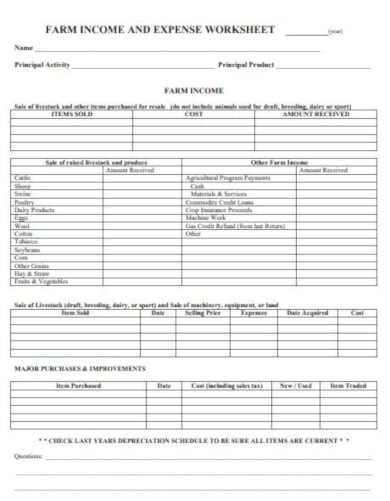

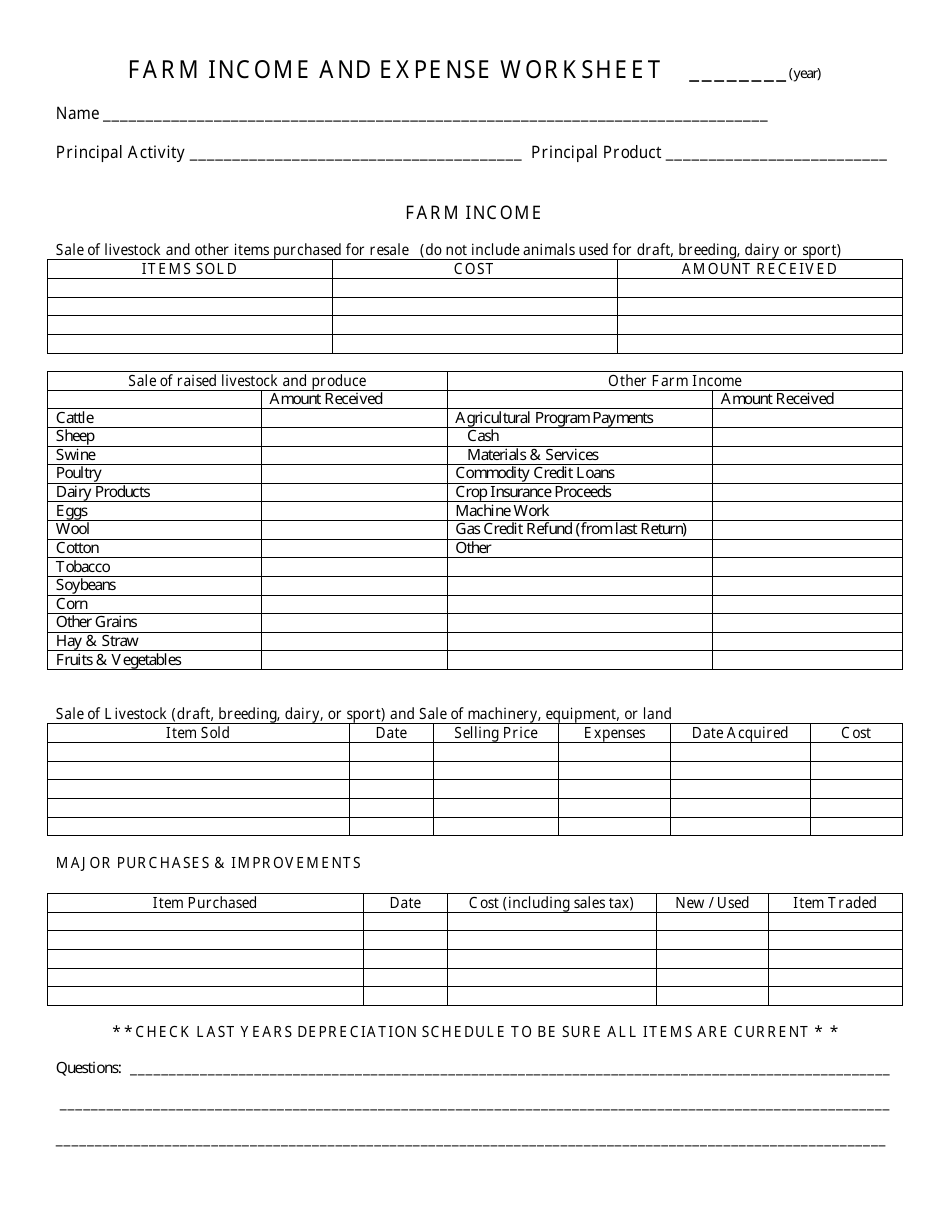

42 farm income and expense worksheet

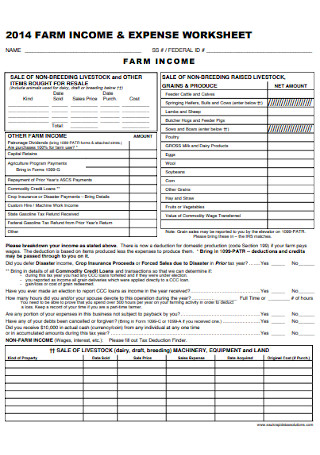

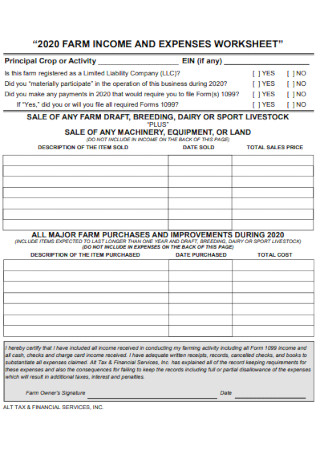

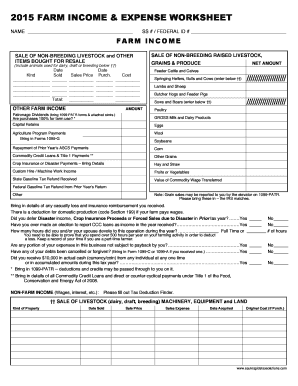

› publications › p523Publication 523 (2021), Selling Your Home | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. PDF Farm Income & Expense Worksheet FARM INCOME & EXPENSE WORKSHEET FARM INCOME & EXPENSE WORKSHEET NAMESS # / FEDERAL ID # FARM EXPENSES LAND, BUILDINGS, BREEDING ANIMAL AND EQUIPMENT PURCHASED(Please bring in purchase agreements.) Date Cost (include Cash Item Date Item Purchased Purchased Sales Tax) to Boot Traded Acquired

Publication 225 (2021), Farmer's Tax Guide | Internal Revenue Service 4835 Farm Rental Income and Expenses. See chapter 16 for information about getting publications and forms. Schedule F (Form 1040) Individuals, trusts, partnerships, S corporations, LLCs taxed as partnerships, and sole members of a domestic LLC engaged in the business of farming report farm income on Schedule F (Form 1040). Use this schedule to ...

Farm income and expense worksheet

PDF 2015 Farm Income & Expense Worksheet 2015 FARM INCOME & EXPENSE WORKSHEET NAME ___________________________________________ SS # / FEDERAL ID # _______________________________________ FARM INCOME Bring in details of any casualty loss and insurance reimbursement you received. There is a deduction for domestic production (code Section 199) if your farm pays wages. › Assets › USDA-FSA-PublicForm Approved OMB No. 0560-0238 (See ... - Farm Service Agency and Non-Farm Debt Payments) 36. Non-Farm Income . 35. Income Taxes 37. Non-Farm Expense . D - CAPITAL . 38. Capital Sales 40. Capital Expenditures 39. Capital Contributions 41. Capital Withdrawals . E - WARNING . I certify that the information provided is true, complete, and correct to the best of my knowledge and is provided in good faith. Publication 525 (2021), Taxable and Nontaxable Income The American Rescue Plan Act of 2021 increased the maximum amount that can be excluded from an employee's income through a dependent care assistance program. For 2021, the amount is increased to $10,500 (previously $5,000). For married filing separate returns, the amount is increased to $5,250 (previously $2,500). See Dependent Care Benefits ...

Farm income and expense worksheet. PDF Farm Income and Expenses Worksheet - Wellspring Tax Service Custom Hire Income received Other Income Total Income: PART II—EXPENSES: Car/Truck: (For actual expense deduction, see Vehicle Expense Worksheet) Year & Make Year & Make Farm Mileage Farm Mileage Personal Mileage Personal Mileage Chemicals Conservation Exp Hired Labor Feed Purchases Employee benefits Fertilizer & Lime May 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site. 2021 Instructions for Schedule C (2021) | Internal Revenue Service For amounts includible in income and deductible as expense under an accrual method, see Pub. 538. To change your accounting method, you must generally file Form 3115. You may also have to make an adjustment to prevent amounts of income or expense from being duplicated or omitted. This is called a section 481(a) adjustment. About Schedule F (Form 1040), Profit or Loss From Farming All Schedule F (Form 1040) Revisions. About Publication 225, Farmer's Tax Guide. About Publication 463, Travel, Entertainment, Gift, and Car Expenses. About Publication 510, Excise Taxes (Including Fuel Tax Credits and Refunds) About Publication 535, Business Expenses. Other Current Products.

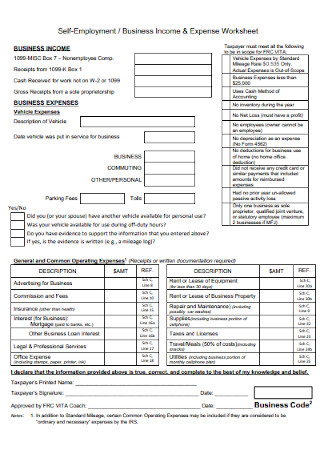

income expense worksheet Farm Expense Spreadsheet Excel Spreadsheet Downloa Farm Expense db-excel.com. spreadsheet farm expense expenses keeping record excel spreadsheets google spreadshee intended db template taxes. 12 Month Profit And Loss Worksheet | Expense | Income Statement . worksheet. Household Budget Worksheet | Kiplinger Work out a proposed household budget by inputting your sources of income and projected expenses into Kiplinger's exclusive worksheet below. You can add and delete rows as necessary to reflect your ... assignmentessays.comAssignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. › publications › p535Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

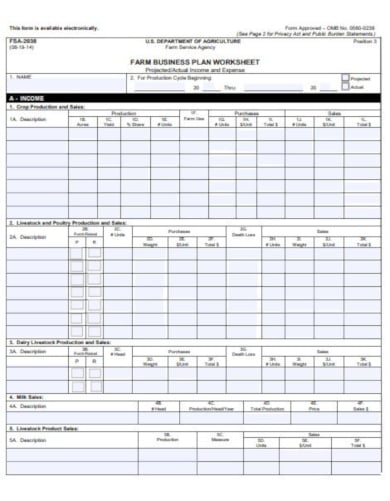

Publication 535 (2021), Business Expenses | Internal Revenue … Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. 12+ Farm Budget Templates - PDF, DOC | Free & Premium Templates A farm budget template is an income and expense sheet template created to manage the accounts of farming operations. It will help you in increasing profits from your farming business, by helping you in organizing your finances in an orderly way and controlling expenses. PDF FARM BUSINESS PLAN WORKSHEET Projected/Actual Income and Expense - USDA FARM BUSINESS PLAN WORKSHEET. Projected/Actual Income and Expense. FSA-2038 (12-31-07) This form is available electronically. 2. For Production Cycle Beginning: ... Income Taxes 37. Non-Farm Expense. D - CAPITAL. 38. Capital Sales 40. Capital Expenditures. A - INCOME (Continued) 33. Total Expenses (Items 11 through 32) 10. Total Income Get Farm Income And Expense Worksheet - US Legal Forms The tips below can help you fill in Farm Income And Expense Worksheet quickly and easily: Open the document in our feature-rich online editor by clicking on Get form. Complete the necessary fields that are marked in yellow. Press the arrow with the inscription Next to move on from field to field. Go to the e-autograph tool to put an electronic ...

Publication 523 (2021), Selling Your Home | Internal Revenue Service Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

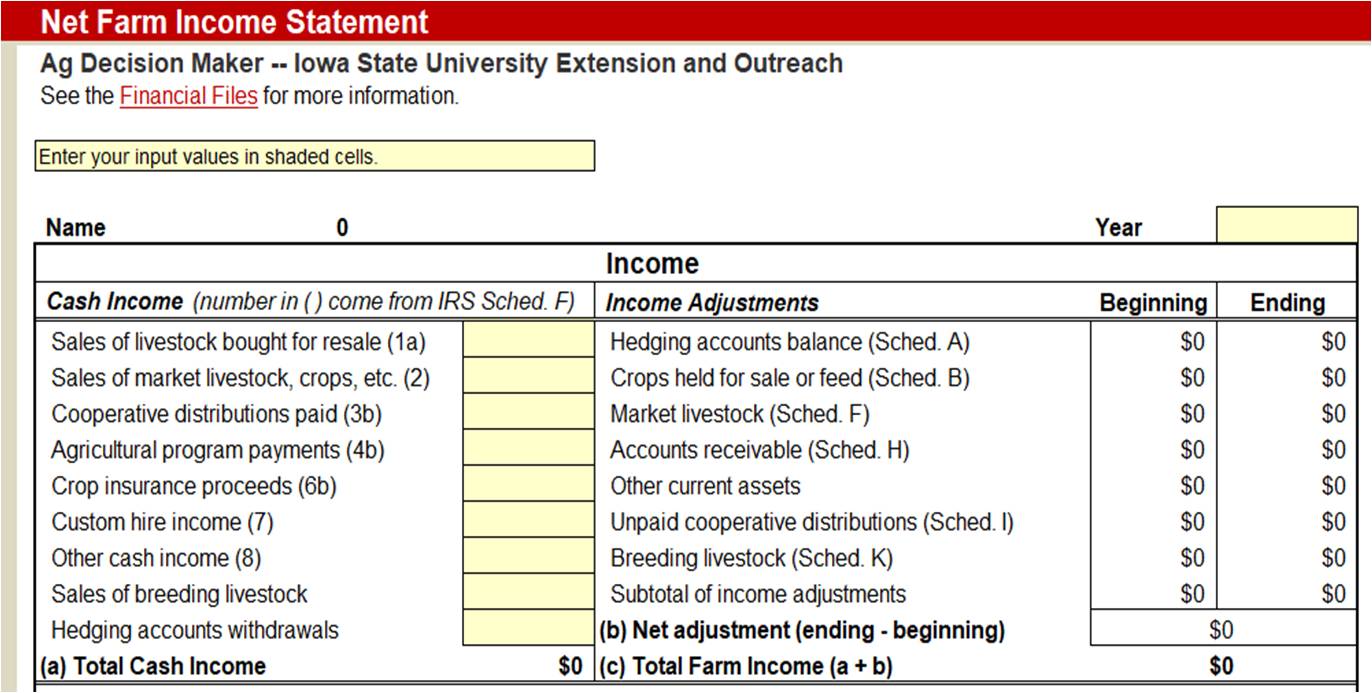

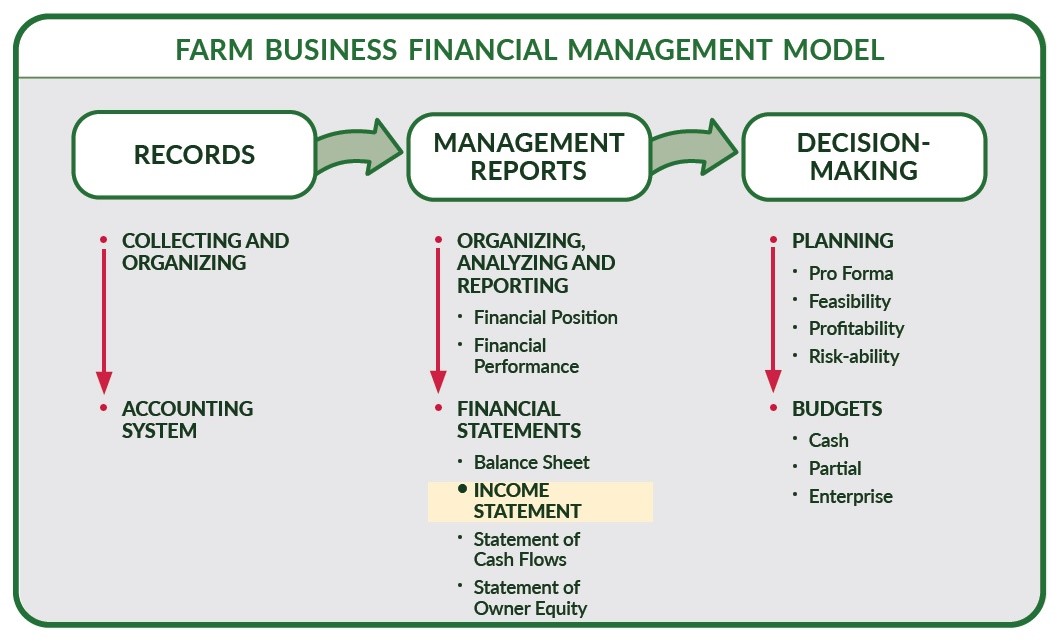

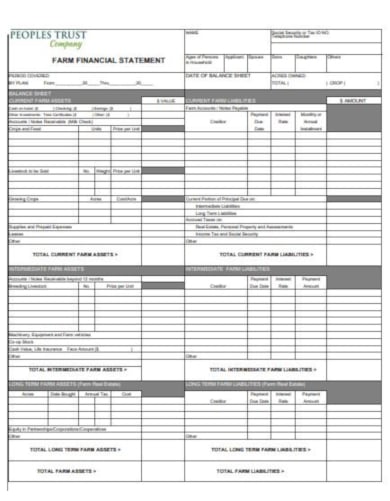

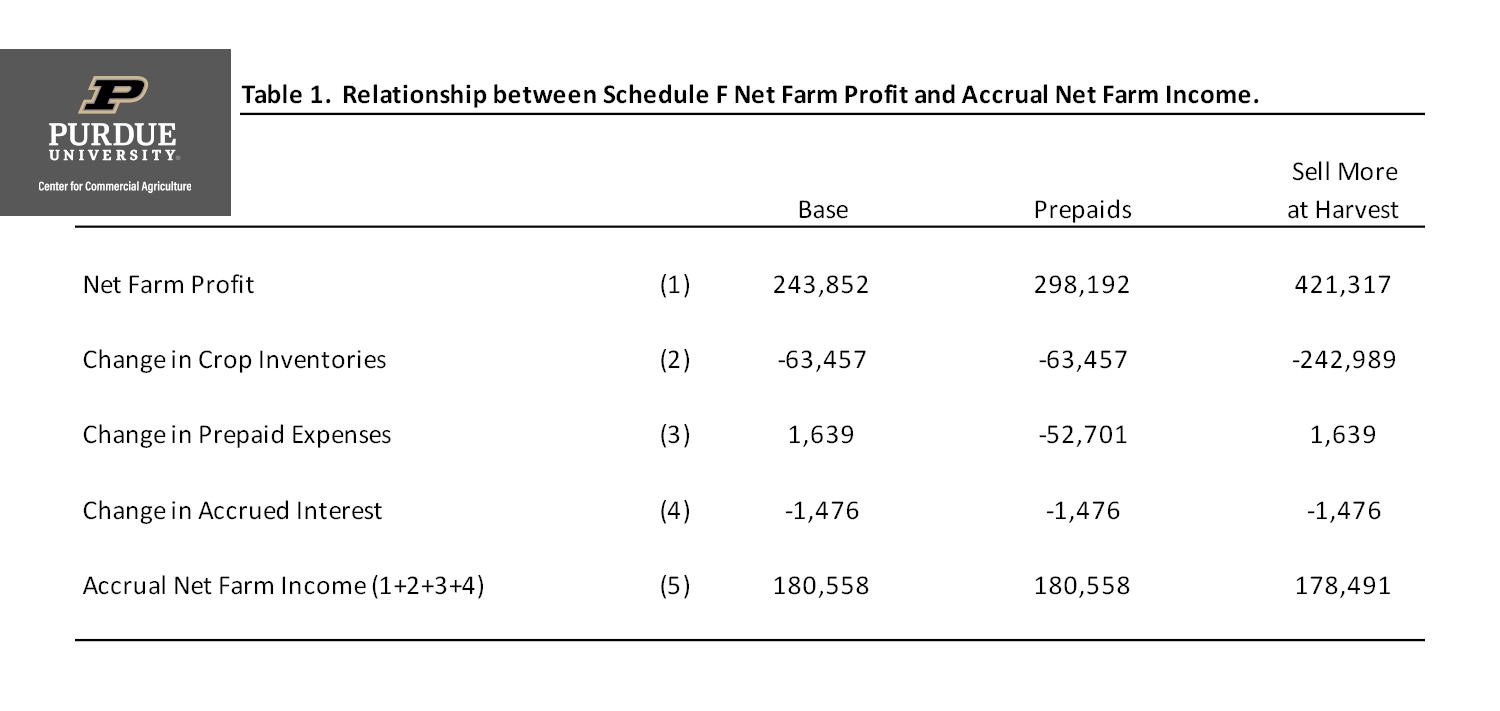

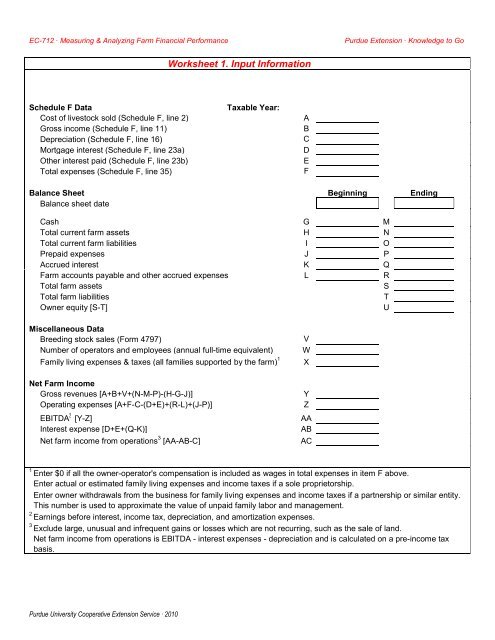

Your Farm Income Statement | Ag Decision Maker - Iowa State University Net Farm Income Subtract interest expense, then add capital gains or subtract capital losses from net farm income from operations to calculate net farm income. ... Worksheet prepares an accrual net income statement from income tax schedules and net worth statements. AG DECISION MAKER; Department of Economics 260 Heady Hall 518 Farm House Lane ...

PDF Schedule F Worksheet - Hickman & Hickman, PLLC Schedule F Worksheet Hickman & Hickman, PLLC. Page 1 Schedule F Worksheet (Farm and/or Farm Rental) Provide all 1099's ... _____ Total Rent Received in 2020: _____ Total Income Received in 2020: Raised Livestock: _____ Total Income Received in 2020: Purchased Livestock: _____ Please indicate totals for any Covid-19 Business Grants/Loans ...

Assignment Essays - Best Custom Writing Services Comparison of Education Advancement Opportunities for Low-Income Rural vs. Urban High School Student. This was exactly what I needed! Thank you so much! Date: May 3rd, 2022. Discipline: Psychology. Order: #117801. Pages: 4. Intimate …

Farm Expense Worksheets - K12 Workbook Worksheets are Farm income and expense work for, Farm income and expense work, Farm income and expense work, Farm income expense work, Farm income expense work, Farm work, Monthly and annual spending plan work, Farm work date funded december 31 2020 farm income. *Click on Open button to open and print to worksheet.

Farm Expenses Worksheet 2021 - CPA Clinics Farm Expenses Worksheet 2021 Prepaid Farm Supplies Prepaid farm supplies include feed, seed, fertilizer, and similar farm supplies that are not used or consumed as of the end of the tax year. A deduction for prepaid farm supplies may be limited to 50% of the total other deductible farm expenses for the year. Real Estate Taxes on Farm Land

› publications › p525Publication 525 (2021), Taxable and Nontaxable Income The American Rescue Plan Act of 2021 increased the maximum amount that can be excluded from an employee's income through a dependent care assistance program. For 2021, the amount is increased to $10,500 (previously $5,000). For married filing separate returns, the amount is increased to $5,250 (previously $2,500). See Dependent Care Benefits ...

Small Business Logbook Expenses Income Tracker Monthly Budget Worksheet Weekly and daily Expense Tracker : Accounting Essentials To Record Income and ...

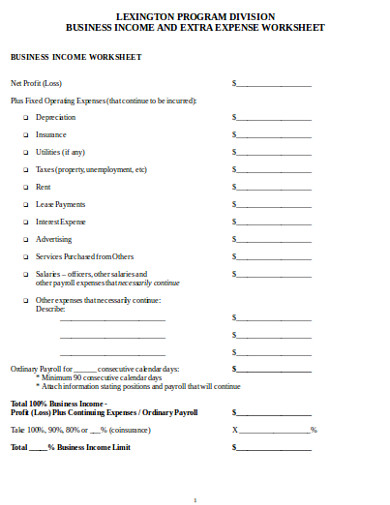

Business Income and Extra Expense Insurance - Travelers Extended business income helps replace that lost income while you get your business activity back to normal levels. You could also experience losses if damage at the premises of your key suppliers disrupts your business. Business income and extra expense for dependent properties coverage can be added to help protect your business during those ...

PDF Farm Income and Expense Worksheet FARM INCOME AND EXPENSE WORKSHEET 1. Livestock (Gross sales)$ 1. Car/Truck Expenses $ 2. Crops 2. Chemicals 3. Patronage Dividends (attach statements) ... Other Farm Income: 10. Insurance- Farm Health 11. Interest: Mortgage Other 12. Labor Hired (wages) Additional Notes: 13. Rent/Lease: Land ...

Work SheetA - NCDHHS Work related child care costs: (Plaintiff work related child care costs) (Defendant work related child care costs) Health Insurance Premium costs: (Plaintiff health insurance premium costs) (Defendant health insurance premium costs) Extraordinary expense: (Plaintiff extraordinary expense)

Form Approved OMB No. 0560-0238 (See Page 2 for ... - Farm … and Non-Farm Debt Payments) 36. Non-Farm Income . 35. Income Taxes 37. Non-Farm Expense . D - CAPITAL . 38. Capital Sales 40. Capital Expenditures 39. Capital Contributions 41. Capital Withdrawals . E - WARNING . I certify that the information provided is true, complete, and correct to the best of my knowledge and is provided in good faith.

› agdm › wholefarmYour Farm Income Statement | Ag Decision Maker Income tax and Social Security tax payments are considered personal expenses and should not be included in the farm income statement, unless the statement is for a farm corporation. Interest paid on all farm loans or contracts is a cash expense, but principal payments are not.

PDF Fayetteville, GA Budget Worksheet Report Budget Worksheet Report Budget Year 2017 Fayetteville, GA. Account Account Description 2017 Board Fund 100 - General Fund REVENUE Department 00000 - Undesignated Licenses and Permits 32.4100 Business License Penalty 500.00 32.4400 Interest on Business Licenses 500.00 Intergovernmental Revenues

DOCX Instructions For FSA-2038 - Farm Service Agency 1 Name Enter the applicant's name. 2 Production Cycle Enter the beginning and ending date of the production cycle and check the appropriate box to indicate if information provided is for projected or actual income and expense. A - Income (Crop Production and Sales) 1A Description Enter a description for each crop produced or sold. 1B Acres

PDF Assisted Living Expense Worksheet - Dogwood Forest living expenses can actually make Dogwood Forest™ Assisted Living the more affordable option. Assisted Living Expense Worksheet Making assisted living even more affordable by considering your financial options: Dogwood Forest™, its affiliated entities, officers, employees, agents or subcontractors, are not tax or financial advisors.

Farm Expense Worksheets - Learny Kids Farm Expense. Displaying top 8 worksheets found for - Farm Expense. Some of the worksheets for this concept are Farm income and expense work for, Farm income and expense work, Farm income and expense work, Farm income expense work, Farm income expense work, Farm work, Monthly and annual spending plan work, Farm work date funded december 31 2020 ...

Saskatchewan Information Guide - Canada.ca Saskatchewan benefits for individuals and families Saskatchewan low-income tax credit. This credit is a non-taxable amount paid to help Saskatchewan residents with low and modest incomes. This amount is combined with the quarterly payments of the federal GST/HST credit.. You do not need to apply for the GST/HST credit or the Saskatchewan low-income tax credit.

› business-income-extra-expenseBusiness Income and Extra Expense Insurance - Travelers Extended business income helps replace that lost income while you get your business activity back to normal levels. You could also experience losses if damage at the premises of your key suppliers disrupts your business. Business income and extra expense for dependent properties coverage can be added to help protect your business during those ...

Publication 525 (2021), Taxable and Nontaxable Income The American Rescue Plan Act of 2021 increased the maximum amount that can be excluded from an employee's income through a dependent care assistance program. For 2021, the amount is increased to $10,500 (previously $5,000). For married filing separate returns, the amount is increased to $5,250 (previously $2,500). See Dependent Care Benefits ...

› Assets › USDA-FSA-PublicForm Approved OMB No. 0560-0238 (See ... - Farm Service Agency and Non-Farm Debt Payments) 36. Non-Farm Income . 35. Income Taxes 37. Non-Farm Expense . D - CAPITAL . 38. Capital Sales 40. Capital Expenditures 39. Capital Contributions 41. Capital Withdrawals . E - WARNING . I certify that the information provided is true, complete, and correct to the best of my knowledge and is provided in good faith.

PDF 2015 Farm Income & Expense Worksheet 2015 FARM INCOME & EXPENSE WORKSHEET NAME ___________________________________________ SS # / FEDERAL ID # _______________________________________ FARM INCOME Bring in details of any casualty loss and insurance reimbursement you received. There is a deduction for domestic production (code Section 199) if your farm pays wages.

0 Response to "42 farm income and expense worksheet"

Post a Comment