41 self employed business expenses worksheet

Self-Employment Ledger: 40 FREE Templates & Examples Expenses. For further completing the self-employment ledger form, write down all accepted business expenses, monthly expenditure. Accepted business expenses could be deducted from your self-employment income. It includes payments on major purchases. Tools, machinery, or equipment used and other long-lasting commodities and the rate of real work ... Self-Employed/Business Monthly Worksheet - Mirto CPA Self-Employed/Business Name of Proprietor Social Security Number Monthly Worksheet Principal Business or Profession, Including Product or Service Income January February March April May June July August Sept October Nov Dec TOTALS Gross Sales Expenses January February March April May June July August Sept October Nov Dec TOTALS Accounting Advertising

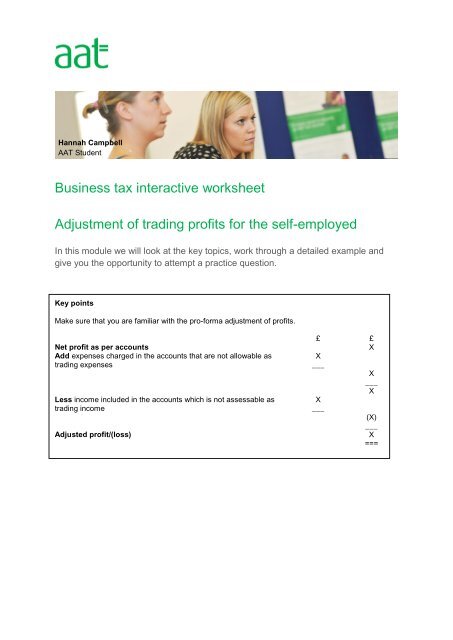

39 self employed expenses worksheet - Worksheet For Fun Mar 09, 2018 · (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. SELF EMPLOYMENT INCOME WORKSHEET Allowable expenses that can be deducted from income are listed below within the worksheet (#4-17). - Income Taxes (federal, state, and local ). EXPENSES:.2 pages

Self employed business expenses worksheet

PDF Self-Employed/Business Monthly Worksheet - OA Tax Partners Self-Employed/Business Name of Proprietor. Social Security Number: Monthly Worksheet: ... Auto & Truck Expense Bank Charges Business Contributions; Business Taxes Commissions; Delivery & Freight Dues & Subscriptions; Equipment Rental Gifts; Insurance Interest. 43 self employed business expenses worksheet - Worksheet ... Self Employed Business Expenses Worksheet Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c's business name (if any). Expenses related to entire home including business portion (indirect). 39 self employed business expenses worksheet - Worksheet ... self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. There is the worksheet that will involve in it the expenses done on the business and its related affair.

Self employed business expenses worksheet. Self-Employed Business Expense Worksheet Business Cards Bank Char es CD, DVD Blanks Client Gifts BUSINESS SUPPLIES WORKSHEET LLC TAX YEAR The purpase of this worksheet is to help you organize your tax deductible business expenses. In order for expense to be deductible, it must be considered an *ordinary and necessary- expense. You may include other applicable expenses. PDF Self Employment Income Worksheet Allowable expenses that can be deducted from income are listed below within the worksheet. Tacoma Public Utilities does not allow the same business deductions as the IRS. Income: Months: Tax Worksheets - Brent Financial Employee Business Expenses: For employees with unreimbursed job-related expenses. (Self-employed individuals should use the Self Employment Worksheet instead.) Educator Expenses: For teachers, aides, instructors, counselors, or principals. You must be employed at a grade school or high school, work at least 900 hours during the school year, and ... (Schedule C) Self-Employed Business Expenses Worksheet for Single Mar 09, 2018 · (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse

PDF Schedule C Worksheet for Self Employed Businesses and/or ... Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors ... I certify that I have listed all income, all expenses, and I have documentation to back up the figures entered on this worksheet. For tax year _____ Printed Name_____ Signature_____ Date _____ ... PDF Monthly Expenses Worksheet - AARP If self-employed, business expense Calculate Your Total Monthly Expense: Total from Column A: $ _____ Total from Column B: + $ _____ Equals Total Monthly Expenses: $ _____ Title: Microsoft Word - Monthly_Expenses_Worksheet.doc Author: equalls Created Date: 12/19/2005 1:21:24 PM ... Self Employed Tax Deductions Worksheet - SignNow The way to complete the Self employment income expense tracking worksheet form online: To start the blank, use the Fill & Sign Online button or tick the preview image of the form. The advanced tools of the editor will direct you through the editable PDF template. Enter your official contact and identification details. PDF Sole Proprietorship/ Self-employed Worksheet Sole Proprietorship/ Self-employed Worksheet If you have a Profit and Loss statement, please supply us with a copy. A backup copy of Quickbooks is also appreciated. This worksheet is for all types of businesses so some things may not apply. Name_____ Tax Year_____

PDF 2020 Sched C Worksheet - Alternatives Schedule C Worksheet for Self-Employed Filers and Contractors - tax year 2020 This document will list and explain the information and documentation that we will need in order to file a tax return for a self-employed person, a contract worker, or a sole-proprietor of a business. In summary, we need these sources of information: PDF 2021 Self-Employed (Sch C) Worksheet Business expenses (cont.) Business part of phone $ Training for this business $ $ Travel away from home $ Business meals fromrestaurants $ Other business meals $ Other (specify) $ Business use of car or truck Total mileage for year mi. Business miles mi. Commuting miles mi. Other miles mi. Vehicle description: Self-Employed Tax Deductions Worksheet (Download FREE) Here's a shortlist of business-related expenses self-employed individuals can claim to lower their tax bills. Business start-up expenses - legal costs, business structure fees, research expenses, borrowing costs, and expenses for technology; Business use of your vehicle - we'll review how to track these costs more below. 1 Superlative Tax Spreadsheet For Self Employed Excel ... Independent contractor expenses spreadsheet and independent contractor deduction worksheet. Start by downloading the tax return spreadsheet from here. It keeps checking the bank figure much easier. This document allows the self employed worker to keep track of their expenses. We have spent a lot of time in development to ensure that this simple ...

Self Employment Worksheet - First Choice Tax Service Self-Employed Business Expenses Worksheet and print it out. 2. Look over the form and gather your tax information. 3. Fill out the form. Deliver it to us via email or in person.

Self-Employed Individuals Tax Center | Internal Revenue ... Self-employed individuals generally must pay self-employment tax (SE tax) as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. In general, anytime the wording "self-employment tax ...

Self-Employed Business Expenses (Schedule C) Worksheet Self-Employed Business Expenses (Schedule C) Worksheet for unincorporated businesses or farms. Use separate sheet for each type of business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse

SELF EMPLOYED INCOME/EXPENSE SHEET - CPA Accounting SELF EMPLOYED INCOME/EXPENSE SHEET NAME OF PROPRIETOR BUSINESS ADDRESS BUSINESS NAME FEDERAL I.D. NUMBER Automobile Mileage (Adequate records required) COST OF GOODS SOLD (If Applicable) Beginning of the Year Inventory End of Year Inventory Purchases Other:

Free expenses spreadsheet for self-employed Expenses Spreadsheet for Self-Employed. Whether it's for your own accounting or to manage your billable expenses, an expenses spreadsheet can help you stay organized and maximize your tax deductions in preparation for your self employment taxes. We've built it to help you get peace of mind and get on with your work.

PDF TAX YEAR 2021 SMALL BUSINESS CHECKLIST - Tim Kelly self-employed health insurance premiums outside services (paid to other businesses) postage printing and copy expense professional memberships retirement contributions for employees retirement contributions for owner(s) rental of vehicles, machinery or equipment rental of space or property repairs security email to lynn@timkelly.com or fax to ...

12+ Business Expenses Worksheet in PDF | DOC | Free ... 5 Steps to Create a Business Expense Worksheet Step 1: Creating New Workbook. You must be creating the new workbook for the business expense worksheet and the... Step 2: Add the Income and Expenses. Step 3: Add Formulas. Then add on the formulas in the worksheet of the business expenses so that you ...

Publication 535 (2021), Business Expenses | Internal ... Worksheet 6-A. Self-Employed Health Insurance Deduction Worksheet; Chronically ill individual. Benefits received. Other coverage. ... This publication discusses common business expenses and explains what is and is not deductible. The general rules for deducting business expenses are discussed in the opening chapter. ... If you are self-employed ...

PDF Self-employed Income and Expense Worksheet self-employed income and expense worksheet taxpayer name ssn principal business or profession business name employer id number business address business entity (circle one) individual spouse joint business city, state, zip code income expenses $ gross receipts or sales $ advertising $ returns & allowances auto & travel $ $

Printable Self Employed Tax Deductions Worksheet ... Self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. Quick guide on how to complete printable self employed tax deductions worksheet Forget about scanning and printing out forms.

Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate.

15 Tax Deductions and Benefits for the Self-Employed IRS Publication 587: Business Use of Your Home (Including Use by Day-Care Providers): A document published by the Internal Revenue Service (IRS) that provides information on how taxpayers who use ...

39 self employed business expenses worksheet - Worksheet ... self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. There is the worksheet that will involve in it the expenses done on the business and its related affair.

43 self employed business expenses worksheet - Worksheet ... Self Employed Business Expenses Worksheet Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c's business name (if any). Expenses related to entire home including business portion (indirect).

PDF Self-Employed/Business Monthly Worksheet - OA Tax Partners Self-Employed/Business Name of Proprietor. Social Security Number: Monthly Worksheet: ... Auto & Truck Expense Bank Charges Business Contributions; Business Taxes Commissions; Delivery & Freight Dues & Subscriptions; Equipment Rental Gifts; Insurance Interest.

0 Response to "41 self employed business expenses worksheet"

Post a Comment