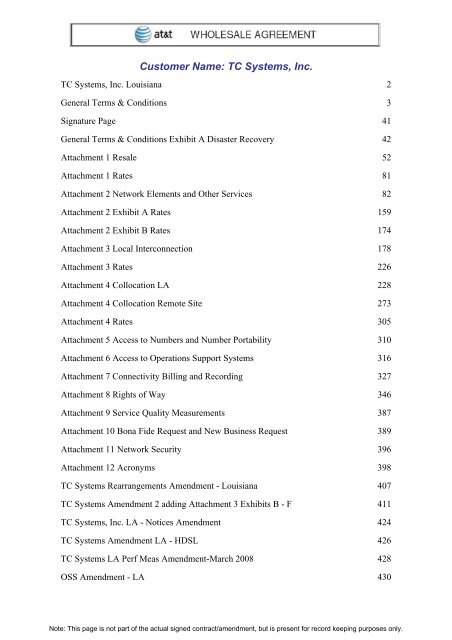

45 at&t cost basis worksheet

The cost basis is how much you paid for your shares after you take into account stock splits, acquisitions and other events. In general, your taxable gain or loss is the difference between your cost basis and the price you receive when you sell the shares, minus brokerage fees. What You Need to Know to Calculate Your Cost Basis? Stay In Touch Your per share cost basis in new AT&T, Inc. equals the aggregate cost basis of $1,500 divided by the total number of new AT&T, Inc. shares received - 77.94 - which is $19.25. * The tax basis of a fractional share interest would be a proportional part of the basis of a whole share. Consult Your Tax Advisor

Cost Basis Calculator for Investors | About Verizon Download the Cost Basis Worksheet (PDF) to determine the cost basis in Idearc, Fairpoint or Frontier shares or if your shares of MCI, Inc. were acquired by Verizon on January 6, 2006. For Bell Atlantics and NYNEX shares acquired in the AT&T divestiture: The cost basis needs to be calculated for each company

At&t cost basis worksheet

How to Handle the Taxes on the AT&T Spinoff of Warner Bros. The cost basis for tax purposes should be based on the value of AT&T and Discovery stock on Friday. AT&T finished at $24.14 and Discovery at $24.43. The initial value of the Warner Bros. Discovery stock received for each AT&T share was roughly $5.90 (0.242 times $24.43), or 25% of the value of AT&T stock on Friday. This results in a post-spin-off tax basis of $4.49 per AT&T share. Your aggregate tax basis in the Comcast Corporation shares received in the Comcast Merger equals your aggregate tax basis in the AT&T Broadband shares (i.e. $751.20). You were entitled to receive 32.35 shares of Comcast Corporation as a result of the Merger. Tax Basis Worksheet Since all shares of the AT&T Broadband stock were converted to Comcast Corp, the tax basis of the new Comcast stock (via AT & T) should be allocated as follows (based on cost basis paid for AT&T stock): AT & T Corp 37.4 % Comcast (via AT & T Broadband spin-off) 62.6 %

At&t cost basis worksheet. At&T Tax Basis Worksheet - smkinfo.com 27.99% (Based upon the cost basis of AT & T stock purchased or owned prior to 9/17/96) Tax Basis Update New Comcast and AT & T Broadband Merger AT&T Corp received a ruling from the IRS to the effect that the spin-off of AT & T Broadband will be tax free to the AT&T shareholders. Since all NCR Teradata Chart - cost-basis-charts.com above reverse split, restoring accounts with 10 or. more whole shares to their original position." Teradata Corporation. 1/21/2005 2 for 1 Stock Split. Type: Spin-off. Shares: 1 share of Teradata for each 1 share of NCR held on 9/14/2007. Basis Allocation: 47.63% NCR, 52.37% Teradata. Due to spin-off of Lucent, AT&T basis now diluted. AT&T (T) spinoff of Warner, forming Warner Brothers Discovery (WBD) - ICLUB The cost basis allocation is dependent on the prices used for both AT&T and Warner Brothers Discovery in the cost basis allocation calculations. In our experience brokers tend to use the prices found in the guidance companies post on their websites including IRS form 8937. ... AT&T (T) Remaining Basis Percentage: 76.52; Cash received: See your ... AT&T Wireless Tax Basis Worksheet tax basis allocation of the spin-off should be: AT & T Corp 77.66% AT & T Wireless 22.34% (Based upon the cost basis of AT & T stock purchased or owned prior to 06/22/2001) For detailed information please go to Investor Relations on the AT&T website

Spinoff Calculator - Cost Basis For double spins use same cost basis for both calculations. $ (no commas) 10. Cash received in lieu of fractional shares (often denoted as CIL) (enter 0.00 if none) $ 11. Tax status of spinoff, enter 1 for tax-free, 2 for taxable, 3 for return of capital, 4 for mixed status : 12. If tax status is taxable or mixed, enter market value per share ... If you owned AT&T common stock (T) as of the close of business on April 5, 2022, the record date for distribution of shares of SpinCo, first calculate your AT&T Cost Basis using the worksheet below and then use that output for the AT&T Inc. / WBD allocation. AT&T Inc. (formerly SBC Communications Inc.) If YES, use this worksheet below to calculate the allocation of your cost basis between AT&T Inc. and WBD common stock. AT&T Inc. / WBD If you acquired your AT&T Inc. shares on or after March 20, 1998 (the date of the last stock split), your cost basis before the SpinCo Distribution is the same as the actual price paid for the shares. AT&T Corp Flowchart - cost-basis-charts.com Basis Allocation: AT&T - 37.4%, AT&T Broadband- 62.6%. All shares of AT&T Broadband were converted into shares of Comcast shortly after the distribution as result of the merger of a wholly owned subsidiary of Comcast Corporation with and into AT&T Broadband. Fractional shares received cash payments. SBC AT&T Merger Merger.

PDF cost basis worksheet - Denver Tax The information described in this worksheet provides some, but not all, of the information needed to determine your tax basis. The other information which you need to determine your tax basis is particular to you individual situation, and your tax advisor can assist you in identifying this other information. How to adjust cost basis in Quicken for AT&T & WBD post-spinoff (in ... To calculate the basis, I multiplied the spinoff ratio (0.241917) times the WBD closing price on 4/11 ($24.78) to get the spinoff value ($5.9947). I then added the WBD spinoff value ($5.9947) to the T closing price ($19.63), and divided the sum ($25.6747) into the spinoff value ($5.9947) to arrive at the percentage of the original T cost basis ... AT&T Cost Basis - Denver Tax This program has the basis history - mergers, splits, spin - offs, etc. - since December, 1963. You will find this faster and easier than any AT&T "worksheet." AT&T Divestiture Basis Tracker - Order & Download Software Now! Special discounted price through 4/30/2022 $79. Regular Price $119. (3,011 KB Approx. 3 minute download [broadband]) A T & T - Cost Basis Starting from your own acquisition date, apply the spinoffs, splits, and name changes in order of occurrence to arrive at your cost basis today. You can use the excellent calculators provided on the AT&T website at to compute each successive step.

Accounting for ATT WBD Spin Off — Quicken Those opening values would produces a total value of $23.715 such that 76.43% (18.89 / 23.715) of the T basis would stay with the original T holding and 23.57% (5.825 / 23.715) would transfer to the new WBD shares. If you only have one lot of T, Quicken will produce good numbers.

what is the verizon stock cost basis from original AT&T spinoff… Cost basis of spinoff of Lucent tech. from AT&T Corp. on Sept. 30, 1996 How much a share was Lucent Tech. when it was spinoff from AT&T Corp. on Sept. 30, 1996. I got(NNN) NNN-NNNNshares. … read more

AT&T Shareholders Who Sell Warner Bros. Stock Face Tax Complexities That figure is about 24%, meaning that 24% of an investor's cost would be attributable to Warner Bros. and 76% to AT&T. So if an investor had originally paid $30 for AT&T, roughly $7.13 (24% of $30) would be attributed to Warner Bros. and $22.87 to AT&T (76% of $30). Barron's had calculated the percentages as roughly 25% and 75% in our ...

How to calculate worth of AT&T stock after splits - SFGATE Out of curiosity, I went through the worksheets, using the information you supplied, and found that your original 100 AT&T shares have dwindled to 30 (thanks to the reverse split), and that your ...

If you acquired your AT&T, Inc. shares prior to March 20, 1998 (date of last stock split) or through a previous acquisition or merger transaction, determining your cost basis is a TWO-STEP process -- first calculate your AT&T Cost Basis per share on one of the worksheets click here and then use that output for the allocation below.

How to compute AT&T and "family" cost basis by yourself. How To Compute AT&T and Its Security "Family" Cost Basis by Yourself Order & Download Now! Special discounted price through 4/30/2022 $79. Regular Price $119. (3,011 KB Approx. 3 minute download [broadband]). Order licenses for additional machines. Before we continue, lets ask a question that you should be immediately raising.

Figuring the Basis of AT&T Shares | Kiplinger The biggest event was the 1984 divestiture, when ATT spun off the seven baby bells. Your basis should be allocated 28.5% to ATT and the remaining 71.5% split among the seven baby bells, with each...

If you acquired AT&T Inc. (formerly SBC Communications Inc.) shares as a result of SBC's acquisition of AT&T Corp., use this worksheet. AT&T Corp. Additional details on AT&T Corp. stock events: AT&T 3-for-1 Stock Split - April 24, 1959

PDF Determining Your Tax Basis in shares of Verizon Communications Common Stock This worksheet describes some of the information needed to computer gain or loss, for income tax purposes, if you sell or otherwise dispose of your Verizon Communications Inc. ("Verizon") common ... Original tax basis per AT&T share _____ (A) Adjust for AT&T Divestiture, Divide (A) by 8.47916 _____ New Basis three stock splits and spin-offs ...

TRACKING COST BASIS OF AT&T, OFFSPRING - Hartford Courant The cost basis for your original shares of AT&T; would have been about $5,700 (before broker commissions). That original $5,700 purchase price, however, must be divided into many parts. Here's why ...

PDF Comcast Corp Class A Common/Philadelphia PA-CMCSA spinoff ... - Cost Basis New Cost Basis ÷ No. of AT&T Corp. Shares = New Per Share Cost Basis Example AT&T Corp. $ 100.00 x 0.374 = $37.40 ÷ 102 = $0.37 Your Calculation AT&T Corp. $ x 0.374 = ÷ = $ Holders of Comcast The cost basis of your new Comcast stock is the equivalent of the cost basis for your

Tax Basis Worksheet Since all shares of the AT&T Broadband stock were converted to Comcast Corp, the tax basis of the new Comcast stock (via AT & T) should be allocated as follows (based on cost basis paid for AT&T stock): AT & T Corp 37.4 % Comcast (via AT & T Broadband spin-off) 62.6 %

This results in a post-spin-off tax basis of $4.49 per AT&T share. Your aggregate tax basis in the Comcast Corporation shares received in the Comcast Merger equals your aggregate tax basis in the AT&T Broadband shares (i.e. $751.20). You were entitled to receive 32.35 shares of Comcast Corporation as a result of the Merger.

How to Handle the Taxes on the AT&T Spinoff of Warner Bros. The cost basis for tax purposes should be based on the value of AT&T and Discovery stock on Friday. AT&T finished at $24.14 and Discovery at $24.43. The initial value of the Warner Bros. Discovery stock received for each AT&T share was roughly $5.90 (0.242 times $24.43), or 25% of the value of AT&T stock on Friday.

/88160302-F-56a0a3e53df78cafdaa385d2.jpg)

0 Response to "45 at&t cost basis worksheet"

Post a Comment