45 business income insurance worksheet

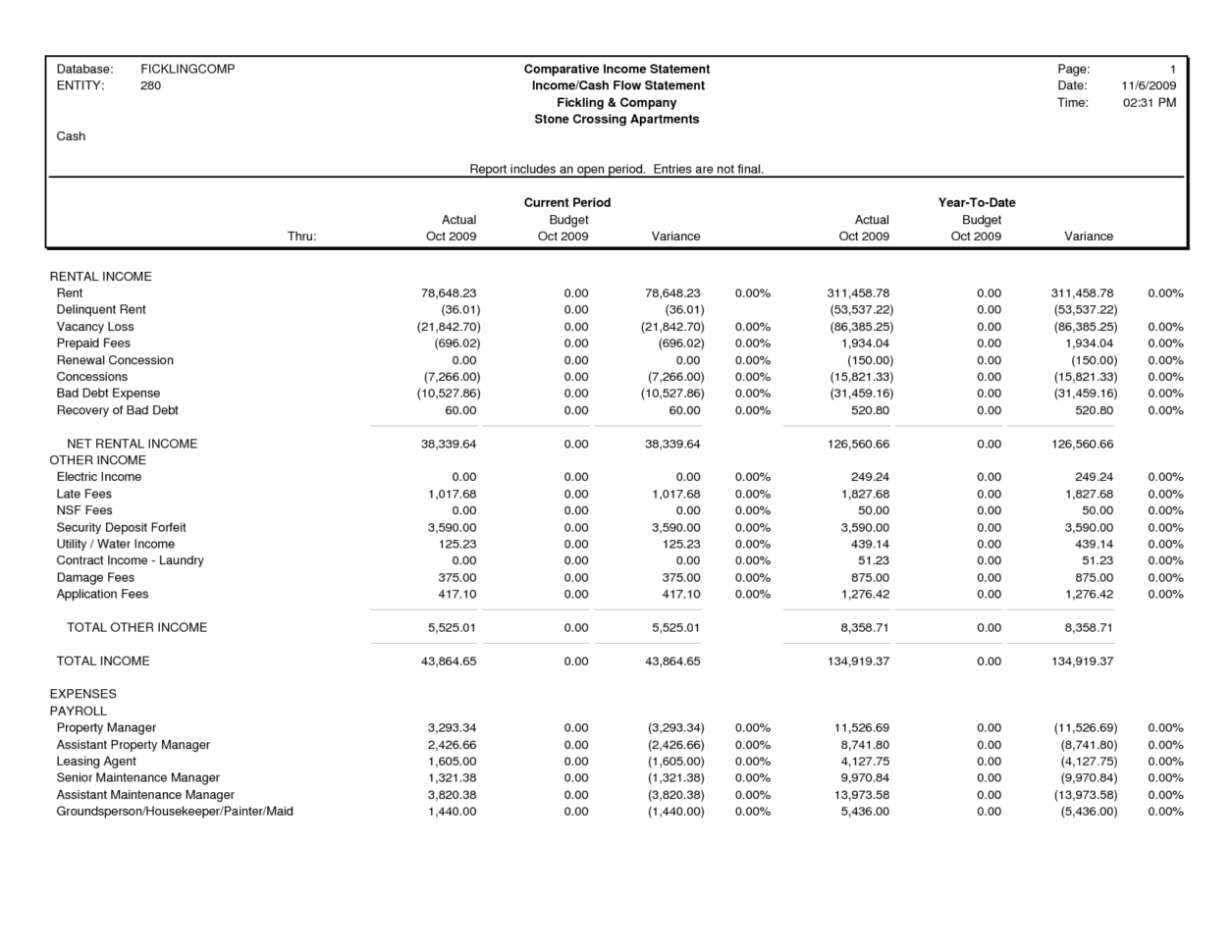

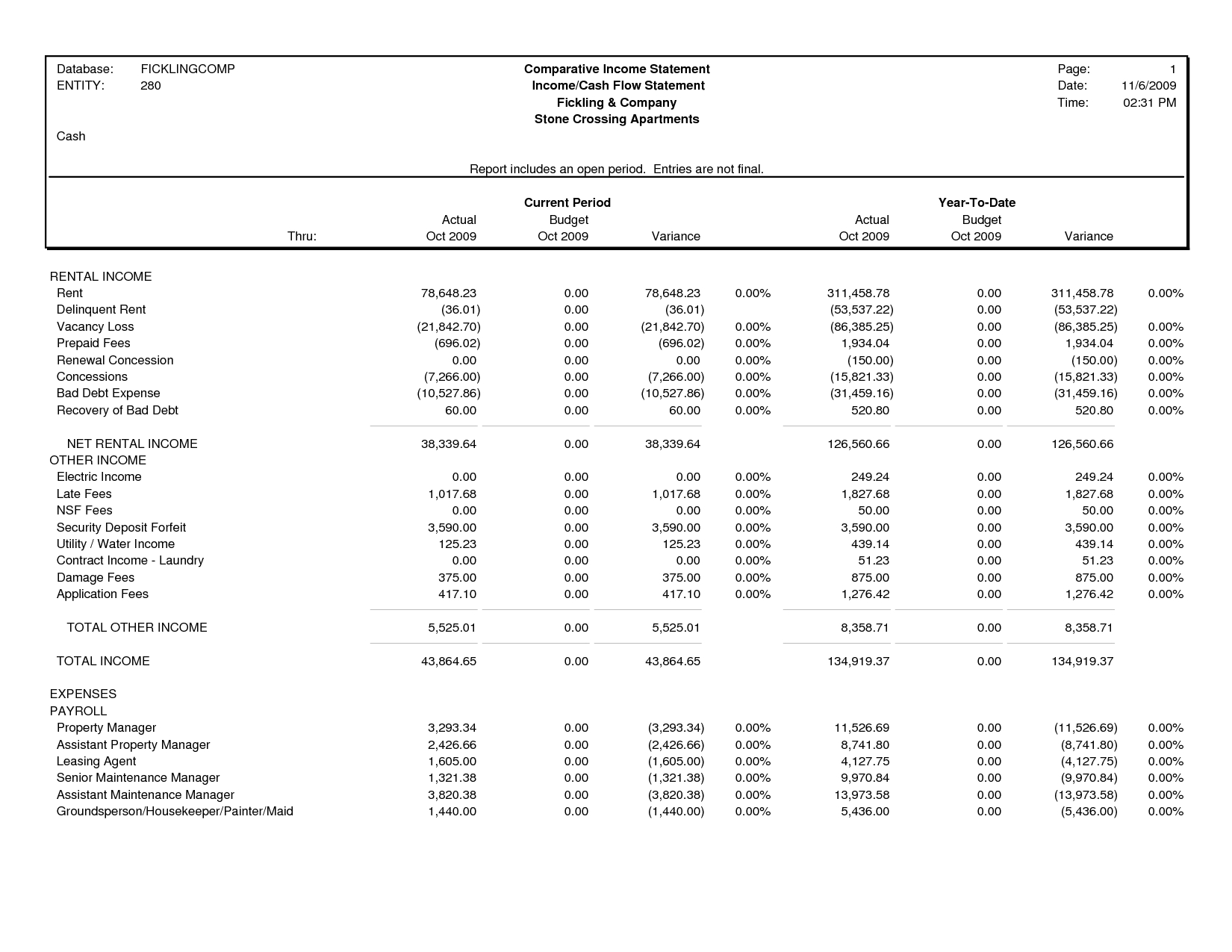

Business Income Insurance - Coverage & Online Resources - VANTREO The calculator available here helps determine the business income and extra expense coverage limit to carry with the insurance company. It uses a bottom-up approach, starting with the net profit of your business and adding continuing expenses to come up with the appropriate amount of coverage for the property policy. Business Income Worksheet | Insurance Glossary Definition - IRMI Definition Business Income Worksheet — a form used to estimate an organization's annual business income for the upcoming 12-month period, for purposes of selecting a business income limit of insurance.

Understanding Business Income Coverage | Travelers Insurance The shop’s insurance policy provides Property coverage and Business Income coverage (including Extra Expense and up to 30 days of Extended Business Income coverage). A fire causes extensive damage to the shop’s interior and cooking equipment.

Business income insurance worksheet

Business Interruption (Income) Insurance and Coverage Basics | Chubb Business insurance policies vary from insurance company to insurance company, but business interruption coverage typically includes compensation for: Lost revenue - based on prior financial records Mortgage, rent and lease payments Employee payroll Taxes and loan payments - due during the covered period Business Income Insurance Coverage: Calculating How Much Your ... Completing a business income worksheet can help you accurately estimate how much business income coverage you may need. Together with a sound business continuity plan, it serves as a critical planning tool to help your business recover from unplanned business interruptions. To get started, choose from the industry selections below: How a Business Income Worksheet Helps You Rebuild after Disaster What Is a Business Income Worksheet? Completing a worksheet may seem like a hassle, but it will help you estimate recovery costs and give you a blueprint to follow during the restoration period. It also documents your organization's pre-loss income and expenses when you submit a worksheet as part of your application for coverage.

Business income insurance worksheet. Business Income - Coverage for Employee Payroll The insured completed the business income report/worksheet (CP 15 15). Payroll was included in the worksheet and no payroll-limiting endorsement was attached. The claims adjuster refused to cover the cost of continuing payroll during the period of restoration citing this wording as the reason: 3. Loss Determination a. Business Income Insurance Coverage | The Hartford Business income insurance coverage is a type of business insurance that helps your company replace lost income if it's unable to operate due to covered property damage. Business income insurance acts as business interruption insurance or income protection insurance. XLS Business Income Coverage Worksheet: PROFESSIONAL SERVICES BI Worksheet Instructions CP ResetExtraExpense ResetForm Seasonality Next Fiscal Year Actual Estimate Cost of Goods Sold BI Value Repairs and Maintenance Bad Debts Interest Expense Depreciation & Depletion Pension, profit-sharing, etc. plans Employee benefit programs Last Fiscal Year Taxes and Licenses (excluding income tax) My Business Income Consultation from Chubb It is offered as a resource to help you establish adequate business income and extra expense values for insurance purposes. This guide is necessarily general in content and is intended as a tool that you can use together with others at your disposal to establish the values you wish to insure.

PDF Business Income Worksheets: Simplified! Business Income Worksheets: Simplified! A Tutorial for the Confused By Robert M. Swift, CPCU, CIPA, CBCP Business Income (BI) worksheets are an integral part of the insurance selection process because they easily determine an organization's financial risk/exposure to loss. If "agreed amount" coverage is requested, insurance companies must ... PDF Business Income Worksheet - Consumer and Commercial Insurance Business Income Worksheet Non Manufacturing or Mercantile Operations Actual values for Estimated values year ending 200_ for year ending 200_ A. Net Income Before Taxes B. Add Total Operating Expenses Sub - Total If Ordinary Payroll is to be excluded or limited: C. Deduct any or all Ordinary Payroll Expense D. Business Income Basis (A+B) - C How Much Business Income Coverage You Need - The Balance Small Business You have under-insured your business income exposure by $100,000. Here's how your insurer calculates your loss payment: Maximum loss payment = loss amount X (limit purchased/ the limit required) Amount paid by your insurer pays = $175,000 X (700,000 / 800,000) or $153,125. You must pay the remaining $21,875 yourself. Business interruption coverage calculator | Services | Zurich Insurance Completing a BI Worksheet is oftentimes perceived as a complicated event, the BICC tool simplifies this process. The result is a mutual benefit of the insurance buying customer, the producer and the insurance provider. A successfully completed BI Worksheet is the foundation for proper Business Interruption valuation and coverage needs.

PDF Simplified Business Income and Extra Expense Worksheet - Vantreo SIMPLIFIED BUSINESS INCOME AND EXTRA EXPENSE WORKSHEET This worksheet is designed to help determine a 12-month business income and extra expense exposure. Business income, in general, pays for net income (or loss) the insured would have earned or incurred, plus continuing normal operating expenses including payroll. Publication 560 (2021), Retirement Plans for Small Business For example, sole proprietors deduct them on Schedule C (Form 1040) or Schedule F (Form 1040), Profit or Loss From Farming; partnerships deduct them on Form 1065, U.S. Return of Partnership Income; and corporations deduct them on Form 1120, U.S. Corporation Income Tax Return, or Form 1120-S, U.S. Income Tax Return for an S Corporation. Business Income Insurance - Asking the Right Questions The ISO Business Income worksheet is not a tool designed to compute a limit of insurance. The worksheet's purpose is to determine the minimum limit required to satisfy coinsurance. Coinsurance is based on the combination of net profit and ALL operating expenses. The Insured's Responsibility Business Income Insurance - Nationwide Business income insurance works with your property policy and provides coverage for events beyond your control such as fire, wind, hail, vandalism or damage from vehicles or aircraft that may cause direct physical loss or damage to covered property which interrupts your business.

How to Calculate Business Income for Insurance | The Hartford Business income insurance can help cover these payroll costs. Utilities. For example, say you need to pay for utilities for the next two months while your business is being repaired. However, you can’t open your operation until after the repairs are finished. Your business income insurance can step in and help pay for your utility bills. Lost ...

Business Income and Extra Expense Insurance - Travelers Business Income and Extra Expense insurance (BIEE) provides coverage when your business shuts down temporarily due to a fire or other covered loss. It helps replace your income and covered expenses like rent, payroll and other financial responsibilities while your property is being repaired or replaced. View Video Transcript

PDF Specialty Human Services Division BUsiness income Worksheet $1,000,000 12-month expected BI exposure (item E, page 1) 8 month max expected period of recovery (item 2, page 1) 3 peak months generate an average of 33% greater business income exposure $100,000 Extra Expense exposure (item F, page 1) a. $1,000,000 12 month BI exposure b. $1,000,000÷12 = $83,333 c. $83,333 × 8 months= $666,666 d.

The Scary Part of Business Income: The Business Income Worksheet ... That's exactly what the business income worksheet is, the time element (business income) equivalent of the commercial property schedule that details for the underwriter the qualified business income the carrier is being asked to insure. The worksheet/report is nothing more than the starting point in the business income underwriting process.

XLS Business Income Coverage Worksheet: MANUFACTURING Insurance to Value % (Limit of insurance requested / Unadjusted Business Income limit) Extended Income and Future Earnings - as % of Total Limit Business Income Coverage (section E) ... The Business Income worksheet is constructed using two columns. The first column is the previous fiscal year actual values and the second column is where you ...

Wynward Insurance Group - Business Income Worksheet Business Income Worksheet. Wynward is pleased to provide our customers with a tool to assist in establishing the correct limit of insurance for the resultant loss of business income after a loss occurs. Please be sure to consult with one of our professional broker partners for advice in this area and in completing the form.

Calculating the Correct Business Income Coinsurance The business income section of the worksheet is completed in this post; and possibly more importantly, how the correct business income coinsurance percentage is developed is explained below. Not discussed in this commentary are the two remaining lines of the business income report/worksheet: the Extra Expense amount ("K.1.") ; and the Extended ...

Business Income and Extra Expense Coverage - Selective Insurance The four coverages are: Business Income Business income replaces the income that normally would have been earned and reimburses you for typical business expenses that you might incur, if no property damage and no suspension of business operations had occurred. Extra Expense Coverage

8+ Income & Expense Worksheet Templates - PDF, DOC | Free ... Title the first worksheet as “income” and the second one as “expenses” by right-clicking the tab at the bottom of each worksheet, then selecting the “rename” option, and entering the name. Add the headings for columns. You have to do this for all of the columns located in the top row of your daily worksheet.

Business Income Coverage | Insurance Glossary Definition - IRMI Definition. Business Income Coverage — commercial property insurance covering loss of income suffered by a business when damage to its premises by a covered cause of loss causes a slowdown or suspension of its operations. Coverage applies to loss suffered during the time required to repair or replace the damaged property.

Income Analysis Worksheet | Essent Guaranty Rental Property – Primary (Schedule E) Determine the average monthly income/loss for a 2-4 unit owner-occupied property. Download Worksheet (PDF)

PDF Policy Number: Commercial Property Cp 15 15 10 12 Business Income ... Business Income following resumption of operations for up to 60 days or the number of days selected under Extended Period Of Indemnity option) + + 3. Combined (all amounts in K.1. and K.2.) $ "Estimated" Column L. Total Of J. And K. $ The figure in L. represents 100% of your estimated Business Income exposure for 12 months, and additional expenses.

PDF BUSINESS INCOME REPORT/WORK SHEET - BSR Insurance The figure in L. represents 100% of your estimated Business Income exposure for 12 months, and additional expenses. Using this figure as information, determine the approximate amount of insurance needed based on your evaluation of the number of months needed (may exceed 12 months) to replace your property, resume

Get Business Income Worksheet Iso 2020-2022 - US Legal Forms Complete Business Income Worksheet Iso in just a couple of moments following the recommendations listed below: Select the document template you want from the collection of legal forms. Choose the Get form button to open the document and move to editing. Submit all of the requested boxes (they will be yellow-colored).

Business Income Insurance for Agribusiness - Nationwide Agribusiness business income insurance. Business income insurance can help keep your commercial agribusiness from closing its doors due to a force outside your control. Forces such as fire, hail, windstorm, vandalism and mechanical or electrical breakdown. If you're closed for business, you still have to pay the bills, employees, rent or ...

Publication 587 (2021), Business Use of Your Home If you paid $3,000 of mortgage insurance premiums on loans used to buy, build, or substantially improve the home in which you conducted business but the Mortgage Insurance Premiums Deduction Worksheet you completed for the Worksheet To Figure the Deduction for Business Use of Your Home limits the amount of mortgage insurance premiums you can ...

How a Business Income Worksheet Helps You Rebuild after Disaster What Is a Business Income Worksheet? Completing a worksheet may seem like a hassle, but it will help you estimate recovery costs and give you a blueprint to follow during the restoration period. It also documents your organization's pre-loss income and expenses when you submit a worksheet as part of your application for coverage.

Business Income Insurance Coverage: Calculating How Much Your ... Completing a business income worksheet can help you accurately estimate how much business income coverage you may need. Together with a sound business continuity plan, it serves as a critical planning tool to help your business recover from unplanned business interruptions. To get started, choose from the industry selections below:

0 Response to "45 business income insurance worksheet"

Post a Comment