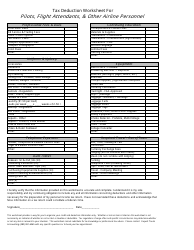

44 tax write off worksheet

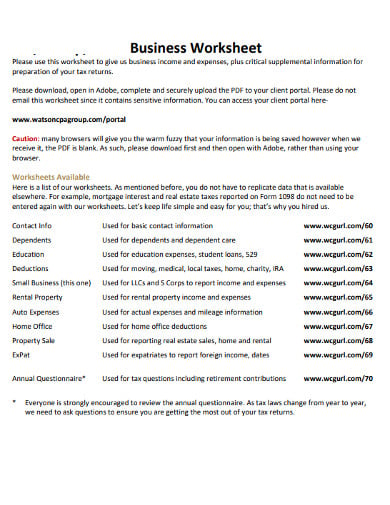

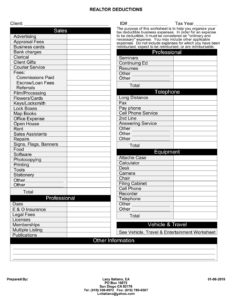

PDF Realtors Tax Deduction Worksheet - FormsPal Tax Deduction Worksheet to assist our clients in becoming more organized for taking advantage of tax deductible business expenses. Remember, in order for an expense to be deductible, it must be considered an ''ordinary and necessary'' business expense. You may include other applicable expenses, but they must be directly related to the operation ... Top 21 Tax Deductions & Tax Tips for Network Marketers Top 21 Tax Deductions for Network Marketers. Here are the common categories on a Schedule C: # 1: Advertising. This could include business cards, buying leads, flyers, participation in an advertising COOP with your upline, sample products, newspaper ads, postcards, pay-per-click ads, or any type of online or offline advertising that you might do to generate leads, find prospects or make more ...

Independent Contractor Expenses Spreadsheet [Free Template] - Keeper Tax See write-offs 1. 🟩 Schedule C Expense Categories This first tab is your bread and butter. All you need to do here is customize it with your name, and fill in your business-use percentages. (Those boxes are in yellow — hover over the cell for notes!) Everything else here will show up automatically, based on what you enter in the other two tabs.

Tax write off worksheet

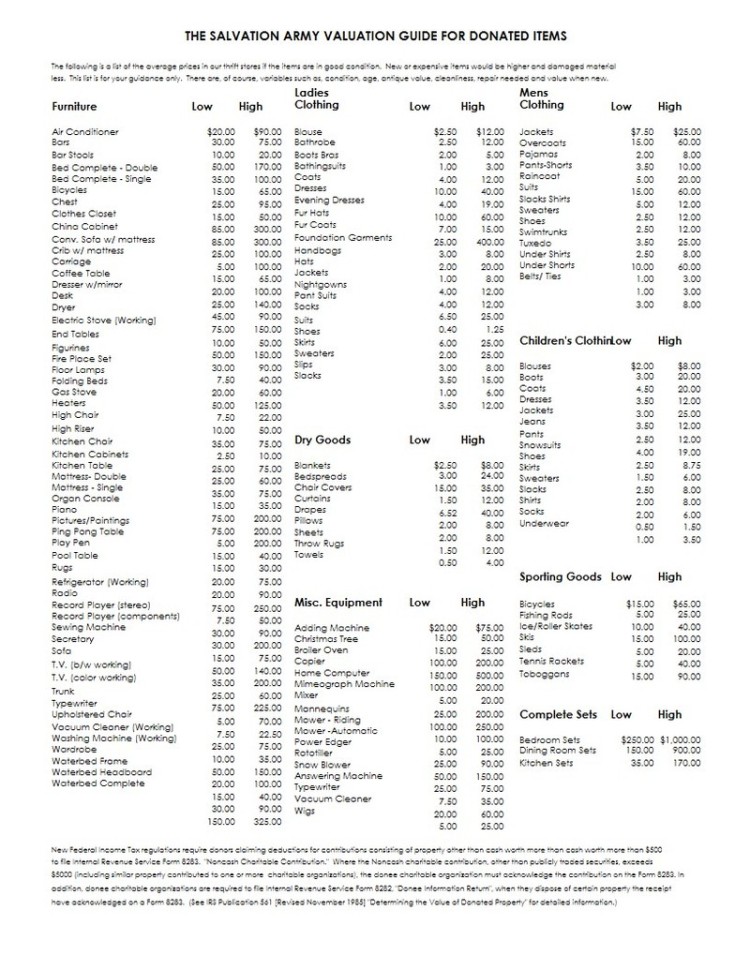

tax write off worksheet deductions tax checklist itemized list printable pdffiller blank. Fillable Online Legalforms Bad Debt Write-off Worksheet - Legal Forms . legalforms debt legal forms worksheet write bad pdffiller sb cs. 30 Realtor Tax Deduction Worksheet - Worksheet Database Source 2020 herbesd.blogspot.com. deduction deductions mcalarney ... Can I Deduct My Computer for School on Taxes? - TurboTax Tax ... Oct 16, 2021 · America’s #1 tax preparation provider: As the leader in tax preparation, more federal returns are prepared with TurboTax than any other tax preparation provider. #1 online tax filing solution for self-employed: Based upon IRS Sole Proprietor data as of 2020, tax year 2019. Self-Employed defined as a return with a Schedule C/C-EZ tax form. An Updated Tax Write-Off Worksheet, by the Nosiest Employee at the IRS ... Did you receive a stimulus payment (Notice 1444-C or Letter 6475)?; Did you receive wages (Form W-2)?; Did you receive state and city refunds (Form 1099-G)?; Did you receive Venmo payments from your ex (Handle @MattDereklol46) AFTER you broke up on July 23, 2021?. If "Yes," were the Venmo payments for previously shared household items, or was it just Matt Johnston trying to get your ...

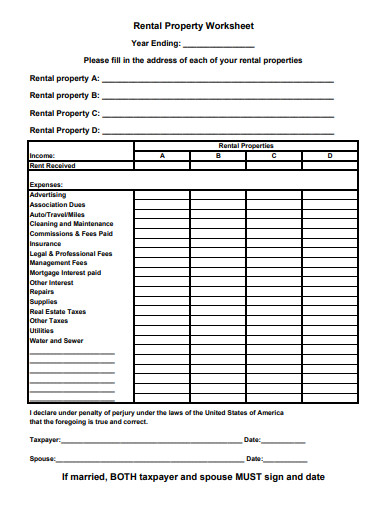

Tax write off worksheet. 2021 Tax Return Preparation and Deduction Checklist in 2022 - e-File This is for the simple reason that all 2021 Forms need to be mailed to you before February 1, 2022. If an employer (s) do not provide you your W-2 forms or the issuer (s) of a 1099 Form does not mail them to you on time, contact them and request it. Step 2: View these important pre-eFile considerations; taxstimate your taxes, use simple tax ... 2020/2021 Tax Estimate Spreadsheet - Michael Kummer Based on your input (see below), the spreadsheet calculates the following: Adjusted Gross Income (AGI) Estimated Income Tax Taxable Income (Federal) Taxable Income (State) Federal Tax State Tax Social Security Tax Medicare Tax Child Tax Credit Effective Federal Tax Rate Effective State Tax Rate The input required from you is (marked in yellow) PDF Worksheet for Firefighters TAX YEAR 201 - Juda Kallus Worksheet for Firefighters PLEASE TRANSFER ALL YOUR SUBTOTALS TO SHEET #2 NAME_____ 201 TAX YEAR. F EQUIPMENT & REPAIRS Generally, to be deductible items must be ordinary and ... reading at both the beginning and end of the tax year. Keep receipts for all car operating expenses - gas, oil, repairs, insurance, etc., and of any reimbursement ... Write It Off - Property Depreciation Report | Quantity ... With years of experience, we are a specialist company preparing property depreciation reports to maximise your depreciation deductions. Click here to know more! Or call 1300 883 760 for your quantity surveyor depreciation report.

1040 (2021) | Internal Revenue Service - IRS tax forms If you are a fiscal year filer using a tax year other than January 1 through December 31, 2021, write “Tax Year” and the beginning and ending months of your fiscal year in the top margin of page 1 of Form 1040 or 1040-SR. PDF Tax Worksheet for Self-employed, Independent contractors, Sole ... make sure I have your last year's tax return so I can follow it. Otherwise, answer the following: Date you purchased the property ... ***Please email or fax worksheet De'More Tax Service Office: 817-726-2181 Mobile: 972-885-9709 Fax: 206-736-0982 Email: taxes@demoretaxservice.com Email: demoretaxservice@gmail.com . 6 Tax Breaks to Help Offset Capital Gains When Selling a Home Sep 15, 2021 · Work with a tax professional who can both guide you through the itemizations form and confirm if you can write off mortgage interest and mortgage points, given the requirements. Example: Naomi is single and paid $2,500 in property taxes and $10,000 in interest on a mortgage loan in 2021. The Best Home Office Deduction Worksheet for Excel [Free ... - Keeper Tax The worksheet will automatically calculate your deductible amount for each purchase in Column F. If it's a "Direct Expense," 100% of your payment amount will be tax-deductible. If it's an expense in any other category, the sheet will figure out the deductible amount using your business-use percentage. Dragging down the deductible amount formula

Tax Deduction Worksheet for Police Officers - Fill and Sign Printable ... The following tips will allow you to complete Tax Deduction Worksheet for Police Officers easily and quickly: Open the form in the full-fledged online editing tool by clicking on Get form. Fill out the required boxes which are colored in yellow. Hit the green arrow with the inscription Next to jump from field to field. Private Practice Tax Write-Offs | Free PDF Checklist Here are some examples of items you can write off in the "supplies" category: Cleaning supplies Postage Pens, paper, stapler, clipboard, etc. Books & magazines in the waiting room File cabinet and any affiliated filing supplies Printed paperwork Printer ink Smaller furniture pieces (under $2,500 - more on this later) Office Expenses Free Tax Forms & Worksheets | Tax Preparation & Bookkeeping The procedure for downloading and filling out forms is as follows: 1. To download this form to your computer click on the thumbnail above. The form will automatically be downloaded to your computer. Customarily what you download will be stored in your "download" folder. So once it is downloaded, look in your download folder to find the PDF for ... Downloadable tax organizer worksheets This downloadable file contains worksheets for, wages and pensions, IRA distributions, interest and dividends, Miscellaneous income (tax refunds, social security, unemployment, other income). Don't forget to attach W-2's and 1099 forms to you worksheets. business.pdf

The Epic Cheat Sheet to Deductions for Self-Employed Rockstars You can write off anyone you pay for professional consultation or work for your business. This is one of those categories that overlaps with others (Consultation, Professional Development, Subcontractor). The most common deductions here are legal consult and fees, accounting, bookkeeping, and tax preparation fees. Meals:

Tax Deductions for Photographers - FreshBooks - FreshBooks If you operate a home office, you can typically write off a portion of your rent as an expense. This is calculated by dividing the square footage of your home office space you use exclusively for business by the total square footage of your home. If you have a home office, this tax deduction is one you don't want to miss.

PDF Tax Deductions for FIREFIGHTERS/PARAMEDICS Tax Deductions for FIREFIGHTERS/PARAMEDICS Name: 1. Communication Expenses Cellular Phone purchase Monthly Cellular expenses used for Business

21 Tax Write-Offs for Real Estate Agents - Keeper Tax Keeper helps real estate agents with 21 tax write-offs by monitoring everyday expense and help lower tax bills. Don't miss out most valuable business tax deductions.

How To Write Off Taxes For MLM Business | Tax Relief Center Though you cannot deduct personal trips, you can write off expenses for business trips and maintenance costs. You can even deduct the costs of meals and supplies for sales presentations. You can easily write off taxes for MLM business. Take these deductions, so you can survive and thrive in the market.

PDF SMALL BUSINESS WORKSHEET - cpapros.com SMALL BUSINESS WORKSHEET Client: ID # TAX YEAR ORDINARY SUPPLIES The Purpose of this worksheet is to help you organize Advertising your tax deductible business expenses. In order for an Books & Magazines expense to be deductible, it must be considered an Business Cards "ordinary and necessary" expense. You may include

PDF Tax Deduction Worksheet - Oxford University Press Tax Deduction Worksheet . This worksheet allows you to itemize your tax deductions for a given year. Tax deductions for calendar year 2 0 ___ ___ HIRED HELP SPACE $_____ Accountant

PDF TRUCKER'S INCOME & EXPENSE WORKSHEET - Cameron Tax Services amounts—during this tax year? OTHER INCOME Sales of Equipment, Machinery, Land, Buildings Held for Business Use Kind of Property Date Acquired Date Sold Gross Sales Price Expenses of Sale Original Cost CAR and TRUCK EXPENSES (personal vehicle) VEHICLE 1 VEHICLE 2 BUSINESS MILES (examples) Year and Make of Vehicle ____ Job seeking miles

FREE Home Office Deduction Worksheet (Excel) For Taxes - Bonsai Our tax software scans your bank/credit card statements to find tax write-offs that may qualify as a deduction at the push of a button. Users typically save $5,600 from their tax bill by using our app. Try a 14-day free trial today. You can make a copy of the excel sheet here. Do You Qualify for the Home Office Deduction?

Publication 560 (2021), Retirement Plans for Small Business Or you can write to: Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. NW, IR-6526 Washington, DC 20224. Although we can’t respond individually to each comment received, we do appreciate your feedback and will consider your comments as we revise our tax forms, instructions, and publications.

Tax Deduction | Excel Templates 1. Use the checklist provided for ideas on what tax deductions would make sense for you. Simply read the different titles to which one is going to make the most sense for yourself. If you find you do not need certain categories, feel free to remove them or change them into something else that works better for your home or business taxes. 2.

Tax Worksheet | Etsy $3.99 (15% off) Taxes Made Easy, Multi-Year Photography Tax Spreadsheets, Tax Write Offs, Audit Prep Guide BP4UPhotoResources (335) $4.00 $9.99 (60% off) Tax Prep Checklist Tracker Printable, Tax Prep 2022, Tax Checklist, Tax List, Tax Tracker ModernFunTemplates (5) $1.12 $1.49 (25% off)

TAX ORGANIZERS - Riley & Associates: Certified Public Accountants Teachers Expense Worksheet (.xlsx) Tradesmen Annual Expense Spreadsheet Tradesmen Expense Worksheet (.pdf) Tradesmen Expense Worksheet (.xlsx) House Cleaning (.pdf) Web Designer (.pdf) Massage Therapist (.pdf) Mechanic (.pdf) Online Sales (.pdf) Other Tax Checklists Annual Rental Property Worksheet (.pdf) Non-Cash Contributions (.pdf)

Hairstylist Tax Write Offs Checklist for 2022 | zolmi.com A tax write off for hairstylists allows you to claim different expenses as long as they are both necessary and ordinary- meaning that these things need to help you run your business and be related to or commonly accepted in your line of work.

Tax Breaks You Can Claim Without Itemizing - SmartAsset Jan 11, 2022 · But some workers – like performing artists and certain government officials – can simply include them on their income tax returns (line 24 of Schedule 1). 9. Jury Duty Payments. Besides the above-the-line deductions, there are other tax breaks (called write-in adjustments) that you can write in and claim without itemizing.

Realtor Tax Deduction Worksheet Form - signNow Follow the step-by-step instructions below to design your rEvaltor tax deduction worksheet form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

Free 1099 Template Excel (With Step-By-Step Instructions!) - Bonsai The Instructions Tab has all of the basic instructions needed to use this spreadsheet and categorize expenses based on their Schedule C line. How to Use this 1099 Template There are 6 basic steps to using this 1099 Template Step 1. Enter all expenses on the "All Business Expenses" tab of the free template Step 2.

An Updated Tax Write-Off Worksheet, by the Nosiest Employee at the IRS ... Did you receive a stimulus payment (Notice 1444-C or Letter 6475)?; Did you receive wages (Form W-2)?; Did you receive state and city refunds (Form 1099-G)?; Did you receive Venmo payments from your ex (Handle @MattDereklol46) AFTER you broke up on July 23, 2021?. If "Yes," were the Venmo payments for previously shared household items, or was it just Matt Johnston trying to get your ...

Can I Deduct My Computer for School on Taxes? - TurboTax Tax ... Oct 16, 2021 · America’s #1 tax preparation provider: As the leader in tax preparation, more federal returns are prepared with TurboTax than any other tax preparation provider. #1 online tax filing solution for self-employed: Based upon IRS Sole Proprietor data as of 2020, tax year 2019. Self-Employed defined as a return with a Schedule C/C-EZ tax form.

tax write off worksheet deductions tax checklist itemized list printable pdffiller blank. Fillable Online Legalforms Bad Debt Write-off Worksheet - Legal Forms . legalforms debt legal forms worksheet write bad pdffiller sb cs. 30 Realtor Tax Deduction Worksheet - Worksheet Database Source 2020 herbesd.blogspot.com. deduction deductions mcalarney ...

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-01.jpg)

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

.png)

0 Response to "44 tax write off worksheet"

Post a Comment