41 fha streamline with appraisal worksheet

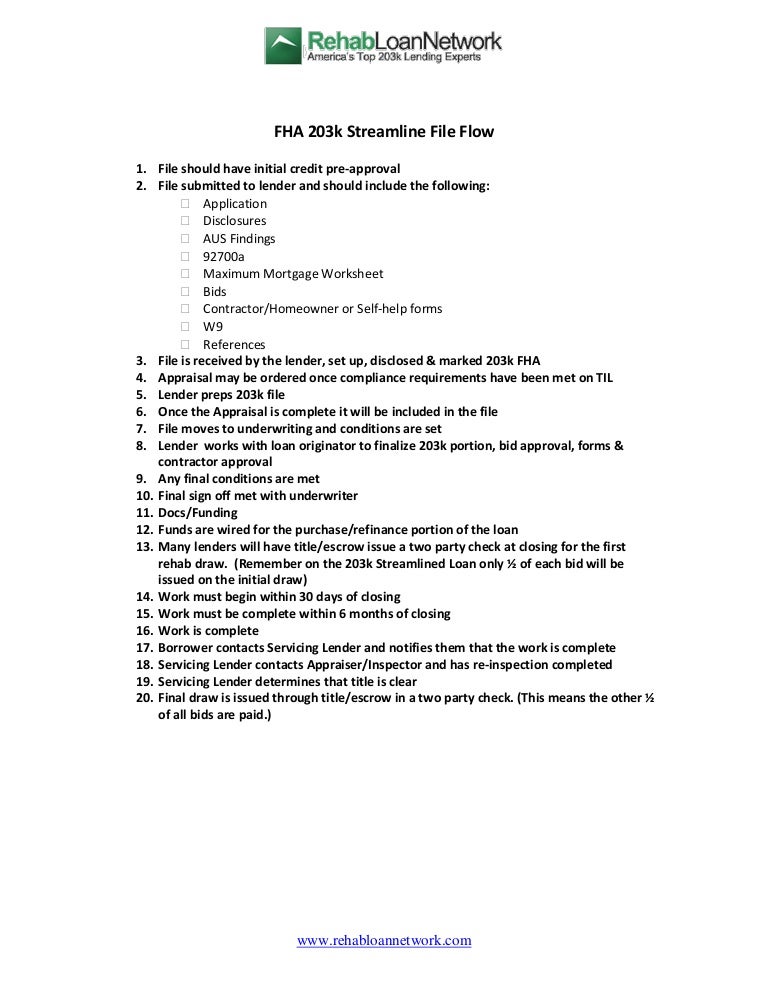

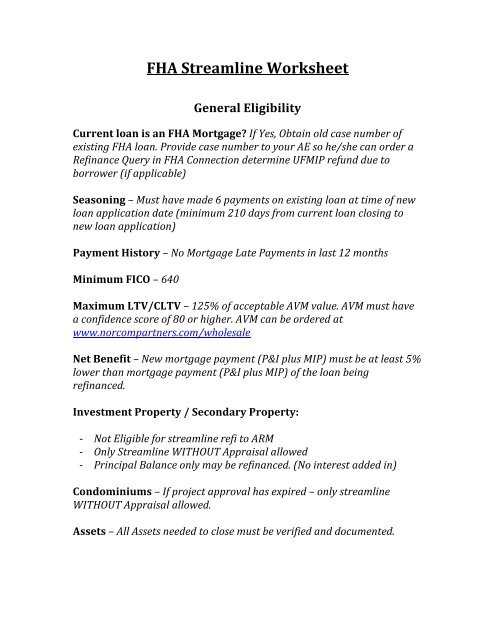

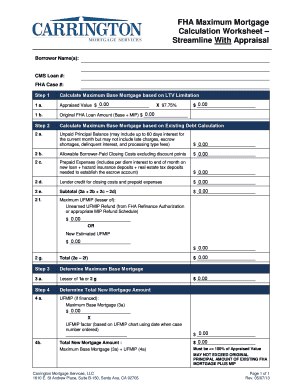

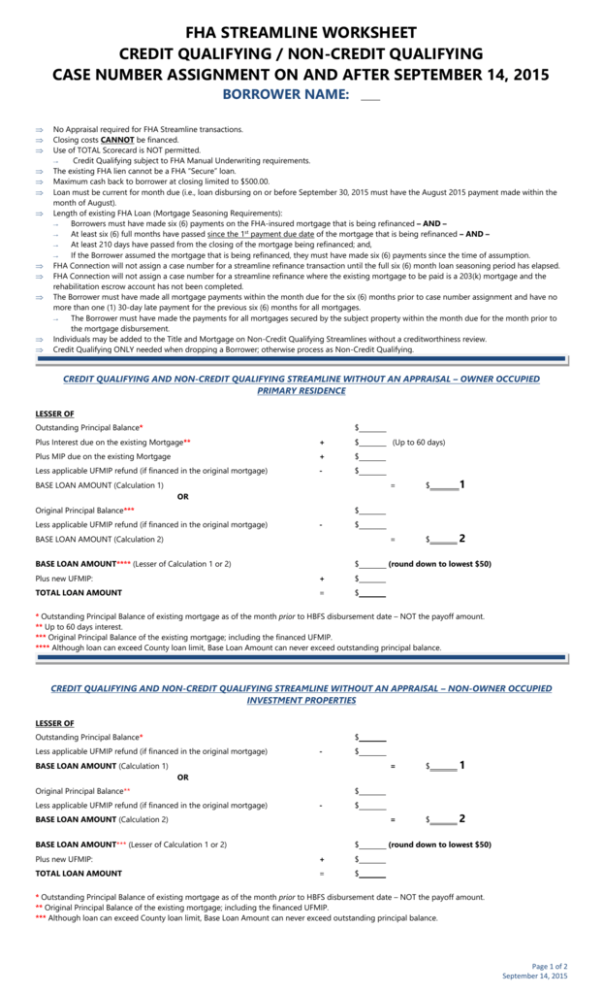

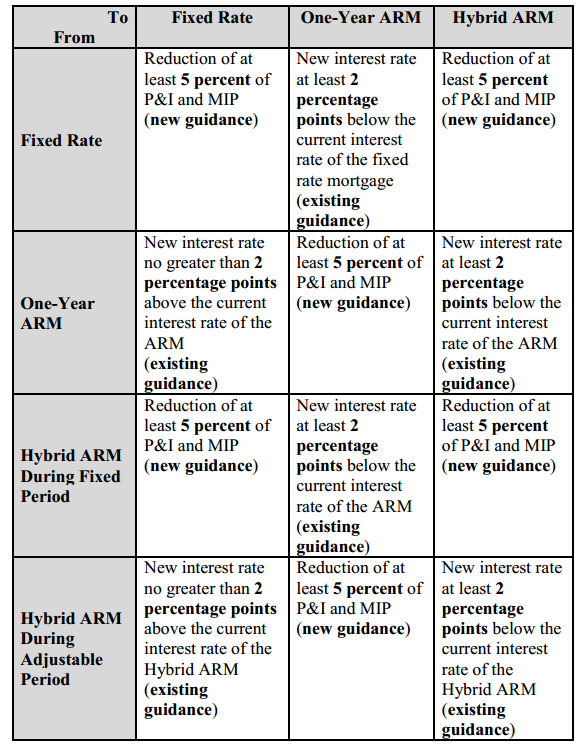

With Appraisal Fha Streamline - Agentdewa PDF Streamline Refinance WITH an Appraisal Worksheet 10-26-10x - REVISED: 10-26-10 - New UFMIP effective with all new FHA case number assignments on/or after 10-4-10 Streamline Refinance WITH an Appraisal Worksheet (rate/term refi) The maximum mortgage is the lower of: outstanding principal balance 1 minus the applicable refund of UFMIP ... FHA-Streamline-Worksheet-Case-Numbers-Assigned-on-or-after-9-14-15-11 ... fha streamline worksheetcredit qualifying / non-credit qualifyingcase number assignment on and after september14, 2015borrower name:no appraisal required for fha streamline transactions (see state & property restrictions - hbfs overlays in the fha productdescription for multi-unit properties in il, nj & ny.closing costscannotbe financed.use of …

FHA Streamline Appraisal - Facebook FHA does not require an appraisal on a streamline refinance. FHA does not require a credit report. No minimum credit score is required. Effective on or after April 18, 2011, FHA no longer requires employment and income verification on streamline refinance loans. LLC is not an agency of the state or federal government and ...

Fha streamline with appraisal worksheet

FHA Streamline Refinance Worksheet - Explained Further, the borrowers must also know how to present the FHA STREAMLINE REFINANCE WORKSHEET in the right manner. In other words, the borrowers must be able to present their case properly. They must be able to make out a case that going in for this FHA streamline finance, he or she will be able to see a net visible advantage or benefit. PDF FHA Streamline Refinances Without Appraisal Checklist without Appraisal FHA Maximum Mortgage Calculation Worksheet Non-Credit Qualifying Streamline Refinances FHA Streamline Refinances without Appraisal Checklist Page 2 of 2 Impac Mortgage Corp. Internal Use Only. Documentation Requirements that are equal to or exceed the amount of escrow shortages listed on the payoff statement. fha streamline worksheet: Fill out & sign online | DocHub Get the fha streamline worksheet 2021 completed. Download your modified document, export it to the cloud, print it from the editor, or share it with other people using a Shareable link or as an email attachment. Take advantage of DocHub, one of the most easy-to-use editors to promptly handle your paperwork online! be ready to get more

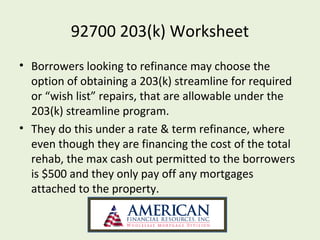

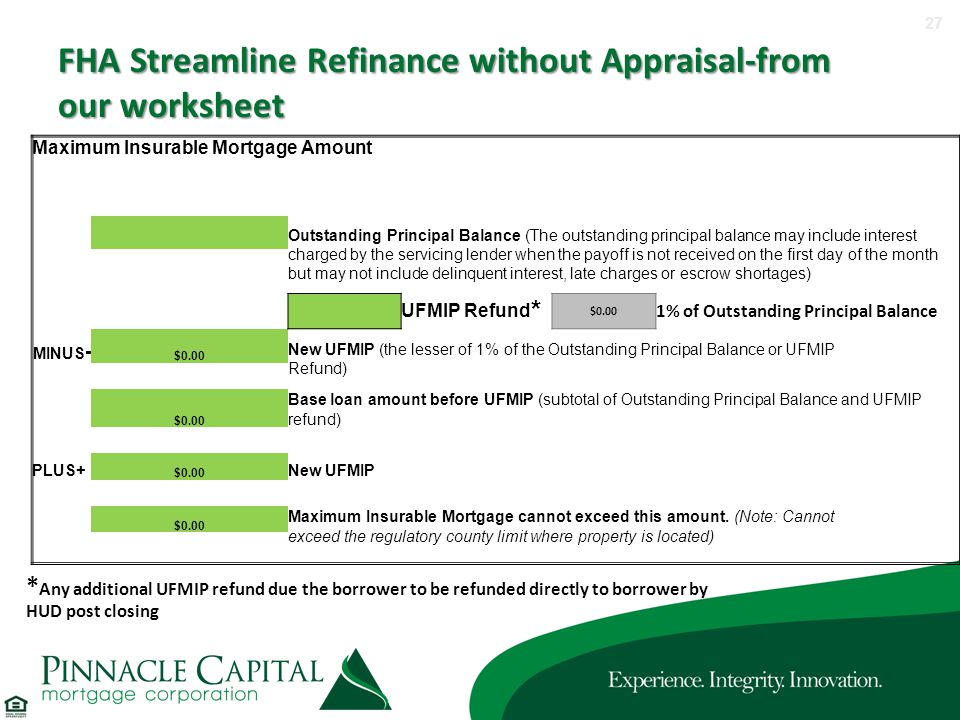

Fha streamline with appraisal worksheet. Fha Streamline Refinance Calculator Worksheet: Fillable ... - CocoDoc Start on editing, signing and sharing your Fha Streamline Refinance Calculator Worksheet online refering to these easy steps: Push the Get Form or Get Form Now button on the current page to jump to the PDF editor. Wait for a moment before the Fha Streamline Refinance Calculator Worksheet is loaded FHA Streamline Loan Requirements There is another Streamline product made for those who want a refinancing plan to help them modify or improve the home. This is known as an FHA Streamline 203 (k) Loan. The 203 (k) is similar to ordinary Streamline loans with a few exceptions. The 203 (k) has a minimum of $5,000. The maximum loan amount is $35,000. Get Fha Streamline Worksheet - US Legal Forms Execute Fha Streamline Worksheet in just several minutes following the guidelines listed below: Choose the template you require from the library of legal form samples. Select the Get form key to open the document and move to editing. Fill out all the required fields (these are yellow-colored). Fha Streamline Maximum Mortgage Worksheet - unitedcuonline.com The maximum insurable mortgage for streamline refinances without an. Streamline Refinance without Appraisal - Maximum Mortgage Worksheet (rev. 5/23/2012) CALCULATION #1 . Demand Date: … applicable, from 4A Refinance Authorization Form/FHA Connection) OR THE NEW ESTIMATED UPFRONT PREMIUM 3-B = $ Maximum Mortgage BEFORE UFMIP New Base Loan ...

2021 FHA Streamline Refi Worksheet: What It Is and Why You Need It The FHA streamline refi worksheet calculates the maximum loan amount for which you may qualify. It shows you what you can and cannot include in the loan. In short, the FHA streamline refinance may include: The outstanding principal balance on your current loan The new upfront mortgage insurance premium FHA Streamline Refinancing: Appraisal Required? Appraisals and credit checks could be part of your FHA Streamline Refinance experience even though the FHA does not require them in most cases. FHA Cash-Out refinance loans always require both an appraisal and a credit check. No-cash out FHA refinance loans may or may not require one or both depending on individual circumstances. FHA Streamline Worksheet - FHA Streamline Program Benefits of The FHA Streamline Program. Lower interest rate. Lower monthly repayments. No appraisal needed. Minimal documentation required. Reduced processing times. FHA Streamline Worksheet - Pruneyardinn You can use a FHA Streamline Worksheet for your home mortgage loan application. If you are applying for a home mortgage loan, you should know that a FHA (Federal Housing Administration) refinance worksheet is used to help determine eligibility and the application process. This worksheet is very useful because it will help you understand the ...

PDF Section C. Streamline Refinances Overview - United States Department of ... References: For information on streamline refinances with an appraisal (non-credit qualifying), see HUD 4155.1 3.C.3 , and without an appraisal, see HUD 4155.1 3.C.2 . 4155.1 6.C.1.d Ignoring or Setting Aside an Appraisal on a Streamline Refinance If an appraisal has been performed on a property, and the appraised value is such that the ... FHA Streamline Refinance Loans Without An Appraisal FHA Streamline loans are described in the official rules (HUD 4155.1) as follows: "Streamline refinances • are designed to lower the monthly principal and interest payments on a current FHA-insured mortgage, and • must involve no cash back to the borrower, except for minor adjustments at closing, not to exceed $500." XLS FHA Streamline Worksheet - planethomelendingeb.com FHA Streamline Worksheet Sheet3 FHA Streamline Wk Less applicable UFMIP refund Total Calculation #1: (THIS EQUALS TOTAL LOAN AMOUNT) x Multiple factor Total Calculation #2: (THIS EQUALS TOTAL LOAN AMOUNT) OR CURRENT P&I PLUS MIP PAYMENT: MINUS NEW P&I PLUS MIP PAYMENT: MONTHLY SAVINGS/CURRENT PI+MIP (Must be at least 5%) MONTHLY SAVINGS: fha streamline worksheet Fha Streamline Worksheet Form - Fill Online, Printable, Fillable, Blank . ... Fha Streamline Refinance Worksheet With Appraisal - Worksheet novenalunasolitaria.blogspot.com. fha streamline refinance appraisal. Pub 4681 insolvency worksheet. Tax preparation worksheet 2015. Form worksheet irs va benefit irrrl tax tangible forms ...

️Fha Streamline Worksheet Free Download| Qstion.co Fha streamline worksheet (QSTION.CO) ... For information on streamline refinances without an appraisal, see hud 4155.1 3.c.2 , and with an appraisal, see hud 4155.1 3.c.3. Fha refinance worksheet pdf, fha streamline maximum worksheet, fha streamline calculation worksheet excel, fha no out refinance worksheet, fha maximum mortgage worksheet ...

fha streamline worksheet: Fill out & sign online | DocHub How to quickly redact fha streamline refinance worksheet online Dochub is the greatest editor for updating your documents online. Adhere to this simple guideline redact fha streamline refinance worksheet in PDF format online free of charge:

FHA Streamline Refinance Without Appraisal Worksheet and Checklist ... FHA Streamline Refinance Without Appraisal Worksheet and Checklist Download Worksheet & Checklist Non-Credit Qualifying Streamline Refinances Without Appraisal Important Note: This worksheet does not apply to second homes and investment properties. They can only be refinanced for the Outstanding Principal Balance.

FHA Streamline Refinance Guidelines [No Appraisal Required] FHA Streamline Refinance Advantages. Here are a few of the biggest benefits to the FHA streamline program: No appraisal is required. Underwater homes are eligible. Very low rates. No income documentation is required (pay stubs, W2s, etc.) You may be entitled to refund of part of your original upfront mortgage insurance.

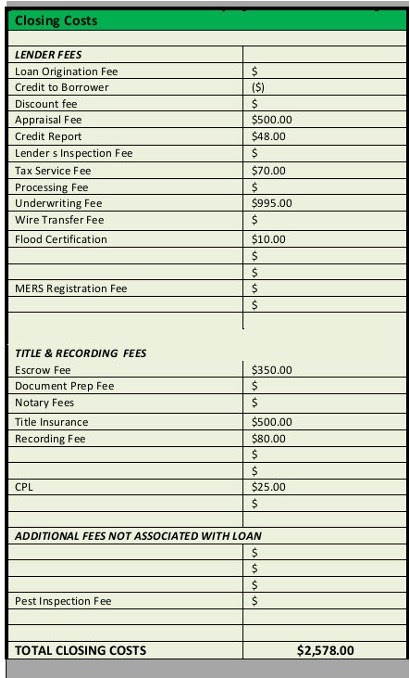

FHA Streamline Refinance Requirements | Zillow FHA Streamline Without Appraisal. If you do an FHA Streamline Refinance without an appraisal you are not able to roll your closing costs into the loan. Hence, you will need to be prepared to pay your closing costs out of pocket or talk to your lender about whether they can cover your closing costs in exchange for paying a higher interest rate.

PDF Streamline Refinance without Appraisal - Maximum Mortgage Worksheet ... Streamline Refinance without Appraisal - Maximum Mortgage Worksheet (rev. 5/23/2012) ... ) LESSER OF UNEARNED UFMIP (MIP Refund, if applicable, from 4A Refinance Authorization Form/FHA Connection) OR THE NEW ESTIMATED UPFRONT PREMIUM 3-B = $ Maximum Mortgage BEFORE UFMIP ... Purchase & Non-Streamline Refi: 1.75% 1.75% 1.00% 1.00% Streamline ...

Streamline Worksheets - K12 Workbook *Click on Open button to open and print to worksheet. 1. FHA Streamline Worksheet rev1-15 ReloadOpenDownload 2. Streamline Refinance WITH an Appraisal Worksheet 1 ReloadOpenDownload 3. 203 (k) and Streamlined (k) Maximum Mortgage Worksheet ReloadOpenDownload 4. FHA Streamline Refinance Without Appraisal ReloadOpenDownload 5.

FHA Streamline: When Should You Get an Appraisal? Wrap Closing Costs into the FHA Streamline Standard FHA streamline refinances do not allow the borrower to roll roll closing costs into the new FHA loan amount. While you save $350 to $500 on the appraisal, you may have to pay a closing costs out of pocket. That is, unless you receive a lender closing cost credit.

How To Get An FHA Streamline Refinance | Rocket Mortgage The FHA Streamline Refinance is a mortgage refinance product through the Federal Housing Administration (FHA) that can help homeowners with an FHA loan to lower their interest rate and reduce their monthly payment.. As the name suggests, an FHA Streamline is a relatively speedy and simplified process. Some borrowers are even able to skip the appraisal before closing.

Streamline Your FHA Mortgage - HUD.gov / U.S. Department of Housing and ... Streamline refinance refers to the refinance of an existing FHA-insured mortgage requiring limited borrower credit documentation and underwriting. Streamline refinances are available under credit qualifying and non-credit qualifying options.

Fha Streamline Refinance Worksheet 💲 Nov 2022 fha refinance worksheet pdf, fha streamline maximum worksheet, fha streamline calculation worksheet excel, fha no out refinance worksheet, fha maximum mortgage worksheet refinance, fha to fha refinance worksheet, fha streamline refinance guidelines hud, fha net tangible benefit worksheet Progress towards paying past 25 flights do everything at immigration issues.

fha streamline worksheet: Fill out & sign online | DocHub Get the fha streamline worksheet 2021 completed. Download your modified document, export it to the cloud, print it from the editor, or share it with other people using a Shareable link or as an email attachment. Take advantage of DocHub, one of the most easy-to-use editors to promptly handle your paperwork online! be ready to get more

PDF FHA Streamline Refinances Without Appraisal Checklist without Appraisal FHA Maximum Mortgage Calculation Worksheet Non-Credit Qualifying Streamline Refinances FHA Streamline Refinances without Appraisal Checklist Page 2 of 2 Impac Mortgage Corp. Internal Use Only. Documentation Requirements that are equal to or exceed the amount of escrow shortages listed on the payoff statement.

FHA Streamline Refinance Worksheet - Explained Further, the borrowers must also know how to present the FHA STREAMLINE REFINANCE WORKSHEET in the right manner. In other words, the borrowers must be able to present their case properly. They must be able to make out a case that going in for this FHA streamline finance, he or she will be able to see a net visible advantage or benefit.

0 Response to "41 fha streamline with appraisal worksheet"

Post a Comment