42 itemized deductions worksheet 2015

› tax-center › filingClaiming A Charitable Donation Without A Receipt | H&R Block Type of federal return filed is based on your personal tax situation and IRS rules. Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income (including wages, salaries, tips, some scholarships/grants, and unemployment compensation). › tax-deduction › federal-standardIRS Federal Standard Tax Deductions For 2021 and 2022 - e-File Apr 11, 2022 · IRS Standard Tax Deductions 2021, 2022. by Annie Spratt. These standard deductions will be applied by tax year for your IRS and state return(s) respectively. As a result of the latest tax reform, the standard deductions have increased significantly, however many other deductions got discontinued as a result of the same tax reform.

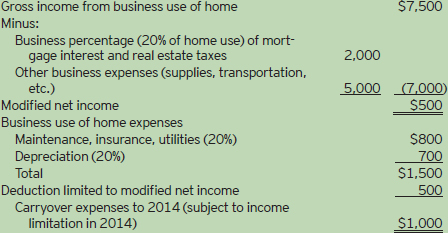

turbotax.intuit.com › tax-tips › small-businessThe Home Office Deduction - TurboTax Tax Tips & Videos Jul 18, 2022 · Prior to the Tax Cuts and Job Act (TCJA) passed in 2017, employees could deduct unreimbursed employee business expenses including the home office deduction. However, for tax years 2018 through 2025, these deductions for employee business expenses have been eliminated. If I'm self-employed, should I take the home office tax deduction?

Itemized deductions worksheet 2015

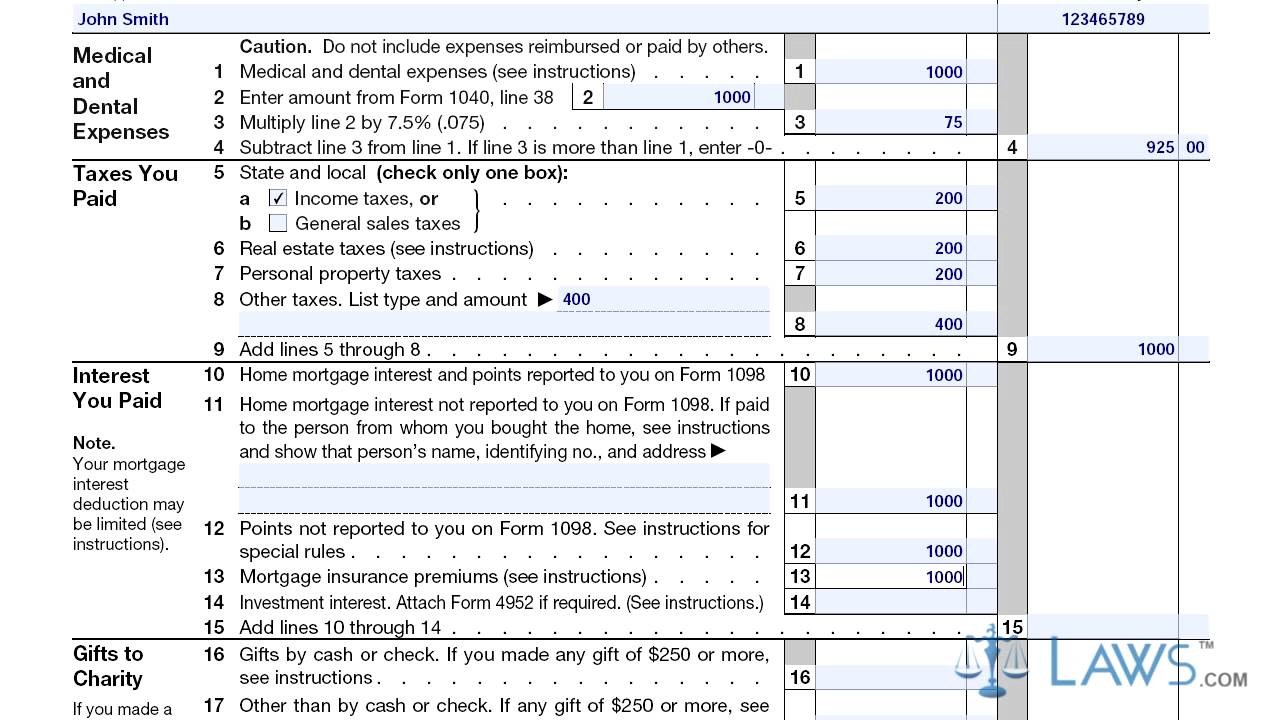

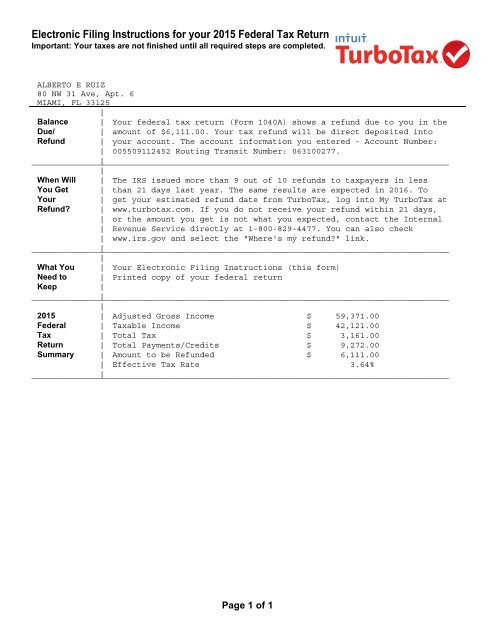

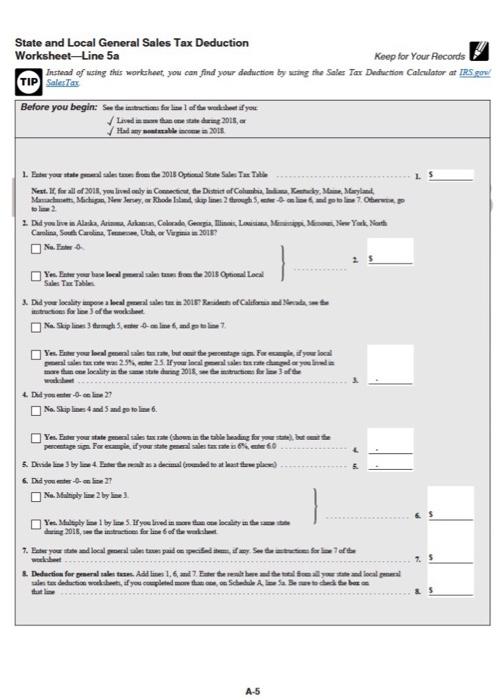

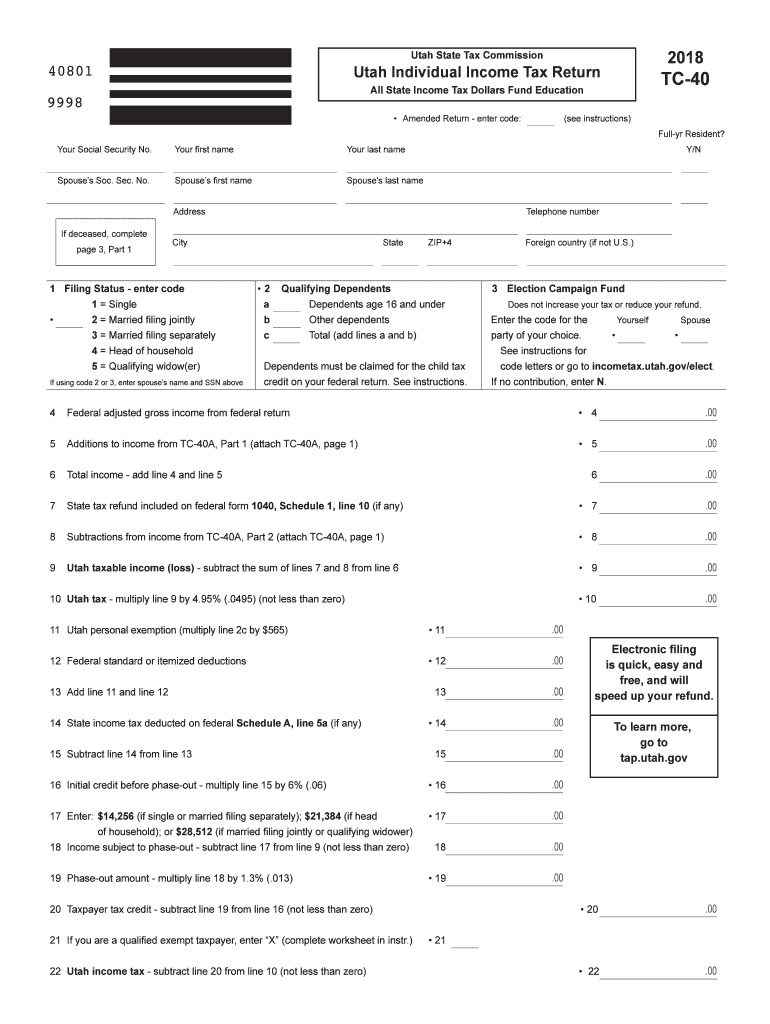

› individual › individual-income-taxIndividual Income Tax Forms | DOR Electronic filing of your tax return and choosing direct deposit may speed up your refund by 8 weeks! › pub › irs-pdf2021 Instructions for Schedule A - IRS tax forms 2021 Instructions for Schedule AItemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses, and › pub › irs-pdf2021 Schedule A (Form 1040) - IRS tax forms Itemized Deductions . 16. Other—from list in instructions. List type and amount .

Itemized deductions worksheet 2015. apps.irs.gov › app › picklistPrior Year Products - IRS tax forms Itemized Deductions 2015 Inst 1040 (Schedule A) Instructions for Schedule A (Form 1040), Itemized Deductions 2014 Form 1040 (Schedule A) Itemized Deductions ... › pub › irs-pdf2021 Schedule A (Form 1040) - IRS tax forms Itemized Deductions . 16. Other—from list in instructions. List type and amount . › pub › irs-pdf2021 Instructions for Schedule A - IRS tax forms 2021 Instructions for Schedule AItemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses, and › individual › individual-income-taxIndividual Income Tax Forms | DOR Electronic filing of your tax return and choosing direct deposit may speed up your refund by 8 weeks!

0 Response to "42 itemized deductions worksheet 2015"

Post a Comment