38 fnma rental income worksheet

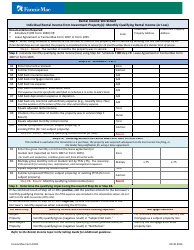

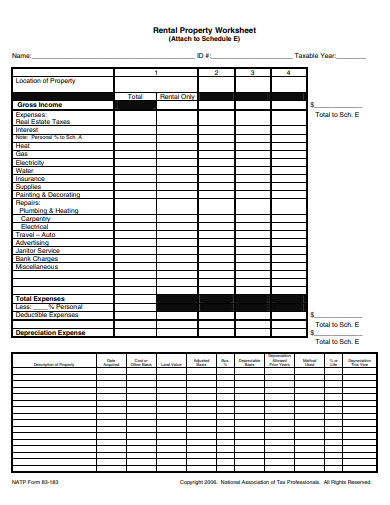

PDF Refer to the Rental Income topic in the Selling Guide for additional ... Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: ... Step 2 B. Lease Agreement OR Fannie Mae Form 1007 or Form 1025 This method is used when the transaction is a purchase, the property was acquired subsequent to the most recent tax filing, or ... Single-Family Homepage | Fannie Mae Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) ... Lease Agreement OR Fannie Mae Form 1007 or Form 1025 For each property complete ONLY 2A or 2B. Author: Rowland, Darian Last modified by: Serret, Christopher J Created Date: 10/20/2015 1:58:34 PM

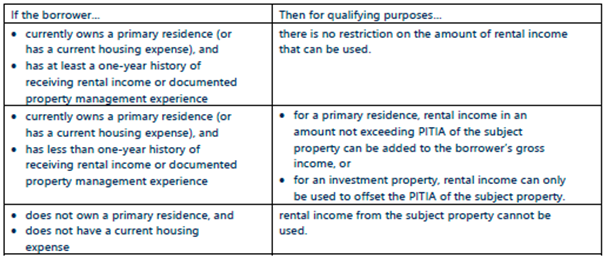

B3-3.5-02, Income from Rental Property in DU (06/01/2022) - Fannie Mae If the Net Monthly Rental Income is a "breakeven" amount, the user must enter either $0.01 or $-0.01. If Net Monthly Rental Income is not entered or is $0.00, DU will calculate it using this formula: (Gross rental income - 75%) — property PITIA expense. The lender can override DU's calculation by entering the Net Monthly Rental Income ...

Fnma rental income worksheet

Fannie Mae Rental Income Worksheet: Fill & Download for Free - CocoDoc How to Edit Your Fannie Mae Rental Income Worksheet Online On the Fly. Follow the step-by-step guide to get your Fannie Mae Rental Income Worksheet edited for the perfect workflow: Hit the Get Form button on this page. You will go to our PDF editor. Make some changes to your document, like adding checkmark, erasing, and other tools in the top ... PDF Form 1038: Rental Income Worksheet - Enact MI Equals adjusted monthly rental income Total A10 Subtract proposed PITIA (for subject property) or existing PITIA (for non-subject property). Subtract Step 2A. Result: Monthly qualifying rental income (or loss): Result Step 2 B. Lease Agreement OR Fannie Mae Form 1007 or Form 1025 For each property complete ONLY 2A or 2B B3-3.5-02, Income from Rental Property in DU (06/01/2022) - Fannie Mae If the Net Monthly Rental Income is a "breakeven" amount, the user must enter either $0.01 or $-0.01. If Net Monthly Rental Income is not entered or is $0.00, DU will calculate it using this formula: (Gross rental income - 75%) — property PITIA expense. The lender can override DU's calculation by entering the Net Monthly Rental Income ...

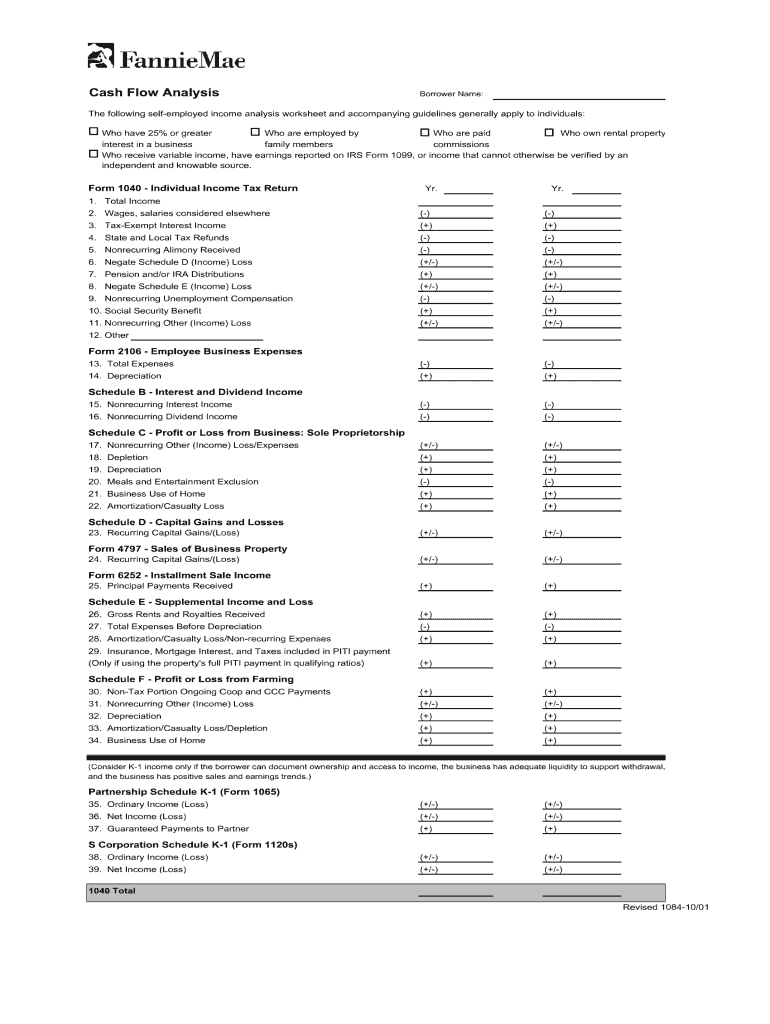

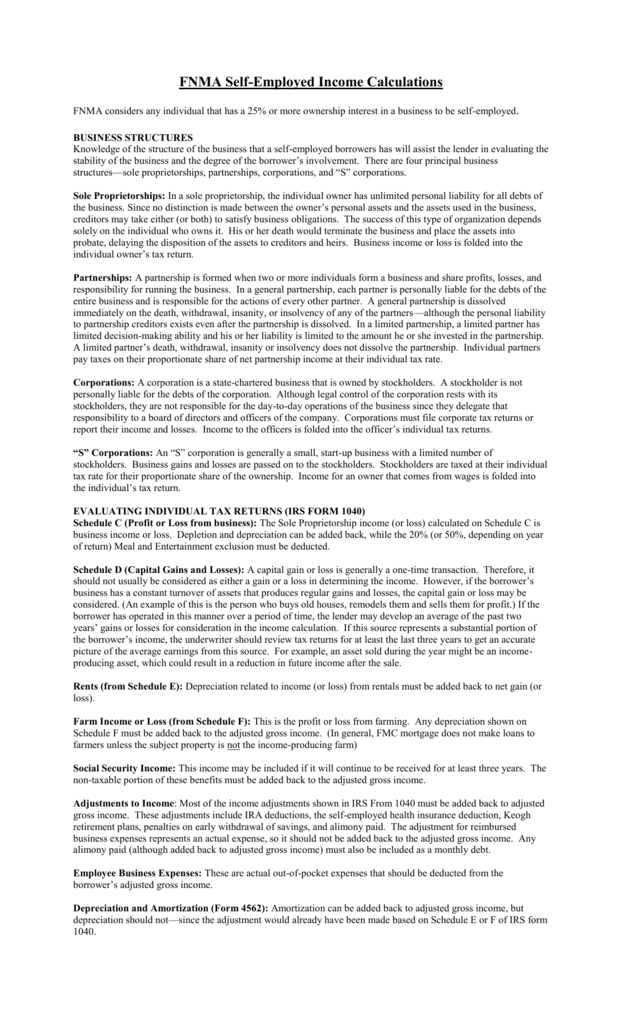

Fnma rental income worksheet. 2021 Cash Flow Analysis Calculator - Essent Mortgage Insurance ORDINARY INCOME, NET RENTAL INCOME: FNMA B3-3.2.2-01 and B3-3.2.2-02 Income from partnerships, SCorps, LLCs, estates, or trusts can only be considered if the lender obtains documentation verifying that: • the income was actually distributed to the borrower or • the business has adequate liquidity to support the withdrawal of earnings. B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Rental Income Worksheet - Business Rental Income from Investment Property(s) . Reporting of Gross Monthly Rent Eligible rents on the subject property (gross monthly rent) must be reported to Fannie Mae in the loan delivery data for all two- to four-unit principal residence properties and investment properties, regardless of whether the ... Single-Family Homepage | Fannie Mae Monthly qualifying rental income (loss): Step 2. Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1007 or Form 1025. Step 1. When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30. Step 2A. Schedule E - Part I B3-6-06, Qualifying Impact of Other Real Estate Owned (06/30 ... Oct 05, 2022 · an existing investment property or a current principal residence converting to investment use, the borrower must be qualified in accordance with, but not limited to, the policies in topics B3-3.1-08, Rental Income, B3-4.1-01, Minimum Reserve Requirements, and, if applicable B2-2-03, Multiple Financed Properties for the Same Borrower;

Single-Family Homepage | Fannie Mae Fannie Mae Form 1039 02/23/16. Rental Income Worksheet Documentation Required: Enter If Fair Rental Days are not reported, the property is considered to be in service for 12 months unless there is evidence of a shorter term of service. Result A1 A2 Subtract A3 Add A4 A5 A6 A7 A8 Equals adjusted rental income. Total A9 Divide Equals adjusted ... fannie mae form 1037: Fill out & sign online | DocHub Result The number of months the property was in service Result Step 2 Calculate the monthly qualifying rental income using Step 2A Schedule E OR Step 2B Lease Agreement or Form 1025. A1 Step 2 A. Schedule E - Part I Enter total rents received from the non-owner-occupied units. Loan Modification Vs. Refinance | Rocket Mortgage Sep 16, 2022 · You lower your monthly mortgage payment when you refinance to a longer mortgage term. This can help you avoid foreclosure if your income is now lower than when you got your loan. Shorten your term. You can also shorten your mortgage term with a refinance. Your monthly payment increases when you shorten your term. Fnma restricted stock income - wyyhoh.mozarda.nl The COVID-19 pandemic is likely to have. 1 day ago · Fannie Mae Income Calculation Worksheet - Fill Online, Printable ... 01/06/2022 · Develop an average income from the last two years (according to the Variable Income When variable income is used to qualify the borrower(s), can a gap of employment (due to COVID-19) be excluded from the ...

B3-3.1-08, Rental Income (05/04/2022) - ask-poli.fanniemae.com Rental Income Worksheet - Business Rental Income from Investment Property(s) . Reporting of Gross Monthly Rent Eligible rents on the subject property (gross monthly rent) must be reported to Fannie Mae in the loan delivery data for all two- to four-unit principal residence properties and investment properties, regardless of whether the ... Realty Publications, Inc. – RPI Forms Download - firsttuesday This form is used by a loan broker when processing a mortgage application from a self-employed borrower as a worksheet for analysis of their income, to determine the sufficiency of the self-employed borrower's income and business expenses as creditworthy. Loan Brokerage: Mortgage loan brokerage, administrative; sort-loanbroker: 229-1: 229-1 Fannie Mae Rental Income Worksheet - signNow Fannie Mae Rental Income Worksheet 2014-2022: get and sign the form in seconds Create a custom fannie mae rental income worksheet 2014 that meets your industry's specifications. Get form. To be in service for 12 months unless there is evidence of a shorter term of service. Step 1. Result: The number of months the property was in service ... Single-Family Homepage | Fannie Mae Fannie Mae Form 1037 02/23/16. Rental Income Worksheet Documentation Required: § Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Step 1. When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30.

Resource Center | CMG Financial 10-27-21 CMG Bulletin 2021-58 FNMA Updates-FHLMC Updates: 10-20-21 CMG Bulletin 2021-57 Reminder-Temporary Conforming Loan Limits Increased-FNMA Condo Reserves-USDA Funds FY2022- AIO 801 MBI- Age of Appraisal: 10-13-21 CMG Bulletin 2021-56 Rescind Announcement VVOE Timing Requirements

Arch Mortgage | USMI - Calculators Individual Rental Income from Investment Property(s) (up to 10 properties) Download XLXS. Freddie Mac Form 92 ... PDF. Fannie Mae Form 1038 Individual rental Income from Investment Property(s) (up to 4 properties) Download XLXS. Fannie Mae Form 1039 Business Rental Income from Investment Property(s) Download XLXS. Close. U.S. Mortgage Insurance.

Selling & Servicing Guide Forms | Fannie Mae Rental Income Worksheet - Individual Rental Income from Investment Property(s) (up to 4 properties) Form 1038A . ... Lender Record Information allows you to prepare your annual certification and submit it electronically to Fannie Mae. View Form. Form 629.

Fannie Mae Income Worksheet - Fill Out and Use This PDF - FormsPal Schedule E - Supplemental Income and Loss. Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below.

Fannie Mae Rental Income Worksheet - Fill Out and Sign Printable PDF ... Create a custom fannie mae rental income worksheet 2014 that meets your industry's specifications. Get form. Months unless there is evidence of a shorter term of service. Step 1. Result The number of months the property was in service Result Step 2. Calculate monthly qualifying rental income loss using Step 2A Schedule E OR Step 2B Lease ...

Cash Flow Analysis (Form 1084) - Fannie Mae Schedule E - Supplemental Income and . Loss. Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to . Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below.

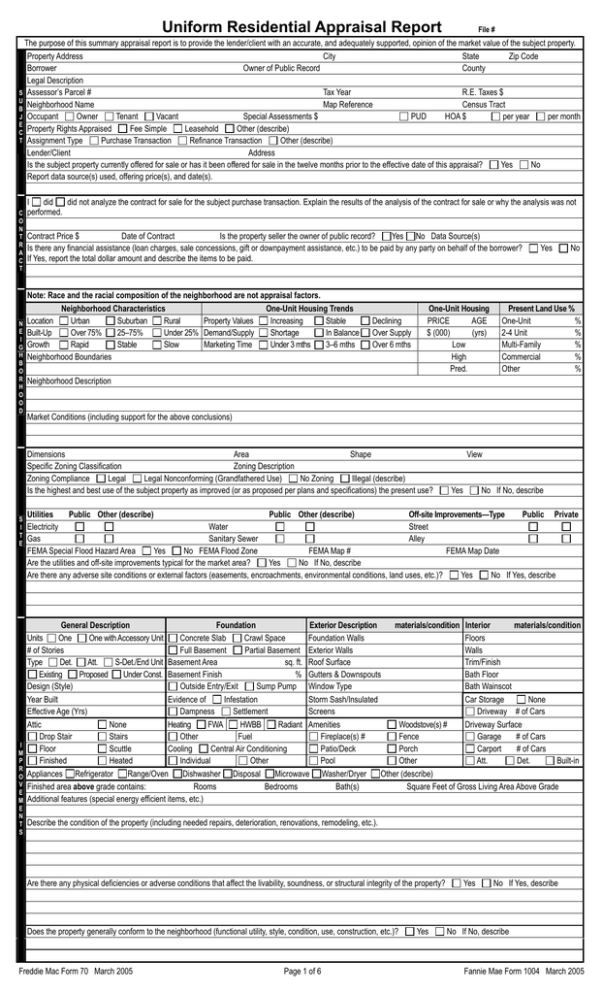

B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae General Requirements for Documenting Rental Income. If a borrower has a history of renting the subject or another property, generally the rental income will be reported on IRS Form 1040, Schedule E of the borrower's personal tax returns or on Rental Real Estate Income and Expenses of a Partnership or an S Corporation form (IRS Form 8825) of a business tax return.

Where can I find rental income calculation worksheets? - Fannie Mae Fannie Mae publishes worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The rental income worksheets are: Principal Residence, 2- to 4-unit Property (Form 1037)*, Individual Rental Income from Investment Property (s) (up to 4 properties) (Form 1038)*, Individual Rental Income from Investment ...

B3-3.5-02, Income from Rental Property in DU (06/01/2022) - Fannie Mae If the Net Monthly Rental Income is a "breakeven" amount, the user must enter either $0.01 or $-0.01. If Net Monthly Rental Income is not entered or is $0.00, DU will calculate it using this formula: (Gross rental income - 75%) — property PITIA expense. The lender can override DU's calculation by entering the Net Monthly Rental Income ...

PDF Form 1038: Rental Income Worksheet - Enact MI Equals adjusted monthly rental income Total A10 Subtract proposed PITIA (for subject property) or existing PITIA (for non-subject property). Subtract Step 2A. Result: Monthly qualifying rental income (or loss): Result Step 2 B. Lease Agreement OR Fannie Mae Form 1007 or Form 1025 For each property complete ONLY 2A or 2B

Fannie Mae Rental Income Worksheet: Fill & Download for Free - CocoDoc How to Edit Your Fannie Mae Rental Income Worksheet Online On the Fly. Follow the step-by-step guide to get your Fannie Mae Rental Income Worksheet edited for the perfect workflow: Hit the Get Form button on this page. You will go to our PDF editor. Make some changes to your document, like adding checkmark, erasing, and other tools in the top ...

0 Response to "38 fnma rental income worksheet"

Post a Comment