43 car and truck expenses worksheet

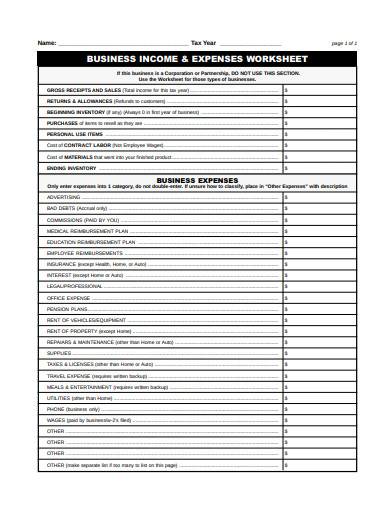

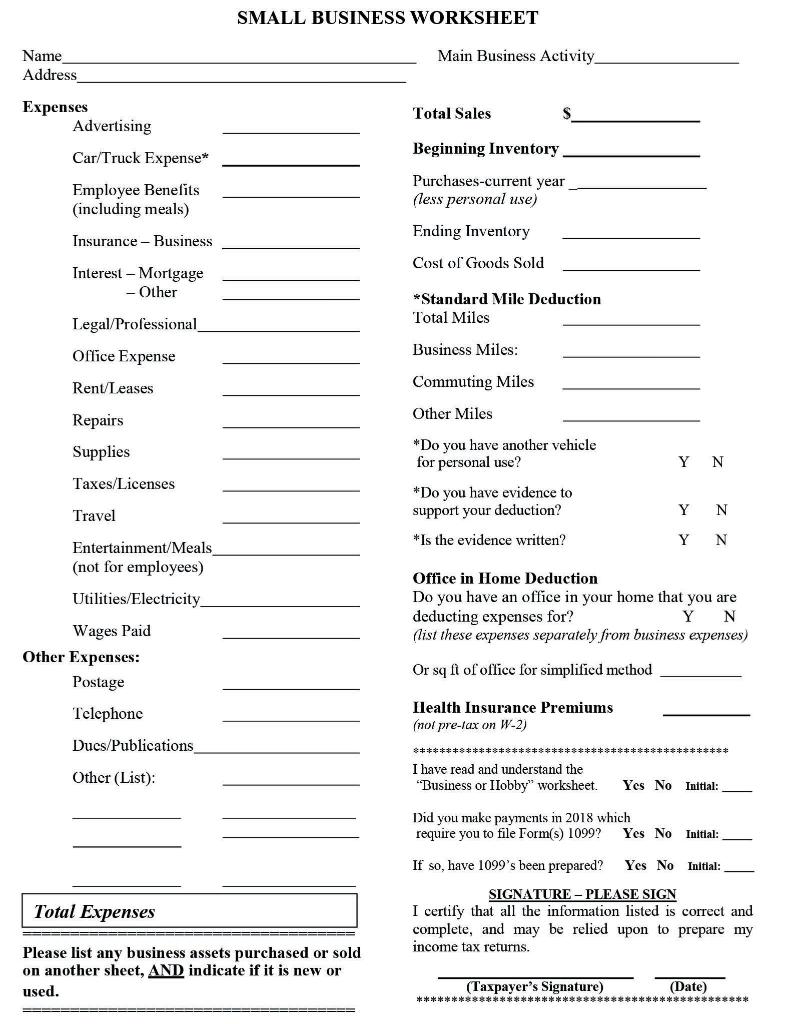

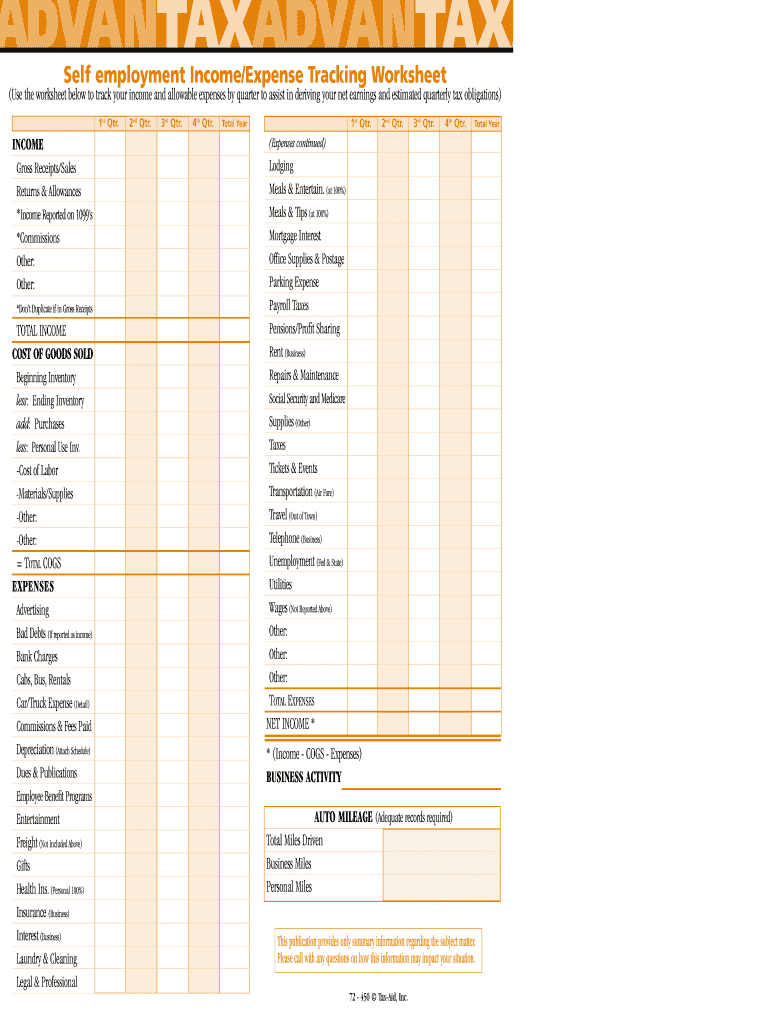

PDF Car and truck expenses worksheet 2019 - nslogisticservice.com Car and truck expenses worksheet 2019 Below is a list of scarce program C and a brief description of each: car and truck expenses: ã, there are two methods that you can use to deduce vehicle expenses, the standard mileage rate or current expenses . You can only use a vehicle method. To use the standard mileage speed, go to the car and truck ... Car and Truck Expense Deduction Reminders - IRS Expenses related to travel away from home overnight are travel expenses. These expenses are discussed in Chapter One of Publication 463, "Travel, Entertainment, Gift, and Car Expenses." However, if a taxpayer uses a car while traveling away from home overnight on business, the rules for claiming car or truck expenses are the same as stated ...

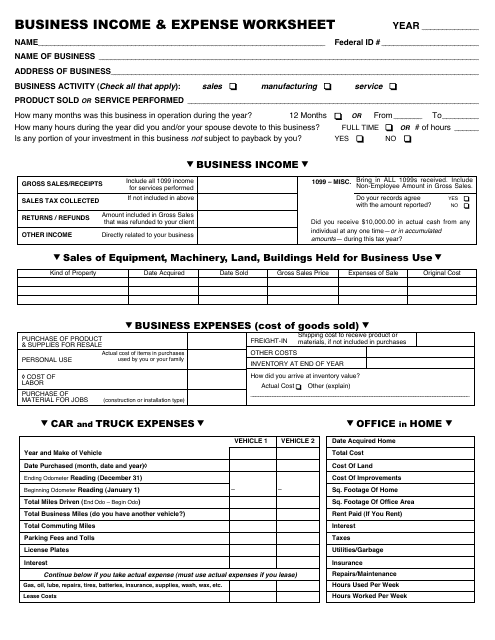

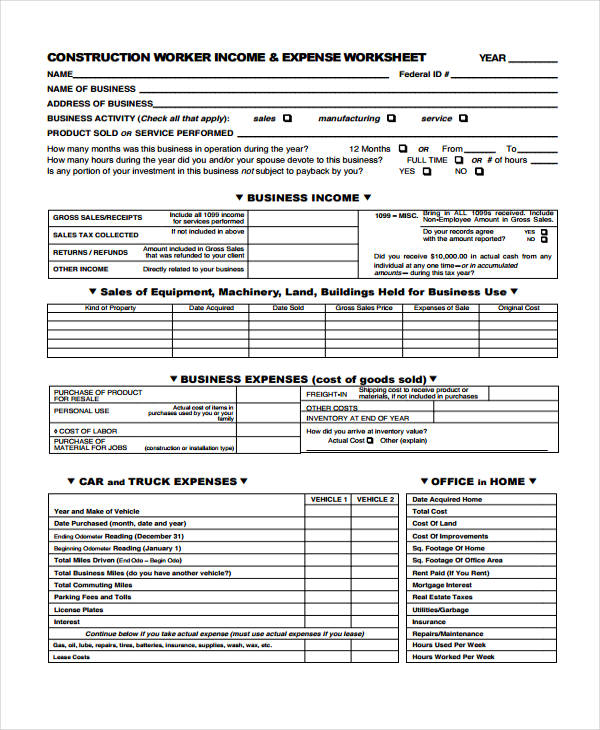

PDF Trucker'S Income & Expense Worksheet &$/,)251,$ 7$; %287,48( Year TRUCKER'S INCOME & EXPENSE WORKSHEET YEAR ----- ... TRUCK RENTAL FEES OTHER INCOME FULL TIME OR # of hours ---YES NO 1099-MISC. Bring in ALL 1099s received. Do your records agree with YESQ ... T CAR and TRUCK EXPENSES (personal vehicle) T VEIDCLEl Year and Make of Vehicle

Car and truck expenses worksheet

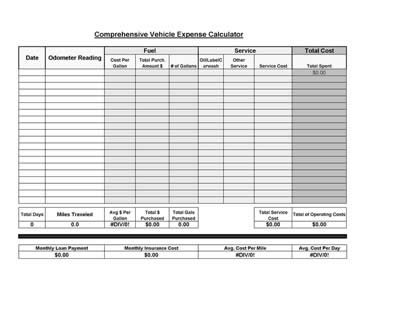

PDF VEHICLE EXPENSE WORKSHEET - Beacon Tax Services VEHICLE EXPENSE WORKSHEET (If claiming multiple vehicles, use a separate sheet for each) Required for all claims: • Do you have any other vehicle available for personal use? Yes No • Do you have written mileage records to support your deduction? Yes No car and truck expenses worksheet 27 Car And Truck Expenses Worksheet - Worksheet Resource Plans starless-suite.blogspot.com. schedule template excel spreadsheet expenses worksheet costing project truck cost within luxury construction monthly budget templates student spreadshee expense google. Car And Truck Expenses Worksheet What expenses can I list on my Schedule C? - Support Click the Listed Property Information tab and select your vehicle type from the drop-down list. Enter your mileage and your actual expenses here. Actual Car Expenses include: Depreciation, License and Registration, Gas and Oil, Tolls and Parking fees, Lease Payments, Insurance, Garage Rent and Repairs and Tires.

Car and truck expenses worksheet. PDF 2021 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET - pdvcpa.com Title: 2021 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET.xlsx Author: mvoytovich Created Date: 2/8/2022 2:19:28 PM PDF TRUCKER'S INCOME & EXPENSE WORKSHEET - Cameron Tax Services Truck loans Equipment loans Business only credit card LEGAL & PROFESSIONAL: Attorney fees for business, accounting fees, bonds, permits, etc. OFFICE EXPENSE: postage, stationery, office supplies, bank charges, pens, faxes, etc. PENSION/PROFIT SHARING: Employees only RENT/LEASE: Truck lease Machinery and equipment Other bus. property, locker fees Knowledge Base Solution - Diagnostic: 40088 - "An amount is ... - CCH To force the printing of Form 4562 attached to Schedule C, use the Depreciation and Depletion Options and Overrides worksheet, Depreciation Options section, Prepare Form 4562 if NOT required field. 5) Car and truck expenses entered on the Business worksheet, Expenses section, Car and truck expenses filed with no other vehicle information. 1040 - Auto Expenses (K1, ScheduleC, ScheduleE, ScheduleF) - Drake Software The above steps will calculate the auto expenses based on the entries made. The following entry points may be used to adjust the calculations or in lieu of the above; see notes for details. Screen C, line 9 Adjusts the calculation, however, this entry also requires a corresponding AUTO or 4562 screen.

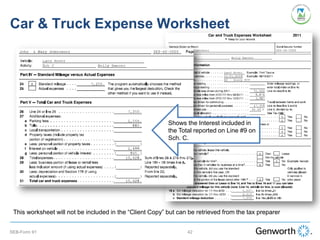

Sch C Wks -- Car & Truck Expenses Worksheet: AMT dep ... - Intuit 1. Delete the vehicle and start over again 2. Add it back in with its original service date. 3. Calculate your estimated depreciation per year based on miles used for business Also try these fixes: Go back to the sale of vehicle and delete any numbers in the AMT section. or Completing the Car and Truck Expenses Worksheet in ... Completing the Total Car and Truck Expenses section This section should be completed for all vehicles. Entries in this section will be used to calculate the actual expenses for the vehicle. Completing the Vehicle Depreciation Information section If you are claiming the standard mileage rate this section can be left blank. PDF VEHICLE EXPENSE WORKSHEET - Pace and Hawley VEHICLE EXPENSE WORKSHEET Pace & Hawley, LLC COMPLETE A SEPARATE WORKSHEET FOR EACH VEHICLE WITH BUSINESS USE ... Taxpayer name: Tax year: Vehicle make: Vehicle model: Vehicle year: Type of vehicle? Auto Truck/Van/SUV Heavy vehicle Other (describe) Date in service: From / / To / / Date of disposition (if applicable) / / YES NO 1. ... Car & Truck Expenses Worksheet: Cost must be entered "schedule C -- Car & Truck Expenses Worksheet: Cost must be entered." Hi everyone, I almost complete my tax return but at the end the program asked me to entered my vehicle cost. There are an empty box next to the question and I need to enter a number before I can file my tax return electronically.

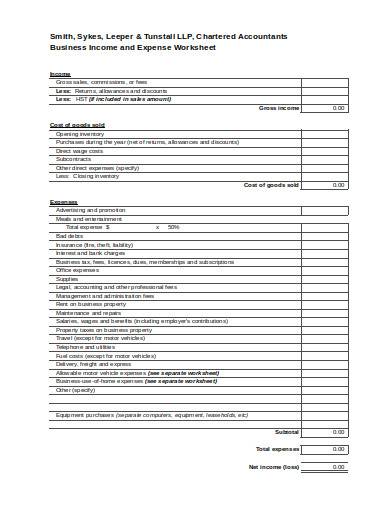

Cash Flow Analysis (Form 1084) - Fannie Mae Meals Expenses: Deduct the portion of business-related meals and entertainment expenses that have been excluded for tax reporting purposes. These expenses, to the full extent they are incurred, are taken into account; therefore, the portion of these expenses that have been excluded must be identified and subtracted from business cash flow. Deducting Auto Expenses - Tax Guide - 1040.com For 2020, the rate is 57.5 cents per mile. With the mileage rate, you won't be able to claim any actual car expenses for the year. You cannot also claim lease payments, fuel, insurance and vehicle registration fees. Also, if you use your vehicle for both business and personal use, you can deduct only the business miles. PDF Car and Truck Expenses Worksheet 201 G - Centro Latino de Capacitacion Car and Truck Expenses Worksheet 201__ G Keep for your records Activity: Part I ' Vehicle Information 1 Make and model of vehicle Example: Ford Taurus 2 Date placed in service Example: 06/15/2016 3 Type of vehicle 4aEnding mileage reading Enter mileage readings, or b Beginning mileage reading enter total miles on line 4c c Total miles vehicle was driven during the year Line 4a less line 4b PDF Vehicle Expense Worksheet - ACT CPA Accounting, Coaching, Taxes Car and Truck Expense Worksheet GENERAL INFO Vehicle 1 Vehicle 2 * Must have to claim standard mileage rate Dates used if not for the time period Description of Vehicle * Date placed in service* Total Business miles* Total Commuting Miles* Other Miles* Total Miles for the period*

Car & Truck Expenses - Drake Software Input car and truck expenses in the Schedule C or the Drake-recommended Auto Screen. Skip to main content Site Map. Menu. Sales: (800) 890-9500 Sign In. Home; Products. Drake Tax ... Learn how to enter expenses for automobiles used in trade or business. Other videos from the same category. Drake Software. 235 East Palmer Street Franklin, NC 28734.

Truck Expenses Worksheet | Spreadsheet template, Tax deductions ... The Car and Truck Expenses Worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate Vehicle Expense Worksheet. Please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. Realtor Tax Deduction Worksheet.

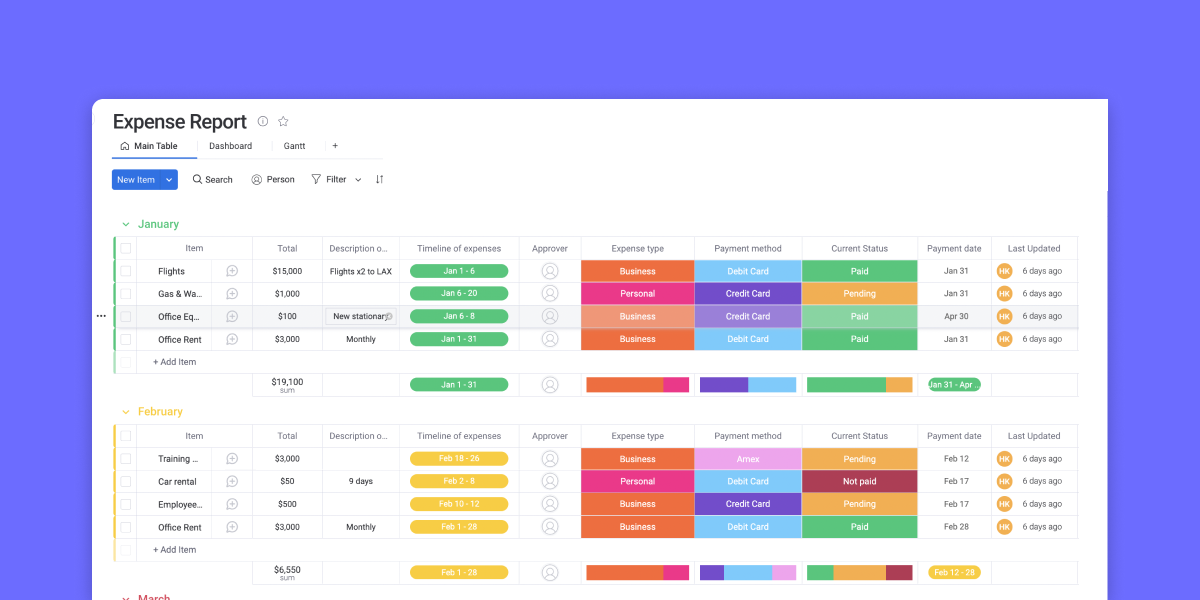

Vehicle Expense Spreadsheet Excel Template (Free) - Software for Enterprise This helps to minimize partial or complete failure, and thus minimize business interruption. It acts as a preemptive insurance policy against catastrophic failures. Excel Vehicle Expense Spreadsheet Template Download (Simply enter your name and email address) Video on how to create the Vehicle Expense Tracker (Part 1)

Turbo tax 2021 Car and Truck Expenses Worksheet showing ... Mar 19, 2022 — Why is turbo tax 2021 Car and Truck Expenses Worksheet showing 0.58 cents per mile when IRS.gov is showing 0.56 cents?

Car and Truck Expenses Worksheet 2015 - Genworth 1. Make and model of vehicle. Example: Ford Taurus. 2. Date placed in service. Example: 06/15/2015. 3. Type of vehicle. 4 a Ending mileage reading.2 pages

What does this mean? Car and Truck Expenses Worksheet Jun 1, 2019 — Car and Truck Expenses Worksheet: Use for hire? ... It means, "Are your cars rented out to other people or are you a taxi type service?".

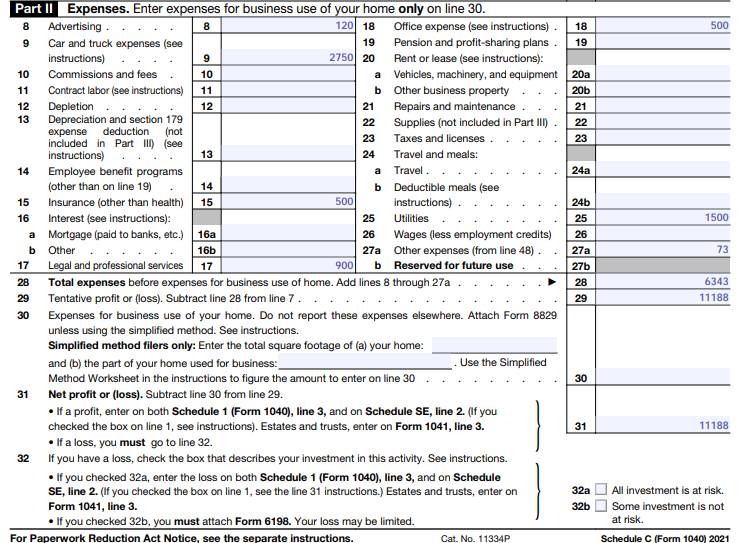

2021 Instructions for Schedule C (2021) | Internal Revenue Service Also, use Schedule C to report (a) wages and expenses you had as a statutory employee, (b) income and deductions of certain qualified joint ventures, and (c) certain amounts shown on a Form 1099, such as Form 1099-MISC, Form 1099-NEC, and Form 1099-K. See the instructions on your Form 1099 for more information about what to report on Schedule C.

car and truck expenses worksheet says Line 51 "depreciation ... Feb 21, 2022 — Solved: I'm getting an error in TurboTax on car and truck expenses worksheet that says Line 51 "depreciation allowed or allowable" and Line ...

PDF Car and Truck Expenses Worksheet (Complete for all vehicles) - ARAI, CPA Car and Truck Expenses Worksheet (Complete for all vehicles) 1 Make and model of vehicle 2 Date placed in service 3 Type of vehicle 4a Ending mileage reading b Beginning mileage reading cTotal miles for the year

Deducting Business Vehicle Expenses | H&R Block $19,500 for trucks or vans; This applies to leases beginning in 2021. For tables with lease-inclusion amounts, see Publication 463: Travel, Entertainment and Gift Expenses at . You can't use the standard mileage rate if you: Used the actual expenses method in the first year you placed the car in service

PDF NEW CLIENT Car And Truck Expenses ORG18 (Employees use ORG17 ORG19 ACTUAL EXPENSES Vehicle 1 Vehicle 2 Vehicle 3 8Gasoline, oil, repairs, insurance, etc ........................................ 9Vehicle registration fee (excluding property tax) .......................... 10Vehicle lease or rental fee.....................................................

Car and Truck Expenses Worksheet Line 9 - TurboTax Support Feb 17, 2020 — Car and Truck Expenses Worksheet Line 9. This should be a simple calculated percentage, but it has the wrong number.

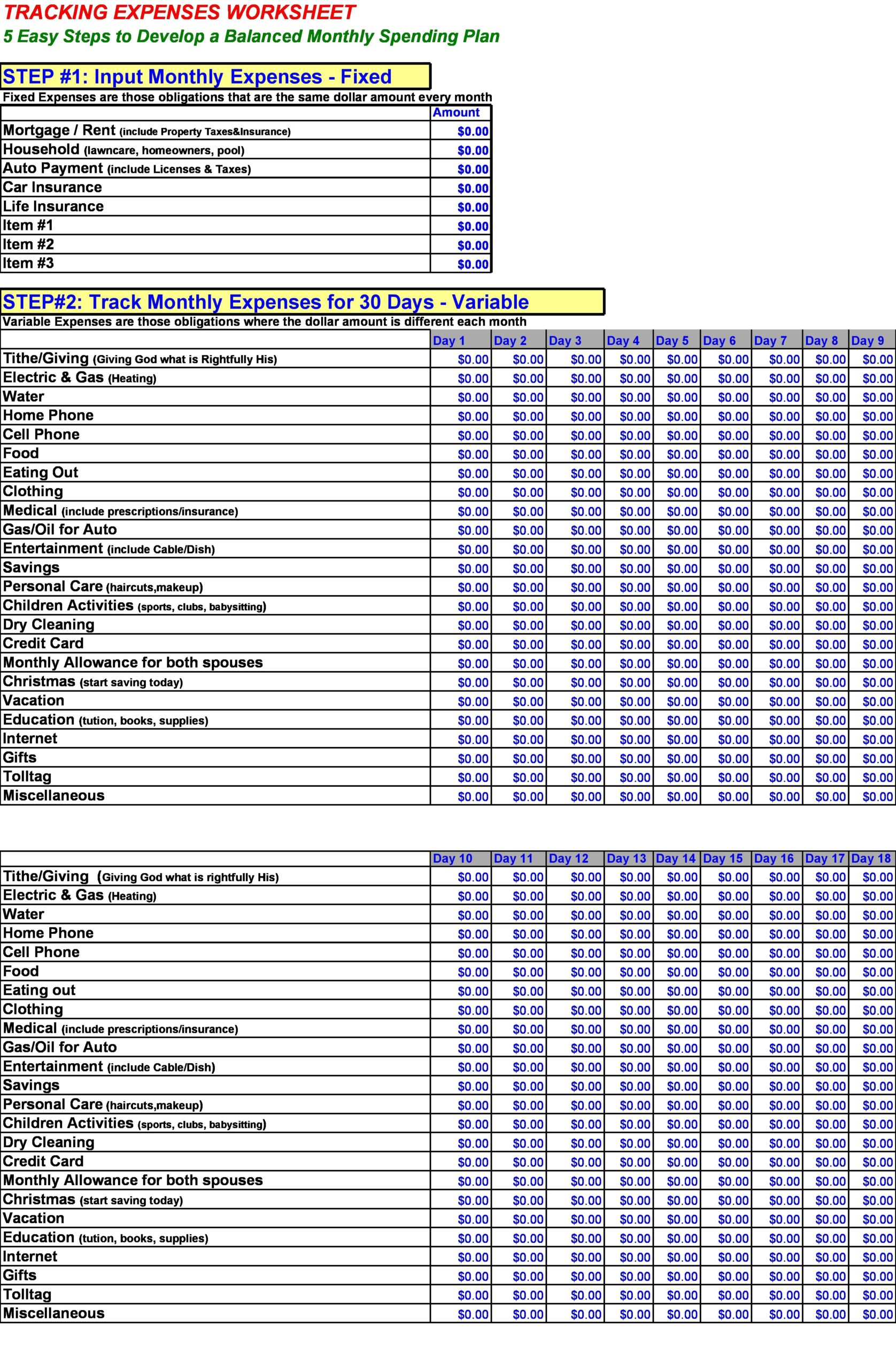

Small Business Logbook Expenses Income Tracker Monthly Budget Worksheet Weekly and daily Expense Tracker : Accounting Essentials To Record Income and ...

Car and Truck Expense Worksheet - Intuit Car and Truck Expense Worksheet cginetto Level 2 03-07-2021 09:38 AM Jump to solution The worksheet will not permit an entry for personal miles. Instead, it adds up business and commuting and then come up with a negative figure where other personal miles is supposed to be. What's wrong with the software now? Solved! Go to Solution. Labels

PDF 2020 Tax Year Car and Truck Expense Worksheet - pdvcpa.com Title: 2020 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET.xlsx Author: jodi Created Date: 1/29/2021 8:33:36 AM

TurboTax Car and Truck Expense Bug: How-To Fix Editing ... - YouTube How to only delete the Car and Truck expenses section form and do that section over - it would not let me make any changes otherwise. To delete: go to the Forms section, on your top toolbar. Then...

Tax-Deductible Car and Truck Expenses - The Balance Small Business You have two options for deducting car and truck expenses. The first is using your actual expenses, which include parking fees and tolls, vehicle registration fees, personal property tax on the vehicle, lease and rental expenses, insurance, fuel and gasoline, repairs including oil changes, tires, and other routine maintenance, and depreciation. 6

What expenses can I list on my Schedule C? - Support Click the Listed Property Information tab and select your vehicle type from the drop-down list. Enter your mileage and your actual expenses here. Actual Car Expenses include: Depreciation, License and Registration, Gas and Oil, Tolls and Parking fees, Lease Payments, Insurance, Garage Rent and Repairs and Tires.

car and truck expenses worksheet 27 Car And Truck Expenses Worksheet - Worksheet Resource Plans starless-suite.blogspot.com. schedule template excel spreadsheet expenses worksheet costing project truck cost within luxury construction monthly budget templates student spreadshee expense google. Car And Truck Expenses Worksheet

PDF VEHICLE EXPENSE WORKSHEET - Beacon Tax Services VEHICLE EXPENSE WORKSHEET (If claiming multiple vehicles, use a separate sheet for each) Required for all claims: • Do you have any other vehicle available for personal use? Yes No • Do you have written mileage records to support your deduction? Yes No

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

0 Response to "43 car and truck expenses worksheet"

Post a Comment