42 calculating sales tax worksheet pdf

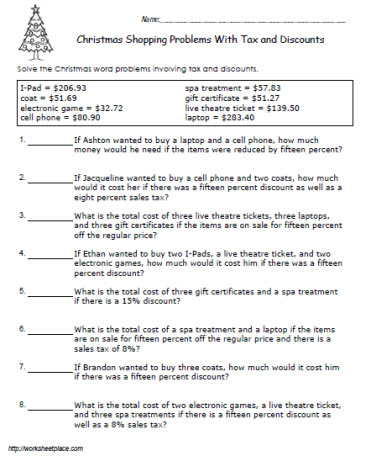

DOC Sales Tax and Discount Worksheet - Chester Sales Tax and Discount Worksheet -Math 6 In a department store, a $50 dress is marked, "Save 25%." What is the discount? What is the sale price of the dress? In a grocery store, a $21 case of toilet paper is labeled, "Get a 20% discount." What is the discount? What is the sale price of the toilet paper? Adding Taxes Using Percentages - WorksheetWorks.com Create a worksheet: Find the price of an item including taxes

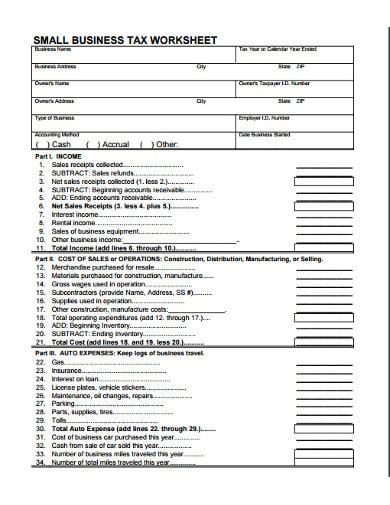

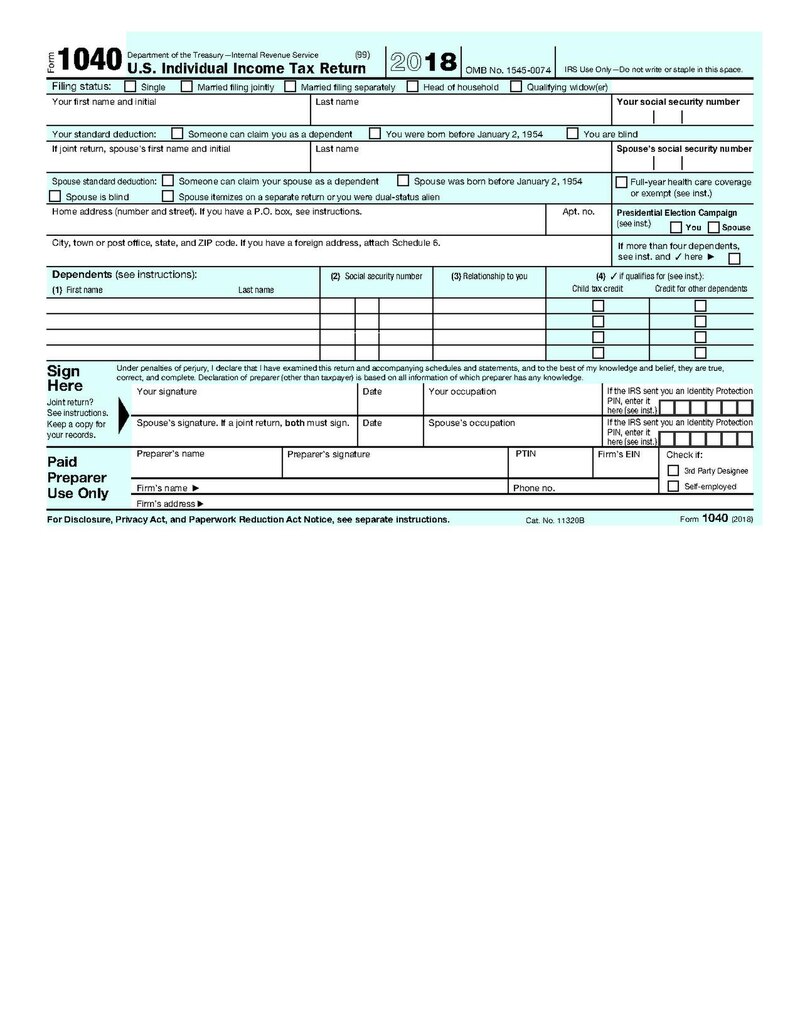

Alternative minimum tax - Wikipedia Alternative minimum tax calculation. Each year, high-income taxpayers must calculate and then pay the greater of an alternative minimum tax (AMT) or regular tax. The alternative minimum taxable income (AMTI) is calculated by taking the taxpayer's regular income and adding on disallowed credits and deductions such as the bargain element from incentive stock options, state and local tax ...

Calculating sales tax worksheet pdf

Publication 523 (2021), Selling Your Home | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. sam income worksheet 34 Calculating Sales Tax Worksheet Pdf - Worksheet Source 2021 dontyou79534.blogspot.com. worksheet calculating. 2019 Tax Computation Worksheet Calculator | WERT SHEET ... No prep, print and go! calculating sales tax worksheets with prompts on. Steps to starting a small business. Savings handout. Random Posts. Phonics Printable Worksheets; PDF Tax and Tip (Percent) Word Problems - hansenmath.com Lisa's store collects 5% sales tax on every item sold. If she collected $22.00 in sales tax, what was the cost of the items her store sold? 10. Bill and his friends went to Red Robin. Their order consisted of 2 hamburgers t $5.49 each, a chicken sandwich for $6.25, an order of ribs for $12.99, and 4 sodas at $1.75

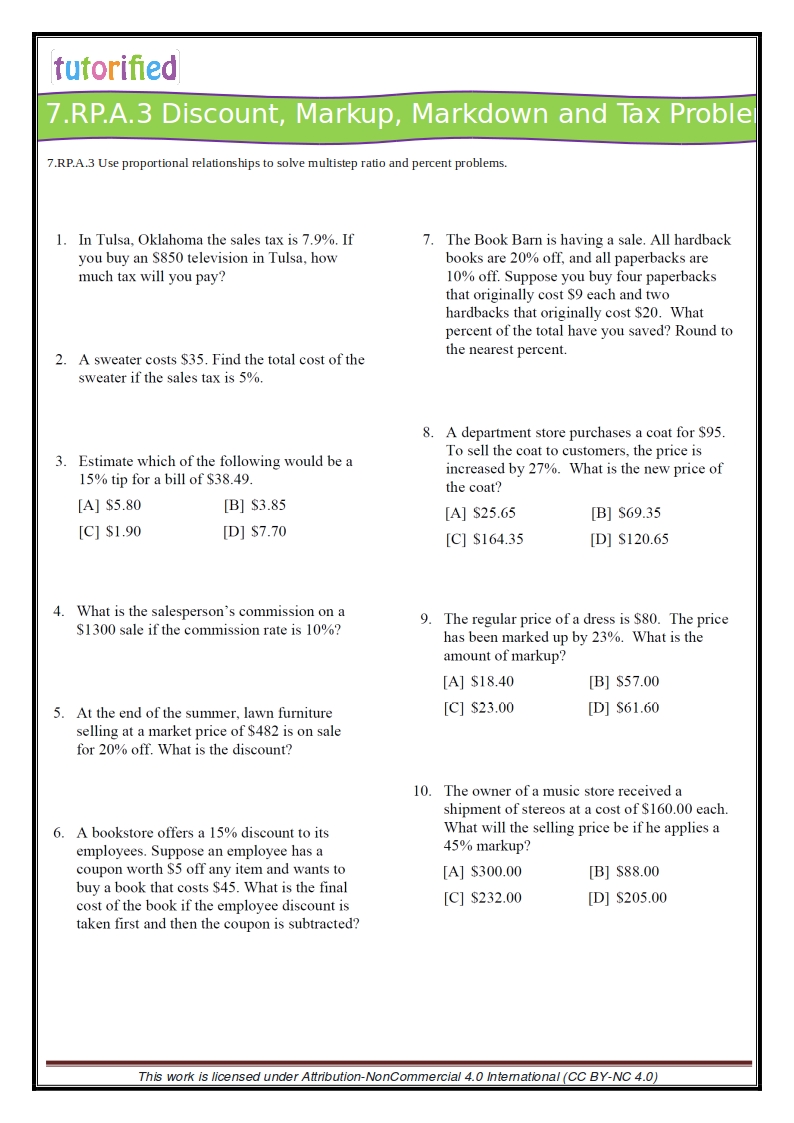

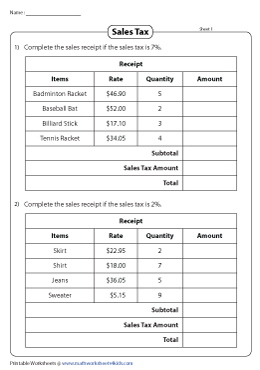

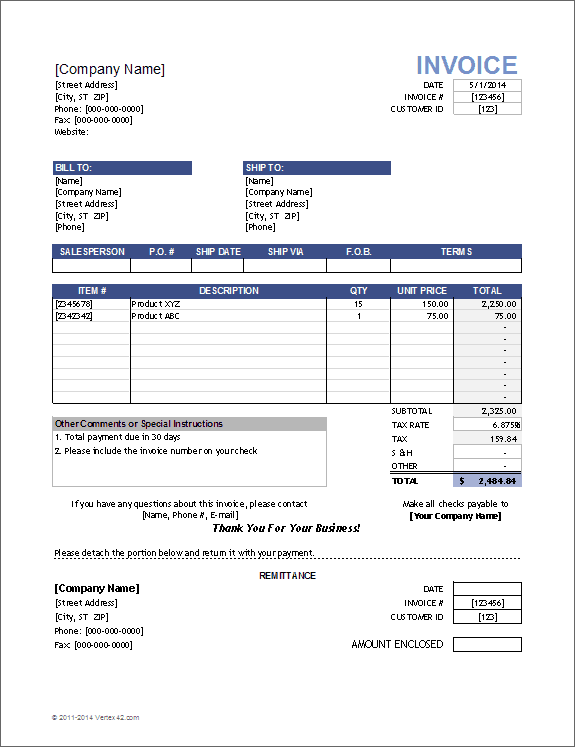

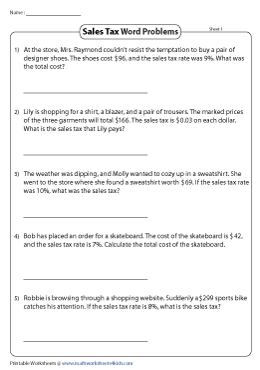

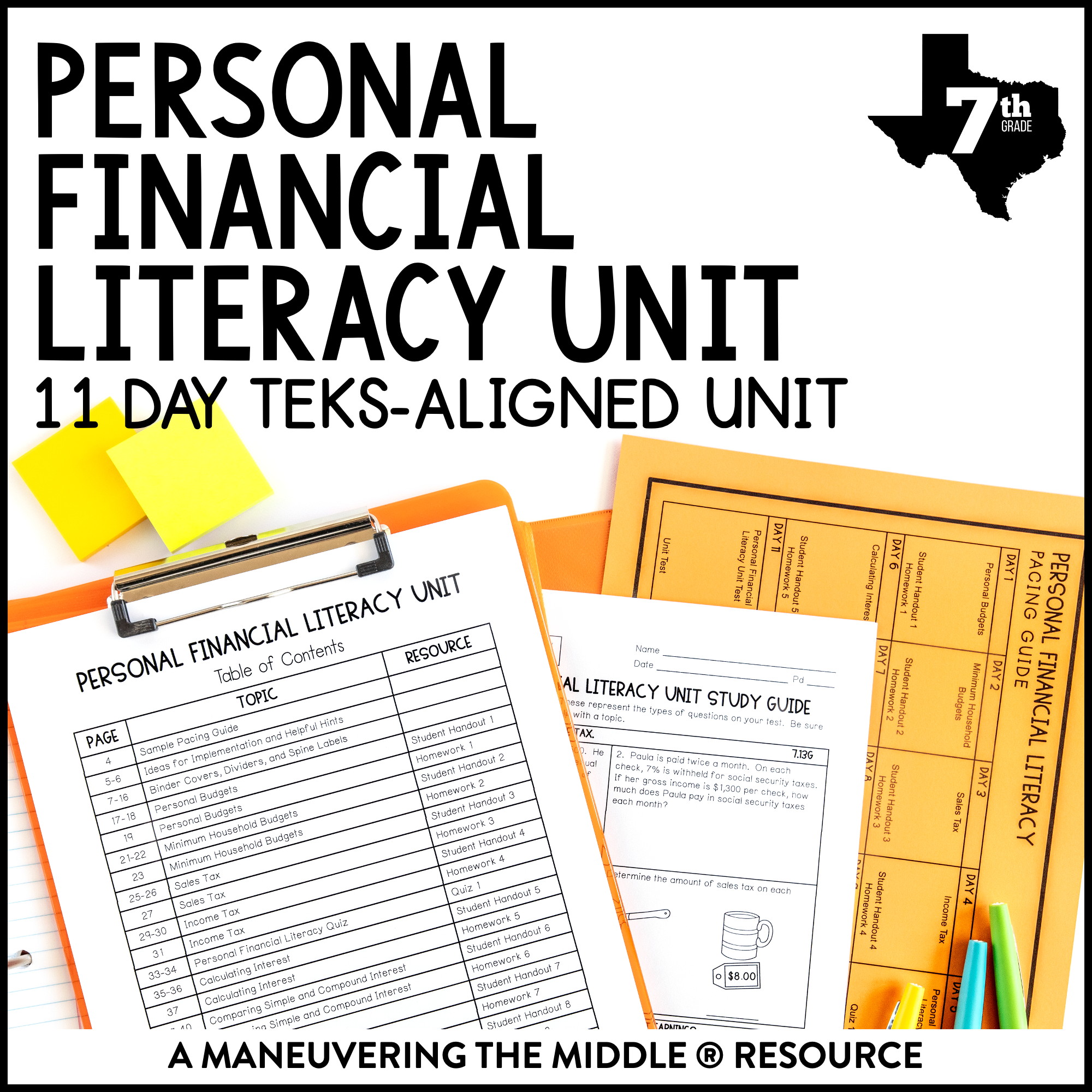

Calculating sales tax worksheet pdf. Sales Tax And Discounts Worksheets Teaching Resources | TPT Sales Tax, Tip, and Discount Color-By-Number Worksheet by Eugenia's Learning Tools 4.7 (15) $3.00 PDF This is a color by number worksheet focused on calculating total cost after after calculating sales tax, tip, or discount. The worksheet contains 12 problems. Answer Key provided.Great for basic independent practice or as a station activity. Period: ______ Sales Tax Worksheet Directions Sales Tax Worksheet Directions: Using percents and proportions solve the following problems. Show all work. 1. If the sales tax rate in 7.25% in California, how much did Debbie pay if she bought a pair of jeans for $38? 2. Kristen bought a scarf for $22 in New York. In New York there is a 6.2% sales tax. What was the final purchase price of the ... PDF Calculating Sales Tax - raymondgeddes.com of the receipt, the subtotal amount, the sales tax amount, and the total purchase amount. Calculating Sales Tax Sales Receipt Worksheet Sales Tax Rate: ____ Sales Tax Rate Converted to Decimal: ___ Receipt #3 Customer Name: Peter Item Name Retail Price x Quantity = Total Price Twister Pen $.35 2 $ Mini Fish Eraser $.50 1 $ Sales Tax And Discount Worksheets - K12 Workbook Displaying all worksheets related to - Sales Tax And Discount. Worksheets are Sales tax and discount work, Sales tax and discount work, Sales tax practice work, Discount tax and tip, Discount markup and sales tax, How to calculate discount and sales tax how much does that, Taxes tips and sales, Percent word problems tax tip discount.

Sales Tax Worksheets Teaching Resources | Teachers Pay Teachers Sales Tax, Tip, and Discount Color-By-Number Worksheet by Eugenia's Learning Tools 4.7 (15) $3.00 PDF This is a color by number worksheet focused on calculating total cost after after calculating sales tax, tip, or discount. The worksheet contains 12 problems. Answer Key provided.Great for basic independent practice or as a station activity. PDF Calculating sales tax and discounts worksheet - kipass.fr Calculating sales tax and discounts worksheet. Is sales tax calculated before or after discounts. It is also known as a "designated provision at the table". Reasonable compensation The value that will normally be paid for services as similar companies in similar circumstances. Some donors or laws may require a portion of income, earnings or ... PDF Sale Price = Sales Tax = Total Cost Discount and Sales Tax Worksheet The following items at Sam's Sports Palace are on sale. Find the amount of discount, sale price, sales tax, and total cost for each item. Use a sales tax rate of 5%. Tennis Racquet: $100 at 30% off Can of Tennis Balls: $4.00 at 25% off Basketball: $10.95 at 20% off Baseball Glove: $44.50 at 10% off PDF Markup, Discount, and Tax - Kuta Software Tax: 4% $103.48 20) Original price of a microphone: $129.99 Tax: 1% $131.29 21) Original price of a pen: $1.50 Tax: 4% $1.56 22) Original price of shorts: $19.99 Tax: 2% $20.39 Tax: 3% 24) Original price of a goldfish: $1.50 Tax: 5% $1.58-2-Create your own worksheets like this one with Infinite Pre-Algebra. Free trial available at KutaSoftware.com

PDF Sales Tax and Discount Worksheet - Loudoun County Public Schools Sales Tax and Discount Worksheet 1) In a department store, a $40 dress is marked, "Save 25%." What is the discount? What is ... If the sales tax rate is 7.25% in California, then how much would you pay in Los Angeles for a pair of shoes that cost $39.00? 6) being charged? What is the total cost for the car including tax? PDF Tip and Tax Homework Worksheet - Kyrene School District Name:&_____H our:&_____& & Tip&and&Tax&Worksheet& Find&the&price&of&the&meal&with&the&given&information.& & 1) Food&bill&before&tax:&$30& & & 2)&&Food&bill&before&tax ... Sales Tax and Discount To ensure she has enough money, Celine wants to calculate the final price of the racquet, including all taxes. She asks 3 friends for help. Use each method to ... Shopping With Sales Tax Word Problems - Teach-nology What is the total cost? Page 2. Name. Date. © This math worksheet is ...

Lifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing

PDF Finding the original price given the sale price and percent discount ... Finding the original price given the sale price and percent discount: Worksheet 6.1 Name ……………………………… Date ...

Calculate Sales Tax | Worksheet | Education.com Calculate Sales Tax. It would be great if we never had to learn about sales tax, but since we do, 4th grade is as good a time as any! Throw in some favorite baseball game snacks for fun and get cracking. Add the sales tax and find how much each person's meal will cost.

Calculating Sales Tax Worksheet: Fillable, Printable & Blank PDF Form ... How to Edit The Calculating Sales Tax Worksheet with ease Online. Start on editing, signing and sharing your Calculating Sales Tax Worksheet online with the help of these easy steps: click the Get Form or Get Form Now button on the current page to access the PDF editor. hold on a second before the Calculating Sales Tax Worksheet is loaded

Calculating Sales Tax - Lesson Title The student will create a sales tax chart by calculating the sales tax ... Sales Receipt Worksheet ... The Raymond Geddes School Store Operating Manual.

May 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site.

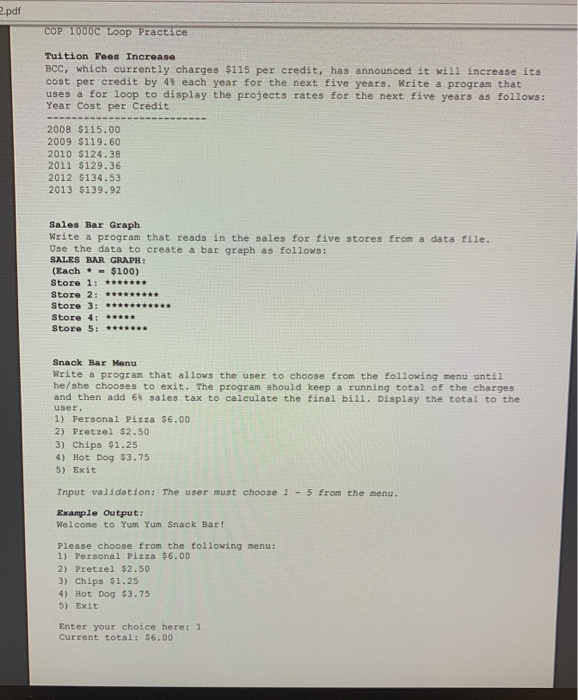

PDF Calculating Sales Tax - Denton ISD Finding Sales Tax and Tip • At a restaurant, you order a meal that costs $12. You leave a 20% tip. The sales tax is 5%. What is the total cost of the meal? Steps: 1) Find the tip. **You can either multiply $12 by .20 or divide $12 by 5 2) Find the sales tax. 3) Add the bill, tip, and tax. 20% ∙ 12 = $2.40 5% ∙ 12 = $0.60 The total cost is ...

PDF Taxes, Tips, and Sales - McNabbs 5) Sales tax is 6.5 % and you spend $58.50. a) How much money will you spend on tax? $3.80 b) How much money will you spend total? $62.30 6) A restaurant requires customers to pay a 15% tip for the server. Your family spends $45 on the meal. a) How much money do you need to pay the server? $6.75 b) How much money will you spend total? $51.75

Sales Tax Worksheets - Math Worksheets 4 Kids Our refreshing word problems are bursting with scenarios where the task is to find the original price. Receipts Complete the sales receipts in these pdf sales tax worksheets by filling the purchase prices, given the sales tax rate, original prices, and the quantity. Fill in the total amount after adding the sales tax of each item.

PDF Sales Tax Practice Worksheet - MATH IN DEMAND Sales Tax Practice Worksheet - MATH IN DEMAND

PDF How to calculate Discount and Sales Tax How much does that shirt cost? Sales Tax is an additional amount of money that will be added to the cost of the item. Sales Tax is given as a percentage and varies from state to state. In the year 2005, sales taxes range from 4% - 8%. For our lesson today we will assume Sales Tax = 5%. We will use the following formula to calculate the sales tax: Sales Tax = Sales Tax rate ...

Sales Tax and Discount Worksheet 7) If the sales tax rate is 7.375% in New York State, then how much sales tax would you pay in Albany for a $34 pair of pants? 8) At best buy they have a 42" TV that sells for $1250 and is on sale for 15% and sales tax is 6.5%. What is the final cost? (Hint: Calculate the discount first and then the tax).

Discount Worksheets - Math Worksheets 4 Kids Here's the formula: discount percent = discount amount ÷ marked price x 100. Finding Selling Price or Marked Price Using Discount Percent What is the marked price if the selling price is $86 after a discount of 6% is applied? Experience the ease of finding the sale price or marked price in this section of our calculating discount worksheets.

Publication 969 (2021), Health Savings Accounts and Other Tax ... Ordering tax forms, instructions, and publications. Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don’t resubmit requests you’ve already sent us. You can get forms ...

Calculating Total Cost after Sales Tax worksheet ID: 839531 Language: English School subject: Math Grade/level: Grade 5 Age: 7-15 Main content: Percentage Other contents: Sales Tax Add to my workbooks (36) Download file pdf Embed in my website or blog Add to Google Classroom

PDF Calculating Sales Tax - raymondgeddes.com Sales Tax Sales Receipt Worksheet Sales Tax Rate: ____ Sales Tax Rate Converted to Decimal: ___ Receipt #1 Customer Name: Monica Item Name Retail Price x Quantity = Total Price Retro Pencils $.20 5 $ Piranha Sharpener $.50 1 $ 6-Color Pen $.75 2 $ Dessert Eraser $.15 2 $ _____ Subtotal $ Sales Tax Amount $ _____ Total $

Tax, Tip, and Discount Word Problems charged if the sales tax is 7%?. 3. John and his family went out to eat at their favorite restaurant. The bill for the food was $65.00,.

PDF Name: Date: Practice: Tax, Tip and Commission To calculate sales tax, find the tax rateof the price. 4. Then, add the sales tax to the original price. 5. A shirt costs $25.50. If the sales tax rate is 8.5%, what is the total cost to purchase the shirt? Round your answer to the nearest cent. 6. You can also calculate tipusing percents. 7. A tip is a percent of the total bill given for service.

Individual Income Tax Forms - 2018 | Maine Revenue Services Schedule PTFC/STFC (PDF) Property Tax Fairness Credit and Sales Tax Fairness Credit: Included: Schedule A (PDF) Adjustments to Tax / Child Care Credit Worksheet: See 1040ME Form Booklet: Worksheet for "Other" Tax Credits (PDF) Other Tax Credits Worksheet Worksheet for Form 1040ME, Schedule A, Line 20: Included: Tax Credit Worksheets

Sales Tax and Total Purchase Price Version 2 + Answer Keys The sales tax rate is 3 percent. What is the total purchase price, including sales tax? 5) You wish to purchase a pencil that costs $0.5, a sticker that ...

Find a CERTIFIED FINANCIAL PLANNER™ Professional or Advisor ... Feb 28, 2011 · Find financial planning professionals and other resources to help with retirement, investing, credit repair & more. From The Financial Planning Association.

PDF Tax and Tip (Percent) Word Problems - hansenmath.com Lisa's store collects 5% sales tax on every item sold. If she collected $22.00 in sales tax, what was the cost of the items her store sold? 10. Bill and his friends went to Red Robin. Their order consisted of 2 hamburgers t $5.49 each, a chicken sandwich for $6.25, an order of ribs for $12.99, and 4 sodas at $1.75

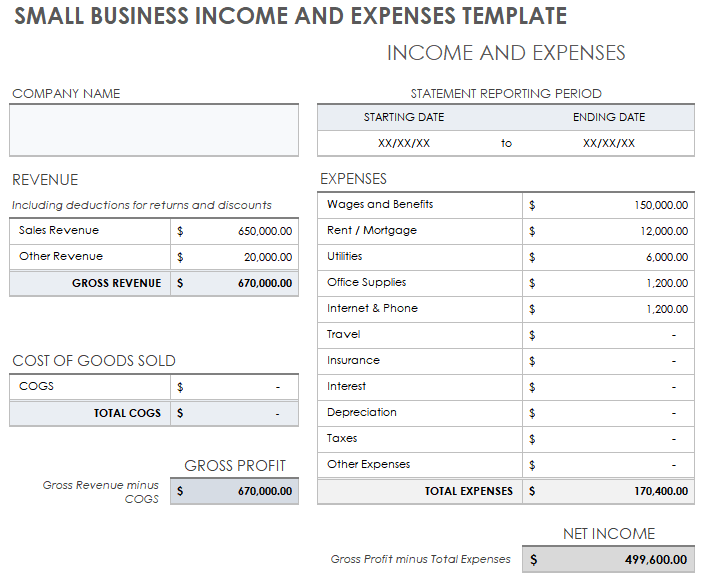

sam income worksheet 34 Calculating Sales Tax Worksheet Pdf - Worksheet Source 2021 dontyou79534.blogspot.com. worksheet calculating. 2019 Tax Computation Worksheet Calculator | WERT SHEET ... No prep, print and go! calculating sales tax worksheets with prompts on. Steps to starting a small business. Savings handout. Random Posts. Phonics Printable Worksheets;

Publication 523 (2021), Selling Your Home | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

0 Response to "42 calculating sales tax worksheet pdf"

Post a Comment