41 funding 401ks and roth iras worksheet

PDF IRA to HSA Worksheet - The National Alliance for Insurance Education ... After the death of an IRA or Roth IRA owner, a qualified HSA funding distribution may be made from an IRA or Roth IRA maintained for the benefit of an IRA or Roth IRA beneficiary. This distribution will be taken into account in determining whether the required minimum distribution has been satisfied from the IRA. 4. Once Per Lifetime Rule. Roth IRA vs. 401(k): What's the Difference? - Investopedia This gives Roth IRA holders a greater degree of investment freedom than employees have with 401 (k) plans (even though the fees charged for 401 (k)s are typically higher ). In contrast to the 401 ...

Act-Ch12-L03-S.pdf - Funding 401(k)s and Roth IRAs ... Funding 401(k)s and Roth IRAs CHAPTER 12, LESSON 3 DATE NAMES DIRECTIONS Complete the investment ... Complete Funding 401ks and Roth IRAs Worksheet.jpg.

Funding 401ks and roth iras worksheet

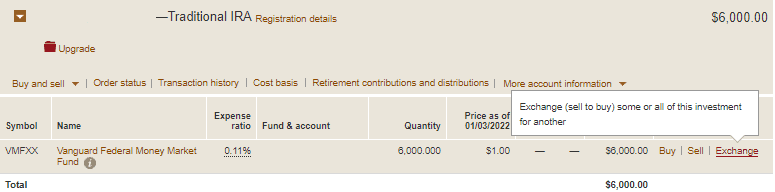

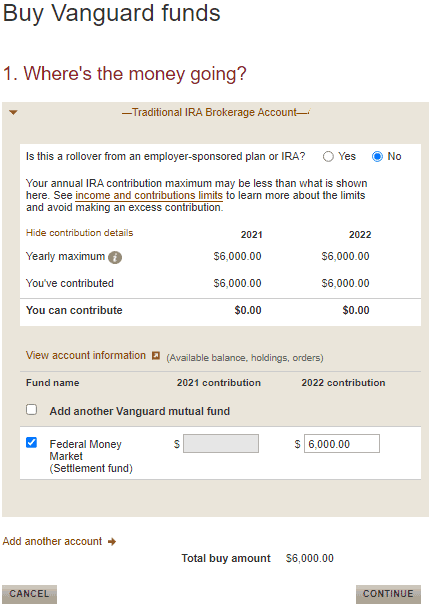

Calculating Roth IRA: 2021 and 2022 Contribution Limits - Investopedia The Roth individual retirement account (Roth IRA) has a contribution limit, which is $6,000 in 2022—or $7,000 if you are age 50 or older. This limit applies across all IRAs. Depending on your ... Ch 11 11.3 Funding 401ks and Roth IRAs.pdf - Course Hero 11.3 Funding 401(k)s and Roth IRAs Name _ Complete the investment chart based on the facts given for ... Complete Funding 401ks and Roth IRAs Worksheet.jpg. Solved Activity: Funding 401(k)s and Roth IRAs Objective ... - Chegg Activity: Funding 401 (k)s and Roth IRAs Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Directions: Complete the investment chart based on the facts given for each situation.

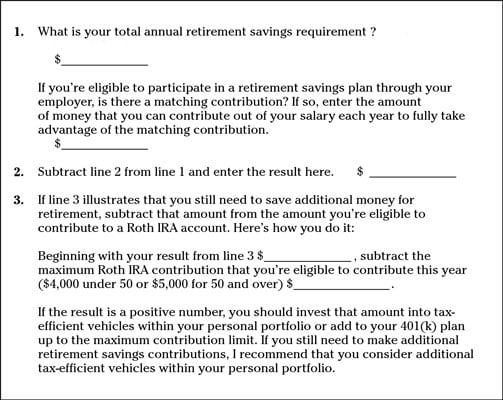

Funding 401ks and roth iras worksheet. Chapter 11 Finance Flashcards | Quizlet Baby Step 4: Invest 15% of household income into Roth IRAs and pre-tax retirement. 1. Fund the 401(k) or other employer plan up to the match (if applicable). 2. Above the match, fund Roth IRAs. If there is no match, start with Roth IRAs. 3. Complete 15% of income by going back to 401(k) or other company plans. Funding_A_401k_And_Roth_IR... NAME: DATE: Funding 401(k)s and Roth IRAs Directions Complete the investment chart based on the. ... Complete Funding 401ks and Roth IRAs Worksheet.jpg. Funding 401(K)S And Roth Iras Worksheet Answer Key - US Quote Hunter Funding 401 (K)S And Roth Iras Worksheet Answer Key A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares." Funding 401(K)S And Roth Iras Worksheet Answers Chapter 8 - Free Gold ... Funding 401 (K)S And Roth Iras Worksheet Answers Chapter 8 A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares."

Roth vs. Traditional 401(k) Worksheet - Morningstar, Inc. Use our free Roth vs. Traditional 401(k) Worksheet to help get your finances in order. ... ratings, and picks; portfolio tools; and option, hedge fund, IRA, 401k, and 529 plan research. Our ... Funding_A_401k_And_Roth_IRA_STUDENT_FILLABLE.pdf - Course Hero Funding 401 (k)sand Roth IRAs Directions Complete the investment chart based on the facts given for each situation. Assume each person is following Dave's advice of investing 15% of their annual household income. Remember to follow the sequence ofcontributions recommended in the chapter. Is Your 401(k) Enough for Retirement? | RamseySolutions.com Let's say you have a 401(k) and a Roth IRA, and you want to withdraw $25,000 from each account so that you can have a $50,000 annual income in retirement. On the Roth IRA side, you could take out $25,000 from your account every year and not owe any taxes on it. ... It's a pretty clear choice: Take advantage of Roth IRAs—and Roth 401(k)s ... PDF NAME: DATE: Funding 401(k)s and Roth IRAs - Weebly Chelsea will fund her Roth IRA. NAME: DATE: INVESTMENT ANNUAL SALARY COMPANY MATCH 401(K) ROTH IRA TOTAL ANNUAL INVESTMENT Joe $40,000 1:1 up to 5% Melissa $55,000 1:2 up to 6% Tyler & Megan $105,000 No Match Adrian $111,000 1:1: up to 3% David & Britney $150,000 No Match Brandon $35,000 2:1 up to 6% Chelsea $28,000 No Match CHAPTER 8

One Participant 401k Plans | Internal Revenue Service - IRS tax forms A one-participant 401 (k) plan is sometimes called a: Solo 401 (k) Solo-k. Uni-k. One-participant k. The one-participant 401 (k) plan isn't a new type of 401 (k) plan. It's a traditional 401 (k) plan covering a business owner with no employees, or that person and his or her spouse. These plans have the same rules and requirements as any other ... Funding a 401 K and Roth - financial lit Flashcards | Quizlet -They match what you put into your 401 (k) -Up to 3% of your salary -If you make $100,000 and you put $3,000 or more into your 401 (k) -Your company will also put $3,000 into your 401 (k) FOLLOW THESE STEPS TO FUND YOUR 401 (K) & ROTH IRA -Calculate 15% or your income >>This is the total you want to invest in your retirement accounts 401(k) and roth ira Flashcards | Quizlet 401k- can be matched by an employer; taxed in retirement (pre-tax money); no max contribution steps for investing in roth ira or 401k 1. calculate target amount to invest (15%) 2. fund our 401 (k) up to the match 3. Above the match, fund roth ira 4. complete 15% of income by going back to 401 (k) single- $___________; salary max $_____________ Roth IRA vs. 401(k): Which Is Better for You? Married couples with only one income earner may open a spousal Roth IRA. Taxes. Contributions are made with pretax dollars, lowering your taxable income. You'll pay taxes on any money you withdraw in retirement. Contributions are made with after-tax dollars, allowing investments to grow tax-free. No taxes on withdrawals in retirement.

Activity_Funding_A_401k_And_... Review the steps to follow when funding a 401 (k) and Roth IRA, located in the workbook: 1 Always take advantage of a match and fund 401 (k). 2 Above the match, fund Roth IRAs. If there is no match, start with Roth IRAs. 3 Complete 15% of income by going back to your 401 (k) or other company plans.

PDF Roth vs. Traditional 401(k) Worksheet - Morningstar, Inc. An increasing number of 401(k) plans are offering a Roth option. The key differences are as follows: Traditional 401(k) p Pretax contributions p Tax-deferred compounding p Taxed upon withdrawal in ...

Complete Funding 401ks and Roth IRAs Worksheet.jpg - NAME

401k Plans | Internal Revenue Service - IRS tax forms A 401 (k) is a feature of a qualified profit-sharing plan that allows employees to contribute a portion of their wages to individual accounts. Elective salary deferrals are excluded from the employee's taxable income (except for designated Roth deferrals). Employers can contribute to employees' accounts. Distributions, including earnings ...

Roth IRA vs. 401K: How to choose | Stash - Stash Learn The annual cap on 401 (k) contributions is significantly higher than the Roth IRA limit. For 2022: Employees can contribute up to $20,500 Employees over 50 can contribute an extra $6,500 With the employer match, contributions cannot exceed $61,000, or $67,500 for employees over age 50

Publication 560 (2021), Retirement Plans for Small Business IRA and SIMPLE 401(k) ... To do this, use the Rate Table for Self-Employed or the Rate Worksheet for Self-Employed, whichever is appropriate for your plan's contribution rate, in chapter 5. Then, figure your maximum deduction by using the Deduction Worksheet for Self-Employed in chapter 5. ... 4530 Designated Roth Accounts under 401(k), 403(b ...

Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET Step 1: Calculate 15% of the total annual salary Step 2: Calculate the maximum match that can be contributed to the 401 (K) Step 3: Calculate the remaining balance into the ROTH IRA column Exceptions * if there is no match, put the maximum amount into the ROTH IRA first, and the remaining into 401 (k)

Funding 401(k)s & Roth IRAs Chart.docx - Course Hero Tyler and Megan can each fund a Roth IRA then put the remainder in the 401 (k). With no match, fund the Roth first ( based on 2018 contribution of $5,500 per individual). Adrian is not eligible to open a Roth IRA because he makes too much money. He will put his entire 15% into his 401 (k). Chelsea will fund her Roth IRA. End of preview.

PDF Business for Small Plans - IRS tax forms SIMPLE IRA Plan. SIMPLE 401\(k\) Plan. Chapter 4. Qualified Plans. Kinds of Plans. Qualification Rules. Setting Up a Qualified Plan. Minimum Funding Requirement. Contributions. Employer Deduction. Elective Deferrals \(401\(k\) Plans\) Qualified Roth Contribution Program. Distributions. Prohibited Transactions. Reporting Requirements. Chapter 5.

PDF NAME: DATE: Funding 401(k)s and Roth IRAs - MRS. JENKINS BUSINESS CLASS ... Melissa will fund the 401(k) up to the match and put the remainder in her Roth IRA. Tyler and Megan can each fund a Roth IRA then put the remainder in the 401(k). With no match, fund the Roth Þrst (based on 2013 contribution of $5,500 per individual). Adrian is not eligible to open a Roth IRA because he makes too much money.

Copy of Funding 401(k)s and Roth IRAs - Course Hero Funding 401(k)s and Roth IRAs Directions: Complete the investment chart based on the facts given for. ... Complete Funding 401ks and Roth IRAs Worksheet.jpg.

Funding 401(k) and Roth IRAs (1).pdf - N A ME: DAT E Funding 401(k)sand Roth IRAsDirectionsComplete the investment chart based on the facts given for each ... Complete Funding 401ks and Roth IRAs Worksheet.jpg.

PDF 401(k) PLAN CHECKLIST - IRS tax forms Most 401(k) plans must file an annual return with the federal government. More Every year it's important that you review the requirements for operating your 401(k) retirement plan. Use this checklist to help you keep your plan in compliance with many of the important rules. Check the box if you can answer "yes" to the question.

Solved Activity: Funding 401(k)s and Roth IRAs Objective ... - Chegg Activity: Funding 401 (k)s and Roth IRAs Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Directions: Complete the investment chart based on the facts given for each situation.

Ch 11 11.3 Funding 401ks and Roth IRAs.pdf - Course Hero 11.3 Funding 401(k)s and Roth IRAs Name _ Complete the investment chart based on the facts given for ... Complete Funding 401ks and Roth IRAs Worksheet.jpg.

Calculating Roth IRA: 2021 and 2022 Contribution Limits - Investopedia The Roth individual retirement account (Roth IRA) has a contribution limit, which is $6,000 in 2022—or $7,000 if you are age 50 or older. This limit applies across all IRAs. Depending on your ...

![Asset Allocation Spreadsheet [Excel Template] | White Coat ...](https://www.whitecoatinvestor.com/wp-content/uploads/2020/12/Screen-Shot-2020-12-03-at-8.18.51-AM.png)

/roth_ira_401k_nesteggs_istock466132651-5bfc328ec9e77c00519bf2e6.jpg)

![How To Do A Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2018/09/Backdoor-Roth-IRA-part-2-3.png)

![How To Do A Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2020/06/Screen-Shot-2020-06-20-at-6.58.37-AM.png)

0 Response to "41 funding 401ks and roth iras worksheet"

Post a Comment