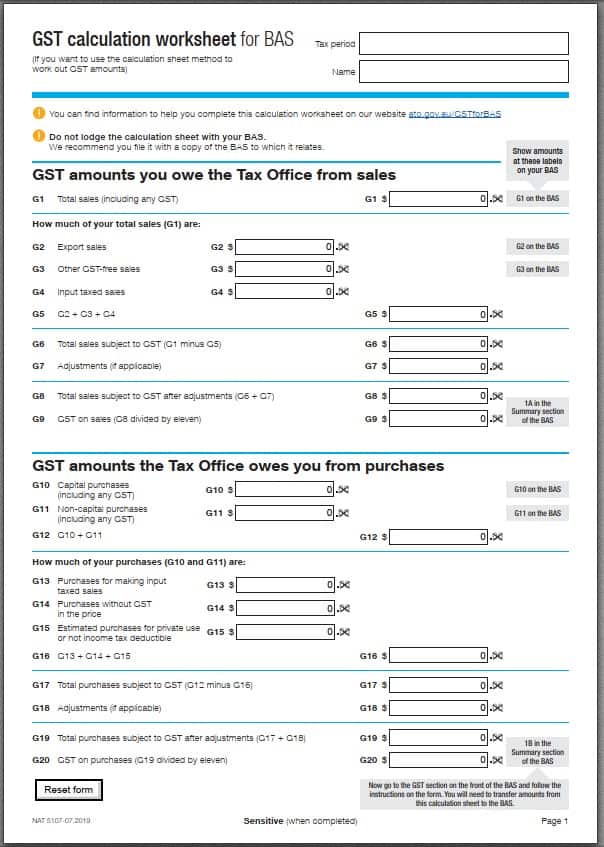

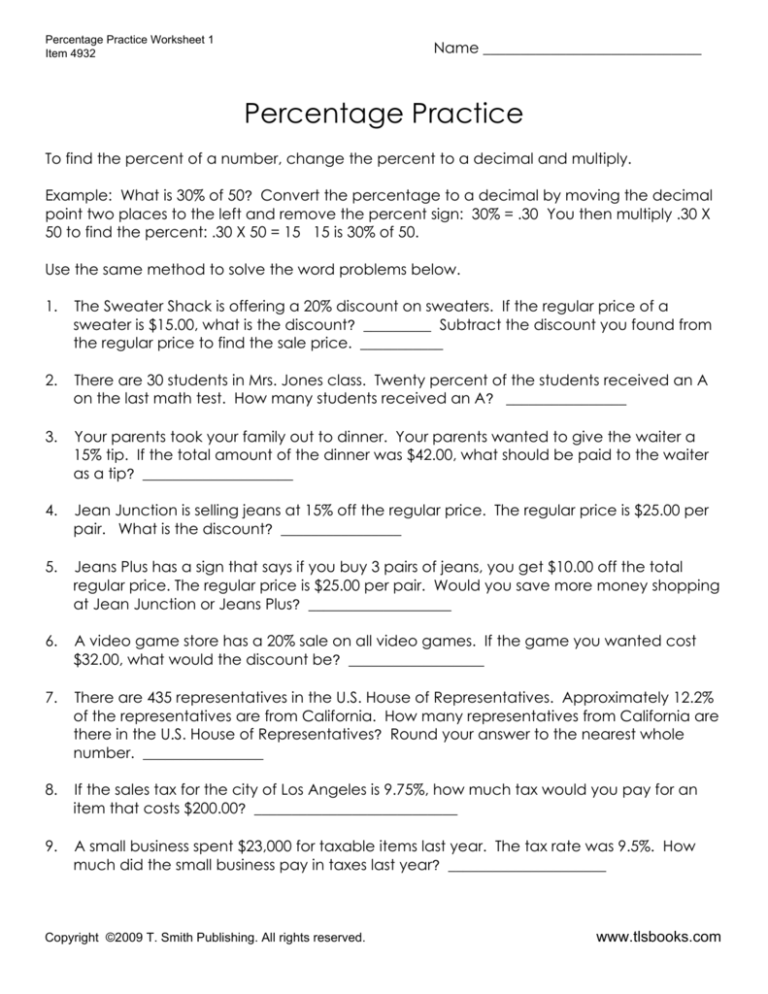

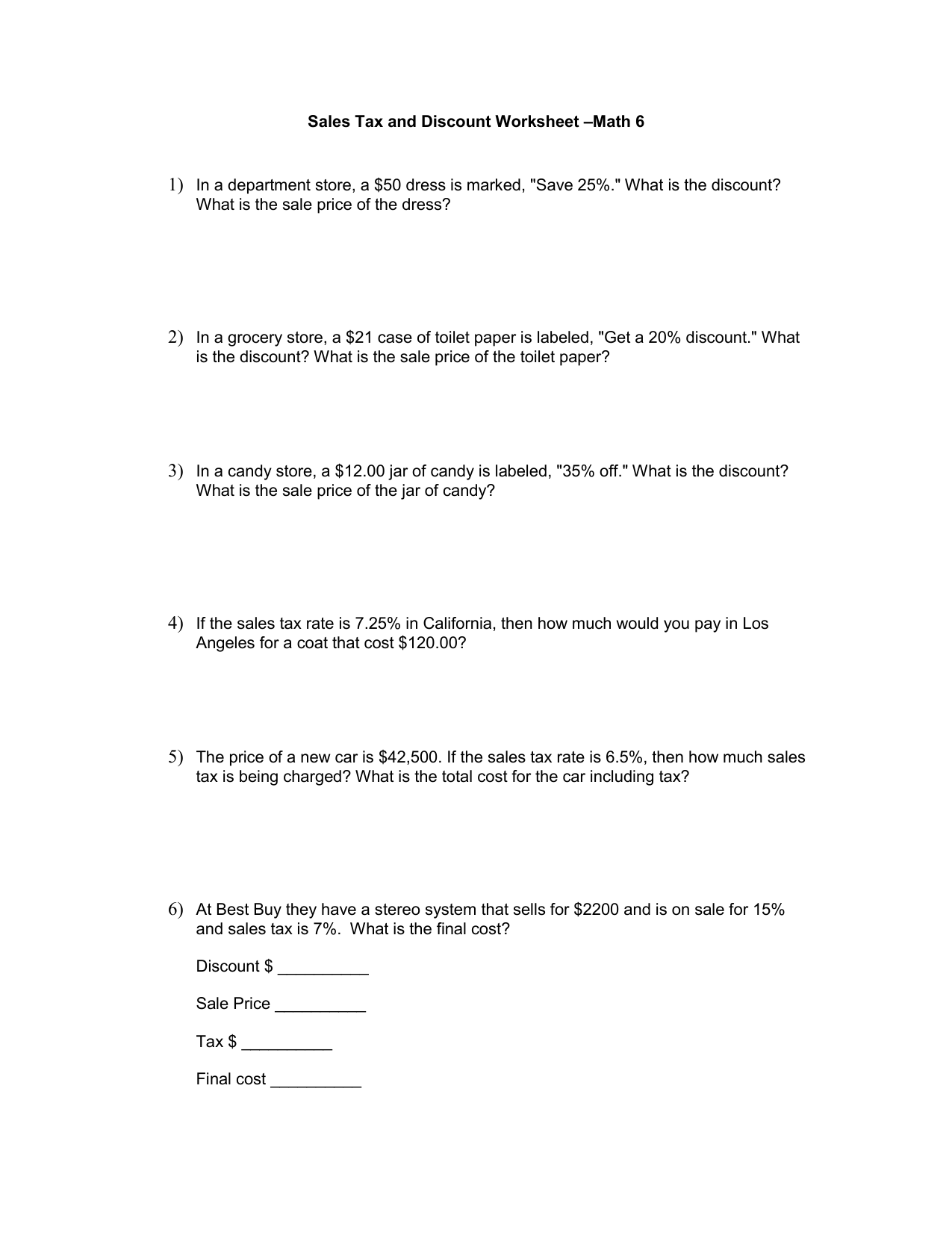

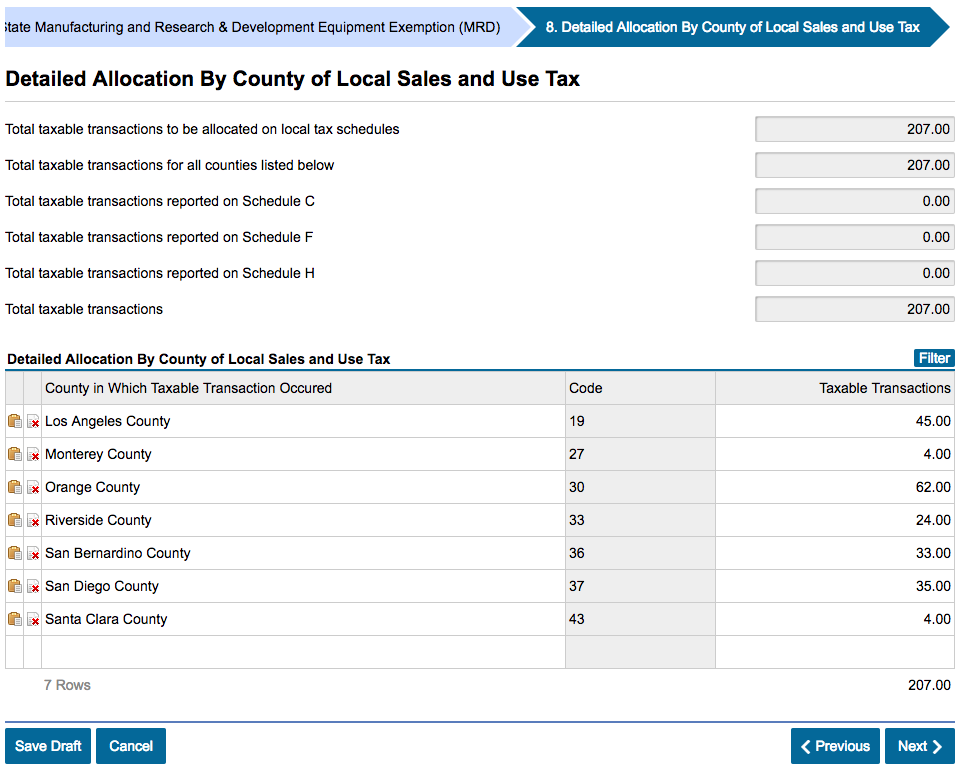

Calculating sales tax worksheet. › sales-tax-deduction-3193004The Federal Sales Tax Deduction - The Balance Feb 06, 2022 · If you choose to deduct your federal sales tax, you have two options for calculating it: using your actual expenses or consulting the IRS sales tax tables. You Have To Itemize Your Deductions When you're filing taxes, you can either claim the standard deduction or itemize your deductions —you can't do both. Performance lawn equipment | Numerical analysis homework ... The worksheet Purchasing Survey in the Performance Lawn Care database provides data related to predicting the level of business (Usage Level) obtained from a third-party survey of purchasing managers of customers Performance Lawn Care.8 . The seven PLE attributes rated by each respondent are. 8 The data and description of this case are based on the HATCO example on pages 28-29 in Joseph F ... for each of the six basic tactics, select the set of ... For each of the six basic tactics, select the set of action steps (A to F) that describe the tactic. Tactics: - Reposition a product- Marketing a product- Scheduling production- Modifying plant and equipment- Raising money and paying debt- Inventing a new product hgms.psd202.org › documents › llouckSales Tax and Discount Worksheet - psd202.org 2.To find the tax, multiply the rate (as a decimal) by the original price. 3.To find the total cost, add the tax to the original price. 5) If the sales tax rate is 7.25% in California, then how much would you pay in Los Angeles for a pair of shoes that cost $39.00? 6) The price of a new car is $29,990. If the sales tax rate is 6.5%, then how ...

› documents › taxes5092, Sales, Use and Withholding Taxes Amended Monthly ... tax separate from the sales tax discount calculated on the credit schedule. Sum both sales tax discount amounts and enter on line 5 of this form. PART 2: USE TAX ON ITEMS PURCHASED FOR BUSINESS OR PERSONAL USE : Line 7: Carry amount from line 9 of Worksheet 5095. To determine use tax due from purchases and withdrawals, › lessons › percentFree Step-by-Step Sales Tax Lesson with ... - Math Goodies Sales tax is a tax on goods and services purchased and is normally a certain percentage added to the buyer's cost. Solution: 2.36 ÷ $32.00 = 0.0735. Sales tax was charged by the department store at a rate of 7.375%. Answer: Mr. Smith should pay the department store $32.00 plus $2.36 in sales tax for a total bill of $34.36. Senior Staff Accountant at Lennar | JobEka.lk Prepares worksheets and schedules, develops detailed or summary financial and statistical reports of income, budgets, federal and state taxes, interest, investments, order volume and costs from sources such as loan cards, county operating reports, fiduciary accounts, income statements and accounts payable and receivable ledgers. EOF

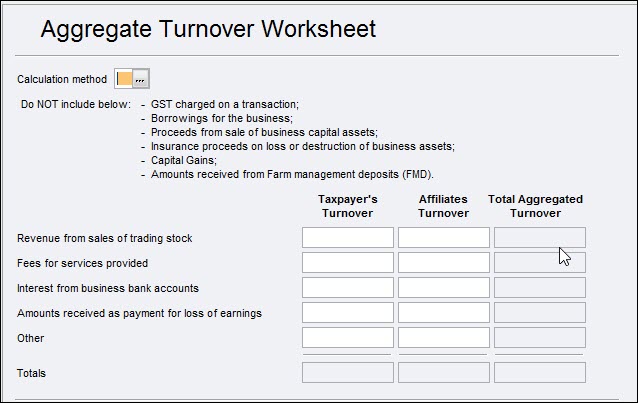

Fit1040 comprehensive project part-i & part ii - Do my ... Create a multi-sheet workbook that will include an Inventory sheet, Sales Tracking Quantity Sold sheet, Sales Tracking Sales Revenue sheet, a Customer Invoice sheet, a Sales Report sheet, and a Vehicle Purchase sheet according to the following specifications. Objectives: · Create, edit, and format a new workbook · Enter and edit labels and values › documents › taxesA. Sales B. Use: Sales and Rentals A. Sales Tax B. Use Tax ... PART 1: SALES AND USE TAX . quarterly return, calculate the allowable discount on sales . Line 1a: Enter the amount from Worksheet 5095, line 4A. tax separate from the sales tax discount calculated on the credit schedule. Sum both sales tax discount amounts and . Line 1b: Enter the amount from Worksheet 5095, line 4B. enter on line 5 of this form. What Does Price Out The Customer Mean? - AnswerHints The customers understanding of the product (perceived value), and the total market demand in the market affect the price strategy largely. The demand can be elastic, wherein a fall in price would result in increase in demand.For example, 10% decrease in price would result in 20% increase in demand in the target market. Daniel b. butler and freida c. butler - Yolo Papers Sales tax from the sales tax table is $1,860. Dan and Freida made Federal estimated tax payments of $8,000. All members of the family had health insurance coverage for all of 2016. Dan and Freida do not wish to contribute to the Presidential Election Campaign. The Kentucky income tax rate is 4%. Required:

Daniel B. Butler And Freida C. Butler - Write My Essay at ... Daniel B. Butler and Freida C. Butler, husband and wife, file a joint return. The Butlers live at 625 Oak Street in Corbin, KY 40701. Dan's Social Security number is 111-11-1111, and Freida's is 123-45-6789.

Excel Project Discussion Paper Assignment Help - Essays ... a. Use the Sales worksheet data to create a Pivot Table into a new worksheet. Name the new worksheet SalesPivot. For Mac users especially, do not create the pivot table by selecting the worksheet (data). Instead, from the Sales worksheet, simply Insert -> Pivot Table and the data will be automatically selected. b.

26481 Purissima Rd, Los Altos Hills, CA 94022 | MLS # ... 26481 Purissima Rd , Los Altos Hills, CA 94022-3326 is a single-family home listed for-sale at $6,495,000. The 3,581 sq. ft. home is a 5 bed, 4.0 bath property. View more property details, sales history and Zestimate data on Zillow. MLS # ML81879304

SOLUTION: CMU Management and Organization Leadership Paper ... Track sales receipts on daily or weekly basis Don't ignore bad news e.g., adequate billing and collection system Cash-basis accounting Accrual-basis accounting BUS/MSCIS 6190 Capstone Global Financial Considerations BUS/MSCIS 6190 Capstone Key Financial Forms Income Statement: shows whether your company is making a profit

Excel Project Discussion Paper Assignment Help a. Use the Sales worksheet data to create a Pivot Table into a new worksheet. Name the new worksheet SalesPivot. For Mac users especially, do not create the pivot table by selecting the worksheet (data). Instead, from the Sales worksheet, simply Insert -> Pivot Table and the data will be automatically selected. b.

/taxable-refunds-4c861c1250a14e3b88fb645966cc6e61.png)

:max_bytes(150000):strip_icc()/Christmas-Shopping-Worksheet-3-56a602eb5f9b58b7d0df784d.jpg)

0 Response to "43 calculating sales tax worksheet"

Post a Comment