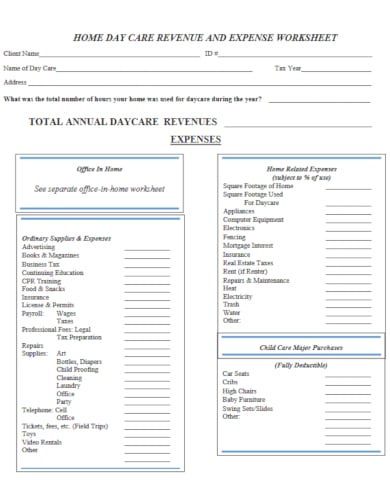

43 home daycare tax worksheet

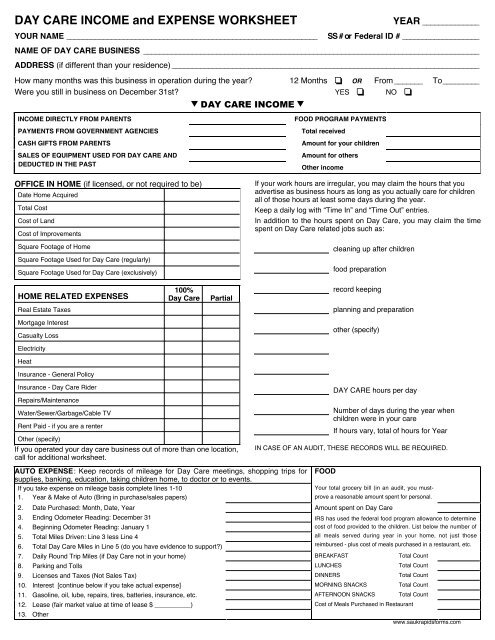

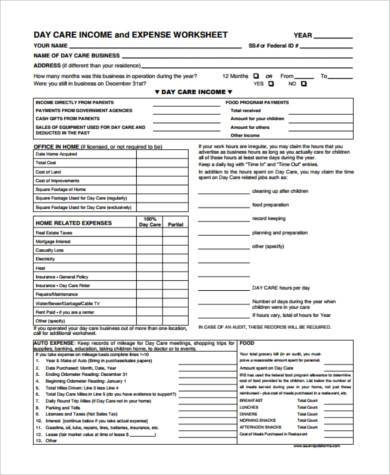

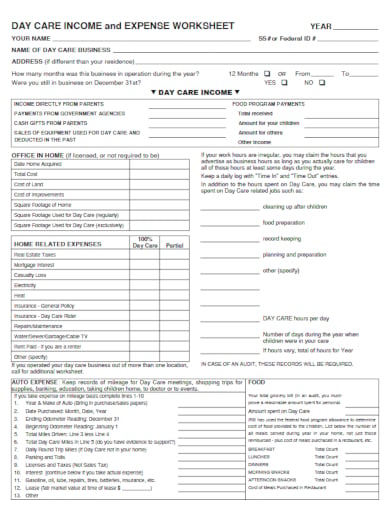

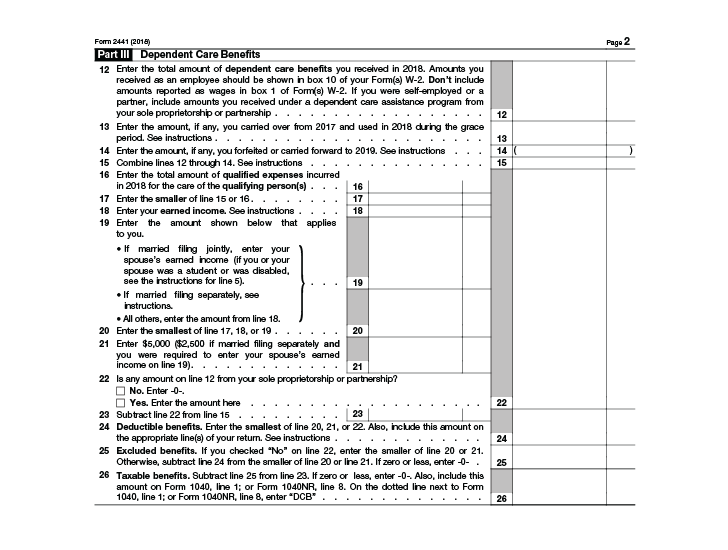

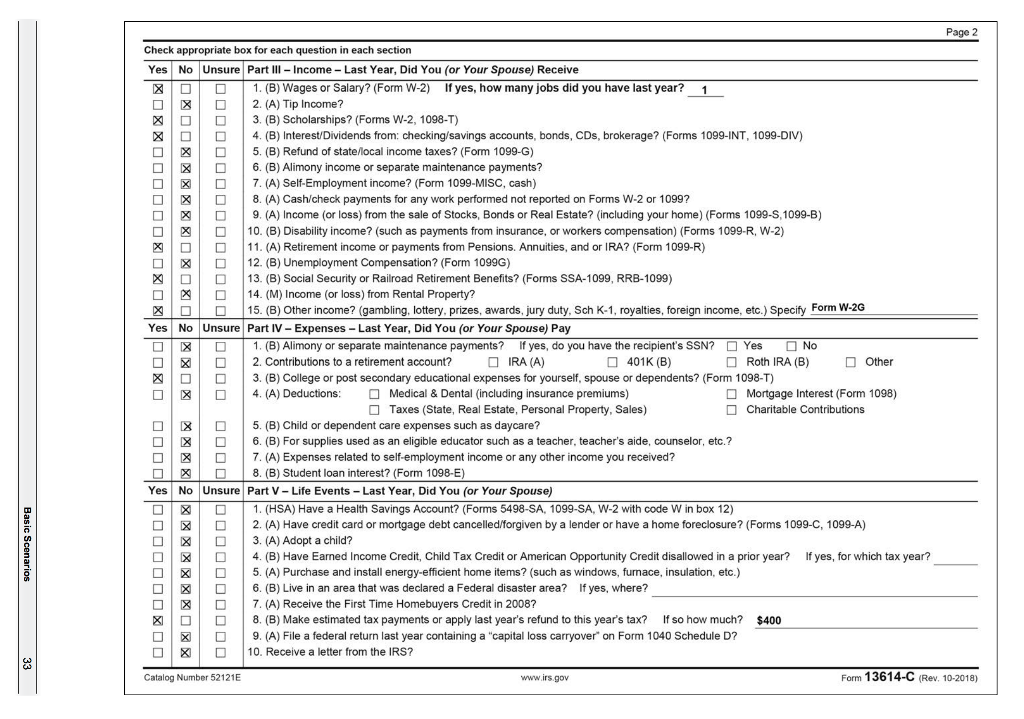

Topic No. 509 Business Use of Home | Internal Revenue Service 06.10.2022 · As a daycare facility. If the exclusive use requirement applies, you can't deduct business expenses for any part of your home that you use both for personal and business purposes. For example, if you're an attorney and use the den of your home to write legal briefs and for personal purposes, you may not deduct any business use of your home ... The Home Office Deduction - TurboTax Tax Tips & Videos Oct 18, 2022 · Tax Advice, Expert Review and TurboTax Live: Access to tax advice and Expert Review (the ability to have a Tax Expert review and/or sign your tax return) is included with TurboTax Live or as an upgrade from another version, and available through December 31, 2022. Intuit will assign you a tax expert based on availability.

Course Help Online - Have your academic paper written by a ... We will take care of all your assignment needs. We are a leading online assignment help service provider. We provide assignment help in over 80 subjects.

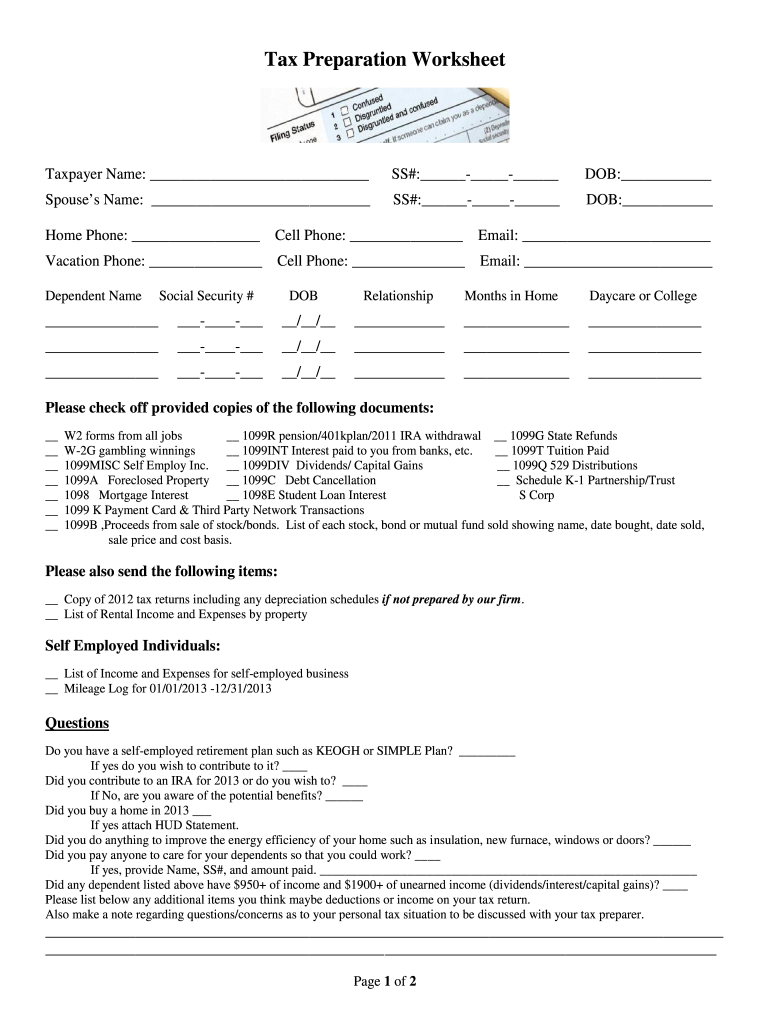

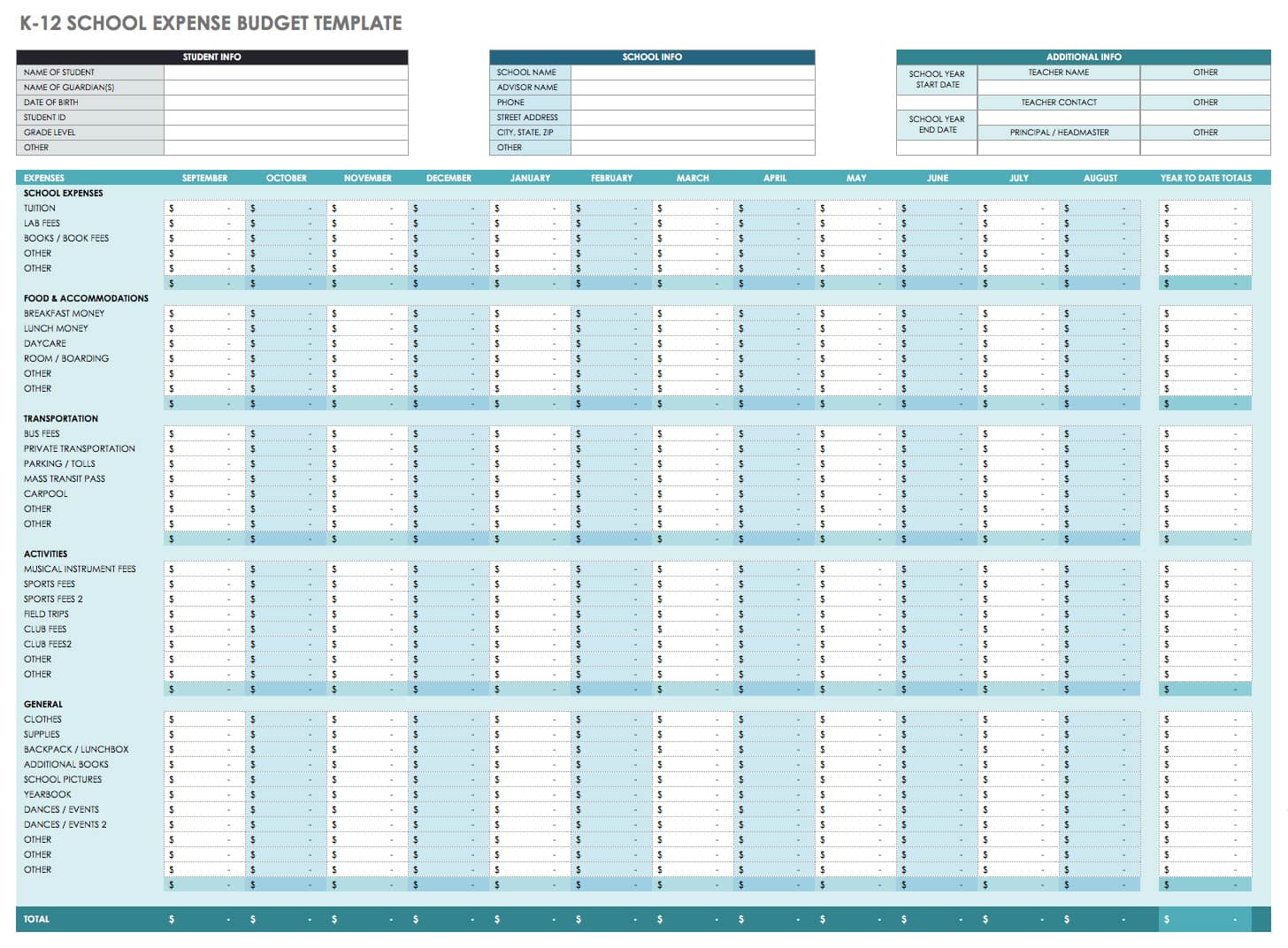

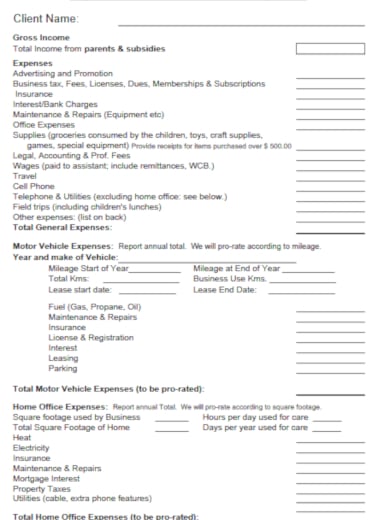

Home daycare tax worksheet

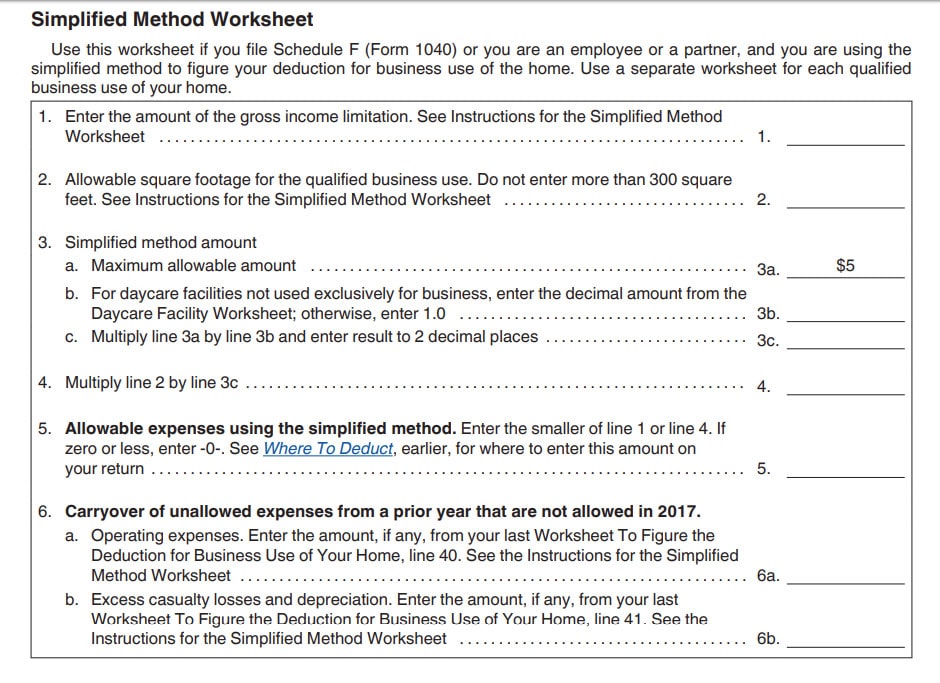

2021 Instructions for Schedule C (2021) | Internal Revenue ... If you used more than one home for a business during the year, you may use a Form 8829 for each home or you may use the simplified method for one home and Form 8829 for any other home. Combine the amount you figured using the simplified method and the amounts you figured on your Forms 8829, and then enter the total on line 30 of the Schedule C ... 2021 IL-1040 Schedule ICR Instructions - Illinois combining the 2020 property tax paid in 2021, as well as a portion of the 2021 tax paid based on the time you owned and lived at the property during 2021. You may not take a credit on your 2021 return for property sold during 2020. For more information, see Publication 108, Illinois Property Tax Credit. Am I eligible for a K-12 education expense Publication 587 (2021), Business Use of Your Home Finally, this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F (Form 1040) or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you are required to pay under the partnership ...

Home daycare tax worksheet. FAQs - Simplified Method for Home Office Deduction Regular use in providing daycare services for children, the elderly, or disabled persons. If you are an employee, use of a portion of the home as the main place in which you conduct your business, or meet with customers, clients or patients, must be for the convenience of your employer. More than One Qualified Business Use of the Home Q9. Oregon Child Support Calculator | AllLaw Home Legal Information Legal Calculators Child Support Calculators. Calculate Child Support Payments in Oregon . The calculator below will estimate your monthly child support payment based on Oregon's child support guidelines. Disclaimer: Please remember that these calculators are for informational and educational purposes only. Oregon Child Support Calculator. Number … About Publication 587, Business Use of Your Home (Including ... Aug 26, 2022 · Publication 587 explains how to figure and claim the deduction for business use of your home. It includes special rules for daycare providers. This publication explains how to figure and claim the deduction for business use of your home. It includes special rules for daycare providers. Publication 587 (2021), Business Use of Your Home Finally, this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F (Form 1040) or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you are required to pay under the partnership ...

2021 IL-1040 Schedule ICR Instructions - Illinois combining the 2020 property tax paid in 2021, as well as a portion of the 2021 tax paid based on the time you owned and lived at the property during 2021. You may not take a credit on your 2021 return for property sold during 2020. For more information, see Publication 108, Illinois Property Tax Credit. Am I eligible for a K-12 education expense 2021 Instructions for Schedule C (2021) | Internal Revenue ... If you used more than one home for a business during the year, you may use a Form 8829 for each home or you may use the simplified method for one home and Form 8829 for any other home. Combine the amount you figured using the simplified method and the amounts you figured on your Forms 8829, and then enter the total on line 30 of the Schedule C ...

0 Response to "43 home daycare tax worksheet"

Post a Comment