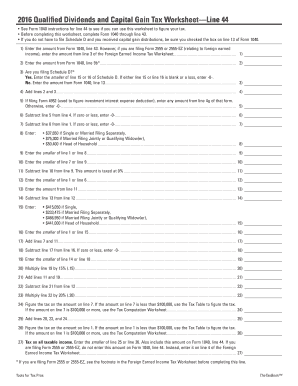

44 2015 qualified dividends and capital gain tax worksheet

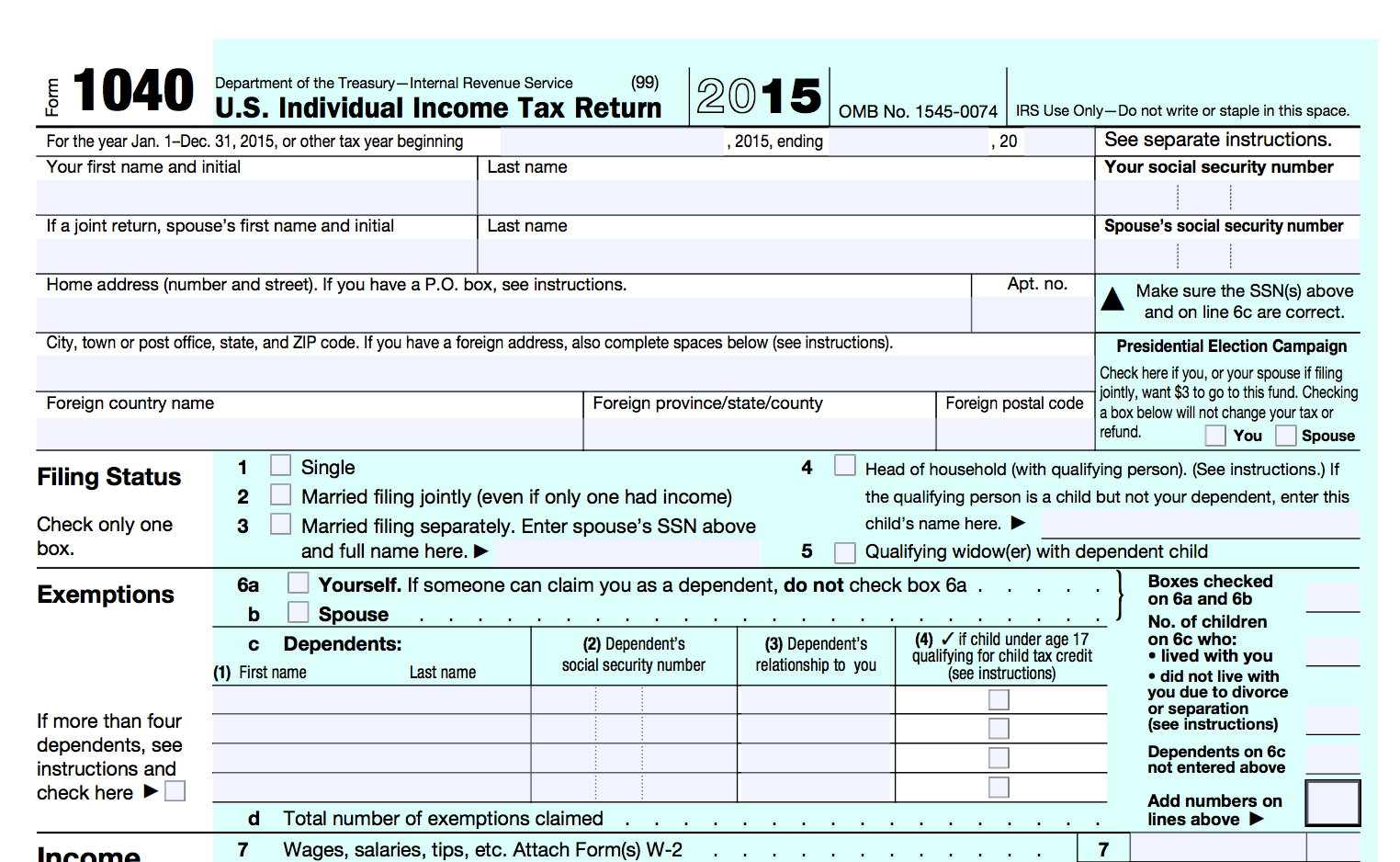

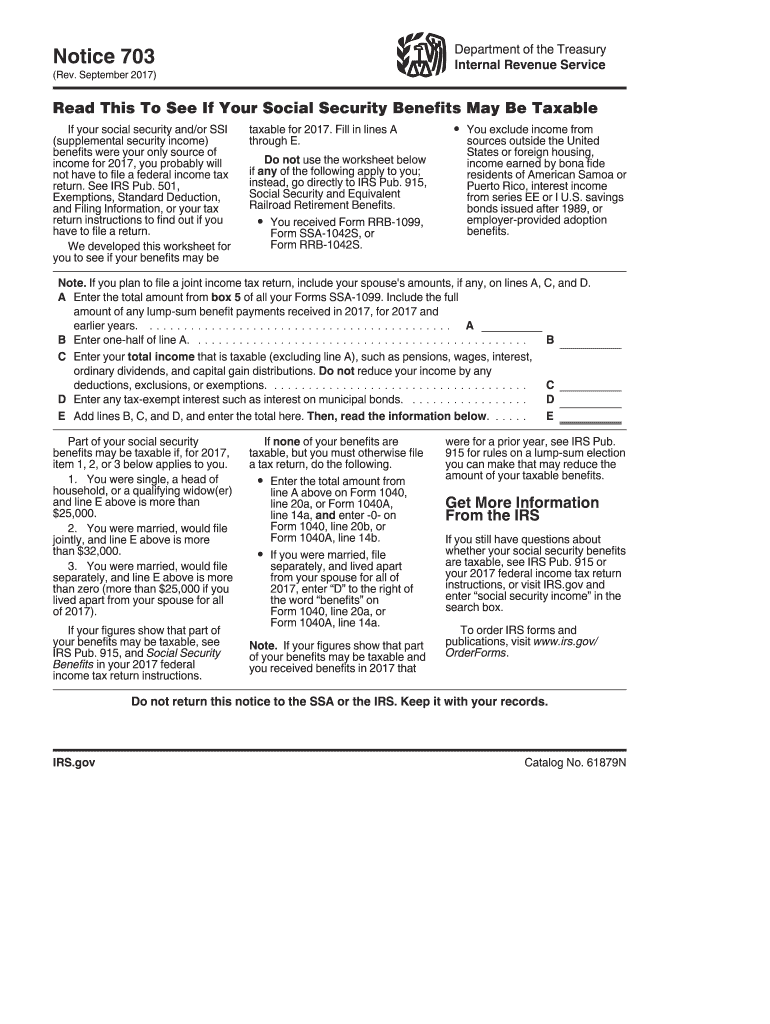

Publication 523 (2021), Selling Your Home - IRS tax forms WebIf you qualify for an exclusion on your home sale, up to $250,000 ($500,000 if married and filing jointly) of your gain will be tax free. If your gain is more than that amount, or if you qualify only for a partial exclusion, then some of your gain may be taxable. This section contains step-by-step instructions for figuring out how much of your ... Qualified Dividends From Foreign Corporations - Expat Tax Web16.08.2015 · August 16, 2015. Qualified Dividends From Foreign Corporations. Attention U.S. Expats! Your foreign dividends may be qualified to be taxed at a special lower tax rate. Here’s how you can know if they are: When you receive dividends from a US corporation, your Form 1099 will specify whether they are qualified dividends or not. …

Publication 3 (2021), Armed Forces' Tax Guide WebCertain investment income must be $10,000 or less during the year. For most people, this investment income is taxable interest and dividends, tax-exempt interest, and capital gain net income. See Worksheet 1 in Pub. 596 for more information on the investment income includible in the amount that must meet the $10,000 limit.

2015 qualified dividends and capital gain tax worksheet

Publication 505 (2022), Tax Withholding and Estimated Tax WebIncludes a net capital gain or qualified dividends, use Worksheet 2-5 to figure the tax to enter here. • Was figured by excluding foreign earned income or excluding or deducting foreign housing, use Worksheet 2-6 to figure the tax to enter here: 4. 5. Enter any expected additional taxes from an election to report your child's interest and dividends, lump-sum … Publication 560 (2021), Retirement Plans for Small Business WebFor tax years beginning after December 31, 2019, eligible employers can claim a tax credit for the first credit year and each of the 2 tax years immediately following. The credit equals 50% of qualified startup costs, up to the greater of (a) $500; or (b) the lesser of (i) $250 for each employee who is not a “highly compensated employee” eligible to participate in the … IRS tax forms IRS tax forms

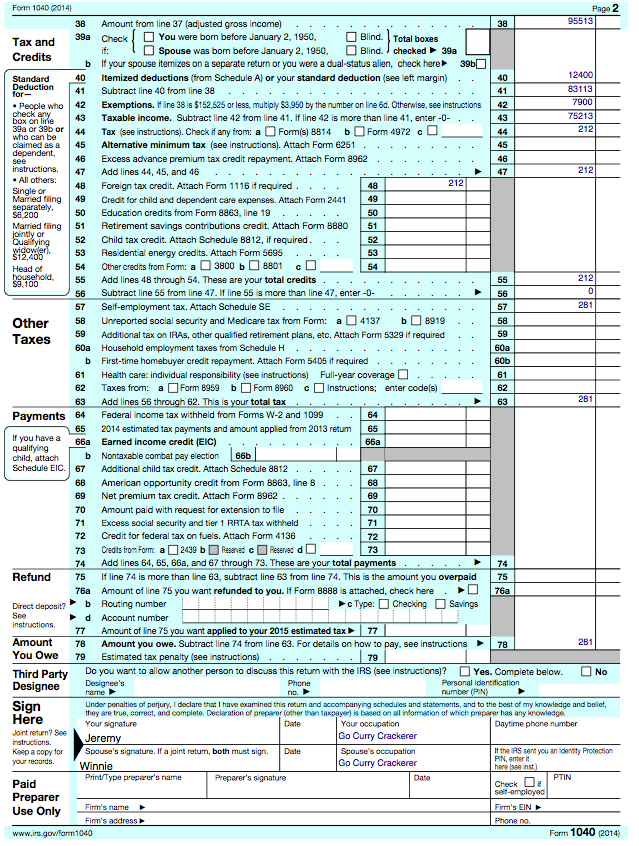

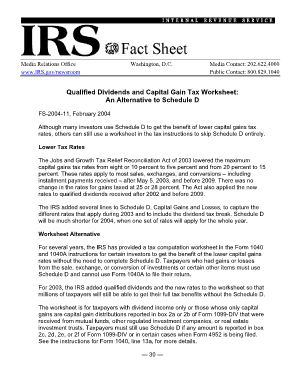

2015 qualified dividends and capital gain tax worksheet. Qualified Dividends And Capital Gain Tax Worksheet 2021 WebQualified Dividends and Capital Gain Tax Worksheet 2015-2022: get and sign the form in seconds ... Qualified Dividends and Capital Gain Tax Worksheet 2015-2022; We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our 3rd party partners) and for other business use. … Publication 550 (2021), Investment Income and Expenses - IRS tax … Capital Gain Tax Rates. Table 4-4. What Is Your Maximum Capital Gain Rate? Investment interest deducted. 28% rate gain. Collectibles gain or loss. Gain on qualified small business stock. Unrecaptured section 1250 gain. Tax computation using maximum capital gain rates. Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. 1040 (2021) | Internal Revenue Service - IRS tax forms WebQualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments . Line 25 Federal Income Tax Withheld. Line 25a—Form(s) W-2; Line 25b—Form(s) 1099; Line 25c—Other Forms; Line 26. 2021 Estimated Tax Payments. Divorced taxpayers. … Capital gains tax in the United States - Wikipedia WebThe Capital Gains and Qualified Dividends Worksheet in the Form 1040 instructions specifies a calculation that treats both long-term capital ... Republicans favor lowering the capital gain tax rate as an inducement to saving and investment. Also, the lower rate partly compensates for the fact that some capital gains are illusory and reflect nothing but …

Publication 502 (2021), Medical and Dental Expenses Jan 13, 2022 · If you were an eligible TAA recipient, ATAA recipient, RTAA recipient, or PBGC payee, see the Instructions for Form 8885 to figure the amount to enter on the worksheet. Use Pub. 974, Premium Tax Credit, instead of the worksheet in the 2021 Instructions for Forms 1040 and 1040-SR if the insurance plan established, or considered to be established ... IRS tax forms IRS tax forms Publication 560 (2021), Retirement Plans for Small Business WebFor tax years beginning after December 31, 2019, eligible employers can claim a tax credit for the first credit year and each of the 2 tax years immediately following. The credit equals 50% of qualified startup costs, up to the greater of (a) $500; or (b) the lesser of (i) $250 for each employee who is not a “highly compensated employee” eligible to participate in the … Publication 505 (2022), Tax Withholding and Estimated Tax WebIncludes a net capital gain or qualified dividends, use Worksheet 2-5 to figure the tax to enter here. • Was figured by excluding foreign earned income or excluding or deducting foreign housing, use Worksheet 2-6 to figure the tax to enter here: 4. 5. Enter any expected additional taxes from an election to report your child's interest and dividends, lump-sum …

0 Response to "44 2015 qualified dividends and capital gain tax worksheet"

Post a Comment