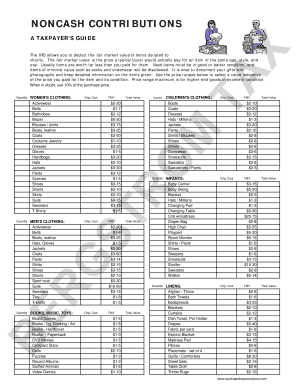

41 non cash charitable contributions worksheet

goodwillnne.org › donate › donation-value-guideDonation value guide - Goodwill NNE Furniture should be in gently-used, non-broken condition. Fabric should be free of stains and holes. Coffee Table. $15 – $100. Dresser. $20 – $80. End Table. $10 ... itsdeductibleonline.intuit.comTax Deductions - ItsDeductible Existing Customers. Sign In. New Customers. Create New Account. Your account allows you to access your information year-round to add or edit your deductions.

2021 Publication 526 - IRS tax forms cash contributions you made for relief efforts for 2019 and 2020 disasters are not subject to the 60% limit for cash contributions. See Qualified contributions for relief efforts for 2018 and 2019 disasters, later. Virginia Beach Strong Act. A special rule ap-plies to cash contributions made on or after May 31, 2019, and before June 1, 2021 ...

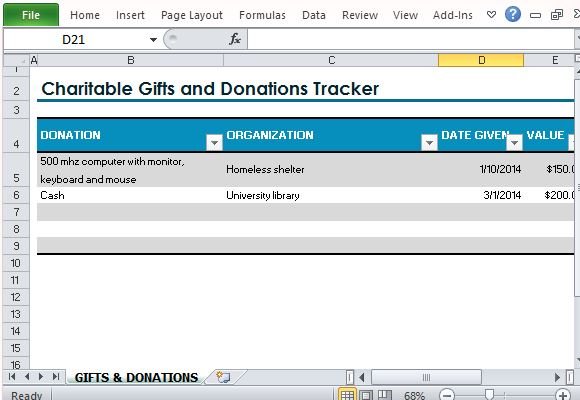

Non cash charitable contributions worksheet

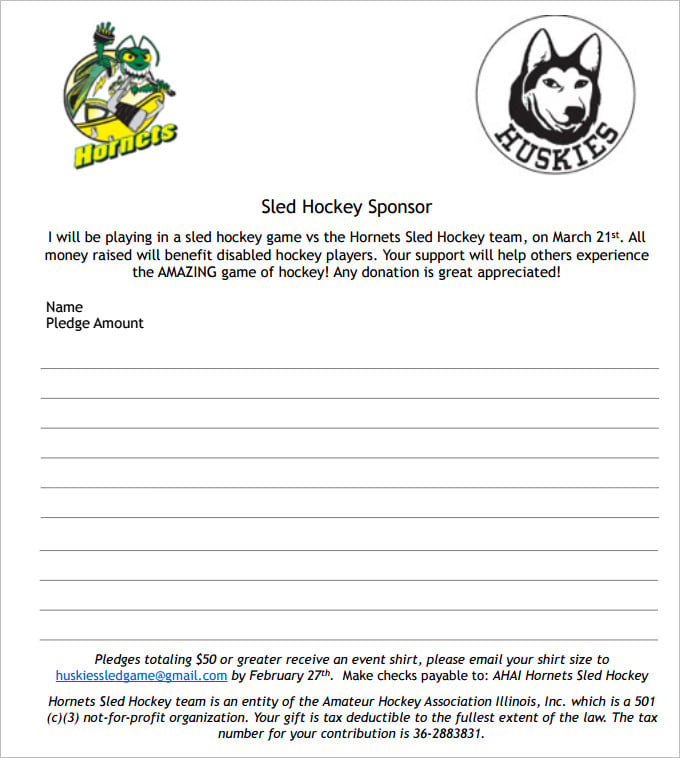

Donation value guide - Goodwill NNE Furniture should be in gently-used, non-broken condition. Fabric should be free of stains and holes. Coffee Table. $15 – $100. Dresser. $20 – $80. End Table. $10 – $75. Kitchen Set. $35 – $135. Lamp, Floor. $8 – $34. Lamp, Table. $3 – $20. Sofa. $40 – $395. Stuffed Chair. $10 – $75. Computer Equipment. › pub › irs-pdfTax Guide for Churches & Religious Organizations - IRS tax forms generally eligible to receive tax-deductible contributions. To qualify for tax-exempt status, the organization must meet the following requirements (covered in greater detail throughout this publication): n the organization must be organized and operated exclusively for religious, educational, scientific or other charitable purposes; Claiming Parents as Dependents | H&R Block There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials, which may be non-refundable. State restrictions may apply. The Income Tax Course consists of 62 hours of instruction at the federal level, 68 hours of instruction in Maryland, 80 hours of instruction in California, and 81 hours of instruction in Oregon.

Non cash charitable contributions worksheet. › formsForms & Applications | Charles Schwab Schwab Charitable is the name used for the combined programs and services of Schwab Charitable Fund, an independent nonprofit organization. Schwab Charitable Fund has entered into service agreements with certain affiliates of The Charles Schwab Corporation. SEP IRA - Simplified Employee Pension Plan | Fidelity Earnings are tax-deferred and contributions are tax-deductible. Who contributes: Funded by employer contributions. Contribution amounts: Must be made by the employer and can vary each year between 0% and 25% of compensation (maximum $58,000 for 2021 and $61,000 for 2022). Each eligible employee must receive the same percentage. Withdrawals Tax-Free Savings Account (TFSA), Guide for Individuals Is this guide for you? This guide is for individuals who have opened or who are considering opening a tax-free savings account (TFSA). It gives general information on this investment opportunity including who is eligible to open a TFSA, what the contribution limits are, possible tax situations, non-resident implications, transfers on marriage or relationship breakdown, what … Tax Guide for Churches & Religious Organizations - IRS tax forms search for organizations that are eligible to receive tax-deductible charitable contributions. Note that not every organization that is eligible to receive tax-deductible contributions is listed on Select Check. For example, churches that have not applied for recognition of tax-exempt status are not included in the publication. Only the parent

› retirement-ira › small-businessSEP IRA - Simplified Employee Pension Plan | Fidelity Earnings are tax-deferred and contributions are tax-deductible. Who contributes: Funded by employer contributions. Contribution amounts: Must be made by the employer and can vary each year between 0% and 25% of compensation (maximum $58,000 for 2021 and $61,000 for 2022). Each eligible employee must receive the same percentage. Withdrawals › en › revenue-agencyTax-Free Savings Account (TFSA), Guide for Individuals For any year in which tax is payable by the holder of a TFSA on contributions made while a non-resident, it is necessary to fill out and send Form RC243, Tax-Free Savings Account (TFSA) Return, and Form RC243-SCH-B, Schedule B – Non-Resident Contributions to a Tax-Free Savings Account (TFSA). Tax Deductions - ItsDeductible Those old clothes are worth more than you think. Get the most of what you're giving. > Learn More › pub › irs-pdf2021 Publication 526 - IRS tax forms cash contributions you made for relief efforts for 2019 and 2020 disasters are not subject to the 60% limit for cash contributions. See Qualified contributions for relief efforts for 2018 and 2019 disasters, later. Virginia Beach Strong Act. A special rule ap-plies to cash contributions made on or after May 31, 2019, and before June 1, 2021 ...

Claiming Parents as Dependents | H&R Block There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials, which may be non-refundable. State restrictions may apply. The Income Tax Course consists of 62 hours of instruction at the federal level, 68 hours of instruction in Maryland, 80 hours of instruction in California, and 81 hours of instruction in Oregon. › pub › irs-pdfTax Guide for Churches & Religious Organizations - IRS tax forms generally eligible to receive tax-deductible contributions. To qualify for tax-exempt status, the organization must meet the following requirements (covered in greater detail throughout this publication): n the organization must be organized and operated exclusively for religious, educational, scientific or other charitable purposes; Donation value guide - Goodwill NNE Furniture should be in gently-used, non-broken condition. Fabric should be free of stains and holes. Coffee Table. $15 – $100. Dresser. $20 – $80. End Table. $10 – $75. Kitchen Set. $35 – $135. Lamp, Floor. $8 – $34. Lamp, Table. $3 – $20. Sofa. $40 – $395. Stuffed Chair. $10 – $75. Computer Equipment.

0 Response to "41 non cash charitable contributions worksheet"

Post a Comment