42 form 1023 ez eligibility worksheet

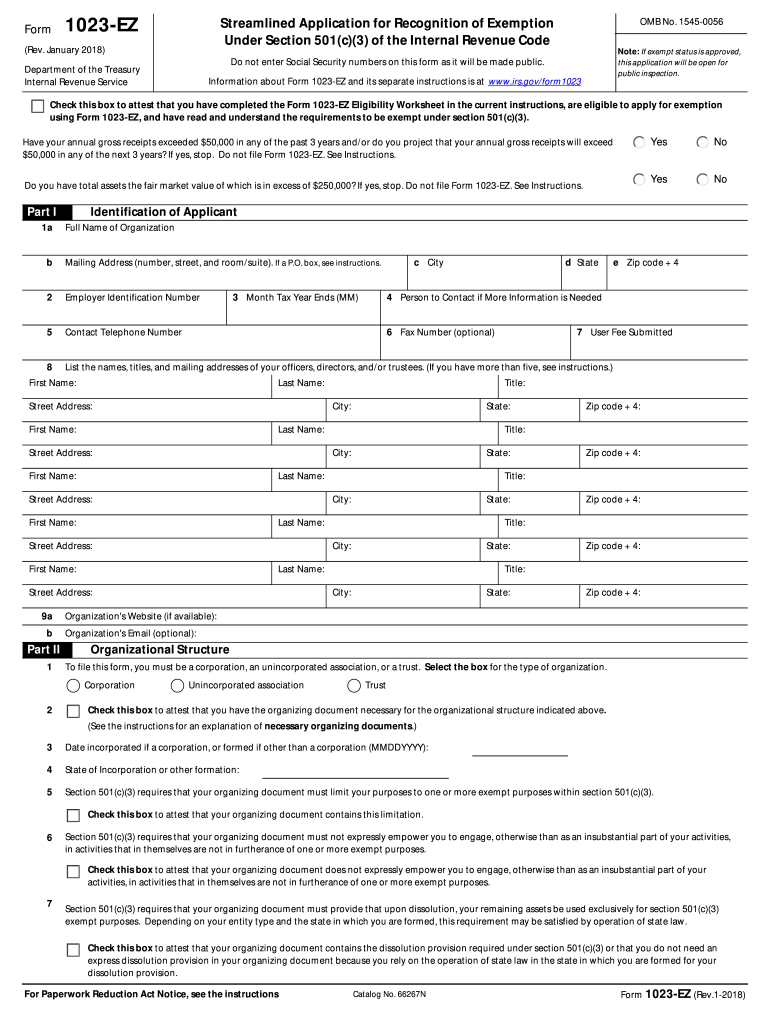

Form 1023 Ez Eligibility Worksheet 2020-2022 - Fill and ... Keep to these simple instructions to get Form 1023 Ez Eligibility Worksheet completely ready for submitting: Get the sample you will need in the collection of legal forms. Open the template in our online editing tool. Go through the guidelines to discover which information you need to give. Click the fillable fields and put the required data. Pay.gov - Application for Recognition of Exemption Under ... You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you are eligible to file that form. If you are not eligible to file Form 1023-EZ, you must file Form 1023 to obtain recognition of exemption under Section 501 (c) (3).

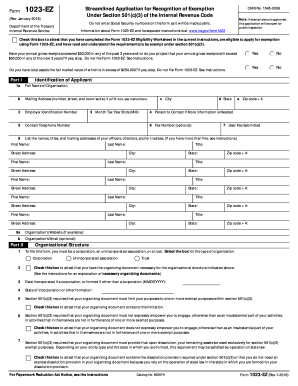

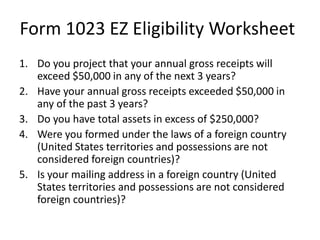

IRS Form 1023-EZ Eligibility Worksheet - Nonprofit ... IRS Form 1023-EZ Eligibility Test Take the 30 question test below to see if your non-profit corporation is eligible to file IRS Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code.

Form 1023 ez eligibility worksheet

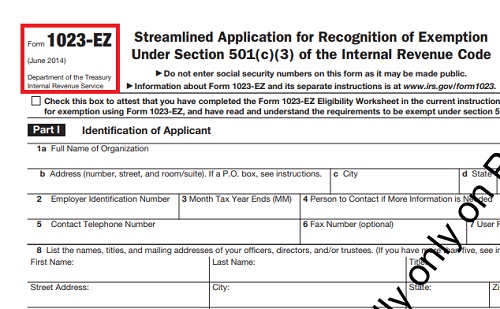

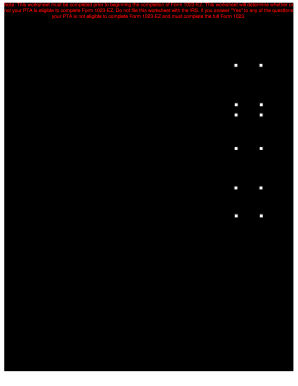

PDF Form OMB No. 1545-0056 Under Section 501(c)(3) of the ... Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). Part I Identification of Applicant 1a Full Name of Organization PDF EZ Eligibility Worksheet - WSPTA Form 1023-EZ Eligibility Worksheet (Must be completed prior to completing Form 1023-EZ) If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer "No" to all of the worksheet questions, you may apply using Form 1023-EZ. 1. Free Frequently Asked Questions - Form 1023-EZ The complete eligibility list appears in an "Eligibility Worksheet" that starts on page 13 of the1023-EZ instructions. This is an interactive Form. If you check "yes" to one of the questions, you receive a message saying that your organization is not eligible to file Form 1023-EZ, and must file the long form.

Form 1023 ez eligibility worksheet. All About IRS Form 1023-EZ - SmartAsset Unfortunately, only certain groups can submit Form 1023-EZ. Who Can File IRS Form 1023-EZ? Wondering whether you're eligible to file Form 1023-EZ? You'll need to find the form's instructions and scroll down to the eligibility worksheet. If you respond "yes" to any of its questions, you can't submit Form 1023-EZ. PDF Page 11 of 20 - Microscopy Society of America Form 1023-EZ Eligibility Worksheet (Must be completed prior to completing Form 1023-EZ) If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer "No" to all of the worksheet questions, you may apply using Form 1023-EZ. 1. Form 1023 Ez Eligibility Worksheet - Fill Out and Sign ... How to complete the Form 1023-EZ Eligibility Worksheet - National PTA - pta online: To start the document, use the Fill & Sign Onlinebutton or tick the preview image of the blank. The advanced tools of the editor will lead you through the editable PDF template. Enter your official identification and contact details. PDF …ˇ¯¸•˜É˝»¨ ˝»É ˚¯•˜ˇ¯…˚¾»˝¯¨`ɾ»»˚˙¸»É˚¿¯˜É ˇ ... ¾fl ¨» ˇ¯¸ ¯¨‰•˜¿—»" •É •˜ »˜˚¿˚ˇ ¯˚¾»¨ ˚¾•˜ • „¯¨˘¯¨•˚¿¯˜ ‚ ¸˜¿˜„¯¨˘¯¨•˚»" •ÉÉ ...

PDF Form 1023-EZ Streamlined Application for Recognition of ... Information about Form 1023-EZ and its separate instructions is at Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). PDF Form 1023-EZ Streamlined Application for Recognition of ... Information about Form 1023-EZ and its separate instructions is at Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). PDF Page 11 of 21 - Chi Epsilon Form 1023-EZ Eligibility Worksheet (Must be completed prior to completing Form 1023-EZ) If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer "No" to all of the worksheet questions, you may apply IRS Form 1023-EZ Application for 501(c)(3) Nonprofits ... The IRS has created an eligibility worksheet (located on page 11 of the Form 1023-EZ instructions) to determine whether or not a particular organization may use the new form. As mentioned previously, one of the main qualifications is the anticipated level of gross receipts.

PDF Instructions for Form 1023-EZ (Rev. January 2017) Form 1023-EZ Eligibility Worksheet. If you meet the eligibility requirements, you must check the box at the top of Form 1023-EZ to attest that you are eligible to file the form. By checking the box, you are also attesting that you have read and understand the requirements to be exempt under section 501(c) 1023 ez eligibility worksheet - Form 1023-EZ Reinstatement ... Get the 1023 ez eligibility worksheet and fill it out with the full-featured PDF editor. Manage docs quickly while keeping your data secure with 1023 ez eligibility worksheet on the web. PDF Instructions for Form 1023-EZ (Rev. January 2018) Form 1023-EZ Eligibility Worksheet. If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer "No" to all of the worksheet questions, you may apply using Form 1023-EZ. About Form 1023-EZ, Streamlined Application for ... To submit Form 1023-EZ, you must: Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. (If you are not eligible to file Form 1023-EZ, you can still file Form 1023 .) If eligible to file Form 1023-EZ, register for an account on Pay.gov. Enter "1023-EZ" in the search box.

1023-EZ Worksheet 2021 - 2022 - IRS Forms - Zrivo The eligibility worksheet for Form 1023-EZ is eight pages long, and it should take you about ten minutes to complete from the start to finish. Before you start filling out Form 1023-EZ, make sure to complete the eligibility worksheet, as it will save you time if you're not supposed to file the form. View Form 1023-EZ Worksheet

Everything You Need to Know About the Form 1023 EZ Prior to filling out the online form, you must first fill out the eligibility worksheet to verify that you fit all of the criteria for the streamlined service. The worksheet has 30 questions, and if you answer yes to any of them, then you are not eligible for the 1023-EZ form.

PDF ---------------------------------------------------------- Form 1023-EZ must be filled and submitted online on , this PDF copy is for reference only! Please go to and read the Pros & Cons and eligibility requirements before using the Form 1023-EZ.

Form 1023-EZ (June 2014) - IRS tax forms Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). Part I Identification of Applicant . 1a . Full Name of Organization. b

1023 Ez Eligibility Worksheet - Fill Online, Printable ... Get the free 1023 ez eligibility worksheet form. Get Form. Show details. Hide details. Note: This worksheet must be completed prior to beginning the completion of Form 1023-EZ. This worksheet will determine whether your PTA is eligible to complete Form 1023-EZ. Do not file this worksheet.

IRS 1023-EZ 2022 Form - Printable Blank PDF Online The filing fee for Form 1023 is $600.Certain organizations are eligible to use Form 1023-EZ instead. The filing fee for Form 1023-EZ is $275.In order to be eligible to file Form 1023-EZ, the organization must:Ethat its annual gross receipts will not exceed $50,000 this fiscal year or either of the next two fiscal years; andHave not had annual ...

1023EZ Inquiry - Formsite Form 1023-EZ Eligibility Worksheet. (Must be completed prior to completing Form 1023-EZ and Saved) Form 1023-EZ is the streamlined version of Form 1023, Application for Recognition of Exemption Under Section 501 (c) (3) of the Internal Revenue Code. Any organization may file Form 1023 to apply for recognition of exemption from federal income ...

IRS Form 1023-EZ ≡ Fill Out Printable PDF Forms Online Eligibility Worksheet Before a business entity embarks on filing Form 1023-EZ, they have to submit the eligibility worksheet, a questionnaire including 30 questions. The worksheet is aimed to indicate the form you need to submit, depending on the answers you give on the questionnaire.

How to File Form 1023-EZ - Startupsavant.com Complete the Form 1023-EZ Eligibility Worksheet Before you can fill out Form 1023-EZ, you must first determine if your organization is eligible to use it instead of Form 1023. To do this, complete the Form 1023-EZ Eligibility Worksheet located on pages 13 through 20 of the IRS' official Instructions for Form 1023-EZ .

Instructions for Form 1023-EZ (01/2018) | Internal Revenue ... Before completing the Form 1023-EZ, you must complete the Form 1023-EZ Eligibility Worksheet. If you meet the eligibility requirements, you must check the box at the top of Form 1023-EZ to attest that you are eligible to file the form. By checking the box, you are also attesting that you have read and understand the requirements to be exempt ...

PDF FORM 1023-EZ: The IRS's Reliance on Form 1023-EZ Causes It ... Consolidated Appropriations Act, 2016, Pub. L. No. 114-113, Division Q, Title IV, § 401(a) (2015) (codified at IRC § 7803(a)(3)). 2 Among other things, organizations eligible to submit Form 1023-EZ must generally have annual gross receipts of less than $50,000 and assets of less than $250,000. See Form 1023-EZ Eligibility Worksheet

Free Frequently Asked Questions - Form 1023-EZ The complete eligibility list appears in an "Eligibility Worksheet" that starts on page 13 of the1023-EZ instructions. This is an interactive Form. If you check "yes" to one of the questions, you receive a message saying that your organization is not eligible to file Form 1023-EZ, and must file the long form.

PDF EZ Eligibility Worksheet - WSPTA Form 1023-EZ Eligibility Worksheet (Must be completed prior to completing Form 1023-EZ) If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer "No" to all of the worksheet questions, you may apply using Form 1023-EZ. 1.

PDF Form OMB No. 1545-0056 Under Section 501(c)(3) of the ... Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). Part I Identification of Applicant 1a Full Name of Organization

0 Response to "42 form 1023 ez eligibility worksheet"

Post a Comment