43 government spending worksheet answers

Government Spending - Nearpod Government Spending. Students will learn about the federal budget, how it's determined, and reasons why people disagree on how it should be balanced. Fiscal Policy Tools: Government Spending and Taxes - Quiz & Worksheet Government spending Recession Fiscal policy Skills Practiced This quiz and worksheet allow students to test the following skills: Making connections - use understanding of the concept of aggregate...

PDF Chapter 14: Taxes and Government Spending Section 1 - Mr. Brook's website Government's Authority to Tax •We authorize the federal government, through the Constitution and our elected representatives in Congress, to raise money in the form of taxes. -Taxation is the primary way that the government collects money. Taxes give the government the money it needs to operate.

Government spending worksheet answers

Icivics Government Spending Answers 26 Mar 2022 — trabalha57141.blogspot.com › 2022/03/43-government-spending43 government spending worksheet answers - Worksheet. Free Event Budget Templates Smartsheet Jan 18, 2017 · An event budget spreadsheet or worksheet can help you track event expenditures, such as venue rentals, refreshments for attendees, marketing and advertising costs, and travel fees. You can also use it to track incomes, such as ticket sales, vendor payments, merchandise sales, and advertising revenue. Government Spending - Definition, Sources, and Purposes Government spending is financed primarily through two sources: 1. Tax collections by the government. 2. Government borrowing. Public spending enables governments to produce goods and services or purchase goods and services that are needed to fulfill the government's social and economic objectives. Over the years, we've seen significant ...

Government spending worksheet answers. PDF Monetary and Fiscal Policy Worksheet #1 - ECONOMICS 1. The rate of inflation has increased by 6.8% over the last year. The U.S. Government wonders what it can do to help improve this situation. a. Should the government use Fiscal or Monetary policies? b. Should the government use expansionary or contractionary policies? c. List the expansionary or contractionary policies the government should use. PDF Chapter 14 taxes and government spending worksheet answers key free Checkpoint Answer: because businesses can take many deductions. The government cannot tax exports, only imports. Taxable income is a person's total income minus exemptions and deductions. 53 State Budgets Governments plan their spending by creating a budget.The federal government has one budget while state governments have two budgets. Economics MCQ | Multiple Choice Questions and Answers Aug 14, 2021 · Economics MCQ Model Papers available here in the PDF forms. Eligible & Interested candidates can download the economics multiple choice questions and answers pdf Last Ten Years Question Papers just by tapping on the direct links given below. Taxes And Government Spending Worksheets & Teaching Resources | TpT HelpingHistory. $1.75. Zip. High School Economics Taxes & Government Spending Study Guide & Test with KEY includes a study guide with 40 questions and answer key and a 20 question test with answer key. Both are fully editable to suit your needs.Please email me with any questions at HelpingHistory@yahoo.comTERMS OF USE.

PDF CHAPTER 14 Government Revenue and Spending - Weebly KEY CONCEPTS Governments provide certain public goods that generally are not provided by the market, such as street lighting, highways, law enforcement, and the court system. Government also provides aid for people in need. Where does the money come from to pay for such goods and services? The most important source is taxes. Study 15 Terms | ECON - Worksheet -... Flashcards | Quizlet ECON - Worksheet - Chapter 14.1 - Government Revenue & Spending - Section 1 - How Taxes Work Learn with flashcards, games, and more — for free. Economics Chapter 10: The Economics of Government Spending - Quizlet a line-item budget expenditure that circumvents normal budget proceduea and benefits a small number of people or businesses. public sector. the part of the government made up of local, state, and federal governments. private sector. the part of the economy made up of private individuals and businesses. transfer payment. Quiz & Worksheet - Government Spending & Crowding Out Private ... When the government receives more than it spends during the year. 2. Which of the following is an example of a budget surplus? When government spending is $100,000,000 and tax receipts are...

MarketWatch: Stock Market News - Financial News - MarketWatch MarketWatch: Stock Market News - Financial News - MarketWatch Icivics Government Spending Answers - Brave Words & Bloody Knuckles Where To Download Icivics Government Spending Answers worksheet is an asso04. ANSWER KEY TO WORKSHEET. View and compare unit,4,worksheet,9,checks,AND,balances,answers on Yahoo Finance. 1. Ww1 dbq answers - fendn.de spending a lot of time campaigning during the last year of the term. If the president has already served a second term, TED Talks Listening Worksheets / TED Talks listening Lessons This reading text is about tax evasion and tax avoidance. The writer discusses the methods some MNCs and rich individuals use to reduce or avoid paying tax and puts forward some suggestions to mitigate this issue The summary writing task consists of a note-taking worksheet, a summary writing task, critical thinking questions, sample notes, a sample summary and sample critical thinking answers.. government spending answer key - northrichlandhillsdentistry Worksheet - IRS tax forms Key Terms public goods and services … Use the table below to answer these questions. GOVERNMENT SPENDING Year Revenue, (in billions of dollars) Spending, (in billions of dollars) 1950 $39 $43 1960 $93.50 $92 1970 $193 $196 1980 $517.10 $591 … Click to visit Is Government Spending Too Easy an Answer?

1040 (2021) | Internal Revenue Service - IRS tax forms Form 1040 and 1040-SR Helpful Hints. Form 1040 and 1040-SR Helpful Hints. For 2021, you will use Form 1040 or, if you were born before January 2, 1957, you have the option to use Form 1040-SR.

PDF WHAT'S IN GDP? - Federal Reserve Bank of Atlanta Government spending A local library purchases new audio books . 4. Net exports or imports A retailer purchases tennis shoes from a manufacturer in China and sells them . 5. Consumption Mother purchases those tennis shoes from the retailer . Write one more example of each of the four components. 6. Answers will vary Consumption . 7. Answers will ...

PDF Teacher's Guide - Theodore Roosevelt High School Government Spending _____1. People agree about how the government should spend its money. _____2. By relying on borrowed money, the government is at risk if people stop lending. _____3. There are negative effects if the government operates at a surplus. _____4. "Balancing the budget" means the government borrows more money than it spends. _____5.

PDF Government Spending and Taxes - Federal Reserve Bank of St. Louis Explain that government spending can be broken down into two very broad cate - gories: 1) government purchases of goods and services and 2) ... Ask students for examples of goods and services provided by the government. (Answers will vary but may include national defense, highways, and national parks.)

5.04 Government Spending Worksheet.docx - Name Government government should spend money. Disagree Disagree T 2. By relying on borrowed money, the government is at risk if people stop lending. F 3. There are negative effects if the government F operates at a surplus. Positive Positive F 4. "Balancing the budget" means the government borrows more money than it spends. Brings in. F 5.

PDF FRED Activity Worksheet Answer Key - EconEdLink also increase so the government can increase their revenue, by doing this incomes of households will fall, which may in turn decrease consumption) 6. Identify and explain some of the benefits a balanced budget would have on taxes, and spending in other categories (healthcare, defense, education, etc.…). (Student answers may vary.

Lesson summary: Fiscal policy (article) | Khan Academy In this lesson summary review and remind yourself of the key terms, calculations, and graphs related to fiscal policy. Topics include how taxes and spending can be used to close an output gap, how to model the effect of a change in taxes or spending using the AD-AS model, and how to calculate the amount of spending or tax change needed to close an output gap.

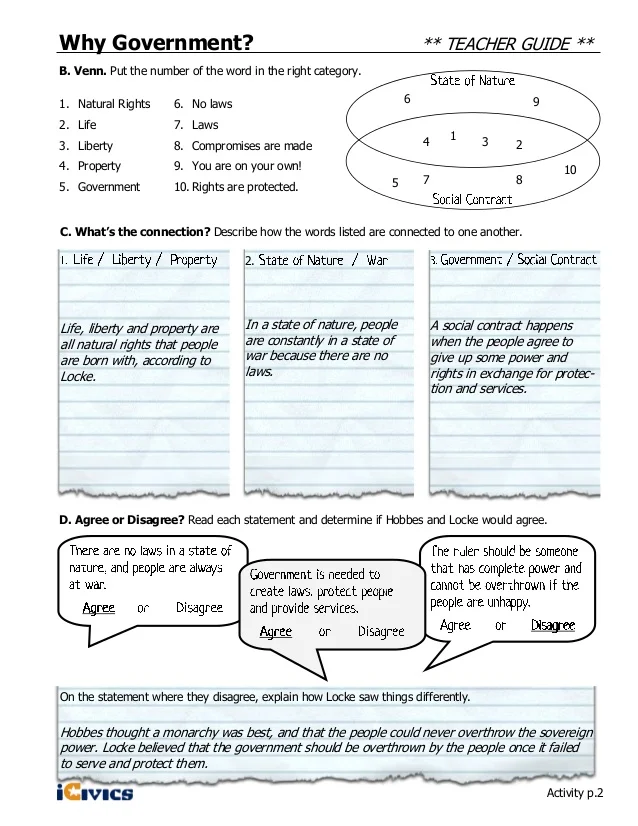

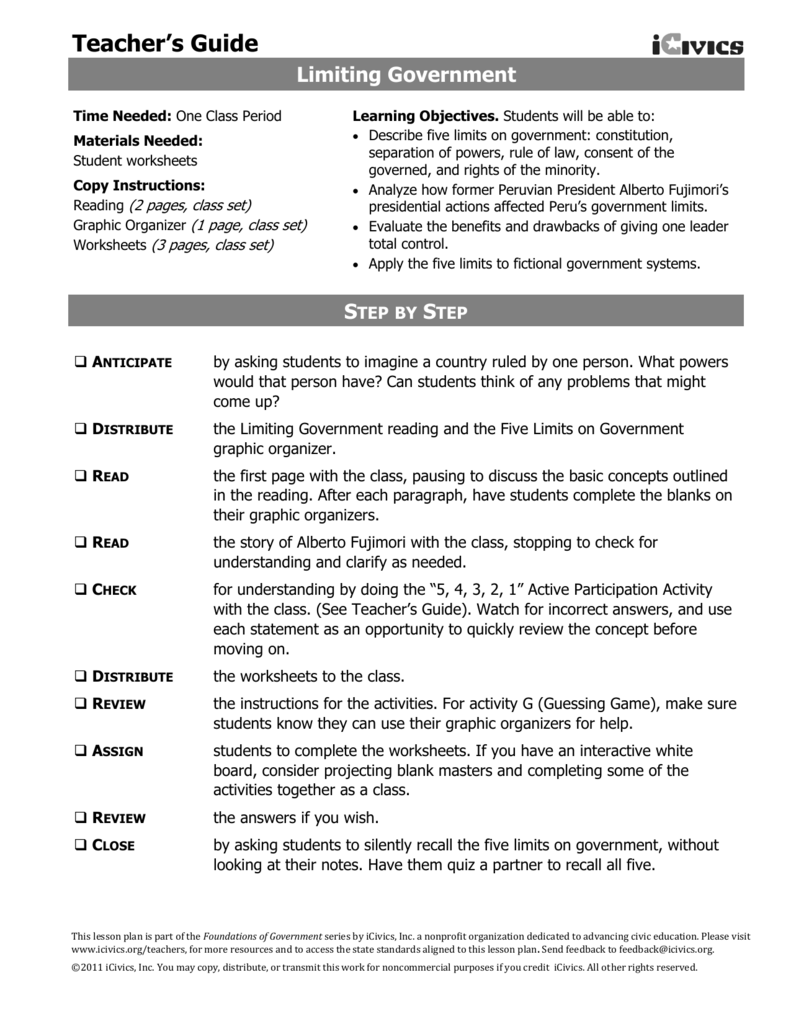

Government Spending STEP BY STEP. the worksheet ... Analyze federal spending data. Make cuts to a fictional personal budget. Identify reasons for people s differing views about government spending. STEP BY STEP ...

PDF Worksheet - IRS tax forms Worksheet Government Spending Theme 1: Your Role as a Taxpayer Lesson 1: Why Pay Taxes? ... Use the table below to answer these questions. GOVERNMENT SPENDING Year Revenue, (in billions of dollars) Spending, (in billions of dollars) 1950 $39 $43 1960 $93.50 $92 ...

Government Spending | Fiscal Policy Lesson Plan | iCivics This lesson tackles a variety of topics related to government spending, including the federal budget, mandatory versus discretionary spending, and government debt. Students learn the difference between a surplus and deficit, the basics of federal budgeting, and the method the government uses to borrow money.

Government Spending Worksheet Please open the file below, complete as directed, save, and submit. 5.04 Government Spending Worksheet.docx · Download 5.04 Government Spending Worksheet.

PDF Is Government Spending Too Easy an Answer? - Harvard University Is Government Spending Too Easy an Answer? By N. GREGORY MANKIW WHEN the Obama administration finally unveils its proposal to get the economy on the road to recovery, the centerpiece is likely to be a huge increase in government spending. But there are ample reasons to doubt whether this is what the economy needs.

government spending worksheet Government Spending Worksheet Answers - Nidecmege nidecmege.blogspot.com ECON 649 Economic Analysis Worksheet 12 - The Government's Finances Answers casestudyhelp.com econ Budget Worksheet For People Who Hate Budgets Daily Spending Government Spending 6th - 12th Grade Lesson Plan | Lesson Planet 6th reviewed

PDF Mathematics Capstone Course Government Spending - Radford University spending. The students will create graphs and answer questions on the worksheet based on the survey data. The students will draw their own conclusions from the data. The assessment for the percent change lesson is a worksheet. The students will be given data about Department of Defense spending and calculate the percent of change for the data.

PDF UNIT 3 Macroeconomics LESSON 8 - Denton ISD 3. Government spending goes up while taxes remain the same. Expansionary. Higher government spending without a corresponding rise in tax receipts increases aggregate demand in the economy. 4. The government reduces the wages of its employees while raising taxes on consumers and businesses. Other government spending remains the same. Contractionary.

PDF Worksheet Solutions Government Spending - IRS tax forms 1. In what years did the government spend more than it collected? 1950, 1970, 1980, 1990 2. Use a calculator to find out how many times larger revenue was in 2000 than in 1950. about 52 times larger 3. Use a calculator to find out how many times greater spending was in 2000 than in 1950. about 42 times greater 4.

0 Response to "43 government spending worksheet answers"

Post a Comment