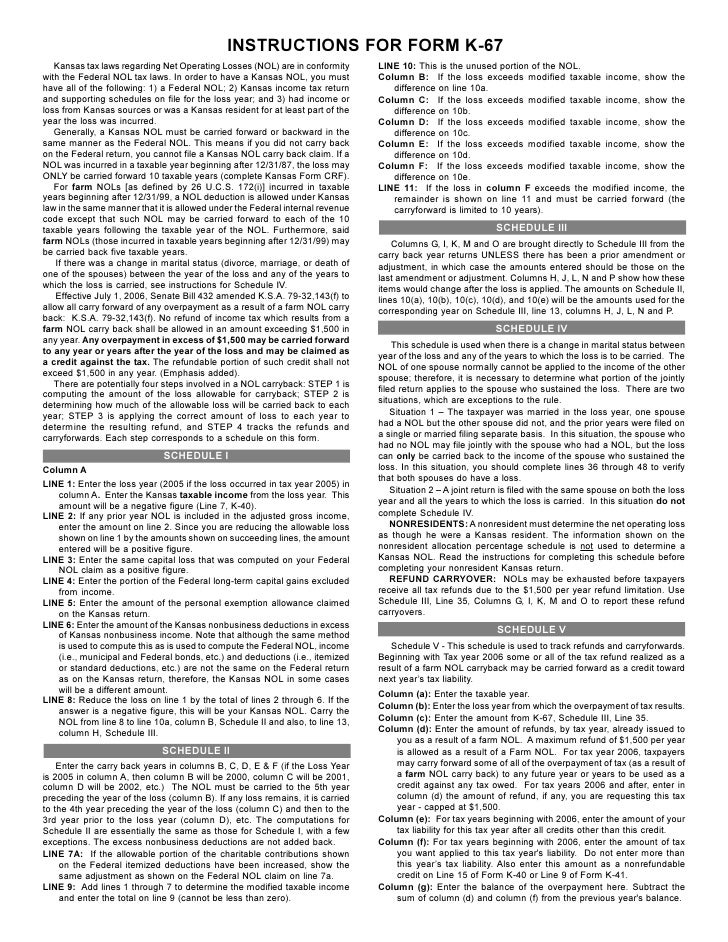

41 schedule d tax worksheet 2014

No Complete the Schedule D Tax Worksheet in the ... No. Complete the Schedule D Tax Worksheet in the instructions. Do not complete lines 21 and 22 below. Note. When figuring which amount is smaller, treat both amounts as positive numbers. If line 16 is a gain, enter the amount from line 16 on Form 1040, line 13, or Form 1040NR, line 14. Then go to line 17 below. If line 16 is a loss, skip lines 17 through 20 below. PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box

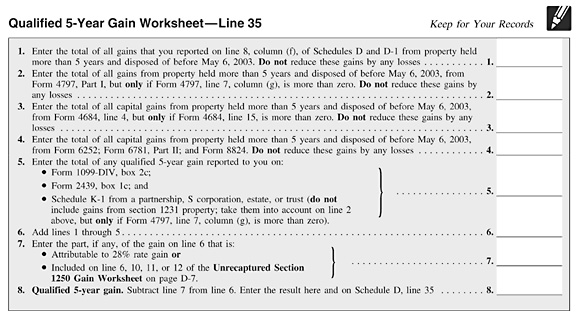

Schedule D - Viewing Tax Worksheet Schedule D - Viewing Tax Worksheet. If there is an amount on Line 18 (from the 28% Rate Gain Worksheet) or Line 19 (from the Unrecaptured Section 1250 Gain Worksheet) of Schedule D, according to the IRS the tax is calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain Tax Worksheet. To view the tax calculation on the Schedule D Tax Worksheet which will show the calculation of the tax which flows to Form 1040, Line 44 or Form 1040NR, Line 42:

Schedule d tax worksheet 2014

PDF Capital Gains and Losses - IRS tax forms SCHEDULE D (Form 1040) Department of the Treasury Internal Revenue Service (99) Capital Gains and Losses. . Attach to Form 1040 or Form 1040NR. . Information about Schedule D and its separate instructions is at . . . Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. OMB No. 1545-0074. 2014. Attachment PDF 2014 Instruction 1040 - TAX TABLE - IRS tax forms Cat. No. 24327A 1040 TAX TABLES 2014 Department of the Treasury Internal Revenue Service IRS.gov This booklet contains Tax Tables from the Instructions for Form 1040 only. sched. H-2 worksheet - Mass recapture tax, the taxpayer must complete and file Schedule H-2, Credit Recapture. Under Massachusetts law, an offset of the recapture tax is allowed for credits that have lapsed or are currently in carry over balances. The Recapture Offset Worksheet substantiates that any off-set taken against the recapture tax is a result of credits which ...

Schedule d tax worksheet 2014. Use Excel to File Your 2014 Form 1040 and Related ... The 2014 version of the spreadsheet includes both pages of Form 1040, as well as these supplemental schedules: Schedule A: Itemized Deductions. Schedule B: Interest and Ordinary Dividends. Schedule C: Profit or Loss from Business. Schedule D: Capital Gains and Losses (along with its worksheet) Schedule E: Supplemental Income and Loss. Prior Year Products - Internal Revenue Service Form 1040 (Schedule D) Capital Gains and Losses. 2021. Inst 1040 (Schedule D) Instructions for Schedule D (Form 1040 or Form 1040-SR), Capital Gains and Losses. 2021. Form 1040 (Schedule D) Capital Gains and Losses. 2020. How to Fill Out a Schedule D Tax Worksheet | Finance - Zacks Schedule D contains different worksheets that you may need to complete, including the Capital Loss Carryover Worksheet, 28% Rate Gain Worksheet and Unrecaptured Section 1250 Gain Worksheet. Each of... 2014 Schedule D (540NR) -- California Capital Gain or Loss ... TAXABLE YEAR SCHEDULE 2014 California Capital Gain or Loss Adjustment D (540NR) Name(s) as shown on return SSN or ITIN (a) (b) (c) (d) (e) Description of property Sales price Cost or other basis Loss Gain Identify S corporation stock If (c) is more than (b), If (b) is more than (c),

PDF 2014 Business Income and Receipts Tax Worksheet Worksheet N Rev. 9-8-2014 For Business Income & Receipts Tax Long Form Filers For Business Income & Receipts Tax Schedule H-J Filers Important Note: Use Worksheet N to complete the Summary Page of BIRT return and NPT return, Line 5..00 0 .00.00 0 .00.00 0 .00.00 0 .00.00 0 .00.00 0 .00 COMPUTATION OF TAX ON NET INCOME 1. PDF 2014 z *149980110002 - Washington, D.C. 2014 SCHEDULE H WORKSHEET P3 Homeowner and Renter Property Tax Credit Revised 11/2014 *149980130002* z z z 2014 SCHEDULE H PAGE 3 Last name and SSN Federal Adjusted Gross Income of the tax fi ling unit (see instructions) - Report the AGI of every member of your tax fi ling unit, including income subject to federal but not DC income tax. Schedule D Tax Worksheet 2015 - worksheet January 2020 capital gains and losses these instructions explain how to complete schedule d form 1040 or 1040 sr. Complete form 8949 before you complete line 1b 2 3 8b 9 or 10 of schedule d. 2014 schedule d tax worksheet form 1040 schedule d instructions page d 15. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero. PDF Line 44 the Tax Computation Worksheet on if you are filing ... Worksheet or line 6 of your Schedule D Tax Worksheet by any of your capital gain excess not used in (1) above. 3. Reduce (but not below zero) the amount on your Schedule D (Form 1040), line 18, by your capital gain excess. 4. Include your capital gain excess as a loss on line 16 of your Unrecaptured Section 1250 Gain Worksheet on page D-9 of the

2021 Schedule D Form and Instructions (Form 1040) Who Must File Form 1040 Schedule D? Short-term gain or loss on stocks, bonds, ETF, etc. Long-term gain or loss on stocks, bonds, ETF, etc. Gain or loss from a partnership, S corporation, estate or trust. Like-kind exchanges of real or personal property. Gain or loss from casualty or theft or property. PDF 2014 Net Profit Tax Worksheets - Phila WORKSHEETS D, E, K and EXTENSION 2014 NET PROFITS TAX RETURN These are worksheets only. Do not file these worksheets with your return. WORKSHEET D: ALLOCATION OF BUSINESS INCOME & RECEIPTS TAX CREDIT FOR PARTNERSHIPS, ETC., WITH CORPORATE MEMBERS (THIS SCHEDULE IS TO BE USED ONLY BY PARTNERSHIPS, JOINT VENTURES AND ASSOCIATIONS Schedule D Tax Worksheet - ttlc.intuit.com Employee Tax Expert March 22, 2020 5:00 PM Line 44 of the Schedule D Tax Worksheet (page D-17) is computed using the 2019 Tax Computation Worksheet. The 2019 Tax Computation Worksheet can be found on page 253 of IRS publication 17. **Say "Thanks" by clicking the thumb icon in a post 2021 Instructions for Schedule D (2021) - IRS tax forms Use Form 8960 to figure any net investment income tax relating to gains and losses reported on Schedule D, including gains and losses from a securities trading activity. Use Form 8997 to report each QOF investment you held at the beginning and end of the tax year and the deferred gains associated with each investment.

PDF IT-540 WEB You must enter your SSN below in the same 2014 ... SCHEDULE D - 2014 DONATION SCHEDULE Individuals who fi le an individual income tax return and have overpaid their tax may choose to donate all or part of their overpayment shown on Line 31 of Form IT-540 to the organizations or funds listed below. Enter on Lines 2 through 25, the portion of the overpayment you wish to donate.

Instructions for Schedule D (Form 1041) (2021) - IRS tax forms These instructions explain how to complete Schedule D (Form 1041). Complete Form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of Schedule D. Use Schedule D to report the following. The overall capital gains and losses from transactions reported on Form 8949. Certain transactions that the estate or trust doesn't have to report on Form 8949.

About Schedule D (Form 1040), Capital Gains and Losses Jul 15, 2021 — Information about Schedule D (Form 1040 or 1040-SR), Capital Gains and Losses, including recent updates, related forms, and instructions on ...

Form 40 Fillable 2014 Alabama Individual Income Tax Return (Includes Form 4952A, Schedules A, B ...

2014 Qualified Dividends and Capital Gain Tax Worksheet ... 2014 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line ...

2014 Business Income & Receipts Tax (BIRT) forms ... Instructions for filing the 2014 Business Income and Receipts Tax and Net Profits Tax. Use this form to file 2014 Business Income & Receipts Tax (BIRT). This form includes Schedules B, C-1, D, A, and E. Use this form to file 2014 Business Income & Receipts Tax (BIRT) if 100% of your business was conducted in Philadelphia.

Schedule D - Viewing Tax Worksheet - TaxAct Click the Forms button in the top left corner Expand the Federal folder, and then expand the Worksheets folder Scroll down and double click Schedule D Tax Worksheet - Tax Worksheet - Line 20 Click on the pink Printer Icon above the worksheet to print. You are able to choose if you wish to send the output to a printer or a PDF document.

Publication 17, Your Federal Income Tax; Chapter 17 - Reporting Gains and Losses, Comprehensive ...

Schedule D - Viewing Tax Worksheet To view the calculation on the Schedule D Tax Worksheet, you need to view the print PDF. If you need help, go to our Printing Your Return and Individual Forms FAQ. The print PDF of the Schedule D Tax Worksheet will show the calculation of the tax which flows to line 6 on Form 1040, or line 14 on Form 1040-NR.

PDF and Losses Capital Gains - IRS tax forms 2014 Instructions for Schedule DCapital Gains and Losses These instructions explain how to complete Schedule D (Form 1040). Complete Form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of Schedule D. Use Schedule D: To figure the overall gain or loss from transactions reported on Form 8949,

Printable Tax Form Schedule A - form 1040 schedule d ... Printable Tax Form Schedule A - 16 images - electronic irs form 1040 schedule f 2018 2019 2021 tax, 33 schedule d tax worksheet 2014 worksheet source 2021, schedule a 2021 irs forms zrivo, new draft 1040 form released by the irs cryptotaxation,

Federal 1041 (Schedule D) (Capital Gains and Losses ... More about the Federal 1041 (Schedule D) Corporate Income Tax TY 2021 We last updated the Capital Gains and Losses in January 2022, so this is the latest version of 1041 (Schedule D) , fully updated for tax year 2021.

IRS 1040 - Schedule D 2019 - Fill and Sign Printable ... Fill in the details required in IRS 1040 - Schedule D, making use of fillable lines. Insert pictures, crosses, check and text boxes, if it is supposed. Repeating info will be added automatically after the first input. If you have any difficulties, use the Wizard Tool. You will see useful tips for simpler finalization.

Schedule R/NR Department of Resident/Nonresident Worksheet This worksheet is to be used to adjust income, deductions, exemptions and the Earned Income Credit for taxpayers who were part-year Mass achu setts residents and also received Massachusetts source income while a nonresident. Married taxpayers filing separate Massachusetts income tax returns must complete separate worksheets.

sched. H-2 worksheet - Mass recapture tax, the taxpayer must complete and file Schedule H-2, Credit Recapture. Under Massachusetts law, an offset of the recapture tax is allowed for credits that have lapsed or are currently in carry over balances. The Recapture Offset Worksheet substantiates that any off-set taken against the recapture tax is a result of credits which ...

PDF 2014 Instruction 1040 - TAX TABLE - IRS tax forms Cat. No. 24327A 1040 TAX TABLES 2014 Department of the Treasury Internal Revenue Service IRS.gov This booklet contains Tax Tables from the Instructions for Form 1040 only.

PDF Capital Gains and Losses - IRS tax forms SCHEDULE D (Form 1040) Department of the Treasury Internal Revenue Service (99) Capital Gains and Losses. . Attach to Form 1040 or Form 1040NR. . Information about Schedule D and its separate instructions is at . . . Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. OMB No. 1545-0074. 2014. Attachment

0 Response to "41 schedule d tax worksheet 2014"

Post a Comment